|

市场调查报告书

商品编码

1640409

停车预订系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Parking Reservation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

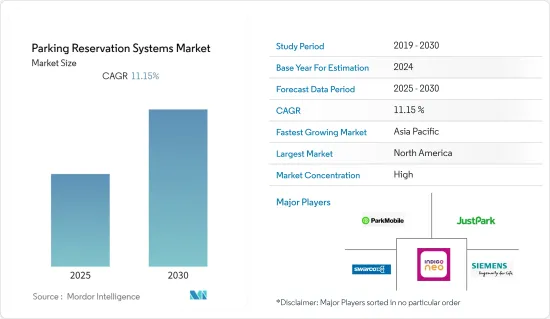

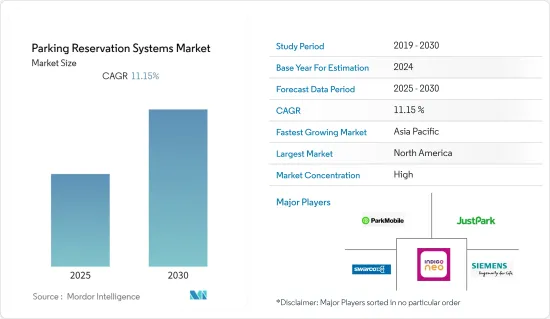

预测期内,停车预订系统市场预计将以 11.15% 的复合年增长率成长。

即时停车资料的需求不断增长、新的智慧城市计划以及车辆数量的增加是推动市场成长的一些因素。

主要亮点

- 停车预订系统市场受到汽车领域人工智慧解决方案的进步所推动,包括向连网汽车和电动车的转变。为了帮助电动车队驾驶保持充电状态,JustPark 和 FleetCharge 于 2022 年 10 月制定了一项创新倡议,为在家中安装电动车充电站提供奖励。 Just Park 将安装电动车充电站、保证每月付款并支付电费。

- 停车预订系统市场可能会受益于智慧型手机的日益普及。随着可支配所得的增加,人们开始利用现代科技来追求舒适、无忧的生活。例如,选择一辆连网汽车或一部具有尖端功能的高阶智慧型手机。因此,消费者愿意支付高价来轻鬆停放这些豪华车辆。这些基于行动的停车预订解决方案能够更有效地搜寻和提供停车预订选项、搜寻当前停车位可用性和相关套餐。

- 新冠肺炎疫情对全球经济带来压力,影响了製造业、生产业并扰乱了金融体系。疫情过后,各行各业纷纷恢復正常业务,受到衝击最大的旅行及旅游业迎来了黄金扩张机会。人们使用汽车上下班以保持社交距离,这需要复杂且可控的停车预约系统。

- 在运行基于软体技术的系统时,成本可能是最大的挑战,因为它需要更多的资金来维护系统。尖峰时段接入费用和软体维护费用必须由客户承担。随着报告和票务技术的引入,停车费用将会上升。

停车预约市场趋势

行动解决方案成长强劲

- 在大多数城市,都市区的快速成长为停车系统带来了重大问题。基于行动的停车预订解决方案在搜寻即时停车位和相关套餐方面提供了更高的识别和提供停车预订解决方案的效率。

- 智慧型手机不再只是用来打电话;它们还充当各种功能的中心枢纽。智慧型手机配备了 GPS 和电子钱包等功能,可用于寻找充电站或停车场等特定位置。智慧型手机电子钱包可方便地用于支付所有费用,包括停车费。

- 政府认识到停车位不足造成的问题并采取行动解决。综合交通体係由高效率的停车管理结构支撑,促进永续交通。卡达已为司机和停车场业主推出了智慧停车服务。

- 2023 年 1 月,苹果将与数位停车预订服务 SpotHero 合作,为消费者提供美国和加拿大 8,000 多个地点的停车资讯。这使用户能够了解特定位置附近的停车选项和可用性。

北美占有最大市场占有率

- 汽车产业的下一个阶段是连网汽车,汽车製造商正在大力投资这些新的经济生态系统、经营模式和收益来源。通用、福特、雪佛兰等全球顶级汽车製造商大多来自北美,这些公司都在持续为自己的车辆配备突破性的人工智慧技术。

