|

市场调查报告书

商品编码

1640462

乙醇胺:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Ethanolamines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

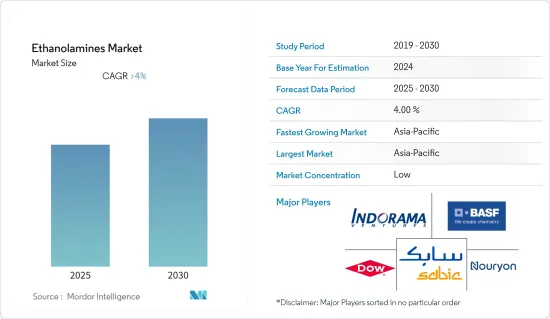

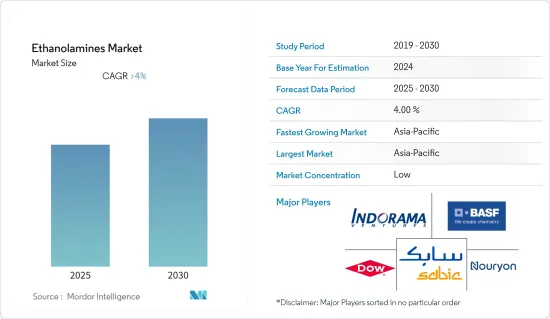

预测期内,乙醇胺市场预计将以超过 4% 的复合年增长率成长。

2020年,新冠肺炎疫情对市场产生了负面影响。不过,目前估计市场已达到疫情前的水平,并预计将继续稳定成长。

主要亮点

- 预计市场将受到对金属保护应用(例如Glyphosate除草剂和腐蚀抑制剂)日益增长的需求的推动。此外,表面活性剂的使用增加预计也将显着有利于市场。

- 然而,杂草抗性的增加预计将减少对Glyphosate的需求,从而阻碍市场成长。

亚太地区是最大的市场,随着中国、印度和日本等国家使用量的增加,预计未来几年将成长最快。

乙醇胺市场趋势

扩大冶金和金属加工产业

- 金属製造是为了最终用途而切割、成型和连接金属的过程。它有多种应用,包括造船、建筑、珠宝饰品、汽车和航太。

- 乙醇胺用于生产金属加工液,并用作金属加工润滑剂中的防冻添加剂。

- 金属加工和冶金过程会产生大量热量并利用水,这会导致表面腐蚀。因此,乙醇胺用于生产金属加工製作流程中使用的润滑剂和金属加工液。这将有助于流程更顺利地运作并且机器更好地运作。

- 更多的钢铁产量需要更多的金属加工来将钢铁塑造成人们想要的形状。这对乙醇胺市场来说也是一个好兆头。

- 据世界钢铁协会 (Worldsteel) 称,2022 年 9 月全球 64 个国家的粗钢产量为 1.517 亿吨,较 2021 年 9 月增长 3.7%。此外,2022 年 1 月至 11 月全球总合生产了 16.914 亿吨。

- 因此,预计未来几年全球冶金和金属加工领域应用的不断增长将推动乙醇胺的需求。

亚太地区占市场主导地位

- 亚太地区占全球市场主导地位,其中中国、日本和印度等国家占最大消费量。

- 乙醇胺主要用于水泥研磨、天然气处理、製药製造、农产品製造和个人保健产品製造等各个行业。

- 建筑业在世界各地正在迅速扩张。例如,中国的成长主要得益于住宅和商业建筑业的快速扩张。中国正在推动并持续推动都市化进程,预计2030年都市化率将达70%。此外,中国建筑业产值在 2021 年达到峰值,约为 29.3 兆元(4.34 兆美元)。因此,这些因素往往会增加全球对乙醇胺的需求。

- 此外,由于日本举办的活动,日本的建设产业预计将显着成长。东京将于2021年举办奥运会,大阪将于2025年举办世博会。日本的建设主要是为了重组和自然灾害后的恢復,这增加了对乙醇胺的需求。

- 此外,个人护理是中国和印度等国家成长最快的行业之一。例如,印度的电子产业是全球成长最快的产业之一。由于政府的优惠政策,例如 100% 外商直接投资 (FDI)、无需工业许可证以及从手动到自动化生产过程的技术转换,国内电子製造业正在稳步扩张。

- 电子产业的持续成长,带动了个人保健产品产量的增加,从而促进了乙醇胺市场的发展。

- 因此,基于上述因素,未来几年乙醇胺市场的成长将受到各终端用户产业需求成长的推动。

乙醇胺产业概况

乙醇胺市场自然是分散的。市场的主要企业包括(不分先后顺序)BASF、陶氏、诺力昂、沙乌地基础工业公司和 Indorama Ventures Limited。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 世界快速工业化

