|

市场调查报告书

商品编码

1640448

电池回收:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

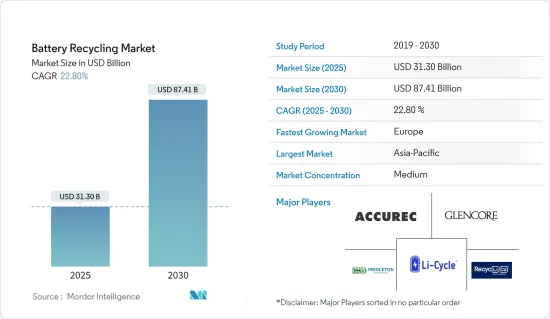

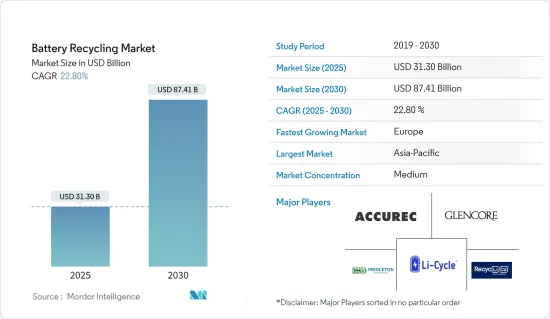

预计 2025 年电池回收市场规模为 313 亿美元,到 2030 年将达到 874.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.8%。

预计在预测期内,电动车的普及率不断提高、人们对电池废弃物处理的日益担忧以及政府的严格政策等因素将推动电池回收市场的发展。

然而,电池回收的高成本、缺乏强大的供应链以及低产量比率预计将阻碍未来几年的市场成长。

电池回收策略的技术创新提供了巨大的市场机会。

由于电池使用量的增加,预计欧洲将成为预测期内成长最快的市场。这一增长是由电动车(EV)中电池的使用不断增加所推动的。

电池回收市场趋势

锂离子电池领域预计将大幅成长

- 锂离子电池技术越来越受欢迎,尤其是在汽车(EV)和可再生能源产业。低廉的价格和良好的化学特性正在推动对该技术的需求。锂电池的使用寿命为3-4年,之后可回收更换新电池。

- 根据国际能源总署(IEA)《电动车展望》报告,2023年全球电动车(BEV和PHEV)销量将超过1,330万辆,预计2024年将再成长35%,达到1,700万辆。电动车在整个汽车市场的份额将从 2020 年的 4% 左右上升到 2023 年的 18%。由于对锂离子电池回收的需求,预计预测期内电动车的兴起将为电池回收市场提供动力。

- 世界各地的公司正在推出各种计划来促进电池回收。例如,2023 年 6 月,美国能源局尖端材料和製造技术 (AMMTO) 办公室宣布,将向 ReCell 营运的锂离子电池翻新、回收和再利用项目提供 2 亿个单位的资金。 ANL)中心。

- 此外,2023年共同开发契约月,阿联酋能源和基础设施部、中东创新和永续解决方案供应商BEEAH以及印度领先的电池回收公司Lohum Cleantech Pvt. Ltd.将联合为阿联酋开发电池回收系统。的条款,Lohum 将建立一个占地80,000 平方英尺的工厂,用于回收和再製造锂电池。该设施预计每年回收 3,000 吨锂离子电池,并将 15MWh 的电池容量转换为永续能源储存系统(ESS)。

- 此外,Umicore、Glencore PLC、Cirba Solutions、Raw Materials Company Inc. (RMC) 和 RecycLiCo Battery Materials Inc 等主要企业正在采用各种技术进步,以降低成本并提高回收过程的效率。预计这将导致未来电池回收率的提高。

- 因此,预计在预测期内,政府推动电池回收活动以及锂离子电池在电动车和能源储存系统中的利用的倡议将推动全球锂离子电池回收市场的发展。

预计欧洲将进一步成长

- 在欧洲,由于新兴企业的出现,电池回收市场正在持续成长。电池回收的其他主要驱动力是该地区不断扩大的电动车市场和能源储存计划。

- 根据国际能源总署(IEA)的数据,2023年纯电动车销量将达220万辆,较2019年成长4.95倍。随着世界各国都将重点放在净零碳排放目标并用清洁燃料能源来源取代碳氢化合物,这一数字正在大幅增长。

