|

市场调查报告书

商品编码

1640439

无线路由器:市场占有率分析、行业趋势和成长预测(2025-2030 年)Wireless Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

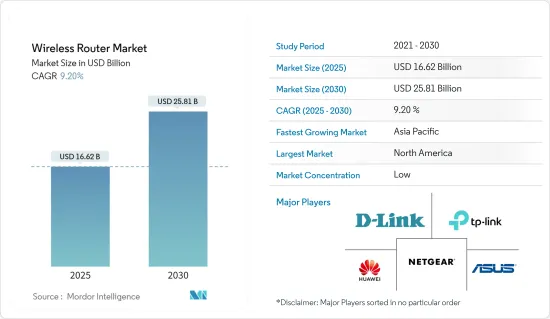

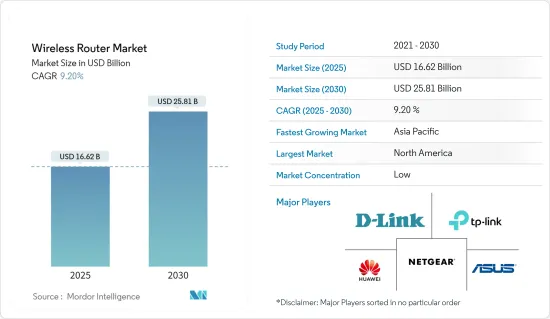

无线路由器市场规模预计在 2025 年为 166.2 亿美元,预计到 2030 年将达到 258.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.2%。

随着WFH(在家工作)变得越来越流行,企业和个人消费者需要为其员工购买各种 IT 产品。因此,包括无线路由器在内的IT周边设备的需求增加。

众所周知,无线路由器包含一个无线存取点,用于提供对互联网或私人电脑网路的存取。根据品牌和型号的不同,无线路由器可以在有线区域网路、仅无线区域网路或混合有线和无线网路中运作。

无线技术成长的主要因素是旨在改进路由器的标准的定期变化。过去十年来,无线路由器技术稳步发展,与电气电子工程师协会 (IEEE) 制定的先进标准保持同步。这些标准定期更新,以提高网路吞吐量,包括最大速度和传输能力。

这些升级使市场参与者能够创新并满足客户对更高频宽和更快网路速度的需求。主要的市场驱动因素是消费者对网路设备的需求不断增加以及 IP 流量不断增长。

由于有效连接的设备数量不断增加,消费者对更快网路连线的需求也日益增长。这推动了对具有足够连接能力的无线路由器的需求。此外,物联网的出现以及消费者对购买可透过网路连接运作并执行多种功能的各种装置和穿戴式装置的偏好的改变,预计将在预测期内推动无线路由器市场的成长。

企业的优先事项与消费者用户不同。安全性、支援、远端存取、企业级 VPN、WAN 冗余、连线选项和扩充性均高于绝对速度、成本绩效和服务品质。此外,公司正在製定策略推出新产品并扩大业务以满足不断增长的市场需求。例如,2022 年 11 月,印度值得信赖的製造产品和 IT 网路解决方案供应商 DIGISOL Systems Ltd 宣布推出 DG-GR6821AC-Digisol XPON ONU 1200 Mbps Wi-Fi 路由器,配备 1 个 PON、2 个 GE 连接埠和 1 FXS 连接埠。

COVID-19 正在加速向无线技术的广泛使用转变。业界对这种日益增长的需求做出了良好的反应,为新技术在资料中心、云端、游戏、硬体和连网型设备等市场中的部署创造了机会。

无线路由器市场趋势

住宅市场预计将出现大幅渗透

连网型设备的兴起推动了每个家庭对网路存取的需求。根据爱立信2021年行动报告,预计2026年终全球5G用户数将达到35亿,约占所有行动用户的40%。由于这些发展,住宅环境中的连网设备数量预计将快速增长。

