|

市场调查报告书

商品编码

1640421

导航系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

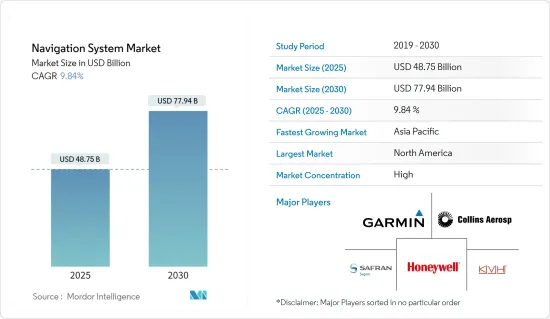

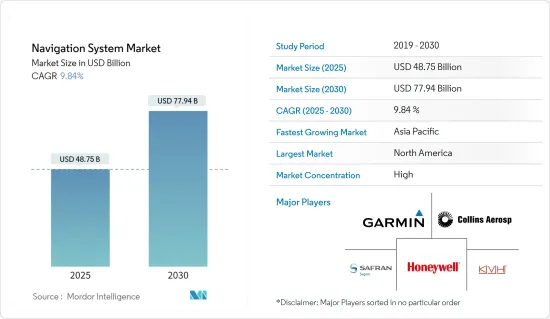

导航系统市场规模预计在 2025 年为 487.5 亿美元,预计到 2030 年将达到 779.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.84%。

主要亮点

- 随着从汽车到自主机器人等各种应用对即时资讯的需求不断增加,导航系统在世界各地得到越来越广泛的应用。随着技术的进步,这些系统正在转型以提供多种服务和导航功能,围绕着导航技术形成庞大的服务生态系统。

- 导航系统除了确定车辆的位置和方向外,还有许多其他用途。它可以帮助您随时了解天气预警、追踪小包裹和货物、改善交通流量等。这些系统也被用于一些先进的应用中,以促进智慧空间的发展。

- 各种 GPS 系统可用于采矿、航空、测量、农业、海洋和军事应用。近年来,全球贸易和海上运输量的增加促进了市场的成长。此外,世界各国政府都在大力投资各工业领域的导航系统。

- 例如,印度太空研究组织(ISRO)和印度机场管理局(AAI)共同实施了 GAGAN计划,作为卫星增强系统 (SBAS)。

- 同样,许多汽车相关企业正致力于为导航系统带来新的创新。例如,2023年2月,宾士与Google宣布建立长期策略伙伴关係,致力于提升汽车创新能力,打造产业下一代数位化豪华汽车体验。透过此次合作,宾士将成为第一家基于Google地图平台全新车载资料和导航功能开发自有品牌导航体验的汽车製造商。

- 近期的新冠疫情严重影响了全球导航系统业务。世界各地的新计画均已停止。由于工人们待在家里,世界各地的工厂都难以整合现代导航系统,扰乱了全球供应链。 COVID-19 仅对该市场产生了暂时的影响,导致生产和供应链停滞。随着条件的改善,导航系统的生产、供应链和需求稳步扩大。

- 预计预测期内航空业的高速扩张和国防费用将推动导航系统市场的成长。然而,昂贵的安装成本和安全法规阻碍了该行业的发展。然而,克服这些障碍需要专注于采用新的技术创新。

导航系统市场趋势

国防推动市场成长

- 导航系统的一个重要应用是国防工业。导航系统允许使用者侦测、定位和描述干扰源。军队使用卫星导航进行地面导航、空中监视和海上导航。

- 导航有助于军事任务精确定位部队、敌军以及敌方设施和设备的位置。准确性、可靠性、定位精度和及时测量是推动国防领域市场采用成长的一些关键因素。

- 许多公司提供各种各样的产品来满足不同最终用户的需求。例如,柯林斯航空于 2022 年 6 月推出了 NavHub-200M,这是第一款针对国际市场且相容军用代码 (M-Code)接收器技术的非 ITAR 车辆导航系统。 NavHub-200M 提供保证的定位、导航和授时 (APNT) 功能,同时提高对全球定位系统 (GPS) 现有和新出现的威胁(例如欺骗和干扰)的整体抵御能力。

