|

市场调查报告书

商品编码

1640464

油田通讯-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Oilfield Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

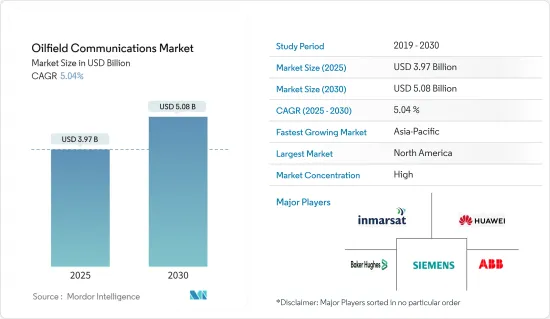

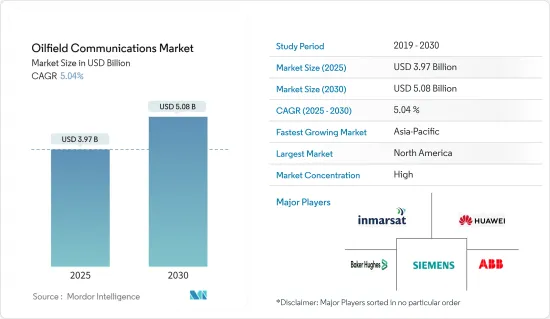

2025 年油田通讯市场规模预估为 39.7 亿美元,预计到 2030 年将达到 50.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.04%。

油田通讯市场受到机器学习、人工智慧、认知智慧和云端等最尖端科技的快速扩张和广泛接受的推动,这些技术正在推动油田中依赖一致通讯的关键任务活动。了对改善网路基础设施的投资增加。

关键亮点

- 一些国家,例如海湾合作委员会国家,正在大力投资升级其通讯基础设施。企业正在透过将自动化与认知和人工智慧 (AI) 技术相结合来快速扩展其业务流程的能力。基础设施有助于改善员工社会福利、资源管理、网路连接以及健康和安全法规。

- 这些优势正在推动对网路通讯的投资增加,以支持雄心勃勃的数位转型目标,从而推动了对油田通讯产品的需求,并预示着该行业的扩张。

- 此外,石油和天然气行业越来越多地采用现代云端基础技术,推动了市场的成长。这些服务提供更好的即时资料、基础设施成本的灵活性以及资料管理和储存的可扩展性。透过运算服务等基于云端基础的技术,生产单位、油井和油田的维护和监控是一个很有吸引力的选择。企业正在转型并依赖边缘和云端服务来数位化其资产、分散资料处理并为其营运部署 SaaS 解决方案。凭藉尖端的突破性技术,云端解决方案可以改变和解锁大量全新且令人兴奋的油田选择。

- 在能源领域,云端平台提供的高运算能力使得云端基础的服务能力被大量采用,进而带动了其他技术的应用,如实体资产的智慧管理,以提高业务效率。因此,石油和天然气行业越来越多地采用现代云端基础的技术,预计将推动对油田通讯的需求增加。

- 石油是有限资源,保质期较短。此外,由于油田通讯供需变化和地缘政治事件,油价多年来一直在波动。地质学家正在不断努力寻找新的石油来源并勘探尚未发现的蕴藏量。同时,研究人员也开始转向非传统能源来源。当冠状病毒来袭时,油田通讯的需求和未来市场趋势正在下降。如果情况持续恶化几年,对市场来说将是灾难性的。

油田通讯市场趋势

采用云端基础的服务将推动市场成长

- 云端基础服务的日益普及迫使石油公司接受油田通讯。这将连接海上和近海的生产统计站点,有助于更好地管理供应链。对石油公司来说,物资的畅通流通至关重要。盈利很大程度上取决于周转率,因此停工是需要避免的。

- 例如,为石油和天然气公司提供服务的通用电气石油天然气公司(GE Oil & Gas)在过去两年半的时间里将 350 个应用程式迁移到了亚马逊的云端服务 AWS。 GE发现,在云端系统上执行企业应用程式可将整体拥有成本平均降低 52%。这是该领域最先进公司的主导趋势。

- 西门子股份公司表示,资料驱动的解决方案将在提高效率和节省成本方面带来巨大效益。西门子表示,数位化可以将布伦特每桶价格成本降低45%,同时将上游资本成本指数降低25%,营运成本指数降低18%。

