|

市场调查报告书

商品编码

1640451

ROV:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

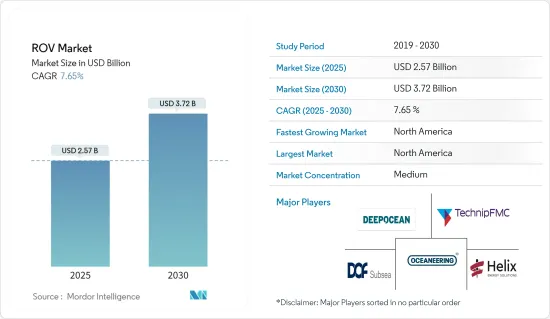

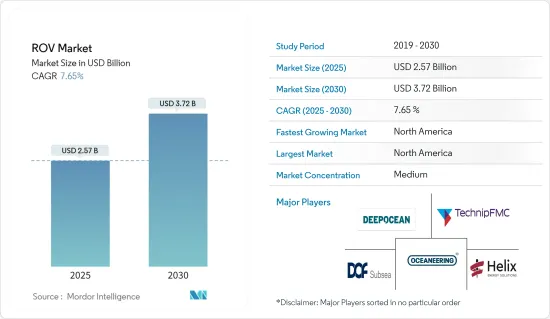

2025 年 ROV 市场规模预计为 25.7 亿美元,预计到 2030 年将达到 37.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.65%。

关键亮点

- 预计预测期内,美洲、亚太地区、中东和非洲的海上石油和天然气探勘活动的增加以及海洋可再生技术的发展将推动 ROV 市场的发展。

- 然而,预计多个地区对海上探勘和生产活动的禁令将抑制市场。

- 然而,正在进行的深水和超深水油气发现以及页岩气探勘预计将在预测期内为 ROV 部署创造重大机会。

- 北美占据全球市场主导地位,大部分需求来自美国和墨西哥。北美在开发先进、高机动性的 ROV 方面处于世界领先地位。

ROV 市场趋势

石油和天然气应用领域预计将占据市场主导地位

- 世界主要经济体仍然严重依赖石油产品,对石油和天然气的依赖日益增加。石油和天然气工业对国际政治和经济有巨大影响。

- 根据《世界能源数据统计评论》预测,2022年全球石油产量为9,987.7万桶/日,与前一年同期比较成长11.1%。世界人口的成长将反映出初级能源消耗的增加,从 2011 年的 520.90 艾焦耳增加到 2022 年的 604.04 艾焦耳。

- 根据石油输出国组织(OPEC)的预测,2023年全球原油需求量(包括生质燃料)将达到1.0221亿桶/日。资讯来源预测,年终,经济活动和相关的石油需求将恢復,每日平均需求将增加1.04亿桶以上。

- 碳氢化合物产业已经开发出适合海上条件的技术,可以成功发现和生产石油和天然气。石油和天然气钻井钻机可以在水深两英里的水域作业。许多深水油井和管道系统依靠无人水下航行器进行安装、检查、维修和维护。

- 在过去的几年中,远程操作车辆(ROV)已经从一种具有小众应用的新兴技术发展成为石油和天然气领域的广泛应用。

- 全球对海上石油工业的资本投资也大幅增加,增加了对进行特定活动的各种先进技术、工具和设备的需求。这些工具包括有助于海上部门维护和检查操作的 ROV。一些石油和天然气公司正在投资 ROV 来支援海底勘测。

- 例如,2023 年 8 月,Energean 与总部位于阿伯丁的远程操作车辆(ROV) 和服务全球供应商 ROVOP 签订了一份为期五年的 ROV 支援合约。该公司将在 Energean 的现场支援船 Energean Star(一艘改装的平台供应船)上部署 ROV。

- ROV 的技术进步使其操作变得更容易、更有效率,从而推动了石油和天然气行业的需求。

- 总体而言,由于海上石油和天然气能源业务的快速成长,预计预测期内对 ROV 的需求将会增加。与遥控海上航行器相关的技术已经取得了多项改进。

北美可望主导市场

- 该地区是世界上最发达的海上石油和天然气产业之一,主要集中在墨西哥湾和阿拉斯加近海的丰富蕴藏量。随着钻井深度逐年增加,蕴藏量也大幅增加,吸引了更多的投资。

- 随着美国大力投资扩大其石油和天然气生产能力,墨西哥湾已成为全球 ROV 需求的热点。根据美国能源资讯署的数据,2022年,墨西哥湾沿岸的石油和天然气产量约占美国原油总产量的15%。该地区是世界上海上钻机部署密度最高的地区之一。该地区包括其他石油和天然气基础设施,包括生产和钻探平臺、海上船舶和管道网路。

