|

市场调查报告书

商品编码

1640410

英国塑胶包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)United Kingdom Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

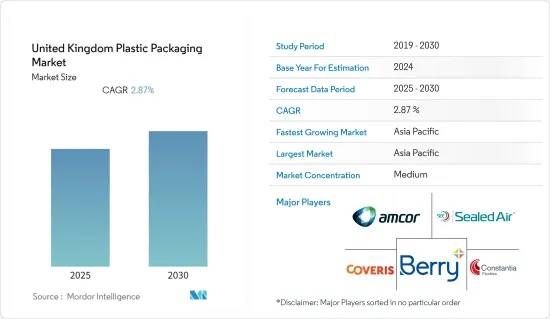

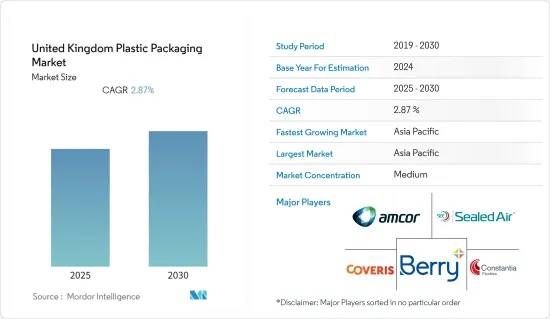

预计预测期内英国塑胶包装市场的复合年增长率为 2.87%。

由于该地区产业部门的扩张,英国包装业正在大幅扩张,推动了该地区对包装服务的需求。据英国包装联合会称,英国包装製造业每年的营业额为110亿英镑(135.9亿美元)。该行业僱用了超过 85,000 名员工,占英国製造业的 3%。更重要的是,它在更大的包装供应链中发挥着至关重要的作用,并对英国的GDP做出了重大贡献。

英国包装产业的大部分是由塑胶包装构成的。此外,凭藉强大的製造能力,英国塑胶包装市场预计将产生大量收入。英国议会估计,该国每年使用 500 万吨塑料,其中包装约占一半。

由于软包装产业的成长,英国对塑胶的需求也很大。国际供应商进入该行业以及本地公司的收购都满足了市场的需求。

在众多使用塑胶的行业中,酪农业最注重减少塑胶的使用。英国食品和农村事务大臣卢克勋爵呼吁英国乳製品产业更加永续,目标是将牛奶包装中使用的塑胶量减少 50%。这表明,这个已经展现出创新多样性的国家在绿色包装方面将进一步发展。

预计英国脱欧将导致英国塑胶包装成本上升,原因是欧盟与英国之间的贸易限制增加、技术纯熟劳工短缺、当地树脂生产商竞争力下降以及塑胶回收再利用下降。包装行业。

新冠疫情爆发后,由于政府采取大规模封锁措施以及供应链中断,英国包装市场成长下滑。除医疗保健、食品饮料外,所有行业都关闭。此外,俄罗斯和乌克兰之间的战争对整个包装生态系统产生了影响。

英国塑胶包装市场的趋势

食品业成长显着

食品包装是塑胶最重要的使用者之一。食品业对塑胶包装的需求日益增加。它的有益特性(例如重量和成本降低)意味着它正在越来越多地取代纸板、金属和玻璃等传统材料。

对加工和包装食品的偏好,以及生活方式和经济成长的快速发展,正在推动该地区食品包装市场的发展。人们对加工食品的偏好日益增长,主要原因是人口从农村到都市区的转移。

然而,该地区的塑胶包装废弃物数量正在增加(每年增加 2%)。欧盟委员会正在考虑全面禁止塑胶包装,预计将抑制市场成长。欧盟新任环境专员维吉尼亚尤斯辛克维丘斯表示,将禁止塑胶包装或使用再生塑胶。

在预测期内,立式袋有望成为食品包装的标准形式,因为它们能够保持食品新鲜度并延长保质期。此外,小袋还具有视觉美感,增强了产品的行销影响力。因此,袋子被广泛采用作为其他包装形式的稳定替代品,预计在预测期内,袋子在需求和客户接受度方面将获得进一步发展。在英国,永续性和可回收性在提高消费者对品牌的偏好方面发挥关键作用。