- 《世界能源资料统计评论》显示,由于全部区域开发了多种太阳能和风能管道,预计 2022 年欧洲发电量将较 2021 年下降 3.5%。大部分电力来自可再生能源发电。发电量和消费量的差距逐年扩大,预计预测期内将增加电池回收的需求。

- 由于多种因素,法国锂离子电池回收市场正在经历强劲成长。成长的关键驱动力之一是该国对永续能源和交通实践的重视。例如,2023 年 3 月,Li-Cycle 宣布计划在法国哈内斯 (Harnes) 建造一座年产 10,000 吨的锂离子电池回收设施。该厂计划于 2024 年完工,隔年年产能将提高至 25,000 吨。

- 同样,2023 年 3 月,Altilium Metals 宣布计划加速开发该国最大的锂离子回收厂,年产能接近 30,000 吨。截至2022年,英国的电池储存容量将达到2.3GW。作为国家电池储存目标的一部分,预计到 2030 年将安装约 20GW。这为一系列公共和私人开发商投资电池能源储存计划提供了机会。

- 西班牙已设定了便携式电池回收率的目标,到2023 年达到45%,到2027 年达到63%,到2030 年达到73%,而对于轻型运输电池,其设定的目标到2028 年达到51% ,到2031 年达到61%。增加电池收集量是正确回收电池的必要步骤。

- 随着欧洲能源储存市场持续成长,很可能对电池回收市场产生重大影响。随着越来越多的家庭和企业投资于能源储存解决方案,以储存多余的太阳能或供高峰使用,对电池的需求正在增长,需要回收的电池数量也将增加。

- 随着这些发展,预计欧洲将在未来几年经历显着的成长。

电池回收业概况

电池回收市场适度细分。市场的主要企业(不分先后顺序)包括 Accurec Recycling GmbH、Glencore PLC、Princeton NuEnergy Inc.、Li-Cycle Holdings Corp. 和 Recyclico Battery Materials Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电动车日益普及

- 人们对电池废弃物处理的兴趣日益浓厚,政府政策也愈发严格

- 限制因素

- 回收高成本

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 电池类型

- 铅酸电池

- 镍电池

- 锂离子电池

- 其他电池类型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 卡达

- 埃及

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Accurec Recycling GmbH

- Aqua Metals Inc.

- Battery Recycling Made Easy

- Battery Solutions Inc.

- Call2Recycle Inc.

- Eco-Bat Technologies Ltd

- Exide Technologies

- Neometals Ltd

- Raw Materials Company

- Recupyl SAS

- 市场排名分析

第七章 市场机会与未来趋势

- 电池回收技术创新

The Battery Recycling Market size is estimated at USD 31.30 billion in 2025, and is expected to reach USD 87.41 billion by 2030, at a CAGR of 22.8% during the forecast period (2025-2030).

Factors such as the increasing adoption of electric vehicles, rising concerns over battery waste disposal, and stringent government policies are likely to drive the battery recycling market in the forecast period.

On the other hand, higher costs, lack of a strong supply chain, and low yield related to battery recycling are expected to hinder market growth in the coming years.

Nevertheless, technological innovations in battery recycling strategies create tremendous opportunities for market development.

Europe is expected to be the fastest-growing market during the forecast period due to the rising number of battery applications. This growth is due to the growing battery usage in electric vehicles (EVs).

Battery Recycling Market Trends

The Lithium-ion Battery Segment is Expected to Witness Significant Growth

- Lithium-ion battery technology has gained prominence, particularly in the automobile (EV) and renewable energy industries. Low pricing and favorable chemistry enhanced technology demand. A lithium battery has a lifetime of three to four years, after which it can be recycled and replaced with a new one.

- According to the International Energy Agency Electric Vehicle Outlook Report, more than 13.3 million electric cars (BEV and PHEV) were sold worldwide in 2023, and sales are expected to grow by another 35% in 2024 to reach 17 million. This significant growth in electric cars' share of the overall car market rose from around 4% in 2020 to 18% in 2023. The rise in electric vehicles is likely to give impetus to the battery recycling market, as there is a need for Li-ion batteries to be recycled during the forecast period.

- The companies across the world are launching various projects to enhance battery recycling. For instance, in June 2023, the Advanced Materials and Manufacturing Technologies (AMMTO) branch of the US Department of Energy announced that USD 2 million would be allocated to programs for the rejuvenation, recycling, and reuse of lithium-ion batteries run by the ReCell Center at Argonne National Laboratory (ANL).

