|

市场调查报告书

商品编码

1640438

密着包装:市场占有率分析、产业趋势与成长预测(2025-2030 年)Skin Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

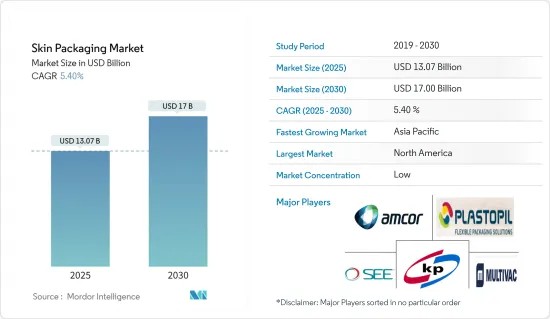

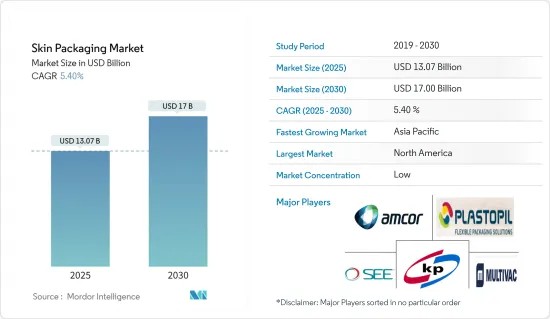

预计 2025 年密着包装市场规模为 130.7 亿美元,预计到 2030 年将达到 170 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.4%。

关键亮点

- 密着包装是一项尖端技术,其中将薄塑胶薄膜铺在热成型托盘或製造的塑胶容器上。除了允许客户查看产品而不受污染的风险之外,这种塑胶薄膜还提供了一层高度透明的保护层,可防止空气和湿气导致产品劣化或损坏。

- 随着人们对保护食品、延长保质期、减少废弃物和提高可见度的需求日益增长,密着包装具有许多优势,例如托盘耐用、可靠,易于运输、储存和展示。

- 对各种肉类和乳製品(如起司、冷盘和各种形式的牛肉)的保存需求不断增长,推动了密着包装市场的发展。近年来,由于真空紧缩包装具有更高的耐用性,传统包装技术在许多食品行业应用中已经过时。此外,与传统包装解决方案相比,它为食品提供了额外的保护层,从而增加了其采用率并支持市场成长。

- 随着人们对回收和生质塑胶的好处的认识不断加深,全球对密着包装的需求正在增加。主要的市场驱动因素包括原料的丰富和密着包装市场技术发展速度的加速。

- 据印度包装工业协会 (PIAI) 称,到 2025年终,印度密着包装市场价值预计将超过 2,048.1 亿美元。由于人均消费支出不断增加,以及对重量轻、耐用、能防止污染的优质软塑胶包装产品的需求不断增长,预计市场将在整个预测期内继续发展。

- 市场发展的部分动力来自于消费者对更长保质期和更好产品可见度的需求。密着包装可以更好地保护产品,保持货物的完整性和新鲜度。它还增加了产品的可见性,让消费者看到实际的产品及其功能,这可能会增加他们的购买慾望。

- 电子产品和元件易受水影响,需要防护装甲。因此,防水贴密着包装的需求量大。它还有助于保护电子设备免受损坏和刮伤。此外,工具、汽车零件等工业产品容易受到本体损伤,且暴露于动态的天气条件下,因此在各类工业产品的包装应用中,密着包装的需求日益增加。

- 永续包装是未来的发展方向,寻找环保替代品是食品业的首要任务。由传统塑胶製成的鲜肉包装面临压力,这就是该行业正在转向环保解决方案的原因。斯道拉恩索的新产品 Trayforma BarrPeel 将于 2023 年 4 月上市,它将使生鲜产品能够包装在真空紧缩包装的纸板托盘中,从而将包装的整体塑胶含量降低到10% 以下。将其保持在。

- 原材料价格的波动和政府对食品包装塑胶使用的严格规定可能会抑制市场的成长。预计环保替代品的出现和日益严重的环境问题将进一步阻碍市场成长。

密着包装市场趋势

食品子区隔肉类将占据主要市场占有率

- 密着包装是一种较新的肉类保存方法,衍生传统的真空包装。在此方法中,将肉类放在塑胶托盘上,并用热成型塑胶薄膜覆盖,在将肉类放在薄膜上的同时对薄膜进行加热。此过程使上皮收缩并精确塑形,防止气泡形成,降低明显渗漏的可能性,延长产品的保质期。