- 此外,在2023年3月,赛峰集团宣布推出新产品NAVKITE,这是一款结合了GEONYXTM-M和VersaSync的综合导航和弹性授时解决方案。这款新产品是一个全自动系统,它将 GeonyxTM-M 导航系统与 VersaSync 时间和频率伺服器结合,可分析 GNSS*/GPS 讯号并检验其完整性。

- 随着政府对安全问题的日益关注,导航系统在国防领域变得至关重要。例如,英国正在计划推出卫星导航系统。伦敦保守党政府最近宣布已拨出 9,200 万英镑(约 1.153 亿美元)进行可行性测试,以设计和开发伽利略卫星系统的替代方案。

- 此外,2022 年 9 月,雷神公司获得了一份价值 5.83 亿美元的美国导航合同,用于开发更新的技术,为士兵提供战场上关键的情境察觉和背景信息。该技术将安装在多种装甲平台上,包括布雷德利战车、圣骑士炮和艾布拉姆斯坦克,以及史瑞克和悍马等轻型装甲平台。

预计北美将占很大份额

- 北美占据全球导航系统市场的大部分份额。北美引领市场主要是因为该地区早期采用技术并对先进导航系统进行巨额投资。此外,预计全部区域对各种自动化技术的支出增加和智慧基础设施建设将进一步推动市场成长。

- 推动市场发展的关键因素是蜂巢式网路基础设施的日益普及以及自动车辆定位 (AVL)、追踪系统等应用技术的整合。然而,缺乏认识、GNSS 技术高成本以及讯号连接等因素阻碍了市场成长。

- 导航系统主要用于国防领域。追踪和定位是国防工业导航系统的主要应用。国防工业支出大部分来自北美地区,其中美国的贡献最大。

- 2023年1月,L3Harris宣布向美国交付导航技术卫星-3号并交付太空船。 NTS-3 是一项由空军研究实验室资助的实验,它将从地球静止轨道传输位置、导航和定时 (PNT) 讯号。其目的是为美国军方展示下一代PNT技术并提供GPS的替代方案。

- 与中国、沙乌地阿拉伯、印度、法国、俄罗斯、英国和德国等国家相比,美国的国防支出开支最高。

- 此外,由于自动驾驶汽车和乘用车产量的增加,北美导航系统市场预计将实现高速成长。乘用车配备有仪表板上或仪表板安装的导航系统。这些原厂导航系统比智慧型手机导航更精确、功能更多、整合度更高。

- 此外,随着对精度的需求不断增加,汽车导航技术正在融入提供即时交付系统的应用程序,帮助追踪和预测供应链。此外,由于汽车共享服务严重依赖导航技术,Ola、Uber 和 Grab 预计将推动市场成长。

导览系统产业概况

导航系统市场的主要竞争者是 Garmin 公司、霍尼韦尔国际公司和柯林斯航空航太公司。 他们透过大量投资研发不断创新产品的能力使他们比其他参与者更具竞争优势。优势。

- 2023 年 2 月,雷神公司宣布已获得一份价值 860 万美元的合同,为日本海上自卫队 (JMSDF) 提供 F-35 JPALS。 JPALS 是一种基于软体的差分全球定位系统导航和精确着陆系统。美国收到了订单。 JPALS 与 F-35 战斗机集成,允许其在任何天气条件下在海上舰艇上作战、接近和降落。

- 2022年1月,非洲国家在非洲-马达加斯加空中导航安全局(ASECNA)的努力下成为星基增强系统(SBAS)的一部分。 SBAS 是一种高精度且强大的全球导航卫星系统 (GNSS),它不再需要区域地面导航辅助设备和机场着陆系统。由非洲安全与航空管理局主导的非洲航空业将能够开发自己的 SBAS 系统,以协助航空公司和航空相关人员。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 汽车产业越来越多地采用导航系统

- 市场限制

- 新兴国家系统成本高,缺乏配套基础设施

第六章 市场细分

- 按应用

- 防御

- 航空

- 海上

- 车

- 其他用途

- 按类型

- 卫星导航系统

- 手术导航系统

- 惯性导航系统

- 其他类型

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Garmin Ltd

- Honeywell International Inc.

- Collins Aerospace Inc.

- Safran Electronics & Defense Inc.

- KVH Industries Inc.

- Raytheon Company Ltd

- SBG Systems SAS

- Advanced Navigation Inc.

