|

市场调查报告书

商品编码

1640465

氯化铁:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Ferric Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

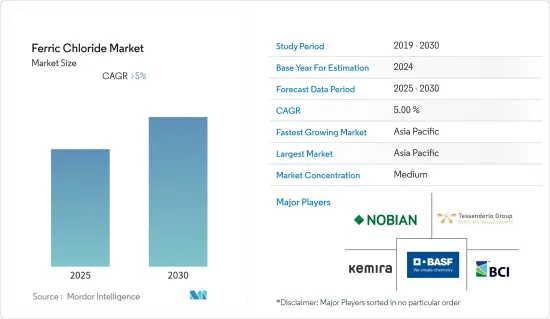

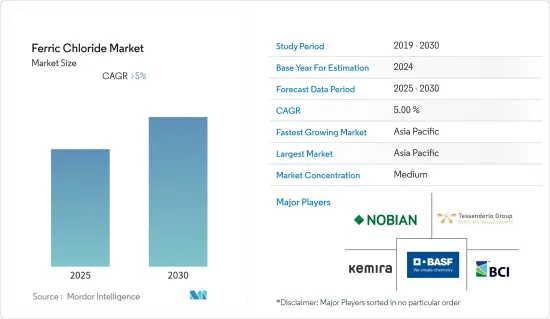

预测期内,氯化铁市场预计将以超过 5% 的复合年增长率成长

COVID-19 对市场产生了负面影响。全球各国停工停产导致的供应链限制严重阻碍了该产业的扩张。然而,去年市场已经復苏,预计未来几年将大幅成长。

关键亮点

- 短期内,污水处理厂的高需求以及为控制污染而不断加强的污水和工业废弃物处理法规可能会推动市场成长。

- 另一方面,对企业生产和运输氯化铁产品的严格规定以及替代产品的存在可能会阻碍市场成长。

- 尚未开发的催化应用市场预计将为市场提供机会。

- 由于中国、印度和日本等国家的供水和用水和污水处理厂数量不断增加,亚太地区很可能在预测期内占据市场主导地位。

氯化铁市场趋势

印刷基板(PCB) 的使用日益增多

- 许多电子产品都使用印刷基板(PCB)。优质的 PCB 製造技术使电子製造商能够生产出更小、更复杂的产品。它被认为是当今充满活力且快速发展的电子创新的关键。

- 三氯化铁(FeCl3)广泛用于印刷电路基板製造中的蚀刻製程。印刷基板用于製造电子电路。全球经济正在经历严峻的技术发展,进一步增加了对 PCB 的需求。

- 联网汽车中 PCB 的采用也加速了 PCB 市场的发展。如今的汽车配备了有线和无线技术,可以轻鬆连接到智慧型手机。

- 目前,台湾是PCB产业领先的国家之一。根据台北印刷电路协会(TPCA)统计,台湾印刷基板产业约占全球33.9%的市场占有率。

- 此外,台湾的印刷电路基板(PCB)产业以金额计算是世界上最大的。根据台湾经济部统计局统计,2021年台湾印刷基板(PCB)总产值为161.8兆新台币(约57.666亿美元),较2020年成长4.84%。

- 根据印度蜂窝与电子协会预测,2022年印度印刷基板组装(PCBA)市场规模将达240亿美元,预计2026年将达到880亿美元。

- 此外,智慧型手机、个人电脑、平板电脑和其他医疗用电子设备产品等消费性电子产品的需求在全球范围内迅速增长,这些产品都意味着使用印刷基板(PCB),其中美国、德国、英国预计印度、中国和日本仍将占据市场领先地位。

中国主宰亚太地区

- 中国是亚太地区领先的经济体,也是世界上工业部门最多的地区。由于供水和用水和污水处理以及印刷基板(PCB)等领域对三氯化铁的需求庞大,预计该国将在全球三氯化铁市场中占据主导地位。

