|

市场调查报告书

商品编码

1640429

超高清:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Super Hi-Vision - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

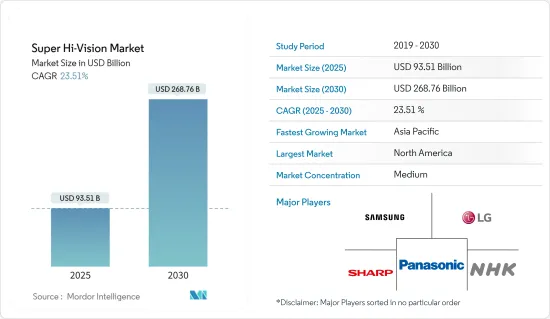

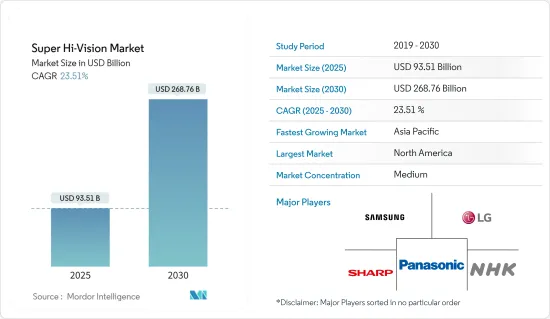

超高清市场在 2025 年的价值预估为 935.1 亿美元,预计到 2030 年将达到 2,687.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.51%。

主要亮点

- 显示器、摄影机和影像压缩技术的不断进步使得超高清内容的创作、分发和消费成为可能。随着技术的进步和普及,製作和展示超高清内容的进入门槛正在逐步降低,预计这将在未来几年推动市场成长。

- 8K 超高清(8K SHV)摄影机的像素数是全高清(1920 x 1080 像素)的 16 倍,是 4K 超高清(3840 x 2160 像素)的 4 倍,在视频领域引起了极大的关注。也就是说,8K超高清将带来16倍的影像资料讯息,相当于16倍的数位变焦,应该相当于全高清的画质。这项最新进展也使得使用更小更轻的相机镜头录製 8K 成为可能。

- 对于更高解析度显示器的需求不断增长,推动着市场的发展。 8K技术以多种解析度实现。此外,8K UHD(解析度 7680 x 4320)非常适合显示器和电视。高像素数提供了宽视角并产生清晰的影像。由于新技术的需求量很大,尤其是在消费品领域,预计该领域将占据相当大的市场占有率。

- 消费性电子产业显示技术的不断发展,加上消费者对高画质电视的偏好日益增长,为市场扩张创造了非常有利的环境。更大萤幕、更高解析度的电视尤其能提供卓越的影像品质并提供更身临其境、逼真的观赏体验。Sharp Corporation开发了一款 85 吋液晶电视,其解析度达到了惊人的水平 7,680 像素、垂直 4,320 像素。这项卓越的成果是透过利用Sharp Corporation专有的 UV2A 技术来实现的,该技术显着提高了显示品质。

- 市场主要受到观看体验需求不断增长(尤其是在娱乐和游戏领域)以及内容创作能力不断提高的推动。此外,相容产品和高速互联网的出现所推动的技术进步也在推动市场成长方面发挥着重要作用。

- 然而,8K产品的高价格和初始成本可能是限制市场成长的潜在因素。此外,超高清内容和设备可能与现有基础设施和设备不完全相容,包括较旧的 HDMI 标准和串流媒体平台。这可能会导致客户对采用该技术的兴趣降低,从而抑制市场成长。

超高清电视市场趋势

对更高解析度显示器的需求不断增长将推动市场成长

- 改善视觉体验的需求是超高清市场成长的主要驱动力。对更高解析度显示器的不断增长的需求是这一趋势的先驱,也是推动超高清领域巨大兴趣和投资的关键市场驱动力。

- 超高清市场以超高清或 8K 解析度为特色,它提供超越传统显示技术的最佳影像品质、清晰度和细节。 8K 电视、显示器和投影机的出现是为了满足客户对身临其境、逼真的影像体验日益增长的需求。这些仪器能够产生具有独特精度的影像。