大多数家庭正在转变为智慧家居,需要互联网来实现许多功能。智慧型电视和智慧音箱(如Amazon Echo和Google Home)的出现推动了无线路由器市场的成长。

此外,随着当地学校转向远距教育,以及越来越多的家长出于对新冠肺炎疫情的担忧而在家工作,网路供应商注意到使用情况发生了变化。网路供应商正在寻求利用这个机会。

2022 年 9 月,ExpressVPN 推出了首款内建 VPN 和 Wi-Fi 6 的消费级路由器 Aircove。这款路由器为用户提供更便利的全屋隐私保护。 Aircove 的覆盖面积高达 1,600 平方英尺,其内建的 VPN 允许无限制的同时连接。 2.4GHz 频段的速度可达 600Mbps,5GHz 频段的速度可达 1,200Mbps。

北美美国预计将占很大份额

在全球范围内,美国是固定宽频网路连线最成熟的市场之一。根据国际电信联盟预测,到 2021 年,美国约有 90% 的人将可以使用网路。美国是世界上最大的线上市场之一。预计在预测期内,庞大的网路人口将推动美国对无线路由器的需求。

思科、D-Link 和 TP-Link 等主要技术参与者的存在以及该国技术趋势的高采用率正在推动无线路由器市场的发展。此外,固定宽频市场正在成熟。饱和状态正在临近,预计在预测期内,超过四分之三的美国家庭将拥有固定宽频连线。

2022 年 2 月,D-Link 宣布推出 Eagle Pro AI 系列,这是一款支援 AI 的 Wi-Fi 路由器,可提高网路速度。该系列包括 R15 EAGLE PRO AI AX1500 智慧型路由器、M15-2PK、M15-3PK EAGLE PRO AI AX1500 网状系统和 E15 AX1500 网状范围扩展器。

预计消费者对固定宽频接取的需求仍将保持低迷。然而,由于行动宽频服务的影响,预计预测期内市场将会成长,固定宽频用户数量预计将超过 330 万。此外,美国智慧家庭日益普及,目前已有 3,000 万户家庭实现智慧家居,也改善了无线路由器的状况。

无线路由器产业概况

无线路由器市场竞争激烈,有几个主要参与者在竞争。从市场占有率来看,目前有几家大公司占据市场主导地位。拥有高市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。此外,在这个市场运营的公司正在收购从事无线路由器技术的新兴企业,以增强其产品供应。

2022年9月,D-Link宣布推出全新EAGLE PRO AI M32系列。本产品为2件组(M32-2PK)或3件组(M32-3PK)系统,采用最新的Wi-Fi 6技术。新款 D-Link M32 网状系统的使用者还可以体验高达 3.2Gbps 的双频 AX3200 802.11AX 组合无线速度。

2022 年 9 月,华硕宣布推出 RT-AXE7800,这是一款 Wi-Fi 6E 路由器,可提供高达 7800Mbps 的频宽和强大的网路安全性。该产品专为满足混合工作者、专业工作室和其他需要管理多台设备的个人不断增长的连接需求而打造。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- Wi-Fi架构与技术的演进

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 网路流量增加以及消费者对网路设备的需求

- 数位化正在推动整个企业的频宽需求呈指数级增长

- 市场限制

- 网路安全和管理的复杂性

- 易受宏观经济波动影响

- 行动宽频使用情况

第六章 市场细分

- 按组件类型

- 按 Wi-Fi 频段

- 单频段

- 双频

- 三频

- 按 Wi-Fi 频段

- 按最终用户产业

- 住宅

- 商业

- BFSI

- 教育

- 卫生保健

- 媒体与娱乐

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家(义大利、北欧)

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区(韩国、东南亚、澳新银行)

- 拉丁美洲(墨西哥、巴西、阿根廷等)

- 中东和非洲(阿拉伯联合大公国、沙乌地阿拉伯、南非等)

- 北美洲

第七章 竞争格局

- 公司简介

- D-Link Corporation

- Belkin International Inc.

- TP-Link Technologies Co. Limited

- Netgear Inc.