- Additionally, in December 2023, the UAE's Ministry of Energy & Infrastructure, BEEAH, the Middle East's provider of innovative and sustainable solutions, and Lohum Cleantech Pvt. Ltd (Lohum), India's top battery recycling company, inked a deal to construct the country's first electric vehicle (EV) battery recycling facility. According to the terms of the joint development agreement, Lohum will establish an 80,000-square-foot facility for recycling and refurbishing lithium batteries. This facility is anticipated to recycle 3000 tons of lithium-ion batteries annually and convert 15 MWh of battery capacity into sustainable energy storage systems (ESS).

- Furthermore, to cut costs and boost efficiency in the recycling processes, leading industry participants like Umicore, Glencore PLC, Cirba Solutions, Raw Materials Company Inc. (RMC), and RecycLiCo Battery Materials Inc. are employing various technological advancements. This is expected to lead to an increase in battery recycling in the future.

- Therefore, government initiatives to boost battery recycling activities and lithium-ion battery utilization for electric vehicles and energy storage systems are anticipated to drive the global lithium-ion battery recycling market during the forecast period.

Europe Expected to Witness Faster Growth

- The battery recycling market has been witnessing continuous growth in Europe due to the blooming start-ups in the field. Other big drivers for battery recycling are the growing electric vehicle market and energy storage projects in the region.

- According to the International Energy Agency (IEA), in 2023, battery electric vehicle sales were recorded at 2.2 million, an increase of 4.95 times compared to 2019. The number has risen significantly as countries worldwide focus on NET zero carbon emission targets and replace hydrocarbons with clean fuel energy sources.

- According to the Statistical Review of World Energy Data, in Europe, electricity generation reduced by 3.5% in 2022, compared to 2021, due to the maintenance of several solar and wind channels across the region. The majority of electricity generation comes from renewable sources of energy. The difference between generations and consumption is increasing every year, and this is likely to increase the demand for battery recycling during the forecast period.

- The lithium-ion battery recycling market in France is experiencing significant growth due to several factors. One of the primary drivers of growth is the country's strong focus on sustainable energy and transportation practices. For instance, in March 2023, Li-Cycle announced its plans to build a 10,000 mt/year lithium-ion battery recycling facility in Harnes, France. The facility is expected to be completed by 2024 and will boost capacity by up to 25,000 mt/year in the following years.

- Similarly, in March 2023, Altilium Metals announced plans to accelerate the development of the country's largest lithium-ion recycling plant, with a capacity of nearly 30,000 tonnes per year. The battery storage capacity in the United Kingdom was 2.3 GW as of 2022. As a part of the national battery storage target, about 20 GW of power will be installed by 2030. This signifies an opportunity for various public and private developers to invest in battery energy storage projects.

- Spain has set a target of portable battery collection for recycling to 45% in 2023, 63% in 2027, and 73% in 2030, and for batteries from light means of transport, the target is set at 51% in 2028 and 61% in 2031. An increase in battery collection is a necessary step for the proper recycling of batteries.

- As the energy storage market continues to grow in Europe, there will be a significant impact on the battery recycling market. With more and more households and businesses investing in energy storage solutions to store excess solar energy or to use during peak hours, the demand for batteries will increase, leading to an increase in the volume of batteries that need to be recycled.

- Owing to such developments, Europe is expected to witness significant growth in the coming years.

Battery Recycling Industry Overview

The battery recycling market is moderately fragmented. Some of the major players in the market (in no particular order) include Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., and Recyclico Battery Materials Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Electric Vehicles

- 4.5.1.2 Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Recycling Operations

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid Battery

- 5.1.2 Nickel Battery

- 5.1.3 Lithium-ion battery

- 5.1.4 Other Battery Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Accurec Recycling GmbH

- 6.3.2 Aqua Metals Inc.

- 6.3.3 Battery Recycling Made Easy

- 6.3.4 Battery Solutions Inc.

- 6.3.5 Call2Recycle Inc.

- 6.3.6 Eco-Bat Technologies Ltd

- 6.3.7 Exide Technologies

- 6.3.8 Neometals Ltd

- 6.3.9 Raw Materials Company

- 6.3.10 Recupyl SAS

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in the Battery Recycling