- 此外,根据《消费者报告》显示,在美国,到 2022年终,8K 解析度电视的销量预计将达到16 万台,比2021 年增长70%,到2023 年,销量将增长近200%,达到47.9万台。如此显着的成长预测凸显了对更高解析度显示器日益增长的需求的影响,这将彻底改变超高清市场。

- 各种内容消费环境中对更具沉浸感和真实感的体验的需求日益增长,是推动高解析度显示器需求激增的主要因素之一。越来越多的终端用户要求显示器能够重现精细的细节、鲜艳的色彩和细緻的纹理,以满足电影、游戏、视讯串流、设计和医学成像等应用的需求。

- 此外,超高清与AR、VR等其他新兴技术的结合将带来巨大的市场机会。在这些领域,视觉保真度对于消除怀疑和创造沉浸式环境至关重要,对更高解析度显示器的需求变得更加明显。 Super HD 提供无缝高清体验的能力与 AR 和 VR 应用的目标一致,使其更具相关性和吸引力。

预计亚太地区将出现强劲成长

- 亚太地区是所研究市场的重要收益贡献者之一,因为该地区拥有庞大的消费群体以及Sharp Corporation和日本京东方等众多参与者。近年来,日本积极投入超高清设备的研发,提供技术支援。因此日本拥有实现和广播8K内容的基础。

- 日本也设立了东京8K影院、东京8K超高清影院等8K体验区,让人们体验8K技术。由于尚处于发展初期,只有少数人能够负担得起,需求仅限于高所得个人和企业。

- 此外,该地区快速的都市化、蓬勃发展的中阶和不断增长的数位内容消费都在创造对增强影像体验的需求。这些因素结合在一起,使得超高清萤幕成为该地区日益增长的高端娱乐、引人注目的教育工具和先进的专业应用需求的重要组成部分。

- 由于预测期内中国的需求不断增长,预计中国将成为重要的市场参与者。中国是消费大国,拥有支援8K设备量产的基础建设。这表明,一旦技术确立并成为标准,中国製造商可能会降低价格,并有望在市场上涌现本土製造商。

- 此外,该地区知名市场参与者进行了多项创新,占据了相当大的市场占有率。例如,三星电子推出了 8K显示器驱动IC(DDI),以便在平面电视设计中实现 8K 解析度和高达 4Gigabit每秒 (Gbps) 的面板内资料传输速度。三星采用 USI-T 2.0(S6CT93P)的 8K DDI 可能会将 8K 影像传送到高阶显示器,从而提高大萤幕电视观赏体验的标准。

超高清产业概况

由于市场环境不断变化和产品阵容有限,超高清市场预计将逐步整合。公司正积极注重创新并建立伙伴关係以确保获得较大的市场占有率。该市场领域的主要企业包括三星电子、NHK、LG电子、Panasonic和Sharp Corporation。

2023 年 2 月,三星电子美国公司宣布计划在授权零售商处逐步发售 2023 年三星 Neo QLED 8K 电视的超高阶版本。 Neo QLED 8K 系列采用量子点技术,提供当今市场上最高的解析度。这项最尖端科技可产生令人眼花撩乱、栩栩如生的色彩。

2023年2月,NBA与身临其境型科技、媒体和娱乐公司Cosm达成长期伙伴关係关係。此次合作旨在为篮球迷提供体验现场比赛的新方式。作为伙伴关係的一部分,Cosm 将为 NBA League Pass 製作和播放精选比赛。这些比赛将在体育场即将建成的巨型 LED 穹顶系统上以沉浸式 8K 解析度进行直播,为球迷提供无与伦比的观看体验。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对更高解析度显示器的需求不断增加

- 家电显示技术的进步

- 市场限制

- 8K产品价格高昂、成本高昂

- 技术简介

第六章 市场细分

- 按应用

- 医疗保健和医药

- 家电

- 商业的

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Samsung Electronics Co., Ltd.

- NHK(Japan Broadcasting Corporation)

- LG Electronics Inc.