- Huawei Technologies Co. Limited

- ASUSTeK Computer Inc.

- Xiaomi Inc.

- Mercury-PC

- Buffalo Americas Inc.

- Edimax Technology Co. Limited

- Amped Wireless

- Cisco Systems Inc.

- Linksys Holdings Inc.

第八章投资分析

第九章:市场的未来

The Wireless Router Market size is estimated at USD 16.62 billion in 2025, and is expected to reach USD 25.81 billion by 2030, at a CAGR of 9.2% during the forecast period (2025-2030).

With work-from-home (WFH) becoming the trend during the COVID-19 pandemic, players and individual consumers needed to secure various IT products for their employees. As a result, supplies of IT peripherals, including wireless routers, witnessed an increase in demand.

Wireless routers are known for including wireless access points that are used to provide access to the internet or a private computer network. Depending on the manufacturer and model, wireless routers function in a wired local area network, wireless-only LAN, or the mixed wired and wireless network.

The primary factor for the growth of wireless technology is the regularly changing standards set for improving routers. Wireless router technology has evolved steadily over the past decade, keeping pace with advances in standards set by the Institute of Electrical and Electronics Engineers (IEEE). These standards are updated regularly to improve network throughput in terms of maximum speeds and transmission capabilities.

These upgrades have given the companies in the market the means to strive for innovation and successfully satisfy the customers' demand for higher bandwidth and faster internet. The key market drivers are increasing consumer demand for web-enabled devices and growth in IP traffic.

The increasing demand for faster internet connectivity among consumers deteriorated due to the increase in the number of effective devices being connected. It is spurring the demand for wireless routers with appropriate connectivity. Further, the advent of IoT and changing consumer preferences toward purchasing various gadgets and wearables capable of operating and performing a plethora of functions with internet connectivity are expected to propel the growth of the wireless router market over the forecast period.

For businesses, the priorities differ from most consumer users. Security, support, remote access, business-grade VPN, WAN redundancy, connectivity options, and scalability are ranked higher than absolute raw speed, value for money, or quality of service. Moreover, companies are introducing new products and strategizing to expand to leverage the market's growing demand. For instance, in November 2022, DIGISOL Systems Ltd, a provider of Trusted Made In India Products and IT Networking Solutions, announced the launch of DG-GR6821AC - Digisol XPON ONU 1200 Mbps Wi-Fi Router with 1 PON, 2 GE Port & 1 FXS Port.

COVID-19 has accelerated the shift toward increased usage of wireless technology. The industry has responded well to this increased demand, which, in turn, has created an opportunity for new technologies to be deployed in the markets, such as data centers, cloud, gaming, hardware, and connected devices.

Wireless Router Market Trends

The Residential Sector is Expected to Record Significant Adoption

The demand for the internet among various households has been increasing with the increase in connected devices. According to Ericsson Mobility Report 2021, by the end of 2026, the company estimates 3.5 billion 5G subscriptions globally, accounting for around 40% of all mobile subscriptions. Such developments are expected to rapidly increase the number of connected devices in residential environments.

A majority of households are being transformed into smart homes that require the internet to facilitate many functions. The advent of smart TVs, and smart speakers, such as Amazon Echo and Google Home, boosted the growth of the wireless router market.

Further, with local schools moving to remote learning and more parents working from home due to COVID-19 concerns, internet providers have noticed a shift in usage. Internet providers are aiming to capitalize on this opportunity.

In September 2022, ExpressVPN launched its first router, Aircove, with a built-in VPN and Wi-Fi 6 consumer router. The router offers users easier home-wide privacy protection. Aircove's coverage range is up to 1,600 square feet, and its onboard VPN allows unlimited simultaneous connections. The device permits to speed-up of 600 Mbps for 2.4GHz bands and 1,200 Mbps for 5GHz.