- 随着我国工业领域经济发展的扩大,污水的产生量也日益增加。全国约有10,113座水处理厂,处理95%城市和30%农村地区的污水。

- 此外,中国计划在2021年至2025年期间新建或维修8万公里污水收集管网,增加污水处理能力2,000万立方公尺/日。

- 根据国际贸易局预测,2025年,中国工业污水市场规模将达194亿美元。作为新兴经济体向更清洁、更永续的经济转型的发展策略的一部分,中国计划向各类重污染产业投资 500 亿美元,以抑制这些产业的污水产生。

- 中国政府推出了防治水、土壤污染的工作计划,并加强了对违反标准的处罚。

- 「十三五」规划公布后,中国政府启动了《水污染防治行动计画》,主要针对造成水污染的工业,对三氯化铁等污水处理化学品的需求巨大。

- 此外,中国是世界领先的印刷电路基板製造国。中国当地存在大量中低端单层、双层及多层PCB产品,市场需求尚不确定。

- 根据业内估计,全球市场有超过2,500家PCB製造商,光是中国当地就占全球PCB製造商的1,200多家。

氯化铁行业概况

氯化铁市场部分分割,少数参与企业占主要份额。全球氯化铁市场的主要企业包括BASF SE、Basic Chemical Industries、Tessenderlo Group、Novian、Kemira 等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 污水处理厂需求旺盛

- 为控制污染,对污水和工业废弃物的处理标准越来越严格

- 限制因素

- 对企业生产和运输氯化铁产品时实施严格监管

- 存在替代产品

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 应用

- 用水和污水处理

- 印刷基板(PCB)

- 颜料製造

- 动物营养补充品

- 沥青喷洒

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Basic Chemical Industries

- Chemifloc LTD

- CHIMI ART

- SEQUENS

- Feralco AB

- HORIZON CHEMICALS

- Kemira

- MALAY-SINO CHEMICAL INDUSTRIES SDN. BHD.

- MISR Chemical Industries

- Nobian

- PVS Technologies, Inc.

- Saf Sulphur Factory

- SIDRA WASSERCHEMIE GmbH

- Tessenderlo Group

第七章 市场机会与未来趋势

- 尚未开发的催化应用市场

The Ferric Chloride Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market. Owing to lockdowns in various countries worldwide, supply chain constraints significantly obstructed the industry's expansion. However, the market recovered last year, and it is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, high demand from wastewater treatment plants and increasing stringent norms for treating sewage water and industrial waste to curtail pollution are likely to drive the market's growth.

- On the flip side, stringent regulations imposed on companies during the manufacturing and shipment of ferric chloride products and the presence of substitute products are likely to hinder the market's growth.

- Nevertheless, an untapped market for its application as a catalyst is expected to act as an opportunity for the market.

- Asia Pacific is likely to dominate the market over the forecast period owing to increasing water and wastewater treatment plants in the countries such as China, India, and Japan.

Ferric Chloride Market Trends

Increasing Applications in the Printed Circuit Board (PCB)

- Most electronics products use printed circuit boards (PCBs). High-quality PCB manufacturing technology has allowed electronics product manufacturers to produce smaller and more complex products. It is considered the key to today's dynamic and rapidly progressing electronic innovations.

- Ferric chloride (FeCl3) is widely used in manufacturing printed circuit boards for the etching process. PCBs are used for making electronic circuits. The global economy is rigorously experiencing technological developments, further increasing the demand for PCBs.

- The adoption of PCBs in connected vehicles has also accelerated the market for PCBs, as vehicles are nowadays equipped with both wire and wireless technologies, which enables vehicles to connect with smartphones easily.

- Currently, Taiwan is one of the leading countries in the PCB industry. According to Taipei Printed Circuit Association (TPCA), Taiwan's Printed Circuit Board industry accounts for around 33.9% market share in the global market,

- Moreover, Taiwan's printed circuit board (PCB) industry is the largest in the world in terms of value. As per the Department of Statistics, Ministry of Economic Affairs of Taiwan, the total production value of printed circuit boards (PCBs) in 2021 in the country amounted to TWD 161.08 trillion (~USD 5,766.60 million) observed an increase of 4.84% as compared to the year 2020.