- 北美城市的设计都假设汽车将成为主要的交通途径。在美国,每辆车拥有8个停车位,都市区占全国土地总面积的5%以上。随着人工智慧技术的进步,这些停车场也必须实现机械化。

- 2022 年 10 月,北美数位停车领导者 SpotHero 庆祝自 2011 年进入该业务以来,停车预订销售额达到 10 亿美元。作为停车行业最具活力的定价解决方案,SpotHero IQ 使营运商能够更成功地开展业务并更好地管理其停车库存,从而增加收益。

- 2022 年 1 月,这家总部位于安大略省滑铁卢的公司利用其 eXactpark 应用程式的智慧停车技术简化了拥挤城市的停车服务。

停车预约产业概况

停车预订系统市场竞争非常激烈,因为国内和全球市场上的竞争公司提供了大量的选择。主要企业纷纷采用产品创新、併购重组等手段,市场集中度较高。市场的主要企业包括 Conduent Incorporated、西门子股份公司、ParkMe Inc 和 JustPark Parking Ltd。

2022 年 1 月,Airtel Payments Bank 与 Park+ 合作,使用 FASTags 将印度的停车状况数位化。 Park+ 门禁系统已在全国 1,500 多个社区、30 个购物中心和 150 个企业园区使用。此次合作将使全国各地的重要商业机构和住宅能够使用基于 FASTag 的智慧停车场。

2022 年 2 月,沃克斯豪尔与停车服务 JustPark 签署了新的合作伙伴关係,获得了路边充电站的独家使用权。该协议还将允许更多人转用电动车,因为他们将能够在住所附近找到方便的充电站。

2022 年 6 月,Touch'n Go eWallet 与 ComfortDelGro 和 Alipay+ 合作,将其跨境付款功能扩展到新加坡。康福德高在新加坡营运超过 9,000 辆计程车。透过此次国际伙伴关係,客户可以携带电子钱包旅行,并在国外享受轻鬆便捷的付款。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 汽车数量增加

- 全球智慧城市计划兴起

- 市场挑战

- 采用率缓慢

第五章 市场区隔

- 按停车位置

- 路外停车

- 路边停车

- 按解决方案

- 基于网路

- 基于行动装置

- 基于语音通话

- 按行业

- 政府

- 零售

- 饭店业

- 娱乐/休閒

- 运输

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- Conduent Incorporated

- Siemens AG

- ParkMe Inc.

- JustPark Parking Ltd

- The Kapsch Group

- Standard Parking Corporation

- APCOA Parking AG

- Streetline Inc.

- Amano Corporation

- Swarco Corporation

第七章投资分析

第八章 市场机会与未来趋势

The Parking Reservation Systems Market is expected to register a CAGR of 11.15% during the forecast period.

The growing demand for real-time car parking data, new smart city projects, and the rising number of cars are a few factors contributing to the market's growth.

Key Highlights

- The market for parking reservation systems is being driven by the advancement of AI solutions in the automotive sector, such as linked automobiles and the migration to electric vehicles. To keep EV fleet drivers charged, JustPark and FleetCharge developed an innovative initiative to offer incentives for installing EV charging stations in homes in October 2022. JustPark will set up an EV charging station, provide a guaranteed monthly payment, and pay for any electricity costs.

- The market for parking reservation systems will benefit from the growing popularity of smartphones. Due to rising disposable incomes, people are using the newest technology for comfort and hassle-free living. Examples include selecting connected cars and high-end smartphones with cutting-edge capabilities. So, consumers are willing to pay more to park these luxury vehicles easily. These mobile-based parking reservation solutions are more effective at locating and offering parking reservation options and retrieving current parking availability and associated packages.

- The COVID-19 pandemic squeezed the world economy by affecting the manufacturing industry, production, disruption, and financial systems. Post-epidemic, the industries returned to regular operations, and travel and tourism-most adversely affected-got an excellent opportunity to expand. People used their vehicles to commute to preserve social distancing, which required advanced and managed Parking Reservation Systems.

- Cost can be the biggest challenge because more money would be needed to maintain the system when it is run using software-based technologies. Customers will have to cover peak access fees and software maintenance costs. The cost of parking will increase due to the deployment of reporting and ticketing technology.

