|

市场调查报告书

商品编码

1640460

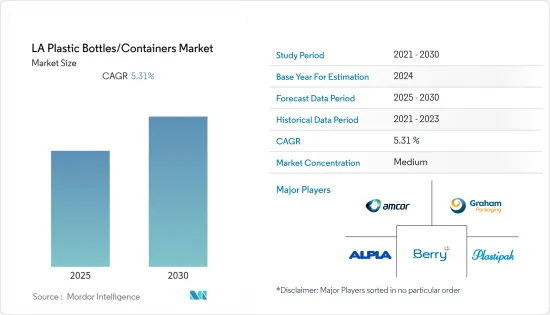

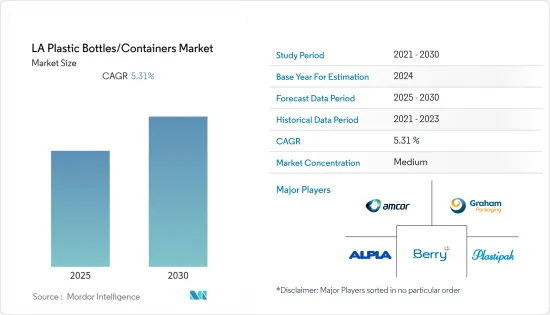

拉丁美洲塑胶瓶和容器:市场占有率分析、行业趋势和成长预测(2025-2030 年)LA Plastic Bottles/Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内拉丁美洲塑胶瓶和容器市场的复合年增长率将达到 5.31%。

主要亮点

- 塑胶包装由于重量轻、易于处理,比其他产品更受消费者的青睐。各种创新、经济高效且永续的包装解决方案正在进入市场,塑胶在该地区仍然被广泛接受。这就是为什么像 Amcor 这样的领先公司正在该领域推出新的发展。在巴西,着名乳製品品牌 Letti 与 Amcor PLC 合作,推出透明的一公升宝特瓶来盛装其乳製品。与 NewAge 合作,Amcor 最近在巴西推出了萨尔斯堡精酿啤酒的 PET。

- 拉丁美洲的 PET 市场由食品和饮料行业主导,因为生产软性饮料和其他饮料的瓶子对 PET 树脂的需求很大。巴西是世界第三大啤酒市场,每年生产140亿公升啤酒。喜力对麒麟的收购可能会进一步推动拉丁美洲 PET 市场的发展。

- 拉丁美洲的塑胶回收再利用趋势倾向于使用 100% 消费后树脂製成且无标籤的瓶子。这些瓶子在当地的回收系统下可以完全回收,进一步促进循环经济。 PET 容器可重复利用,这对所有相关人员来说是一个巨大的成就,也是拉丁美洲该行业的重大转折点。

- 由于塑胶和塑胶製品可能对环境产生负面影响,许多拉丁美洲消费者开始转向环保产品。这是因为许多国家的政府对此项业务实施了严格的法律法规。因此,其成长速度明显慢于使用其他材料的其他产业。预计大多数地区国家的回收率较低将对塑胶瓶/容器业务产生重大影响。根据巴西塑胶组织 Fundacao Instituto de Administracao委託的研究,巴西只有 25.8% 的塑胶被回收。

- 快速的都市化(尤其是在新兴国家)、不断增长的可支配收入以及忙碌的消费者生活方式使得消费者选择随时随地的饮料。这有助于扩大该地区的宝特瓶业务。然而,国家和地方都有法律禁止或限制生产和使用袋子、瓶子、杯子和吸管等一次性塑胶製品,这些製品经常被用作海洋垃圾。这些规定可能会限制市场扩张。

- 预计 COVID-19 对塑胶瓶/容器市场的影响将是巨大的,因为它支持饮料、食品和製药等终端用户行业,这些行业属于基本服务,即使在封锁规定期间也不会停止。限度。然而,2020年前四个月造成的供应链中断已导致整个供应链的订单延迟和前置作业时间。

拉丁美洲塑胶瓶市场的趋势

越来越多地采用轻量化包装方法

- 与玻璃相比,使用 PET 可使重量减轻高达 90%,从而实现更经济的运输过程。目前,PET塑胶瓶已被广泛应用,取代了笨重且易碎的玻璃瓶,为矿泉水和其他饮料提供了可重复使用的包装。此外,它们具有比 PE 和 PP 瓶更好的机械性能,从而减轻了重量。

- PET 使我们能够生产出所有塑胶中最轻的瓶子和容器。根据 PETRA 介绍,PET 是一种透明、耐用、轻质的塑料,广泛用于包装方便装的软性饮料、果汁和水。该地区销售的几乎所有单份和两公升汽水和水都是用 PET 製成的。

