|

市场调查报告书

商品编码

1640471

汽车润滑油:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

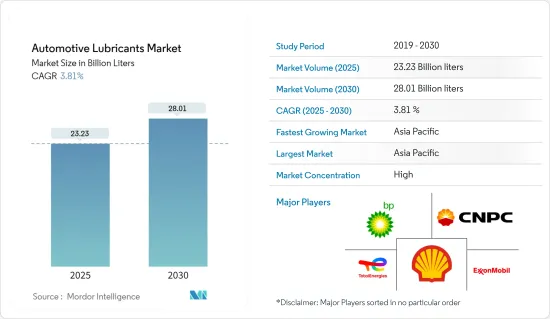

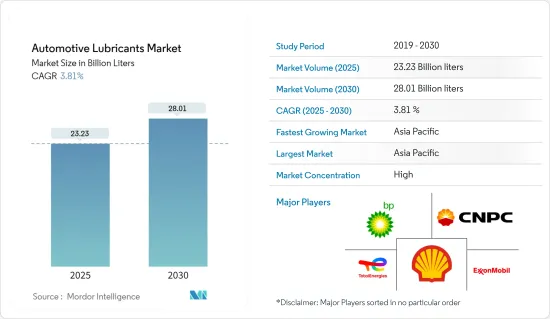

预计 2025 年汽车润滑油市场规模将达到 232.3 亿公升,预计到 2030 年将达到 280.1 亿公升,预测期内(2025-2030 年)复合年增长率为 3.81%。

2020 年,COVID-19 疫情爆发导致全国范围内实施封锁、製造活动和供应链中断以及全球生产停顿,对市场产生了负面影响。不过2021年情况有所好转,市场恢復了成长轨迹。

关键亮点

- 短期内,二手车的大量流行以及汽车产量的增加是推动被调查市场需求的关键因素。

- 然而,电动车和假冒机油的兴起预计将阻碍市场成长。

- 随着生物润滑油越来越受到关注,预计该市场将出现新的商机。

- 预计亚太地区将主导全球市场,大部分需求来自中国和印度。

汽车润滑油市场趋势

增加引擎油耗

- 机油主要由75-90%的基础油和10-25%的添加剂组成,在内燃机的润滑中起着重要作用。

- 这些油对于各种应用都至关重要,包括减少磨损、防止腐蚀和确保引擎部件平稳运行。

- 为了满足日益增长的机油需求,全球领先的製造商正在透过推出针对特定消费者需求的新型机油来实现产品多样化。

- 2024 年 4 月,润滑油行业主要企业Saneg 透过从其义大利工厂推出合成和半合成机油,加强了其在乌兹别克斯坦的业务。具体来说,该公司推出了SEG Motol Diesel 10W-40(API CI-4/SL)机油,专为远距拖拉机、越野车和施工机械等重型柴油机械而设计。

- 2023年9月,埃克森美孚行销(泰国)有限公司(EMMTL)致力于以创新的产品解决方案服务泰国消费者和商业部门。在汽车应用中,美孚 1 号和美孚超级旨在提供增强的引擎保护。这将对研究市场产生正面影响。

- 新兴市场对轻型高性能汽车的需求不断增长、汽车基数不断增加以及可支配收入不断提高是车用润滑油需求旺盛的关键原因。

- 2023年,在强劲的经济和消费者偏好变化的推动下,汽车产业将经历显着成长。根据国际汽车製造商组织(OICA)的资料,2020年全球汽车产量约9,354万辆,高于2022年的8,483万辆,成长率约10.26%。

- 德国是欧洲汽车产业的重要参与者,拥有大众、宾士、奥迪、宝马和保时捷等知名品牌。随着研发的持续投入和汽车产量的活性化,中国可望引领汽车润滑油市场的成长。

- 在欧洲,2023年新车註册与前一年同期比较增加了18.7%。预计2023年乘用车销售量将达到1,499万辆,商用车销售量将达290万辆,而2022年分别为1,264万辆及244万辆。

- 鑑于这些动态,未来几年市场将大幅成长。

亚太地区可望主导市场

- 亚太地区的快速工业化正在推动市场成长。该地区的汽车产业正在快速成长,对润滑油的需求预计将增加。

- 此外,汽车产业越来越依赖润滑油来实现最佳性能,预计这一趋势将进一步加强市场。预计亚太地区将占相当大的市场占有率,主要受中国、马来西亚、印度、泰国、印尼和斯里兰卡等新兴市场的消费所推动。

- 中国在润滑油消费量和生产量方面都是全球强国。影响中国润滑油格局的主要参与企业包括壳牌公司、中国石化、埃克森美孚公司和英国石油公司。预测期内,该产业的成长主要得益于投资活性化和扩张。

- 随着汽车持有快速成长和技术进步的推动,中国汽车产业已成为车用润滑油的最大消费产业。中国工业协会预计,2023年中国汽车产销量将双双突破3,000万辆,较上年实现显着两位数成长。

- 此外,中汽协资料显示,2023年中国商用车将强劲復苏,销量将成长22.1%至403万辆,产量将成长26.8%至404万辆。汽车销售和产量的激增直接增加了润滑油的需求。

