|

市场调查报告书

商品编码

1640450

橡胶测试机:市场占有率分析、产业趋势与成长预测(2025-2030 年)Rubber Testing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

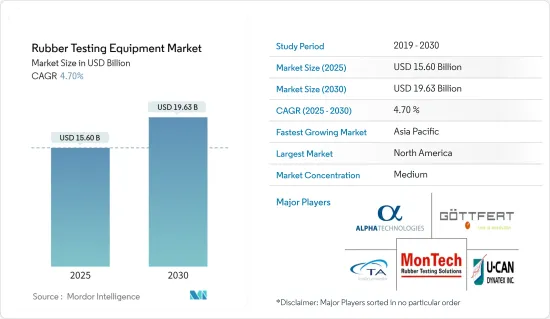

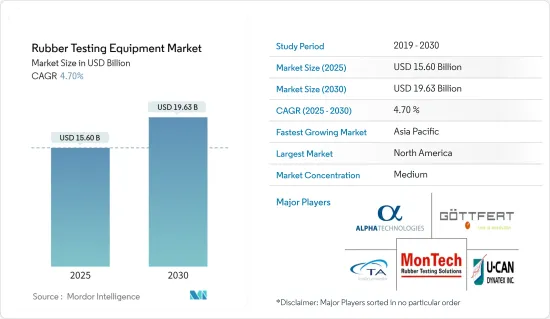

橡胶测试机市场规模预计在 2025 年为 156 亿美元,预计到 2030 年将达到 196.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.7%。

全球经济不断增强、工业化和快速都市化进程对橡胶的需求产生了积极影响。橡胶测试机械的成长主要受到汽车、航太、医疗保健和建筑等行业对高品质橡胶产品的需求不断增长的推动。

此外,严格的品质标准和法规要求进行严格的测试和分析,以确保产品的耐用性、安全性和性能。自动化、数位化等技术进步也显着提高了测试的效率和准确性,进一步推动了市场的成长。

橡胶测试包括使用流变仪、硫化仪和黏度计来优化生产和最终使用特性。橡胶流变仪可测量最小黏度、最大黏度、焦烧时间和转换时间等重要特性。硫化仪在使用者定义的恆定应变和频率下测量等温和非等温测试条件下橡胶化合物的硫化曲线。

工业化和都市化带来的建设活动加强,加上汽车产量的稳定成长,预计将主要促进橡胶测试机械市场的成长。

随着消费者对耐用商品的需求不断增长,预计软管和皮带等产品的需求将稳定成长。建筑业经历了强劲增长,这可能会导致对橡胶屋顶材料的需求大幅增加。製造业也持续实现有效成长,预计将有助于扩大需求。

市场前景乐观,区域分析显示成长将主要集中在全球最大的橡胶生产国亚太地区。市场正在经历多项技术突破,从自动化技术到软体管理工具和智慧测试技术的出现。这些技术进步以及对在设计和生产过程中需要测试的耐用消费品的需求不断增长,预计将成为市场成长的主要驱动力。

橡胶试验机市场趋势

轮胎需求成长推动市场

轮胎橡胶试验机广泛用于测量橡胶和其他材料的拉伸强度和伸长率。该机器专为轮胎动态和静态测试而设计。识别轮胎的性能和属性并确定其设计对车辆动态的影响。

轮胎测试包括多种特性的详细分析,包括耐久性和寿命、负载、力矩、室内胎面磨损、加速老化、政府监管测试和故障分析。

配备非公路轮胎(如 iOR、重型卡车轮胎、轻型卡车轮胎和乘用车轮胎)的车辆数量不断增加,正在推动全球橡胶测试机市场的发展。耐久性测试和彻底跳动测试等轮胎测试技术的进步进一步推动了市场成长。

从销售和生产角度来看,美国是与中国并列的全球最重要的汽车市场之一。根据OICA统计,2023年美国汽车产业产量约1,060万辆。预计这些因素将极大地促进市场发展。

北美占有最大市场占有率

北美地区工业橡胶製品需求略显低迷,但随着汽车产量明显改善及製造业復苏,需求逐渐回升。

美国是世界上最大的汽车製造国之一,平均每年生产超过1400万辆汽车。自从本田在美国开设第一家製造厂以来,大多数日本、韩国和欧洲汽车製造商都在美国建立了一家或多家製造厂。