软包装可望大幅成长

预计预测期内英国的软包装将呈现稳定的成长率。宠物食品、生鲜食品和咖啡等终端用户的不断增加,推动了该地区对更高柔性包装製造的需求。为了满足不断变化的生活方式,人们从固定膳食转向灵活膳食,这一总体趋势以及小型家庭的增加推动了对单份膳食的需求。

灵活的包装可延长产品的保质期,进而提高产品的永续性。它还可以推出只能透过软包装实现的新产品,例如冷冻食品。

疫情爆发之初,食品生产经历了前所未有的繁荣,而一些快速消费品(FMCG)製造商也改变了生产线。由于製造设施发达,英国软塑胶包装市场预计将获得可观的收益。

然而,软包装基金于 2021 年启动,旨在激励对就业和基础设施急需的投资,使软塑胶回收在英国成为财务永续的系统。领先的快速消费品和零售公司,包括玛氏英国、亿滋国际、雀巢、百事可乐和联合利华,已联手设立了100 万英镑(约合120 万美元)的基金,以使回收商能够以经济的方式回收柔性塑胶。该基金透过与製造商、零售商和回收商合作,旨在透过赋予材料稳定的价值来改善柔性塑胶的回收并减少塑胶污染。

加工食品需求的稳定成长以及轻质软塑胶的日益普及等多种因素正在推动市场发展,并在短期、中期和长期产生各种影响。此外,随着该地区消费者对产品品质的认可度不断提高,冷冻食品包装市场的需求也正在激增。由于经济成长和生活方式的改变,欧洲对冷冻食品包装的需求不断增加,刺激市场在预测期内实现高速成长。

英国不断提高的回收率正在推动软塑胶包装的使用。根据2022年7月公布的英国废弃物统计数据,该国包装废弃物的回收率已从2014年的59.2%上升至2021年的63.2%。私营部门的措施也有助于提高该国的回收率和推动软质塑胶包装的使用。

英国塑胶包装产业概况

英国对塑胶包装的需求正在大幅增长,市场集中度较高,主要参与者包括 Amcor、Coveris Holding、Berry Global、Sealed Air Corporation 和 Constantia Flexibles。

Greiner Packaging UK & Ireland 将于2022 年10 月在北爱尔兰邓甘嫩庆祝成立50 週年,该公司宣布了一项1000 万英镑(1060 万美元)的投资计划,旨在将销售额提高到1 亿英镑(1.63 亿美元)。该公司还透露,计划投资超过 1,000 万英镑(约 1,060 万美元)安装新机器、试运行新製造大厅,并将仓库容量从 3,000 个空间扩大到 11,000 个空间。在邓甘嫩,我们每天为 Dale Farm、Yeo Valley、Arla 和 Irish Yogurts 等主要乳製品製造商生产近五百万个塑胶罐。

2022 年 9 月,为协助企业实现永续性目标,希悦尔在 BUBBLE WRAP 品牌下结合再生材料创造了多种新型保护包装选择。为了满足日益增长的环保包装需求,我们推出了三种新型充气薄膜,分别使用 30% 或 50% 的再生塑胶废弃物。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

- 全球塑胶包装市场概况

第五章 市场动态

- 市场驱动因素

- 越来越多地采用轻量化包装方法

- 增加环保包装和再生塑料

- 市场限制

- 原料(塑胶树脂)价格上涨

- 政府法规和环境问题

第六章 市场细分

- 按包装类型

- 软质塑胶包装

- 硬质塑胶包装

- 依产品类型

- 硬质塑胶包装

- 瓶子和罐子

- 托盘和容器

- 其他产品类型(瓶盖、封口等)

- 软质塑胶包装

- 小袋

- 包包

- 薄膜和包装

- 其他产品类型

- 硬质塑胶包装

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 个人护理及家居产品

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Amcor PLC

- Coveris Holding

- Berry Global

- Sealed Air Corporation

- Constantia Flexibles

- Polystar Plastics Ltd

- Coda Plastics Limited

- Charpak Ltd

- Wipak UK Ltd

- Sonoco Products Company

- Tyler Packaging Limited(Macfarlane Group PLC)

- National Flexible

- Clifton Packaging Group Limited

第八章投资分析

第九章:市场的未来

The United Kingdom Plastic Packaging Market is expected to register a CAGR of 2.87% during the forecast period.