- Trimble Navigation Ltd

- Lord Sensing Systems Inc.

- L3Harris Technologies Inc.

- Northrop Grumman Corporation

- Esterline Technologies Corporation

- Moog Inc.

第八章投资分析

第九章:市场的未来

The Navigation System Market size is estimated at USD 48.75 billion in 2025, and is expected to reach USD 77.94 billion by 2030, at a CAGR of 9.84% during the forecast period (2025-2030).

Key Highlights

- With the increasing demand for real-time information in various applications ranging from automotive to autonomous robots, navigation systems are increasingly widely adopted globally. With technological advancement, these systems have transformed and offered multiple services and navigation facilities, creating a considerable service ecosystem around navigation technologies.

- Besides determining the location or direction of vehicles, they have many different uses. They help to know the weather alerts, track parcels, and shipments, improve the traffic flow, etc. Also, these systems are used in several advanced applications to facilitate smart spaces.

- Various GPS systems find use in mining, aviation, surveying, agriculture, maritime, and military applications. Increased global trade and maritime traffic have aided the market's growth in recent years. Moreover, governments worldwide havesignificantly investeds in navigation systems across various industry verticals.

- For instance, in collaboration, the Indian Space Research Organization (ISRO) and the Airports Authority of India (AAI) implemented the GAGAN project as a Satellite-Based Augmentation System (SBAS), which is anticipated to benefit numerous stakeholders operating in Indian airspace.

- Similarly, many automotive players focus on bringing new technological innovations to navigation systems. For instance, in February 2023, Mercedes Benz and Google announced a long-term strategic partnership to improve auto innovation and create the industry's next-generation digital luxury car experiences. Through this partnership, Mercedes-Benz will be the first automaker to develop its own branded navigation experience based on the new in-vehicle data and navigation capabilities of the Google Maps platform.

- The recent COVID-19 pandemic severely impacted the global navigation system business. New projects all around the world had come to a halt. As workers stayed home, worldwide factories struggled to integrate modern navigation systems, disrupting global supply chains. COVID-19's impact on this market was only temporary because only the production and supply chain was halted. Production, supply networks, and demand for navigation systems steadily expanded as the situation improved.

- The aviation industry's high expansion and defense spending is expected to fuel the navigation system market growth during the projected period. However, expensive installation costs and safety regulations are impeding industry growth. Nonetheless, overcoming such impediments will focus on introducing new technological innovations.

Navigation Systems Market Trends

Defense is Boosting the Market Growth

- One of the significant applications of navigation systems is the defense industry. Navigation systems allow users to detect, locate, and characterize interference sources. Military forces use satellite navigation for ground navigation, aerial monitoring, and maritime navigation.

- Navigation helps military missions accurately position their units, the enemy's forces, and the locations of the enemy's facilities or installations. Accuracy, reliability, precision in positioning, and timely measurements are some of the major factors driving the growth of market adoption in the defense sector.

- Many companies provide a wide range of products to cater to the needs of various end-users. For instance, in June 2022, Collins Aerospace introduced NavHub-200M, the first non-ITAR vehicular navigation system for the international market compatible with Military Code (M-Code) receiver technology. NavHub-200M provides Assured Positioning, Navigation, and Timing (APNT) capabilities while improving overall resistance to existing and emerging threats to Global Positioning Systems (GPS), such as spoofing and jamming.

- Similarly, in March 2023, Safran announced to offer a new product, NAVKITE, an integrated navigation and resilient timing solution combining a GEONYXTM-M and a VersaSync. This new product is a fully automated system based on a combination of the GeonyxTM-M navigation system and the VersaSynctime and frequency server that analyzes GNSS*/GPS signals and verifies their integrity.

- Owing to the increasing security concerns by the government of various countries, a navigation system has become an indispensable part of the defense sector. For instance, Britain is moving toward launching its satellite navigation system. The Conservative government of London recently announced that it has set aside GBP 92 million (~USD 115.3 million) to undertake a feasibility test for designing and developing an alternative to the Galileo Satellite System.

- Moreover, in September 2022, Raytheon Company Ltd. announced that it had been awarded a USD 583 million contract for US Army navigation to develop an updated version of a technology that provides soldiers with critical situational awareness and context on the battlefield. The technology will be mounted into various armored platforms, including Bradley Fighting Vehicles, Paladin artillery, and Abrams tanks, as well as lighter options, such as Strykers and Humvees.