- Panasonic Corporation

- Sharp Corporation

- BOE Japan Co. Ltd

- Canon Inc.

- Hisense Co. Ltd

- Dell Inc.

- Red Digital Cinema Camera Company

- Ikegami Tsushinki Co. Ltd.

第八章投资分析

第九章 市场机会与未来趋势

The Super Hi-Vision Market size is estimated at USD 93.51 billion in 2025, and is expected to reach USD 268.76 billion by 2030, at a CAGR of 23.51% during the forecast period (2025-2030).

Key Highlights

- Ongoing advancements in display technology, camera technology, and video compression techniques are enabling the creation, distribution, and consumption of Super Hi-Vision content. As technology improves and becomes more accessible, the barriers to entry for producing and displaying Super Hi-Vision content are gradually being lowered, anticipated to drive market growth in the coming years.

- The 8K Super Hi-Vision (8K SHV) camera is gaining significant prominence in the market, which represents 16 times of numbers of pixels than numbers of pixels of Full HD (1920 x 1080 pixels) and 4 times 4K Ultra HD (3840 x 2160 pixels). It means that 8K Ultra HD brings 16 times of image data information, equivalent to 16 times digital zoom, which should be equal to Full HD quality. This latest development is also capable of recording 8K in a camera head that is smaller and lighter.

- Rising demand for better-resolution display screens is driving the market. The 8K technology is implemented in different resolutions. Furthermore, the 8K UHD (7680 X 4320 resolution) is best suited for monitors and televisions. Its high pixel count provides better viewing angles and high-clarity images. This segment is expected to account for a major market share as new technologies witness high demand, especially in the case of consumer goods.

- The continuous evolution of display technology in the consumer electronics industry, coupled with the growing consumer preference for high-resolution televisions, has fostered a highly favorable environment for market expansion. Large-screen and high-resolution TVs, in particular, offer superior image quality, delivering a more immersive and lifelike viewing experience. To illustrate, Sharp stands as a prime example with its creation of an 85-inch LCD boasting an impressive resolution of 7,680 horizontal X 4,320 vertical pixels. This remarkable achievement is attributed to the utilization of Sharp's proprietary UV2A technology, which significantly enhances display quality.

- The market is significantly driven by the rising demand for viewing experiences, especially in the entertainment and gaming sectors, and the increasing content creation capabilities. In addition, growing technological advancements supported by the emergence of compatible products and high-speed internet also play a significant role in driving market growth.

- However, the high price and prime cost of 8K products could be a potential factor responsible for restraining the market growth. In addition, super Hi-Vision content and devices might not be completely compatible with existing infrastructure and devices, such as older HDMI standards or streaming platforms. This might decline customer interest in adopting the technology, thereby restraining the market growth.

Super Hi-Vision Market Trends

Rising Demand for Better Resolution Display Screen to Drive the Market Growth

- The demand for enhanced visual experiences has emerged as a crucial driving force, propelling the growth of the Super Hi-Vision market. The escalating demand for better-resolution display screens is at the forefront of this trend, a pivotal market driver that has sparked considerable interest and investment in the Super Hi-Vision sector.

- The super hi-vision market, distinguished by its ultra-high definition or 8K resolution, provides optimal image quality, clarity, and detail that exceeds traditional display technologies. 8K TVs, monitors, and projectors have been introduced in response to customers' increasing demand for immersive, true-to-life visual experiences. These devices can generate images with unique precision.

- Moreover, in the United States, sales of televisions with 8K resolution are expected to reach 160,000 units by the end of the year 2022, an increase of 70% from 2021, and are projected to increase by about 200% to 479,000 in 2023, according to the Consumer Technologies Association (CTA) Summer 2022 Sales & Forecasts Update Report. Such significant forecasted growth emphasizes the impact of the rising demand for better-resolution display screens in transforming the Super Hi-Vision market landscape.

- The increasing need for realism and immersion in various content consumption environments is one of the main drivers driving the surge in demand for higher-resolution display screens. End customers are increasingly looking for displays that can reproduce the tiniest details, brilliant colors, and detailed textures for applications like movies, games, video streaming, design, and medical imaging.