- In India, as per India Cellular & Electronics Association, the printed circuit board assembly (PCBA) market size in India was estimated at USD 24 billion in 2022 and is expected to reach USD 88 billion by the year 2026.

- Additionally, the demand for consumer gadgets which implies the usage of printed circuit board (PCBs), such as smartphones, PCs, tablets, and other medical electronics products, is rapidly increasing across the world, with the United States, Germany, the United Kingdom, India, China, and Japan expected to remain at the top of the market.

China to Dominate the Asia-Pacific Region

- China is a major economy in the Asia-Pacific, with the highest number of industries in the world. The country is expected to dominate the global market for ferric chloride due to the major demand from applications such as water and wastewater treatment and printed circuit boards (PCB).

- With the growing economic development in the industrial sector of China, there has been an increase in wastewater generation. The country has around 10,113 water treatment plants that treat wastewater for 95% of municipalities and 30% of rural areas.

- Moreover, China plans to build or renovate 80,000 km of sewage collection pipeline networks and increase sewage treatment capacity by 20 million cubic meters/day between 2021-2025.

- As per the International Trade Administration, the industrial wastewater market in China is expected to reach USD 19.4 billion by 2025. As part of the country's development strategy to transform into a cleaner and more sustainable economy, China planned to invest USD 50 billion into various heavy-polluting industries to control the wastewater generation from these industries.

- The Chinese government introduced water and soil pollution prevention and control work plans and increased the penalties for violation of the norms.

- After the declaration of the 13th Five Year Plan, the Chinese government initiated the Water Pollution Prevention and Control action plan, which primarily focuses on preventing industries from causing water contamination and has created a significant demand for wastewater treatment chemicals such as ferric chloride in the country.

- Additionally, China is the major manufacturer of printed circuit boards in the world. There are a large number of medium and low-order, single-, double-, or multi-layer PCB products with undefined market demand in mainland China.

- According to industry estimates, there are more than 2,500 PCB manufacturers in the global market, with mainland China itself accounting for more than 1,200 PCB manufacturers in the world.

Ferric Chloride Industry Overview

The ferric chloride market is partially fragmented, with few players holding the major share in the market. The leading players in the global ferric chloride market include (not in any particular order); BASF SE, Basic Chemical Industries, Tessenderlo Group, Nobian, and Kemira among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from Wastewater Treatment Plants

- 4.1.2 Increasing Stringent Norms for the Treatment of Sewage Water and Industrial Waste to Curtail Pollution

- 4.2 Restraints

- 4.2.1 Stringent Regulations Imposed on Companies during the Manufacturing and Shipment of Ferric Chloride Products

- 4.2.2 Presence of Substitutes Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Application

- 5.1.1 Water and Wastewater Treatment

- 5.1.2 Printed Circuit Board (PCB)

- 5.1.3 Pigment Manufacturing

- 5.1.4 Animal Nutrient Supplements

- 5.1.5 Asphalt Blowing

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Spain

- 5.2.3.7 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Egypt

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Basic Chemical Industries

- 6.4.3 Chemifloc LTD

- 6.4.4 CHIMI ART

- 6.4.5 SEQUENS

- 6.4.6 Feralco AB

- 6.4.7 HORIZON CHEMICALS

- 6.4.8 Kemira

- 6.4.9 MALAY-SINO CHEMICAL INDUSTRIES SDN. BHD.

- 6.4.10 MISR Chemical Industries

- 6.4.11 Nobian

- 6.4.12 PVS Technologies, Inc.

- 6.4.13 Saf Sulphur Factory

- 6.4.14 SIDRA WASSERCHEMIE GmbH

- 6.4.15 Tessenderlo Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Market for Application as a Catalyst