在新的联邦立法和电动车需求不断增长的推动下,美国汽车业正在投入数十亿美元建设新工厂。例如,现代汽车正在美国加紧兴建第一家电动车工厂,目标于2025年投入生产。

加拿大的汽车产业竞争力强,对加拿大的GDP贡献巨大。加拿大虽然逐渐失去製造地,但每年仍生产超过120万辆汽车,领先橡胶测试机市场。

加拿大是北美第二大汽车生产国,拥有五座大型组装厂、540多家OEM零件製造商、400多家经销商以及许多其他与汽车相关的产业。该行业是该国製造业的最大贡献者,从而推动了对橡胶测试机的需求。

橡胶试验机产业概况

橡胶测试机市场由几家主要公司组成。从市场占有率来看,目前少数几家大公司占据着市场主导地位。这些领先公司凭藉着突出的市场占有率,致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。

2024 年 4 月—Alpha Technologies 宣布推出其下一代拉伸解决方案—AlphaFlex10 拉伸试验机。 AlphaFlex10 拉伸试验机与我们流变仪器产品组合的可靠软体和服务支援无缝集成,是 Alpha Technologies 为您的橡胶和合成橡胶材料测试需求提供的综合解决方案不可或缺的一部分。

2023 年 11 月-美卓推出磨机衬板橡胶。这种橡胶是革命性的 SkegaTM Life 橡胶,其耐磨寿命比目前的优质橡胶高出 25%。这种新型橡胶是在美卓实验室开发的,并在现场研究中检验。 Skegalife 是美卓 Planet Positive 产品的一部分,透过提高耐磨性和减少维护,实现了更高的永续性和安全性,优化了产量并增加了运转率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 耐用消费品需求不断增加

- 橡胶测试的技术进步。

- 市场限制

- 拥有成本高

第六章 市场细分

- 按考试类型

- 密度测试

- 黏度测试

- 硬度测试

- 弯曲试验

- 其他测试

- 按最终用户应用

- 胎

- 通用橡胶製品

- 工业橡胶製品

- 通用聚合物

- 化合物

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Alpha Technologies

- TA Instruments Inc.

- U-Can Dynatex Inc.

- Montech Rubber Testing Instruments

- Goettfert Inc.

- Prescott Instruments Ltd

- Ektron Tek Co. Ltd

- Gotech Testing Machines

- Norka Instruments, Sanghai Ltd.

- Gibitre Instruments Srl

第八章投资分析

第九章 市场机会与未来趋势

The Rubber Testing Equipment Market size is estimated at USD 15.60 billion in 2025, and is expected to reach USD 19.63 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

The demand for rubber is positively influenced by the constant efforts to strengthen global economies, industrialization, and rapid urbanization. The growth of rubber testing equipment is primarily driven by the increasing demand for high-quality rubber products across industries like automotive, aerospace, healthcare, and construction.

Additionally, stringent quality standards and regulations contribute to the need for precise testing and analysis to ensure product durability, safety, and performance. Technological advancements, such as automation and digitalization, also significantly enhance testing efficiency and accuracy, further fueling market growth.

Rubber testing includes using rheometers, curemeters, and viscometers to optimize production and end-use properties. Rubber rheometers measure important characteristics such as minimum and maximum viscosity, scorch time, and conversion time. Curemeters measure curing profiles of rubber compounds under isothermal and non-isothermal test conditions at constant user-defined strain and frequency.

The intensifying construction activities, on account of industrialization and urbanization, combined with the steady rise in the production of automobiles, are expected to primarily contribute to the growth of the rubber testing equipment market.

Owing to the snowballing consumer demand for long-lasting goods, products like hoses and belts are expected to witness a steady rise in demand. There can be a substantial requirement for rubber roofing, as the construction sector saw robust growth. The manufacturing industry is also expected to contribute to the growing demand as it continues to record growth effectively.

The market outlook is positive, and the region-wise analysis reveals that growth is mainly concentrated in Asia-Pacific, the largest global rubber producer. There have been several technological developments in the market, ranging from automated techniques to the advent of software management tools and intelligent testing techniques. In addition to the growing demand for durable goods, which require testing during design and production, these technological advancements are expected to majorly drive the market's growth.