- 该技术旨在将少量新鲜肉、碎肉和加工肉类商业化,供零售店购买。透过将塑胶薄膜应用于产品,我们可以改善消费者的每种感官体验。

- 随着人们对联合国永续发展目标(SDG)的认识不断提高,密着包装在超级市场和其他零售商中变得越来越普遍,以延长保质期并最大限度地减少食物浪费。密着包装主要用于包装肉块,而不是家庭食用的肉片,因为肉块在被购买之前往往会在货架上放置更长时间。

- 皮膜的主要特征是不易黏在骨头上,从而延长保质期,可以牢固地固定产品,在配送过程中保护肉类,而且是透明的,这样消费者就可以检查产品。密着包装密封的尺寸不仅有利于商品行销和延长保质期,还能减少肉类浪费和退货。特别是在肉类行业,由于洩漏和密封不良,零售商退货率很高。

- 由于电子商务的蓬勃发展,对肉类和分割肉包装的需求迅速增加,预计在预测期内将保持稳定。根据经济合作暨发展组织的资料,预计2028年全球鸡肉消费量将达到147.47千吨,高于2022年的135.62千吨。因此,随着肉类产品的消费量不断增加,对密着包装的需求也不断增加。

预计亚太地区将占据主要市场份额

- 随着有组织的零售和电子商务领域的扩张以及原材料的易得性,亚太地区预计将为市场参与企业提供良好的成长潜力。预计中国、印度和印尼消费者购买力的上升将推动对包装食品的需求,有助于扩大市场。

- 随着中国经济的蓬勃发展、都市化的快速发展和生活水准的提高,中国密着包装产业正在蓬勃发展。消费者喜欢更安全、更实用、更个性、更环保的包装。根据中国国家统计局的数据,中国约有63.9%的人口居住在都市区。过去几十年来,中国的都市化稳步提高。

- 随着亚太地区的不断发展,各大公司纷纷扩大在亚太地区的业务。例如,负责任包装解决方案的领导者安姆科在中国惠州开设了一家最先进的生产工厂。该工厂耗资超过 1 亿美元建造,占地 59 万平方英尺,是中国产能最大的软包装工厂,增强了 Amkor 满足亚太地区日益增长的客户需求的能力。

- 人口成长、收入水准提高和生活方式的改变预计将推动消费者支出增加,从而推动印度对密着包装产品的需求。此外,网路和电视等媒体的普及率不断提高,也增加了农村对包装商品的需求。

- 随着食品和饮料行业的需求不断增加和新业务的涌现,印度用于食品和饮料的包装数量激增。 Zomato 和 Swiggy 等食品宅配服务的推出和快速扩张,导致食品和饮料包装的使用量增加。食品包装已经发生了很大的变化,强调品牌认知度,同时透过密着包装来维持食品的品质和水准。

- 随着人口增长和都市化,中国对肉类的需求大幅增长,这影响了对各种类型的密着包装的需求,以使肉类在更长时间内保持新鲜和嫩滑。根据经济合作暨发展组织(OECD)的数据,中国人均肉品消费量正在上升。预计将从2021年的45.17公斤增加到2023年的48.28公斤,2029年达到52.84公斤。

- 推动这一市场发展的是中国消费者对肉类、起司、鱼类、猪肉、鱼贝类和蔬菜的日益增长的偏好,这些食品大多带皮包装以延长保质期。中国消费者已经习惯购买新鲜的鱼贝类。

密着包装产业概况

密着包装市场的竞争格局较为分散,Amcor Group GmbH、Sealed Air Corporation、Clondalkin Flexible Packaging Orlando Inc. 和 Plastopil Hazorea Co. 等市场参与企业加大研发支出,有助于他们获得竞争优势。化,这是一种策略

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 即食包装食品的需求不断增加

- 保香包装的需求不断增加

- 市场限制

- 日益增长的环境问题和政府对塑胶使用的严格监管

- 技术简介

- 密着包装机

- 密着包装技术的最新趋势

第六章 市场细分

- 按应用

- 食物

- 肉类

- 鱼贝类

- 加工食品

- 起司

- 工业产品(包括电子、电器零件)