The UK packaging industry is expanding significantly due to the region's expanding industrial sector, which is driving up demand for packaging services there. The UK packaging manufacturing industry generated GBP 11 billion (USD 13.59 billion) in annual sales, according to the Packaging Federation of the United Kingdom. It employs more than 85,000 people, representing 3% of the manufacturing workforce in the United Kingdom. Furthermore, it plays a crucial role in the larger packaging supply chain and contributes significantly to the UK GDP.

The packaging sector in the United Kingdom is largely composed of plastic packaging. Furthermore, due to extensive manufacturing capabilities, it is expected that the UK market for plastic packaging would generate a sizeable amount of income. The UK Parliament estimates that five million tons of plastic are used there annually, with packaging accounting for approximately half of that.

Due to the growth of the flexible packaging industry, plastics are also in demand in the United Kingdom. The market need is being helped by both the expansion of international vendors in this area and the acquisition of local businesses.

Among various industries using plastic, the dairy industry is focusing on reducing plastic use. The UK's Food and Farming Minister, Lord Rooker, called for the country's dairy industry to become more sustainable, targeting a 50% reduction in the number of plastics used in milk packaging. That indicates even more growth for greener packaging in a country that has already shown innovative diversity.

Brexit is anticipated to increase plastic packaging costs in the United Kingdom due to rising trade regulations between the European Union and the United Kingdom, a shortage of skilled labor, a loss of competitiveness for local resin producers, and a decline in plastic recycling rates, all of which could potentially have an impact on the country's plastic packaging industry.

With the outbreak of COVID-19, the UK packaging market witnessed a decline in growth, owing to the widespread lockdown measures adopted by the government and supply chain disruptions. All the sectors, except healthcare and food and beverage, were shut down in the country. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

UK Plastic Packaging Market Trends

Food Industry Driving Prominent Growth

Food packaging is one of the most significant users of plastics. The demand for plastic packaging in the food industry is increasing. They are increasingly replacing traditional materials, such as paperboard, metals, and glass, owing to their beneficial properties, such as lightweight and reduced cost.

The preference for processed and packaged foods has propelled the food packaging market in the region due to rapidly developing lifestyles and economic growth. The main reason for the increasing preference for processed food is the shifting population dynamics toward urban centers from rural areas.

However, the region is witnessing an increasing amount of plastic packaging waste (by 2% annually). The EU Commission is considering the general ban on plastic packaging, which is expected to constrain market growth. Virginijus Sinkevicius, the new EU Commissioner for Environment, stated that they are planning to ban plastic packaging or the usage of recycled plastic.

Over the forecast period, stand-up pouches are expected to become a standard form of food packaging due to their ability to retain the freshness of food products and extend the shelf life of products. In addition, the pouches also offer a great visible aesthetic, adding to the marketing benefits of products. This has led to the wide adoption of pouches as a stable alternative to other formats and is expected to take further momentum in terms of demand and customer acceptance during the forecast period. In the United Kingdom, sustainability and recyclability play a significant role in raising consumer preference toward brands.

Flexible Packaging is Expected to Observe Significant Growth

Flexible packaging in the United Kingdom is expected to witness a stable growth rate during the forecast period. The increasing number of end users, such as pet food, fresh food, and coffee, is driving the need for producing higher flexible packaging in the region. The general trend of the shift from rigid to flexible to fit the changing lifestyles, along with the growth of smaller households, is increasing the need for single-serve options.

Flexible packaging increases the sustainability of the products by increasing their shelf life. It has also enabled the introduction of new products, like frozen food, which has been realized only through flexible packaging.