- 根据 Amcor PLC 的一项研究,拉丁美洲消费者越来越喜欢传达新鲜和奢华感的透明乳製品包装。因此,Amcor 为 Letti 设计了一款 1 公升半透明宝特瓶,具有保护功能,以优化产品新鲜度。瓶子壁很厚,可以避免变形,瓶口直径为 38 毫米,还配有紫外线阻隔剂,可以保护每个瓶子中的物品。

- 该地区的 PET 使用量正在增加,短期内主要原因之一是 PET 树脂价格下跌。美国贸易战导致PET树脂价格下跌。拉丁美洲除墨西哥、阿根廷和巴西外,几乎所有主要经济体都是净进口国,预计将压低PET瓶片树脂的价格并大幅降低生产成本。

- 此外,根据国际贸易委员会的数据,去年拉丁美洲和加勒比地区乙烯基聚合物的进口额约为 95.1 亿美元,较 2020 年(约 53.5 亿美元)增加 77.75%。进口量的成长反映了对乙烯聚合物等轻质材料的需求,其中 PET 是瓶子和容器的主要贡献者。

墨西哥预计将占据较大市场占有率

- 墨西哥城週边的大都会圈人口超过2,200万,面临确保供水安全的困境。其供水主要依赖从附近流域的进口,而过度抽取地下水已造成地层下陷等问题,引发人们永续性的质疑。墨西哥城缺水问题的影响在整个大都会圈出奇地不均衡,在低收入的近郊地区尤其严重。

- 低收入族群因无法持续获得干净水源而遭受多种后果。水传播感染疾病风险的增加和不良的健康影响与水质不良有直接关係。对许多家庭来说,从屋外取水需要花费时间和精力。墨西哥城大多数低收入家庭的用水需求是透过水车和瓶装水来满足。

- 另一方面,水罐车运送的成本高于透过公共配水系统定期供水的成本。与由供需关係决定价格的瓶装水和私人供水车服务相比,公共供水系统获得了大量补贴。整体而言,由于水罐车成本高昂,瓶装水的需求急遽增加。

- 根据墨西哥都会自治大学伊斯塔帕拉帕分校的报告,80%的墨西哥人对公共供水较不信任,因此经常使用公共供水。八成墨西哥人和九成墨西哥城居民经常使用瓶装水,这使得墨西哥成为世界上人均消费量最大的国家。

- 在墨西哥城,每人平均每年喝 390 公升水,比以瓶装水为主的法国还多。根据自治市大学伊斯塔帕拉帕分校介绍,这个区是墨西哥城最贫困的地区之一,这里的居民在宝特瓶水上的花费最多,占其消费量的 90%。

- 据ITC称,去年乙烯聚合物进口额约为32.5亿美元,较2020年(约16.6亿美元)成长95.78%。进口量的激增表明该国对塑胶瓶/容器的需求增加。

拉丁美洲塑胶瓶产业概况

拉丁美洲的塑胶瓶/容器市场相当分散。主要参与者包括 Amcor PLC、Graham Packaging Company、Plastipak Holdings Inc. 和 ALPLA Group。食品和饮料需求增加等因素可能为塑胶瓶和容器市场提供巨大的成长机会。这就是为什么许多公司将这个市场视为新兴市场。

2022 年 6 月:Amcor 与 Minderoo 基金会合作建造塑胶回收设施。分类和回收设施的建设将透过名为「看见未来」的合作项目获得资金。前三个枢纽将位于印尼、荷兰和巴西。 Minderoo (STF) 打算在未来两年内开始建造其首个分类和回收设施。首批三家回收中心将吸引约 3 亿美元的全球塑胶回收设施新投资,每年可产生约 15 万吨再生塑料,并将 20 万吨塑胶垃圾从垃圾掩埋场掩埋。 。

2022 年 1 月:ALPLA 和墨西哥饮料公司 Coca-Cola FEMSA 在墨西哥塔巴斯科州昆杜阿坎市建造了一座回收设施。该回收设施名为「塔巴斯科新生态工厂」(PLANETA),耗资 6,000 万美元兴建。该新技术将每年处理5万吨聚对苯二甲酸乙二醇酯(宝特瓶。 PLANETA 回收设施将每年生产 35,000 吨可立即使用的再生 PET 材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 对永续和创新食品包装产品的需求不断增加

- 越来越多地采用轻量化包装方法

- 市场挑战

- 关于塑胶使用的环境问题

- 人们对替代包装形式的认识不断提高

- COVID-19 市场影响评估

第六章 市场细分

- 按原料

- PET

- PP

- LDPE

- HDPE

- 其他成分

- 按行业

- 饮料

- 食物

- 化妆品

- 药品

- 家居用品

- 其他行业

- 按国家

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- ALPLA Group

- Amcor PLC

- Plastipak Holdings Inc.