The United States in North America is Expected to Hold Major Share

Globally, the United States is one of the most mature markets for fixed broadband internet connections. According to ITU, In 2021, approximately 90% of individuals in the United States had internet access. The United States is one of the biggest online markets in the world. Such a huge population using the internet is expected to boost the demand for wireless routers in the United States over the forecast period.

The presence of major technological giants, such as Cisco, D-Link, and TP-Link, coupled with the high adoption of technological trends in the country, boosts the market for wireless routers. Moreover, the fixed broadband market is mature. It is nearing saturation, with more than three out of every four US households expected to have a fixed broadband connection over the forecast period.

In February 2022, D-Link announced the launch of an AI-powered Wi-Fi router, the Eagle Pro AI series, to boost internet speed. It includes R15 EAGLE PRO AI AX1500 Smart Router, M15-2PK, and M15-3PK EAGLE PRO AI AX1500 Mesh Systems, and E15 AX1500 Mesh Range Extender.

Consumer demand for fixed broadband access is expected to record sluggish growth. However, due to the impact of mobile broadband services, the market is expected to witness growth over the forecast period, resulting in more than 3.3 million fixed broadband subscriptions. Furthermore, the increasing adoption of smart homes, with 30 million US households already being smart homes, is also favoring the conditions for wireless routers.

Wireless Router Industry Overview

The wireless router market is highly competitive, with several major players. In terms of market share, few major players currently dominate the market. The major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring start-ups working on wireless router technologies to strengthen their product capabilities.

In September 2022, D-Link announced the launch of its new EAGLE PRO AI M32 range. The product comes with a 2-pack (M32-2PK) or 3-pack (M32-3PK) system and features the latest Wi-Fi 6 technology. Users of the new D-Link M32 Mesh Systems also experience dual-band AX3200 802.11AX combined wireless speeds of up to 3.2 Gbps.

In September 2022, ASUS announced the launch of RT-AXE7800, a Wi-Fi 6E router, offering up to 7800 Mbps of bandwidth and robust network security. It is made to expand the connectivity requirements of individuals who need to manage many devices, such as hybrid workers and professional studios.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Wi-Fi Architecture and Technology Evolution

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Internet Traffic and Increasing Consumer Demand for Internet-enabled Devices

- 5.1.2 Exponential increase in the bandwidth Requirements Across Enterprises Owing to Digitization

- 5.2 Market Restraints

- 5.2.1 Network Security and Complexities Related to Network Management

- 5.2.2 Susceptibility to Macro-economic Changes

- 5.2.3 Usage of Mobile Broadband

6 MARKET SEGMENTATION

- 6.1 By Component Type

- 6.1.1 By Wi-Fi Band

- 6.1.1.1 Single Band

- 6.1.1.2 Dual Band

- 6.1.1.3 Tri Band

- 6.1.1 By Wi-Fi Band

- 6.2 By End-user Industry

- 6.2.1 Residential

- 6.2.2 Business/Commercial

- 6.2.2.1 BFSI

- 6.2.2.2 Education

- 6.2.2.3 Healthcare

- 6.2.2.4 Media and Entertainment

- 6.2.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe (Italy, Nordics)

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific (South Korea, Southeast Asia, and ANZ)

- 6.3.4 Latin America (Mexico, Brazil, and Argentina, among others)

- 6.3.5 Middle East and Africa (United Arab Emirates, Saudi Arabia, and South Africa, among others)

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 D-Link Corporation

- 7.1.2 Belkin International Inc.

- 7.1.3 TP-Link Technologies Co. Limited

- 7.1.4 Netgear Inc.

- 7.1.5 Huawei Technologies Co. Limited

- 7.1.6 ASUSTeK Computer Inc.

- 7.1.7 Xiaomi Inc.

- 7.1.8 Mercury-PC

- 7.1.9 Buffalo Americas Inc.

- 7.1.10 Edimax Technology Co. Limited

- 7.1.11 Amped Wireless

- 7.1.12 Cisco Systems Inc.

- 7.1.13 Linksys Holdings Inc.