Food production witnessed an unprecedented boom at the beginning of the pandemic, while some fast-moving consumer goods (FMCG) manufacturers repurposed production lines. The market for flexible plastic packaging in the United Kingdom is anticipated to register significant revenue due to substantial manufacturing facilities.

However, to motivate investment in much-needed jobs and infrastructure to make flexible plastic recycling a financially sustainable system in the United Kingdom, the Flexible Packaging Fund was launched in 2021. FMCG and retail leaders, including Mars UK, Mondelez International, Nestle, PepsiCo, and Unilever, teamed up to form a GBP 1 million (approximately USD 1.2 million) fund to help make flexible plastic recycling economically viable for recyclers and easier for consumers. In collaboration with manufacturers, retailers, and recyclers, the fund intends to improve flexible plastic recycling and reduce plastic pollution by giving the material a stable value.

Several factors, like a steady rise in the demand for processed food and increasing adoption of lightweight flexibles, drive the market with varying impacts over the short, medium, and long-term periods. Further, the market for frozen food packaging is witnessing an upsurge in demand with the consumer appreciation of the product quality in the region. With the growth in the economy and changing lifestyles, there is an increased demand for frozen food packaging in Europe, and the market is expected to grow lucratively during the forecast period.

Increasing recycling rates in the United Kingdom have been driving the use of flexible plastic packaging in the country. According to UK Statistics on Waste, published in July 2022, the recycling rate of packaging waste increased in the country from 59.2% in 2014 to 63.2% in 2021. Initiatives by private players are also helping the recycling rate to improve, driving the usage of flexible plastic packaging in the country.

UK Plastic Packaging Industry Overview

As the demand for plastic packaging has been increasing significantly in the United Kingdom, the market is mildly concentrated with the presence of major players like Amcor, Coveris Holding, Berry Global, Sealed Air Corporation, and Constantia Flexibles, among others.

In October 2022, Greiner Packaging UK and Ireland, which was celebrating its 50th anniversary in Dungannon, Northern Ireland, announced a GBP 10 million (USD 10.6 million) investment program and set a goal of GBP 100 million (USD 106.3 million) in revenue. The company also revealed plans to invest over GBP 10 million (about USD 10.6 million) in new machinery installation, a new manufacturing hall's commissioning, and an increase in the warehouse's capacity from 3,000 to 11,000 spaces. It produces almost five million plastic pots every day in Dungannon for significant dairy producers, including Dale Farm, Yeo Valley, Arla, and Irish Yogurts.

In September 2022, to assist businesses in achieving their sustainability objectives, Sealed Air created a variety of new protective packaging options under the BUBBLE WRAP brand that incorporate recycled content. To help businesses fulfill the rising need for packaging that is more environmentally friendly, three new inflatable films have been introduced that use 30% or 50% recycled plastic waste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the COVID-19 on the Market

- 4.5 Overview of the Global Plastic Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastics

- 5.2 Market Restraints

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations and Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Packaging

- 6.2 Product Type

- 6.2.1 Rigid Plastic Packaging

- 6.2.1.1 Bottles and Jars

- 6.2.1.2 Trays and containers

- 6.2.1.3 Other Product Types (Caps and Closures, etc.)

- 6.2.2 Flexible Plastic Packaging

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films and Wraps

- 6.2.2.4 Other Product Types

- 6.2.1 Rigid Plastic Packaging

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care and Household

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Coveris Holding

- 7.1.3 Berry Global

- 7.1.4 Sealed Air Corporation

- 7.1.5 Constantia Flexibles

- 7.1.6 Polystar Plastics Ltd

- 7.1.7 Coda Plastics Limited

- 7.1.8 Charpak Ltd

- 7.1.9 Wipak UK Ltd

- 7.1.10 Sonoco Products Company

- 7.1.11 Tyler Packaging Limited (Macfarlane Group PLC)

- 7.1.12 National Flexible

- 7.1.13 Clifton Packaging Group Limited