North America Expected to Hold Significant Share

- The North American region holds the majority share in the global navigation system market. The primary reason for North America to be the market leader can be the early adoption of technology in the region and immense investment into advanced navigation systems. Also, increased spending on various automation technologies and building a smart infrastructure throughout the region is further expected to boost market growth.

- The key factors driving the market are the increasing penetration of cellular network infrastructure and the integration of technologies for applications, such as Automatic Vehicle Location (AVL), tracking systems, etc. However, factors such as lack of awareness, high cost of GNSS technology, and signal connectivity hinder the market's growth.

- The navigation system is mostly used in the defense sector. Tracking and positioning is a navigation system's primary application area used in the defense industry. Most of the defense industry's spending comes from the North American region, with the United States contributing the most.

- In January 2023, L3Harris announced to delivery of the Navigation Technology Satellite-3 to the U.S. Air Force and the spacecraft. NTS-3 is an Air Force Research Laboratory-funded experiment that will transmit Positioning, Navigation, and Timing (PNT) signals from Earth's geostationary orbit. The goal is to demonstrate next-generation PNT technology for the U.S. military and provide an alternative to GPS.

- The United States is the largest spender on national defense compared to countries like China, Saudi Arabia, India, France, Russia, the United Kingdom, Germany, etc.

- Moreover, the navigation system market in North America will witness high growth owing to the rising production of autonomous and passenger vehicles. Passenger vehicles are equipped with dashboards or dashboard-mounted navigation systems. These factory-installed navigation systems are more accurate, have more features, and have better integration than smartphone navigation.

- Furthermore, with the growing need for accuracy, automotive navigation technology is helping supply chain tracking and forecasting by incorporating applications that provide real-time delivery systems. Moreover, Ola, Uber, and Grab are expected to drive market growth as car-sharing services rely heavily on navigation-based technology.

Navigation Systems Industry Overview

The competitive rivalry in the navigation systems market is high owing to some key players like Garmin Ltd, Honeywell International Inc., Collins Aerospace Inc., Safran Electronics & Defense Inc., and many more. Their ability to continually innovate their products through significant research and development investments has helped them achieve a competitive advantage over other players.

- In February 2023, Raytheon Company Ltd. announced that it had won USD 8.6 million contract to provide F-35 JPALS for Japan Maritime Self-Defense Force (JMSDF). JPALS is a software-based differential Global Positioning System navigation and precision landing system. The contract was awarded by U.S. Navy. JPALS is integrated with the F-35 fighter, capable of operating, approaching, and landing on naval vessels at sea in all weather conditions.

- In January 2022, African countries joined part of the satellite-based augmentation system (SBAS) because of ASECNA (Agency for Aerial Navigation Safety in Africa and Madagascar) efforts. SBAS is a precise and robust Global Navigation Satellite System (GNSS) system that eliminates the need for regional ground-based navigation aids and airport landing systems. Africa Aviation, led by ASECNA, can develop its own SBAS system to assist the airlines or aviation stakeholders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Implementation of Navigation Systems in the Automobile Industry

- 5.2 Market Restraints

- 5.2.1 High System Cost and Lack of Supporting Infrastructure in Developing Countries

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Defense

- 6.1.2 Aviation

- 6.1.3 Maritime

- 6.1.4 Automotive

- 6.1.5 Other Applications

- 6.2 By Type

- 6.2.1 Satellite Navigation Systems

- 6.2.2 Surgical Navigation Systems

- 6.2.3 Inertial Navigation Systems

- 6.2.4 Other Types

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Collins Aerospace Inc.

- 7.1.4 Safran Electronics & Defense Inc.

- 7.1.5 KVH Industries Inc.

- 7.1.6 Raytheon Company Ltd

- 7.1.7 SBG Systems SAS

- 7.1.8 Advanced Navigation Inc.

- 7.1.9 Trimble Navigation Ltd

- 7.1.10 Lord Sensing Systems Inc.

- 7.1.11 L3Harris Technologies Inc.

- 7.1.12 Northrop Grumman Corporation

- 7.1.13 Esterline Technologies Corporation

- 7.1.14 Moog Inc.