- 医疗设备

- 耐久性消费品

- 食物

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Plastopil Hazorea Co. Ltd

- Sealed Air Corporation

- Amcor Group GmbH

- MULTIVAC Sepp Haggenmller SE & Co. KG

- Klckner Pentaplast Ltd

- Flexopack SA

- Winpak LTD

- SUDPACK Holding GmbH

- Taghleef Industries Group

- KM Packaging Services Ltd

第八章投资分析

第九章:市场的未来

The Skin Packaging Market size is estimated at USD 13.07 billion in 2025, and is expected to reach USD 17.00 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Key Highlights

- Skin packaging is a state-of-the-art technique consisting of thin layers of plastic film over a thermoforming tray or manufactured plastic container. In addition to allowing customers to look at the product without any risk of contamination, this plastic film provides a very transparent layer of protection against air and moisture that may degrade products or cause them to spoil.

- The growing need to protect food, increase shelf life, reduce waste, and increase visibility is raising the demand for skin packaging from the food industry since it offers benefits, such as reliability, with durable trays, which support and protect products during shipping, storage, and display.

- The growing demand for the preservation of various meat and dairy products, such as cheese, cold cuts, and various forms of beef, is driving the skin packaging market. As vacuum skin packaging provides better durability, traditional packaging techniques have been phased out in various food industry applications in recent years. Moreover, it provides an additional layer that protects the food compared to conventional packaging solutions, increasing its adoption and supporting market growth.

- The demand for skin packaging has increased globally due to the growing understanding of the advantages of recycling and bioplastics. Key market drivers include the abundance of raw materials and the quickening pace of technical developments in the skin packaging market.

- According to the Packaging Industry Association of India (PIAI), the Indian skin packaging market will be worth more than USD 204.81 billion by the end of 2025. The market will continue to develop throughout the forecast period due to rising per capita spending and growing demand for superior products with flexible plastic packaging that is light and durable and can provide protection against contamination.

- In part, the market is driven by consumers wanting longer shelf life and better visibility of products. Skin packaging offers better product protection, preserving the integrity and freshness of the goods. It also gives the goods better visibility so that consumers can see the actual product and its characteristics, which may motivate purchases.

- Since electronic products and components are sensitive to water, they require protective armor. Hence, the demand for skin packaging is high due to its water-resistant properties. It also helps protect the body from damage and scratches in electrical products. Furthermore, industrial goods, such as tools and automotive parts, are prone to body damage and are exposed to dynamic weather conditions, increasing the need for skin packaging in different industrial goods packaging applications.

- Sustainable packaging is the future, and the quest for eco-friendly alternatives is a top priority in the food industry. Fresh meat packaging made from conventional plastic is facing pressure; hence, the industry is shifting toward eco-friendly solutions. In April 2023, Stora Enso's new Trayforma BarrPeel (barrier-coated paperboard for vacuum skin packaging) aimed to enable perishable products to be packaged in recyclable paperboard trays, reducing the overall plastic content of packaging to less than 10%.

- The fluctuating prices of raw materials and stringent regulations imposed by the government on the application of plastic for food packaging are likely to restrain market growth. The availability of environmentally friendly alternatives and rising environmental concerns are further expected to hamper market growth.

Skin Packaging Market Trends

The Meat Sub-segment Under Food is Expected to Hold a Major Market Share

- Skin packaging is a recent method of meat storage derived from traditional vacuum packaging. This method involves placing raw meats on a plastic tray and then covering them with a thermoformed plastic film that is heated simultaneously while the meat is being positioned. This process ensures that the upper skin is precisely shaped by shrinking it, thus preventing the formation of air and reducing the likelihood of visible exudation, increasing the product's shelf-life.

- This technique was created to commercialize small amounts of raw, minced, or meat preparations that can be bought in a retail store. The close fixation of the plastic film on the product also has the finality to enhance all sensory aspects perceived by the consumer since this technique is mainly used for self-service purchases.

- Skin packaging is becoming increasingly common in supermarkets and other retail outlets to extend expiration dates and minimize food loss, supported by the increased awareness of the UN Sustainable Development Goals (SDGs). As meat blocks tend to remain on the shelves long before being purchased, the skin packaging method is primarily used for blocks of meat rather than sliced meat for household consumption and other products.

- The ability to resist bone punctures and increase shelf life, hold the product in place, and protect the meat during distribution, as well as the clarity of the film that allows consumers to see the product, are the main characteristics of skin films. Aside from its advantages for merchandising and shelf life, the skin packaging seal's size reduces meat waste and returns. There can be many returns from retailers due to leaks or packages with poor seals, especially in the meat industry.