- 云端技术有效地解决了先前阻碍其采用的安全问题,为先驱企业带来了透明度,以革新过时的内部部署系统。

北美占主要份额

- 北美是该市场的先驱,预计将占据主要份额,因为它是最大的石油和天然气生产国。在北美,许多公司正在为其陆上和海上油田营运寻求先进的数位通讯解决方案。

- 许多石油生产公司的总部都设在美国。大多数公司在全球推出或推广新服务之前,都会在国内进行试点。

- 中国对新技术的快速采用和对全球通讯日益增长的兴趣将推动市场的发展。

- 此外,由于新发现的页岩资源以及 OCS核准的大陆棚租赁计划导致的探勘和生产活动的快速增加,该地区预计将在预测期内成为成长最快的油田通讯市场之一。

油田通讯产业概况

油田通讯市场有几家主要公司提供全方位解决方案。主要参与企业包括西门子股份公司、ABB 有限公司、华为技术有限公司、贝克休斯(通用电气公司)、国际海事卫星组织有限公司和 Speedcast 国际有限公司。併购是市场关键的成长策略之一,预计将改变产业的竞争态势并为新产品开发创造机会。

2022年7月,贝克休斯宣布将收购最尖端科技供应商之一AccessESP。 AccessESP 的「GoRigless ESP 系统」不使用钻机或拉动井生产管道(如有线、挠曲油管或井下拖拉机),而是使用常见的轻型干预工具在水下输送电力,我们提供独特的解决方案,允许安装和拆除泵浦(ESP)。这些解决方案在成本和停机时间方面显着降低了 ESP 更换操作的重要性,而这在海上和偏远地区的情况越来越重要。

2022 年 5 月,为了透过减少钻机访问次数来降低井口安装总成本,总部位于美国的油田通讯公司贝克休斯宣布正在安装一种名为MS-2 环空密封的新型海底环空密封。技术已公布。在休士顿举行的2022年海洋技术会议上,来自北美和南美的多家客户宣布、展示并采用了整合密封系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查假设和定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 越来越多地采用云端基础的服务

- 地理挑战推动人们依赖数位通讯来提高油田采收率和生产力

- 开发和采用有效的通讯技术

- 市场限制

- 严格的法规结构和糟糕的资料资产安全性增加了风险

第六章 市场细分

- 按解决方案

- M2M通讯

- 统一通讯(UC) 解决方案

- 视讯会议

- VoIP

- 有线/无线对讲

- 其他解决方案

- 透过通讯网络

- 蜂窝通讯网络

- 甚小孔径终端通讯网络

- 光纤通讯网路

- 微波通讯网路

- 四网络

- 按站点

- 陆上通讯

- 海上通讯

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Huawei Technologies Co. Ltd.

- Siemens AG

- Speedcast International Limited

- ABB Ltd.

- Commscope, Inc.

- Inmarsat PLC(Triton Bidco)

- Tait Communications

- Baker Hughes(General Electric Company)

- Alcatel-Lucent France, SA

- Ceragon Networks Ltd.

- Rad Data Communications, Inc.

- Rignet, Inc.

- Hughes Network Systems LLC

- Airspan Networks, Inc.

- Commtel Networks Pvt. Ltd.

第八章投资分析

第九章 市场机会与未来趋势

The Oilfield Communications Market size is estimated at USD 3.97 billion in 2025, and is expected to reach USD 5.08 billion by 2030, at a CAGR of 5.04% during the forecast period (2025-2030).

The oilfield communication market is being driven by the exponential expansion and widespread acceptance of cutting-edge technologies like machine learning, artificial intelligence, cognitive intelligence, and cloud, owing to the rising investment in improving network infrastructure as dependable hardware is needed for mission-critical activities in the oilfields, which depend on consistent communication.

Key Highlights

- Several nations, like the GCC, have significantly invested in upgrading their telecommunications infrastructure. Companies are quickly expanding the capabilities of business processes by fusing automation with cognitive and artificial intelligence (AI) technology. The infrastructure helps to improve staff welfare, resource management, network connectivity, and health and safety regulations.

- These advantages are driving up investments in network communication to support their ambitious digital transformation ambitions, which is driving up demand for oilfield communications products and has foreseen the industry's expansion.

- Additionally, the rising adoption of contemporary cloud-based technologies in the oil and gas industry propels market growth. These services provide better real-time data, more flexibility in infrastructure costs, and the capacity to scale data management and storage. Maintenance and monitoring of production units, wells, and oilfields are now appealing options made possible by cloud-based technologies, such as computing services. Businesses are transforming and relying on edge and cloud services to digitalize their assets, decentralize data processing, and deploy SaaS solutions for operations. With cutting-edge breakthrough technology, cloud solutions can transform and open up a wealth of novel and exciting oilfield options.

- A significant amount of cloud-based service capabilities are being used in the energy sector due to the high computing power made available by cloud platforms, which also encourages the adoption of other technologies like the intelligent management of physical assets and promotes greater operational efficiency. Therefore, the oil and gas industry's growing embrace of contemporary cloud-based technology is anticipated to drive the need for oilfield communications.

- Oil is a limited resource that has a little shelf life. Oil prices have also fluctuated throughout the years because of shifting supply and demand for oilfield communication and geopolitical events. Geoscientists are constantly working to find new oil sources and investigate undiscovered reserves. On the other hand, researchers are looking at non-traditional energy sources nonstop. At the coronavirus outbreak, the demand for oilfield communications and market future trends were waning. It will be disastrous for the market if the situation worsens for several years.