- Graham Packaging Company

- Berry Global Group Inc.

- Altium Packaging LLC

- Alpha Packaging

- Gerresheimer AG

- Container Corporation of Canada Ltd

- Greiner Packaging GmbH

- Comar LLC

第八章投资分析

第九章:市场的未来

The LA Plastic Bottles/Containers Market is expected to register a CAGR of 5.31% during the forecast period.

Key Highlights

- Plastic packaging has been witnessing an increasing inclination from consumers over other products, as plastic packages are lightweight and easier to handle. A wide variety of innovative, cost-effective, and sustainable packaging solutions is emerging in the market, and plastic, as a product, is still widely accepted in the region. It has led to significant players, like Amcor, introducing new developments in the area. In Brazil, a prominent dairy brand, Letti, collaborated with Amcor PLC to introduce transparent one-liter PET bottles for its milk products. In partnership with New Age, Amcor recently launched PET for its Salzburg Craft Beer in Brazil.

- The food and beverage industry dominated the Latin American PET market due to massive demand for PET resins to manufacture bottles for soft drinks and other beverages. The Brazilian beer market is the third largest globally and produces 14 billion liters annually. The acquisition of Kirin by Heineken will further drive the Latin American PET market.

- The trends of plastic recycling in Latin America are inclined towards using 100% post-consumer resin and a label-free bottle. The bottle is completely recyclable in the region's recycling system, which promotes the circular economy even more. The fact that the containers are recycled repeatedly because of PET is a massive achievement for everyone concerned and a significant turning point for the Latin American industry.

- Many consumers in Latin America are beginning to utilize eco-friendly items as plastic and plastic products can potentially have adverse environmental effects. Due to the stringent laws and regulations many governments in these nations imposed on the business. As a result, it grew significantly more slowly than other industries using other materials. The poor recycling rates of most areas countries have been predicted to substantially impact the plastic bottle and container business. Only 25.8% of plastics in Brazil were recycled, according to research commissioned by Fundacao Instituto de Administracao, a plastic organization in Brazil.

- Consumers have been influenced to pick on-the-go beverages by fast urbanization, particularly in emerging nations, rising disposable incomes, and consumers' busy lives. It is driving the expansion of the PET bottle business in the area. However, legislation is enacted at the national and sub-national levels to prohibit or limit the manufacture and use of single-use plastic goods like bags, bottles, cups, and straws, frequently found in marine debris. Such regulations may restrict market expansion.

- The impact of COVID-19 on the plastic bottles/containers market is minimal as it supports the end-user industries, such as beverages, food, pharmaceutical, etc., which come under essential services and are not discontinued even amidst the lockdown restrictions. However, the supply chain disruptions caused in the first four months of 2020 resulted in order delays and lead time across the supply chain.

Latin America Plastic Bottle Market Trends

Increasing Adoption of Lightweight Packaging Methods

- Adoption of PET can lead to up to 90% weight reduction compared to glass, allowing a more economical transportation process. Currently, plastic bottles made from PET are widely replacing heavy and fragile glass bottles, as they offer reusable packaging for mineral water and other beverages. Additionally, better mechanical qualities reduce weight compared to PE and PP bottles.

- Using PET will help manufacture the lightest bottle and containers among all types of plastic. According to PETRA, PET is a clear, durable, lightweight plastic widely used to package convenience-sized soft drinks, juices, and water. Virtually all single-serving and 2-liter carbonated soft drinks and water sold in the region are made from PET.

- In research, Amcor PLC found that Latin American consumers are increasingly attracted to transparent dairy packaging, which conveys freshness and premium quality. So, Amcor designed a one-liter translucent PET bottle for Letti that has some protective features to optimize the freshness of products. It includes a thicker wall to avoid deformation, a 38-mm finish, and an ultraviolet blocker to protect the contents of each bottle.

- There has been a rise in the use of PET in the region, one of the primary reasons in the short run is the falling prices of PET resins. Due to the US-China trade war, the prices of PET resins have been continually falling. With almost all major economies of Latin America, apart from Mexico, Argentina, and Brazil, being net importing countries, this is expected to bring down the prices of bottle-grade PET resins, thereby significantly reducing production costs.