Rubber Testing Equipment Market Trends

The Rising Demand for Tires to Drive the Market

Rubber testing equipment for tires is widely used to determine rubber and other materials' tensile strength and elongation. The equipment is specially designed for dynamic and static testing of tires. It identifies the tire's performance and attributes and defines its design's effect on the vehicle's dynamics.

Tire testing encompasses a detailed analysis of several properties, such as durability and endurance, force, moment, indoor tread wear, accelerated aging, government regulatory testing, and failure analysis.

The increasing number of vehicles with off-the-road tires, i.e., OTR, heavy truck tires, and light truck and passenger car tires, has driven the rubber testing equipment market globally. The evolution of tire testing techniques, such as endurance and radical run-out testing, has further boosted the market's growth.

Along with China, the United States is among the most significant automobile markets worldwide in terms of sales and production. As per OICA, in 2023, the auto industry in the United States produced approximately 10.6 million motor vehicles. Such factors are expected to boost the market significantly.

North America Holds Largest Market Share

Although there is a slight slump, North America's demand for industrial rubber products is gradually recovering, owing to a drastic turnaround in motor vehicle production and the recovering manufacturing sector.

The United States is one of the largest automotive manufacturers in the world, manufacturing an average of over 14 million vehicles annually. Since Honda opened its first manufacturing plant in the United States, almost every Japanese, Korean, and European automaker has established one or more manufacturing plants in the United States.

Due to new federal legislation and increased demand for electric vehicles, the US automotive industry is pouring billions of dollars into building new factories. For instance, Hyundai is rapidly building its first US electric vehicle plant, with production on track for 2025.

Canada's automotive industry is competitive and significantly contributes to the Canadian GDP. Although Canada is gradually losing its manufacturing base, it still produces more than 1.2 million cars annually, driving the rubber testing equipment market.

With over five heavy-duty assembly plants, over 540 OEM parts manufacturers, 400 dealerships, and many other automotive-related industries, Canada is the 2nd largest vehicle producer in North America. This sector is the most significant contributor to the country's manufacturing industry, thus driving the demand for rubber testing equipment.

Rubber Testing Equipment Industry Overview

The rubber testing equipment market consists of a few major players. In terms of market share, few of the major players currently dominate the market. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

April 2024 - Alpha Technologies announced the launch of its next-generation tensile solution, the AlphaFlex10 Tensile Tester. The AlphaFlex10 tensile tester seamlessly integrates with the trusted software and service support of rheology equipment products that are an integral part of Alpha's comprehensive solutions for rubber and elastomer material testing needs.

November 2023 - Metso launched a mill lining rubber that introduced its mill lining portfolio, an innovative SkegaTM Life rubber with up to 25% longer wear life than the current premium rubber. The new rubber type is developed in Metso's laboratory and validated by field studies. Skega Life is a part of Metso's Planet Positive offering, enabling increased sustainability and safety, optimized throughput, and uptime due to improved wear resistance and lower maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Durable Goods

- 5.1.2 Technological Advancements in Rubber Testing

- 5.2 Market Restraints

- 5.2.1 High Cost of Ownership

6 MARKET SEGMENTATION

- 6.1 By Type of Testing

- 6.1.1 Density Testing

- 6.1.2 Viscocity Testing

- 6.1.3 Hardness Testing

- 6.1.4 Flex Testing

- 6.1.5 Other Types of Testing

- 6.2 By End-user Application

- 6.2.1 Tire

- 6.2.2 General Rubber Goods

- 6.2.3 Industrial Rubber Products

- 6.2.4 General Polymer

- 6.2.5 Compound

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alpha Technologies

- 7.1.2 TA Instruments Inc.

- 7.1.3 U-Can Dynatex Inc.

- 7.1.4 Montech Rubber Testing Instruments

- 7.1.5 Goettfert Inc.

- 7.1.6 Prescott Instruments Ltd

- 7.1.7 Ektron Tek Co. Ltd

- 7.1.8 Gotech Testing Machines

- 7.1.9 Norka Instruments, Sanghai Ltd.

- 7.1.10 Gibitre Instruments Srl