- 美国拥有世界上最大的国防预算,并且是ROV船舶研发的先驱。 2023年5月,美国宣布计划投资高达51亿美元购买高科技舰艇,用于巡逻深海并部署小型潜艇和无人机。预计此类投资将推动北美 ROV 市场的发展。

- 随着 ROV 技术变得越来越便宜,美国石油和天然气生产商正在投资 ROV 服务来获取资料并对海底资产和水面进行日常维护操作。儘管其初始成本高于潜水作业,但 ROV 完成相同量的工作所需的时间更少,从而降低了计划的整体 OPEX。

- 2024 年 5 月,美国海上服务公司 Edison Chouest 收购了位于阿伯丁的远程操作车辆供应商 ROVOP。此次收购将使该公司的持有达到 100 多艘 ROV 和 6 艘自主水下航行器。预计该行业的此类活动将降低 ROV 的成本并提高其可靠性。

- 因此,北美ROV产业正在迅速发展。由于对海上建筑和石油天然气服务的需求不断增加,推动该地区对 ROV 的需求,预计该行业将在预测期内继续快速增长。

ROV行业概况

ROV 市场比较分散。市场的主要企业(不分先后顺序)包括 DeepOcean AS、DOF Subsea AS、Oceaneering International Inc.、Helix Energy Solutions Group Inc. 和 TechnipFMC PLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 美洲、亚太、中东和非洲的海上石油和天然气探勘活动增加

- 海上可再生技术的发展

- 限制因素

- 多地区禁止海上探勘生产活动

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 工人阶级 ROV

- 观察级 ROV

- 应用

- 石油和天然气

- 防御

- 其他的

- 深海海洋探勘

- 活动

- 测量

- 检查、维修和保养

- 埋葬和挖沟

- 其他活动

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 丹麦

- 挪威

- 英国

- 义大利

- 北欧的

- 俄罗斯

- 法国

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 南非

- 卡达

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- DeepOcean AS

- DOF Subsea AS

- Helix Energy Solutions Group Inc.

- TechnipFMC PLC

- Bourbon Corporation SA

- Fugro NV

- Oceaneering International Inc.

- Saab Seaeye Limited

- Forum Energy Technologies Inc.

- Saipem SpA

- Delta SubSea LLC

- ROVOP

- List of Other Prominent Players

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 正在进行的深水和超深水油气发现

简介目录

Product Code: 53122

The ROV Market size is estimated at USD 2.57 billion in 2025, and is expected to reach USD 3.72 billion by 2030, at a CAGR of 7.65% during the forecast period (2025-2030).

Key Highlights

- Increasing offshore oil and gas exploration activities in the Americas, Asia-Pacific, and Middle East and Africa and growing offshore renewable technologies are expected to drive the ROV market during the forecast period.

- On the other hand, the ban on offshore exploration and production activities in multiple regions is expected to restrain the market.

- However, the ongoing deepwater and ultra-deepwater oil and gas discoveries and shale gas explorations are expected to create huge opportunities for ROV deployment over the forecast period.

- North America dominated the market worldwide, with most of the demand coming from the United States and Mexico. North America is still leading the world with its advanced, highly maneuverable ROV development.

ROV Market Trends

The Oil & Gas Application Segment is Expected to Dominate the Market

- The dependence on oil and gas increases as major economies globally still rely heavily on petroleum-based products. The oil and gas industry displays immense influence in international politics and economics.

- According to the Statistical Review of World Energy Data, global oil production in 2022 was 99,877 thousand barrels per day, an increase of 11.1% over the previous year. The increase in global population reflected an increase in primary energy consumption, which stood at 604.04 exajoules in 2022, up from 520.90 exajoules in 2011.

- According to the Organization of the Petroleum Exporting Countries (OPEC), in 2023, the global demand for crude oil (including biofuels) amounted to 102.21 million barrels per day. The source expects economic activity and related oil demand to pick up by the end of the year, with the projections suggesting an increase of more than 104 million barrels per day.

- Many potential global reserves of hydrocarbons lie beneath the sea, and the hydrocarbon industry has developed techniques suited to the conditions found in offshore sites to find and produce oil and gas successfully. Oil and gas drilling rigs may operate in up to two miles of water depth. Many deepwater wells and pipeline systems rely on unmanned underwater vehicles to help perform installations, inspections, repairs, and maintenance.

- Over the past few years, remotely operated vehicles (ROV) have evolved from emerging technology with niche uses to extensive applications in the oil and gas sector.