Parking Reservation Market Trends

Mobile-based Solutions to Witness Significant Growth

- In most cities, there is a significant parking system issue due to the rapid urban population growth. The mobile-based parking reservation solutions have greater efficiency in identifying and providing parking reservation solutions in terms of retrieving real-time parking availability and related packages.

- Smartphones are being utilized for more than just making calls; they are a central hub for many different functions. They are packed with features like GPS and e-wallets that can be used to find specific locations, such as electric charging stations or parking lots. The smartphone's e-wallet will be used to conveniently pay for everything, including the parking fee.

- The Government is aware of the issues caused by a lack of parking and is acting to address them. The integrated transportation system is supported by an efficient parking management structure, promoting sustainable transportation. For drivers and owners of parking spaces in Qatar, the Smart Parking service was introduced.

- In January 2023, Apple and the digital parking reservation service SpotHero partnered to provide consumers with access to parking information for over 8,000 locations across the United States and Canada. It will inform users of the parking options and availability close to a particular location.

North America Occupies the Largest Market Share

- The next phase of the automobile industry is that of connected automobiles, and automakers are making significant investments in these new economic ecosystems, business models, and revenue streams. The majority of the world's top automakers, including General Motors, Ford, and Chevrolet, constantly creating ground-breaking AI technologies for their vehicles, have their origins in North America.

- North American cities were designed with the idea that cars would be the primary source of transportation. In the United States, there are eight parking spaces for every car, which take up more than 5% of the total urban land area. These parking places must be mechanized as AI technology advances in the nation.

- In October 2022, SpotHero, the digital parking leader in North America, celebrated the sale of USD 1 billion in parking reservations sold since it entered the business in 2011. The most dynamic pricing solution in the parking sector, SpotHero IQ, enables operators to run their companies more successfully and better manage their parking inventory, which boosts revenues.

- In January 2022, Waterloo, Ontario-based company simplified parking in crowded cities with smart parking technology using the eXactpark app.

Parking Reservation Industry Overview

The parking reservation systems market is highly competitive due to the abundance of options offered by firms competing in domestic and global markets. The key firms use tactics like product innovation and mergers and acquisitions, which suggests that the market is relatively concentrated. Some of the major players in the market are Conduent Incorporated, Siemens AG, ParkMe Inc, and JustPark Parking Ltd, among others.

In January 2022, to digitize the parking environment in India using the vehicle's FASTag, Airtel Payments Bank partnered with Park+.Park+ access control systems are used in over 1,500 societies,30 malls, and 150 corporate parks nationwide. With the help of this partnership, significant commercial and residential buildings around the country will have access to smart parking options based on FASTag.

In February 2022, Vauxhall established a new collaboration with parking service JustPark to allow exclusive access to off-street charging stations. Also, this agreement will enable more individuals to switch to electric vehicles because they can locate convenient charging stations close to their residences.

In June 2022, in collaboration with ComfortDelGro and Alipay+, Touch 'n Go eWallet increased the reach of its cross-border payment capabilities to Singapore. ComfortDelGro runs over 9,000 taxis across Singapore. This international partnership enables its customers to travel with the eWallet and take advantage of a simple and convenient payment experience outside of their native country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Vehicles

- 4.3.2 Increasing Smart City Projects Across the World

- 4.4 Market Challenges

- 4.4.1 Slow Adoption Rate

5 MARKET SEGMENTATION

- 5.1 By Parking Site

- 5.1.1 On-street Parking

- 5.1.2 Off-street Parking

- 5.2 By Solutions

- 5.2.1 Web-based

- 5.2.2 Mobile-based

- 5.2.3 Voice Call-based

- 5.3 By End-user Vertical

- 5.3.1 Government

- 5.3.2 Retail

- 5.3.3 Hospitality

- 5.3.4 Entertainment/Recreation

- 5.3.5 Transportation

- 5.3.6 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Conduent Incorporated

- 6.1.2 Siemens AG

- 6.1.3 ParkMe Inc.

- 6.1.4 JustPark Parking Ltd

- 6.1.5 The Kapsch Group

- 6.1.6 Standard Parking Corporation

- 6.1.7 APCOA Parking AG

- 6.1.8 Streetline Inc.

- 6.1.9 Amano Corporation

- 6.1.10 Swarco Corporation