- Moreover, according to ITC, last year, the imports of polymers of ethylene in Latin America and the Caribbean were valued at around USD 9.51 billion, a 77.75% rise in imports from the previous year, 2020, which was valued at about USD 5.35 billion. The growth in import value represents the demand for lightweight materials such as ethylene polymers, where PET is one of the significant contributors to bottles and containers.

Mexico is Expected to Hold a Significant Market Share

- The metropolitan region around Mexico City has a population of over 22 million and has been struggling to ensure water security. Its supply primarily depends on imports from nearby basins and an overdraft of groundwater, which causes issues like subsidence and raises questions about sustainability. The effects of this water stress in Mexico City are incredibly uneven across the metropolitan region and are particularly bad in low-income peri-urban areas.

- Low-income populations suffer several effects due to unreliable access to clean water. An increased risk of waterborne infections and adverse health effects are directly related to poor water quality. Carrying water from outside the house takes time and energy for many households. The majority of the domestic water demand for low-income homes in Mexico City is often met by water trucks and bottled water.

- On the other hand, the cost of water truck delivery is higher than the cost of ordinary water supply provided by the public distribution system. Compared to bottled water and private water truck service, which are priced according to supply and demand, the public water system's water price is heavily subsidized. Overall, the need for bottled water has dramatically grown due to the higher cost of the water truck.

- Autonomous Metropolitan University Iztapalapa Unit reports that 80% of Mexicans are frequent customers since they have little faith in the public water system. Eight out of ten Mexicans and nine out of ten people living in Mexico City frequently use bottled water, making Mexico the world's largest per-capita product consumer nation.

- In Mexico City, every person drinks an average of 390 liters a year, more than in France, where there is a tradition of drinking bottled water. Citizens of the Borough, one of the poorest in Mexico City, spend the most on bottled water, accounting for 90% of water consumption, according to the Autonomous Metropolitan University Iztapalapa Unit.

- According to the ITC, imported ethylene polymers, last year were valued at around USD 3.25 billion, a 95.78% rise in imports from the previous year, 2020, valued at about USD 1.66 billion. The import surge indicates the increased demand for plastic bottles and containers in the country.

Latin America Plastic Bottle Industry Overview

The Latin American plastic bottle and container market are moderately fragmented in nature. Some major players are Amcor PLC, Graham Packaging Company, Plastipak Holdings Inc., and ALPLA Group. Factors, such as the increasing demand for food and beverages will provide considerable growth opportunities in the plastic bottles and containers market. Therefore, many companies are seeing this market as an emerging one.

June 2022: Amcor and the Minderoo Foundation partner to create plastic recycling facilities. The construction of sorting and recycling facilities will be funded by the collaboration known as Sea The Future. The first three hubs will be Indonesia, the Netherlands, and Brazil. Minderoo (STF) intends to start building the first sorting and recycling facilities within two years. The first three recycling centers want to attract roughly USD 300 million in new investments in plastic recycling facilities worldwide, create about 150,000 metric tons of recycled plastic annually, and stop 200,000 metric tons of plastic trash from being landfilled.

January 2022: A recycling facility was built in the Cunduacan municipality of Mexico's Tabasco state by ALPLA and the Mexican beverage company Coca-Cola FEMSA. The recycling facility, known as Planta Nueva Ecologa de Tabasco (PLANETA), is being developed with an expenditure of USD 60 million. It will have new technology and an annual processing capacity of 50,000 tonnes of PET bottles made of polyethylene terephthalate. The PLANETA recycling facility will produce 35,000 tonnes of ready-to-use recycled PET material annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Sustainable and Innovative Food Packaging Products

- 5.1.2 Increasing Adoption of Lightweight Packaging Methods

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns Regarding Use of Plastics

- 5.2.2 Increasing Awareness about Alternative Forms of Packaging

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Raw Materials

- 6.1.1 PET

- 6.1.2 PP

- 6.1.3 LDPE

- 6.1.4 HDPE

- 6.1.5 Other Raw Materials

- 6.2 By End-User Vertical

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-User Verticals

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Argentina

- 6.3.3 Mexico

- 6.3.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALPLA Group

- 7.1.2 Amcor PLC

- 7.1.3 Plastipak Holdings Inc.

- 7.1.4 Graham Packaging Company

- 7.1.5 Berry Global Group Inc.

- 7.1.6 Altium Packaging LLC

- 7.1.7 Alpha Packaging

- 7.1.8 Gerresheimer AG

- 7.1.9 Container Corporation of Canada Ltd

- 7.1.10 Greiner Packaging GmbH

- 7.1.11 Comar LLC