- 亚太地区建设活动成长

- 限制因素

- 抗性杂草增多导致Glyphosate需求下降

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 单乙醇胺 (MEA)

- 二乙醇胺 (DEA)

- 三乙醇胺 (TEA)

- 按最终用户产业

- 农业

- 建造

- 个人护理

- 石油和天然气

- 冶金与金属加工

- 纤维

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Dow

- Indorama Ventures Limited

- INEOS

- Jiaxing Jinyan Chemical Co. Ltd

- LyondellBasell Industries Holdings BV

- Nouryon

- SABIC

- Sintez OKA Group of Companies

- OUCC

- China Petrochemical Corporation

第七章 市场机会与未来趋势

The Ethanolamines Market is expected to register a CAGR of greater than 4% during the forecast period.

In 2020, COVID-19 negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels and is forecast to grow steadily in the future.

Key Highlights

- Growing demand for applications, such as glyphosate herbicides and corrosion inhibitors, for metal protection is likely to drive the market. Furthermore, the increasing use of surfactants is also expected to benefit the market significantly.

- However, rising weed resistance is expected to reduce glyphosate demand and stymie market growth.

The Asia-Pacific region is the biggest market and is expected to grow the fastest over the next few years because countries like China, India, and Japan are using more and more.

Ethanolamines Market Trends

Expanding Metallurgy and Metalworking Sector

- Metalworking is the process of cutting, forming, and joining a metal for end-use applications. It is used for various applications, such as shipbuilding, construction, jewelry, automotive, and aerospace.

- Ethanolamines are used in the production of metalworking fluids and are also used as an antifreeze additive in lubricants for metalworking.

- Metalworking and metallurgy processes generate huge amounts of heat and utilize water, which may corrode surfaces. So, ethanolamines are used to make the lubricants and metalworking fluids that are used during the metalworking process. This helps the process go more smoothly and makes sure that the machines work well.

- When steel production goes up, more metalworking is needed to shape the steel into the shape people want. This is good for the market for ethanolamines.

- According to the World Steel Association (worldsteel), global crude steel production for the 64 countries was reported at 151.7 million metric tons (Mt) in September 2022, representing an increase of 3.7% compared to September 2021. Also, from January to November 2022, a total of 1,691.4 million metric tons (Mt) were made around the world.

- So, the growing use of metallurgy and metalworking around the world is expected to drive the demand for ethanolamines over the next few years.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market across the world, with the largest consumption coming from countries such as China, Japan, and India.

- Ethanolamines are mostly used in different industries for things like grinding cement, treating gas, making drugs, making agricultural products, and making personal care products.

- The building construction sector is expanding rapidly across the globe. For example, China's growth is fueled mainly by rapid expansion in the residential and commercial building sectors. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about CNY 29.3 trillion (USD 4.34 trillion). As a result, these factors tend to increase the demand for ethanolamines across the globe.

- Also, the Japanese construction industry is expected to grow significantly, owing to the events hosted in the country. Tokyo hosted the Olympics in 2021, and Osaka will host the World Expo in 2025. Japan's construction is mostly driven by rebuilding and getting back on its feet after natural disasters, which increases the need for ethanolamines.

- Moreover, personal care is one of the fastest-growing sectors in countries like China and India. For example, the Indian electronics industry is one of the fastest-growing industries globally. The domestic electronics manufacturing sector has been expanding at a steady rate, owing to favorable government policies such as 100% foreign direct investment (FDI), no requirement for industrial licenses, and the technological transformation from manual to automatic production processes.

- As a result of the continued growth in the electronics industry, the production of personal care products is increasing, which has boosted the ethanolamines market.

- So, based on the above factors, the growth of the ethanolamines market over the next few years will be driven by the increasing demand from various end-user industries.

Ethanolamines Industry Overview

The ethanolamines market is naturally fragmented. Some of the major players in the market include BASF SE, Dow, Nouryon, SABIC, and Indorama Ventures Limited, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Industrialization Across the Globe

- 4.1.2 Growing Construction Activities in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Increasing Weed Resistance to Weaken the Demand for Glyphosate

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Monoethanolamine (MEA)

- 5.1.2 Diethanolamine (DEA)

- 5.1.3 Triethanolamine (TEA)

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Construction

- 5.2.3 Personal Care

- 5.2.4 Oil and Gas

- 5.2.5 Metallurgy and Metalworking

- 5.2.6 Textile

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Dow

- 6.4.3 Indorama Ventures Limited

- 6.4.4 INEOS

- 6.4.5 Jiaxing Jinyan Chemical Co. Ltd

- 6.4.6 LyondellBasell Industries Holdings B.V.

- 6.4.7 Nouryon

- 6.4.8 SABIC

- 6.4.9 Sintez OKA Group of Companies

- 6.4.10 OUCC

- 6.4.11 China Petrochemical Corporation