- In addition, the integration of super hi-vision with other emerging technologies, such as AR, VR, etc., presents significant market opportunities. In these domains, where visual fidelity is critical to breaking disbelief and creating immersive environments, the demand for better-resolution display screens becomes even more prominent. Super Hi-Vision's ability to deliver a seamless, high-resolution experience aligns with the goals of AR and VR applications, strengthening its relevance and desirability.

Asia Pacific is Expected to Witness Significant Growth Rates

- The Asia-Pacific region is one of the significant revenue contributors to the market studied due to the presence of a large consumer population, along with the presence of a number of players, like Sharp and BOE Japan. For the past few years, Japan has been actively investing in the development of super hi-vision devices while supporting technological aspects. Thus, Japan has a stronghold for enabling and broadcasting 8K content.

- The country placed 8K experience zones, such as Tokyo 8K Theater and Tokyo 8K Super Hi-Vision Theater, for people to experience 8K technology. Since it is in the early stages of development, it is only affordable for some, and the demand is only from high-income individuals or businesses.

- In addition, rapid urbanization, a burgeoning middle class, and the rise of digital content consumption in the region have created a demand for enhanced visual experiences. These elements have combined to make Super Hi-Vision screens a vital component of the area's expanding need for high-end entertainment, engaging educational tools, and advanced professional applications.

- China is expected to emerge as a prominent market player by witnessing an increasing demand over the forecast period. China is a major consumer with the infrastructure to support the mass production of 8K devices. This indicates that once the technology is set and becomes the norm, Chinese manufacturers are likely to lower the prices, and local manufacturers are expected to emerge in the market.

- Moreover, the region witnessed considerable innovations from prominent market players in order to gain significant market shares. For example, Samsung Electronics introduced an 8K display driver IC (DDI), which enables the delivery of 8K resolution in slim TV designs with an intra-panel data transmission speed of up to 4 gigabits per second (Gbps). Samsung's 8K DDI (S6CT93P) with USI-T 2.0 will provide 8K pictures to premium displays that might increase standards for viewing experiences on big-screen TVs.

Super Hi-Vision Industry Overview

The super hi-vision market is expected to witness moderate consolidation due to the evolving market landscape and limited product offerings. Companies are actively focusing on innovation and forming partnerships to secure substantial market shares. Leading players in this market segment include Samsung Electronics Co., Ltd., NHK, LG Electronics Inc., Panasonic Corporation, Sharp Corporation, and more.

In February 2023, Samsung Electronics America announced its plans to gradually release the 2023 Samsung Neo QLED 8K TV ultra-premium versions in authorized retail stores. The Neo QLED 8K series features Quantum Dot technology, offering the highest resolution currently available in the market. This cutting-edge technology produces a dazzling array of vibrant and true-to-life colors.

In February 2023, the NBA entered into a long-term partnership with Cosm, an immersive technology, media, and entertainment provider. This collaboration aims to provide basketball fans with a novel way to experience live games. As part of this partnership, Cosm will produce and broadcast a curated selection of NBA League Pass games, which is the league's out-of-market live game streaming service. These games will be showcased in immersive 8K resolution on massive LED-dome systems within upcoming stadiums, offering fans an unparalleled viewing experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Better Resolution Display Screen

- 5.1.2 Advancements in Display Technology in Consumer Electronics

- 5.2 Market Restraints

- 5.2.1 High Price and Prime Costing of 8K Product

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Healthcare and Medical

- 6.1.2 Consumer Electronics

- 6.1.3 Commercial

- 6.1.4 Other Applications

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co., Ltd.

- 7.1.2 NHK (Japan Broadcasting Corporation)

- 7.1.3 LG Electronics Inc.

- 7.1.4 Panasonic Corporation

- 7.1.5 Sharp Corporation

- 7.1.6 BOE Japan Co. Ltd

- 7.1.7 Canon Inc.

- 7.1.8 Hisense Co. Ltd

- 7.1.9 Dell Inc.

- 7.1.10 Red Digital Cinema Camera Company

- 7.1.11 Ikegami Tsushinki Co. Ltd.