|

市场调查报告书

商品编码

1640437

丙烯酸纤维:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Acrylic Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

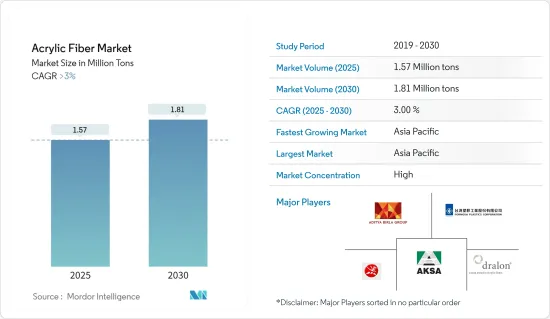

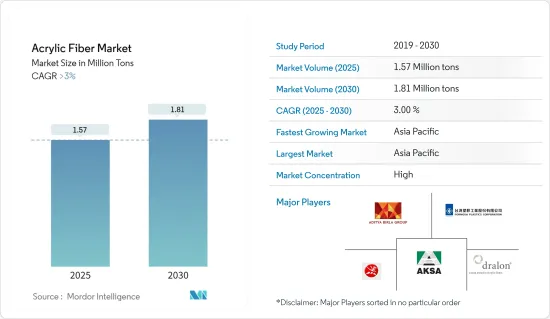

丙烯酸纤维市场规模预计在 2025 年为 157 万吨,预计到 2030 年将达到 181 万吨,预测期内(2025-2030 年)的复合年增长率将超过 3%。

2021 年的新冠疫情对市场产生了负面影响,导致企业、产品和製造设施放缓,减少了经济活动。不过,预计市场将在预测期内復苏。

关键亮点

- 推动市场成长的关键因素包括对服装的高需求和工业应用的增加。

- 然而,聚酯等替代品的可用性以及全球对丙烯酸纤维生产的严格规定预计将阻碍市场的成长。

- 然而,预计丙烯酸纸的成长机会和未来市场将在预测期内提供充足的成长机会。

- 由于东南亚国协和印度的需求量很大,亚太地区占据了丙烯酸纤维市场的主导地位。

腈纶市场趋势

羊毛占据市场主导地位

- 羊毛在服饰中的使用历史可追溯至古代。羊毛具有抗皱、吸湿、保温等优良能。羊毛的一大特性是它能够随着时间的推移恢復变形。因此,用这种纤维製成的服装颇具吸引力。

- 以 100% 羊毛纤维编织或针织的织物用途广泛,包括毛衣、派克大衣、靴子、靴子内衬、帽子、手套、运动服、地毯、毛毯、滚筒刷、块毯、防护衣、假髮、头髮已成为製作接髮等服饰的标准。

- 大部分腈纶纤维都用于羊毛腈纶混纺,这种混纺织品非常受欢迎。圆形针织品采用 55% 羊毛和 45% 腈纶混纺。这种混纺纤维特别用于生产运动服,具有易于护理、耐用、外观保持性好、色彩造型鲜艳和手感舒适等优点。

- 根据需求,世界各地使用多种不同的混合物。 50/50 和 70/30 腈纶羊毛混纺面料製成的服饰价格便宜,外观漂亮,而且易于护理。 50/50 的腈纶/羊毛混纺用于製作耐用且不变形的轻质服饰,而 70/30 的腈纶/羊毛混纺则用于製作休閒裤。

- 据国际毛纺织组织称,中国仍然是世界上最大的羊毛纤维买家,但美国对羊毛的需求也在增加。截至 2022 年 11 月的一年中,进口到美国的羊毛服饰数量与 2021 年同期相比增加了 47%。

- 因此,预计预测期内羊毛领域对丙烯酸纤维的需求将持续增加,并占据市场主导地位。

中国主导亚太市场

- 中国是全球最大的腈纶生产国,占世界腈纶产量的30%以上。受国内和国际市场特别是东南亚国协、欧洲、美国、日本等市场需求的推动,中国纺织业规模逐年扩大。

- 伊朗、印度、越南、巴基斯坦和阿联酋是中国出口腈纶的最大市场。我们也从日本、德国、泰国、韩国和土耳其等国家进口腈纶纤维。

- 中国是世界上最大的纺织品生产国和出口国。以以金额为准,其约占世界纺织品出口总额的43%。因此,中国服饰的成长可望提振腈纶市场。

- 该国纺织业取得了显着的成长。根据中国国家统计局统计,2023年中国重点纺织企业主营收益与前一年同期比较%。 2023年,中国纺织品服饰出口预计将达到历史最高的2,936亿美元。

- 因此,预计所有这些市场趋势将在预测期内推动中国丙烯酸纤维市场的需求。

腈纶产业细分

腈纶纤维市场本质上是整合的。市场的主要企业包括 Aksa Akrilik Kimya Sanayii AS、Dralon、吉林化纤集团、Aditya Birla Management Corporation Pvt.Ltd 和台塑股份有限公司(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 服装需求旺盛

- 增加工业用途

- 其他驱动因素

- 限制因素

- 聚酯等替代品的可用性

- 全球对腈纶生产有着严格的规定

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 形式

- 史泰博

- 灯丝

- 混合

- 羊毛

- 棉布

- 其他混合物(纤维素)

- 应用

- 服饰

- 家居家具

- 工业的

- 其他用途(室内装潢)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- Aditya Birla Management Corporation Pvt. Ltd

- Aksa Akrilik Kimya Sanayii AS

- China Petrochemical Corporation(Sinopec)

- Dralon

- Formosa Plastics Corporation

- Indian Acrylics Limited

- Japan Exlan Co., Ltd

- Jiangsu Zhongxin Resources Group

- Jilin Chemical Fiber Group Co. Ltd

- Kaltex

- Kaneka Corporation

- Mitsubishi Chemical Corporation

- Pasupati Acrylon

- PetroChina Company Limited

- Taekwang Industrial Co. Ltd

- Toray Industries Inc.