- The demand for meat and cut meat packaging is rapidly increasing due to the e-commerce boom, and it is expected to be constant during the forecast period. According to the Organisation for Economic Co-operation and Development data, poultry meat consumption worldwide is expected to reach 147.47 metric kilotons in 2028, an increase from 135.62 metric kilotons in 2022. Thus, due to the increasing consumption of meat products, there is a constant need for skin packaging.

Asia-Pacific is Expected to Hold Significant Share of the Market

- Due to the expanding organized retail and e-commerce sectors and the simplicity with which raw materials can be obtained, Asia-Pacific is anticipated to present prospective growth possibilities for market players. The demand for packaged food goods is expected to increase due to the rising consumer buying power in China, India, and Indonesia, which would boost market expansion.

- China's skin packaging industry is growing due to the country's booming economy, rapid urbanization, and rising standard of living. Consumers gravitate toward more secure, practical, distinctive, and environmentally responsible packaging. According to the National Bureau of Statistics of China, approximately 63.9% of China's total population resides in cities. China has experienced a steady increase in its urbanization rate over the past few decades.

- Companies are extending their presence in Asia-Pacific as the region continues to develop. For instance, Amcor, a leader in responsible packaging solutions, opened its brand-new, cutting-edge production facility in Huizhou, China. The 590,000 square foot factory, which cost over USD 100 million to build, is China's largest flexible packaging facility in terms of production capacity, enhancing Amcor's capabilities to fulfill rising client demand throughout Asia-Pacific.

- The rising population, rising income levels, and changing lifestyles are expected to increase consumer spending, raising the demand for skin packaging products in India. Moreover, the increased media penetration via the Internet and television is boosting the demand from the rural sector for packaged goods.

- With increased demand and the emergence of new businesses in the food and beverage industry, India witnessed a surge in the packaging used for food and beverages. Food and beverage packaging use has increased due to the launch and rapid expansion of food delivery services like Zomato and Swiggy. There have been considerable advancements in food packaging that emphasize brand recognition while upholding the caliber and level of the food product with contain skin packs.

- With the growing population and urbanization, the demand for meat in China is growing significantly, which impacts the demand for different types of skin packaging for meat to keep it fresh and tender for a longer duration. According to the Organisation for Economic Co-operation and Development, per capita meat consumption in China showed a growing trend. It was 45.17 kilograms in 2021, which increased to 48.28 kilograms in 2023; it is expected to reach 52.84 kilograms by 2029.

- The market is driven by the growing preference of Chinese customers for meat, cheese items, fish, pork, seafood, vegetables, and others that are mostly skin-packed to make them shelf-stable. Customers in the nation are becoming increasingly accustomed to purchasing fresh fish and seafood.

Skin Packaging Industry Overview

The competitive landscape of the skin packaging market is fragmented, consisting of several players like Amcor Group GmbH, Sealed Air Corporation, Clondalkin Flexible Packaging Orlando Inc., and Plastopil Hazorea Co. Increased R&D spending by market participants leads to product differentiation, which is a strategy to secure a competitive advantage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Ready-to-Consume Packaged Food Products

- 5.1.2 Growing Demand for Flavor Retaining Packaging

- 5.2 Market Restraint

- 5.2.1 Rising Concerns About the Environment and Stringent Government Regulations Regarding the Use of Plastic

- 5.3 Technology Snapshot

- 5.3.1 Skin Packaging Machinery

- 5.3.2 Recent Developments in Skin Packaging Technology

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Food

- 6.1.1.1 Meat

- 6.1.1.2 Fish and Seafood

- 6.1.1.3 Processed Food

- 6.1.1.4 Cheese

- 6.1.2 Industrial Goods (Including Electronic and Electrical Components)

- 6.1.3 Medical Devices

- 6.1.4 Durable Consumer Goods

- 6.1.1 Food

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United kingdom

- 6.2.2.2 France

- 6.2.2.3 Germany

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.5 Middle East And Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Plastopil Hazorea Co. Ltd

- 7.1.2 Sealed Air Corporation

- 7.1.3 Amcor Group GmbH

- 7.1.4 MULTIVAC Sepp Haggenmller SE & Co. KG

- 7.1.5 Klckner Pentaplast Ltd

- 7.1.6 Flexopack SA

- 7.1.7 Winpak LTD

- 7.1.8 SUDPACK Holding GmbH

- 7.1.9 Taghleef Industries Group

- 7.1.10 KM Packaging Services Ltd