- Capital expenditure in the offshore industry is also increasing significantly worldwide, thus boosting the demand for various advanced technologies, tools, and equipment to perform certain activities. These tools include the ROVs, as they ease the maintenance and inspection work in the offshore sector. Several oil and gas companies are investing in ROVs to support subsea surveys.

- For instance, in August 2023, Energean awarded a five-year ROV support contract to Aberdeen-based ROVOP, a global supplier of remotely operated vehicles (ROVs) and services. The company will deploy its ROVs onboard Energean's field support vessel, Energean Star, a converted platform supply vessel.

- Technological advancements in ROVs make their operations easier and more efficient, thus boosting their demand in the oil and gas industry.

- Overall, the demand for ROVs is expected to increase during the forecast period due to the rapidly growing offshore oil, gas, and energy operations. There have been several improvements in the technologies associated with remote-operated offshore vehicles.

North America is Expected to Dominate the Market

- The region has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and the offshore Alaska region. With the drilling depths increasing over the years, the volume of technically recoverable reserves has also increased significantly, thus attracting more investments.

- As the United States invested heavily in expanding its oil and gas production capacity, the Gulf of Mexico has become a global hotspot for ROV demand. According to the US Energy Information Administration, in 2022, oil and natural gas production in the Federal Offshore Gulf of Mexico accounted for about 15% of total US crude oil production. The region has one of the highest global densities of offshore rig deployment. It comprises other oil and gas infrastructure, such as production and drilling platforms, marine vessels, and pipeline networks.

- The United States spends the most globally on its defense budget and has pioneered R&D on ROV vessels. In May 2023, the US Navy announced its plans to invest up to USD 5.1 billion in high-tech vessels that would patrol the deepest reaches of the ocean and deploy mini-subs and drones. Such types of investments are expected to drive the ROV market in North America.

- As ROV technology has become increasingly affordable, oil and gas producers in the United States are investing in ROV services to obtain data and perform routine maintenance work on subsea assets and surfaces. Despite the higher upfront cost compared to diving crews, ROVs need less time to complete the same amount of work, which reduces overall project OPEX.

- In May 2024, Edison Chouest, a US offshore services company, acquired Aberdeen-based remotely operated vehicle provider ROVOP. The deal will likely boost the company's fleet to over 100 ROVs and six autonomous underwater vehicles. Such activities in the industry are expected to reduce costs and increase ROV reliability.

- Thus, the ROV industry in North America is highly developed. As demand increases for marine construction and oil and gas services, the industry is expected to keep growing fast during the forecast period, thereby driving the demand for ROVs in the region.

ROV Industry Overview

The ROV market is semi-fragmented. Some of the major players in the market (in no particular order) include DeepOcean AS, DOF Subsea AS, Oceaneering International Inc., Helix Energy Solutions Group Inc., and TechnipFMC PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Oil & Gas Exploration Activities in the Americas, Asia-Pacific, and Middle East and Africa

- 4.5.1.2 Growing Offshore Renewable Technologies

- 4.5.2 Restraints

- 4.5.2.1 Ban on Offshore Exploration and Production Activities in Multiple Regions

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Work Class ROV

- 5.1.2 Observatory Class ROV

- 5.2 Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Other Applications

- 5.2.4 Deep Sea Marine Exploration

- 5.3 Activity

- 5.3.1 Survey

- 5.3.2 Inspection, Repair, and Maintenance

- 5.3.3 Burial and Trenching

- 5.3.4 Other Activities

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 Denmark

- 5.4.2.3 Norway

- 5.4.2.4 United Kingdom

- 5.4.2.5 Italy

- 5.4.2.6 NORDIC

- 5.4.2.7 Russia

- 5.4.2.8 France

- 5.4.2.9 Turkey

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Thailand

- 5.4.3.6 Malaysia

- 5.4.3.7 Indonesia

- 5.4.3.8 Vietnam

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Nigeria

- 5.4.5.4 South Africa

- 5.4.5.5 Qatar

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DeepOcean AS

- 6.3.2 DOF Subsea AS

- 6.3.3 Helix Energy Solutions Group Inc.

- 6.3.4 TechnipFMC PLC

- 6.3.5 Bourbon Corporation SA

- 6.3.6 Fugro NV

- 6.3.7 Oceaneering International Inc.

- 6.3.8 Saab Seaeye Limited

- 6.3.9 Forum Energy Technologies Inc.

- 6.3.10 Saipem SpA

- 6.3.11 Delta SubSea LLC

- 6.3.12 ROVOP

- 6.4 List of Other Prominent Players

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Deepwater and Ultra-deepwater Oil and Gas Discoveries

02-2729-4219

+886-2-2729-4219