- Vardhman Acrylics Ltd

第七章 市场机会与未来趋势

- 压克力纸的未来市场

- 其他机会

The Acrylic Fiber Market size is estimated at 1.57 million tons in 2025, and is expected to reach 1.81 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2021, as the pandemic resulted in the slowdown of businesses, products, and manufacturing facilities, resulting in less economic activity. However, the market is expected to recover during the forecast period.

Key Highlights

- The major factors driving the growth of the market studied include the high demand for apparel and increasing industrial applications.

- On the flip side, the availability of substitutes like polyester and stringent regulations worldwide on the production of acrylic fiber are expected to hinder the growth of the market.

- However, growing opportunities and the future market for acrylic paper are expected to offer ample growth opportunities during the forecast period.

- Asia-Pacific dominated the acrylic fiber market due to high demand from the ASEAN countries and India.

Acrylic Fiber Market Trends

The Wool Segment to Dominate the Market

- The use of wool for clothing dates back to ancient times. Wool has outstanding properties, such as resistance to wrinkles, moisture absorption, and warmth. A significant feature of wool is its ability to recover from deformation over time. Hence, clothing made from these fibers is attractive.

- Fabrics woven or knitted with 100% wool fiber have become a standard in making apparel, such as sweaters, hoodies, boots, boot lining, hats, gloves, athletic wear, carpeting, blankets, roller brushes, upholstery, area rugs, protective clothing, wigs, and hair extensions.

- A majority of acrylic fiber is used to make wool and acrylic blends, which are very popular. A blend of 55% wool and 45% acrylic fiber is used to make circular knit goods. This blend is particularly used in making sportswear, with characteristics like ease of care, durability, appearance retention, color styling, and palatability.

- Different blends are used worldwide depending on the requirements. The 50/50 and 70/30 acrylic wool blends are popular among those apparel that are inexpensive, look good, and are easy to handle. The 50/50 acrylic wool blend is used to make lightweight apparel that has excellent durability and shape retention, while the 70/30 acrylic wool blend is used to make slacks.

- According to the International Wool Textile Organization, China remains the top buyer of wool fiber globally, yet there is an increasing demand for wool in the United States. During the year that concluded in November 2022, the quantity of wool clothing brought into the United States increased by 47% compared to the same period in 2021.

- Hence, increasing demand for acrylic fiber in the wool segment is expected to dominate the market over the forecast period.

China to Dominate the Market in Asia-Pacific

- China is the largest producer of acrylic fibers in the world, accounting for a share of more than 30% of global acrylic fiber production. Owing to the demand from domestic and international markets, primarily from ASEAN countries, Europe, the United States, and Japan, the textile industry in China has expanded over the years.

- Iran, India, Vietnam, Pakistan, and the United Arab Emirates are some of the largest markets where China exports acrylic fibers. The country also imports acrylic fiber from countries like Japan, Germany, Thailand, South Korea, and Turkey.

- China is the largest textile-producing and exporting country in the world. It holds about 43% share of the world's total textile exports in terms of value. Thus, the growth in China's clothing industry is anticipated to boost the market for acrylic fibers.

- The country has witnessed significant growth in the textiles segment. According to the National Bureau of Statistics of China, in 2023, the combined earnings of China's leading textile companies increased by 7.2% compared to the previous year. In 2023, China's exports of textiles and clothing reached a record high of USD 293.6 billion.

- Hence, all such market trends are expected to add to the demand for the acrylic fibers market in China during the forecast period.

Acrylic Fiber Industry Segmentation

The acrylic fiber market is consolidated in nature. Some of the major players in the market include (not in any particular order) Aksa Akrilik Kimya Sanayii AS, Dralon, Jilin Chemical Fiber Group Co. Ltd, Aditya Birla Management Corporation Pvt. Ltd, and Formosa Plastics Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand for Use in Apparel

- 4.1.2 Increasing Industrial Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes, like Polyester

- 4.2.2 Stringent Regulations Worldwide on the Production of Acrylic Fiber

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Staple

- 5.1.2 Filament

- 5.2 Blending

- 5.2.1 Wool

- 5.2.2 Cotton

- 5.2.3 Other Blendings (Cellulose)

- 5.3 Application

- 5.3.1 Apparel

- 5.3.2 Household Furnishing

- 5.3.3 Industrial

- 5.3.4 Other Applications (Upholstery)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Management Corporation Pvt. Ltd

- 6.4.2 Aksa Akrilik Kimya Sanayii AS

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 Dralon

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 Indian Acrylics Limited

- 6.4.7 Japan Exlan Co., Ltd

- 6.4.8 Jiangsu Zhongxin Resources Group

- 6.4.9 Jilin Chemical Fiber Group Co. Ltd

- 6.4.10 Kaltex

- 6.4.11 Kaneka Corporation

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Pasupati Acrylon

- 6.4.14 PetroChina Company Limited

- 6.4.15 Taekwang Industrial Co. Ltd

- 6.4.16 Toray Industries Inc.

- 6.4.17 Vardhman Acrylics Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Market for Acrylic Paper

- 7.2 Other Opportunities