Oilfield Communications Market Trends

Growing Adoption of Cloud-based Services to Drive the Market Growth

- With the growing adoption of cloud-based services, oil companies are compelled to use oil field communication. This keeps their offshore sites connected with the inshore site about production stats, which helps in better supply chain management. The smooth flow of materials is very important for oil companies as their profitability is highly dependent upon the turnover, and downtime needs to be avoided.

- For instance, over the past two and a half years, GE Oil & Gas, the service provider to oil and gas companies, has shifted 350 of its applications to Amazon's cloud offering, AWS. GE found that the total cost of ownership of running its enterprise applications on the cloud systems provided a saving of 52% on average. This is the dominant trend in the sector's most progressive companies.

- According to Siemens AG, data-based solutions will lead to huge gains in terms of efficiency gains and cost savings. According to Siemens, digitization can reduce Brent price cost per barrel by 45% while reducing the upstream capital cost index and operations cost index by 25% and 18%, respectively.

- Cloud technology has effectively addressed security concerns that previously restrained its adoption, thereby rewarding pioneering companies with the transparency to revolutionize their outdated on-premise systems.

North America to Account for a Major Share

- North America is the pioneer in this market and is expected to hold a significant share as it is the largest oil and gas producer, with companies seeking advanced digital communication solutions for their onshore and offshore field operations.

- Many oil-producing companies are headquartered in the United States. Most companies pilot new services in the country before global launches and deployment.

- This country's fast adoption of new technology and the growing focus on global communication push the market forward.

- Moreover, with newfound shale resources and rapidly increasing exploration and production activities due to the Outer Continental Shelf Leasing Program approved by OCS, the region is expected to be one of the fastest-growing markets for oilfield communications over the forecast period.

Oilfield Communications Industry Overview

The oilfield communications market has a few major players who provide the entire spectrum of solutions. The major players include Siemens AG, ABB Ltd, Huawei Technologies Co. Ltd, Baker Hughes (General Electric Company), Inmarsat PLC, and Speedcast International Limited. Merger and Acquisition are expected to be one of the key growth strategies of the market, which will change the dynamics of competition in this industry and increase opportunities for new product development.

In July 2022, Baker Hughes announced it would acquire AccessESP, one of the top cutting-edge technology suppliers for artificial lift solutions. Oil and gas operations might be modernized by cutting operational expenses and downtime and becoming considerably more productive.AccessESP's "GoRigless ESP System" offers its unique solutions that enable the installation and dismantling of an electrical submersible pump (ESP) using common, light-duty intervention tools instead of a rig or pulling well production tubings, such as a wireline, coiled tubing, or well tractors. The importance of ESP replacement workovers, which are becoming increasingly crucial in offshore and remote situations, is considerably reduced by these solutions in terms of cost and downtime.

In May 2022, to reduce total wellhead installation costs due to fewer rig visits, Baker Hughes, a US-based oilfield communications business, introduced a novel subsea wellhead technology called the MS-2 Annulus Seal. At the offshore technology conference in Houston in 2022, several clients in North and South America presented, displayed, and adopted this integrated sealing system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud-based Services

- 5.1.2 Geographically Challenging Locations will Increase Reliance on Digital Communication for Oilfield Recovery and Productivity

- 5.1.3 Development and Adoption of Effective Communication Technologies

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Framework and the Rising Risk of Inadequate Data and Asset security

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 M2M Communication

- 6.1.2 Unified Communication Solutions

- 6.1.3 Video Conferencing

- 6.1.4 VoIP

- 6.1.5 Wired/Wireless Intercom

- 6.1.6 Other Solutions

- 6.2 By Communication Network

- 6.2.1 Cellular Communication Network

- 6.2.2 VSAT Communication Network

- 6.2.3 Fiber Optic-Based Communication Network

- 6.2.4 Microwave Communication Network

- 6.2.5 Tetra Network

- 6.3 By Field Site

- 6.3.1 Onshore Communications

- 6.3.2 Offshore Communications

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle-East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huawei Technologies Co. Ltd.

- 7.1.2 Siemens AG

- 7.1.3 Speedcast International Limited

- 7.1.4 ABB Ltd.

- 7.1.5 Commscope, Inc.

- 7.1.6 Inmarsat PLC (Triton Bidco)

- 7.1.7 Tait Communications

- 7.1.8 Baker Hughes (General Electric Company)

- 7.1.9 Alcatel-Lucent France, S.A.

- 7.1.10 Ceragon Networks Ltd.

- 7.1.11 Rad Data Communications, Inc.

- 7.1.12 Rignet, Inc.

- 7.1.13 Hughes Network Systems LLC

- 7.1.14 Airspan Networks, Inc.

- 7.1.15 Commtel Networks Pvt. Ltd.