- 2023年,受可支配收入增加、新型运动型多功能车蓬勃发展以及贷款利率诱人的推动,印度的乘用车销量将首次突破400万辆大关。根据印度汽车工业协会 (SIAM) 的数据,国内市场乘用车、轿车和多用途车销量超过 410 万辆,较 2022 年的 379 万辆增长 8.2%。其中,多功能车销量占总销售量的57.4%。

- 2023年,日本新乘用车註册量将大幅增加,达到约399万辆,较上年的345万辆有大幅成长。日本全国新车註册量约478万辆,其中乘用车註册量排名第一。

- 这些因素加上有利的政府法规,正在推动整个全部区域对汽车润滑油的需求。

汽车润滑油产业概况

汽车润滑油市场部分整合。主要企业(不分先后顺序)包括壳牌公司、中国石油化学集团公司、英国石油公司、埃克森美孚、道达尔能源公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 二手车流行导致润滑油需求增加

- 由于汽车製造增加导致润滑油消耗增加

- 其他驱动因素

- 限制因素

- 电动车日益普及

- 假冒引擎油

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 产品类型

- 机油

- 变速箱/齿轮油

- 油压

- 润滑脂

- 汽车模型

- 搭乘用车

- 商用车

- 摩托车

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International Ltd

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- Lukoil

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- SK Lubricants Co. Ltd

- TotalEnergies

- Valvoline Inc.

- Veedol International Limited

第七章 市场机会与未来趋势

- 人们对生物润滑剂的兴趣日益浓厚

- 其他机会

The Automotive Lubricants Market size is estimated at 23.23 billion liters in 2025, and is expected to reach 28.01 billion liters by 2030, at a CAGR of 3.81% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions recovered in 2021, restoring the market's growth trajectory.

Key Highlights

- Over the short term, the vast penetration of used vehicles and increasing vehicle manufacturing are the major factors driving the demand for the market studied.

- However, the increasing adoption of electric vehicles and counterfeiting of engine oils are expected to hinder the market's growth.

- Nevertheless, the growing prominence of bio-lubricants is expected to create new opportunities for the market studied.

- The Asia-Pacific region is expected to dominate the global market, with the majority of demand coming from China and India.

Automotive Lubricants Market Trends

Increasing Usage of Engine Oils

- Engine oils, primarily composed of 75-90% base oils and 10-25% additives, play a crucial role in lubricating internal combustion engines.

- These oils are essential for various applications, including wear reduction, corrosion protection, and ensuring the smooth operation of engine components.

- In response to the rising demand for engine oils, leading global manufacturers are diversifying their offerings, introducing new engine oils tailored to specific consumer needs.

- In April 2024, Saneg, a key player in the lubricant industry, bolstered its footprint in Uzbekistan by rolling out synthetic and semi-synthetic motor oils from its Italian plant. Specifically, the company unveiled its SEG Motol Diesel 10W-40 (API CI-4/SL) oils, tailored for heavy-duty diesel machinery like long-haul tractors, off-road vehicles, and construction equipment.

- In September 2023, ExxonMobil Marketing (Thailand) Limited (EMMTL) announced its commitment to serve Thai consumers and business sectors with innovative product solutions. For automotive, Mobil 1 and Mobil Super are engineered to raise engine protection performance. This makes a positive impact on the studied market.

- Growing demand for lightweight, high-performance cars in emerging markets, increasing automotive hubs, and rising disposable income are the major reasons for the high demand for automotive lubricants.

- In 2023, buoyed by a strong economy and shifting consumer preferences, the automotive sector witnessed notable growth. Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) indicates global vehicle production reached approximately 93.54 million units, up from 84.83 million units in 2022, marking a growth rate of about 10.26%.

- Germany, a key player in Europe's automotive landscape, is home to renowned brands like Volkswagen, Mercedes-Benz, Audi, BMW, and Porsche. With ongoing investments in R&D and a boost in automotive production, the country is poised to drive the growth of the automotive lubricants market.

- In Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 14.99 million units and 2.9 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- Given these dynamics, the market is set for significant growth in the coming years.

Asia-Pacific is Expected to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is poised to fuel market growth. The region's burgeoning automotive industry is set to drive an uptick in lubricant demand.

- Furthermore, as the automotive sector increasingly relies on lubricants for optimal performance, this trend is expected to bolster the market further. Asia-Pacific is projected to command a significant market share, predominantly driven by consumption in developing nations like China, Malaysia, India, Thailand, Indonesia, and Sri Lanka.

- China stands out as a global powerhouse, both in lubricant consumption and production. Major players shaping China's lubricant landscape include Shell Plc, Sinopec, ExxonMobil Corporation, and BP Plc. The sector's growth was bolstered by heightened investments and expansions throughout the forecast period.

- China's automotive sector, driven by a burgeoning vehicle fleet and tech advancements, emerges as the top automotive lubricant consumer. 2023 saw both sales and production of automobiles in China hit a record 30 million units, marking a notable double-digit growth from the prior year, as highlighted by the China Association of Automobile Manufacturers (CAAM).

- Moreover, 2023 marked a significant rebound for China's commercial vehicles, with sales and production jumping 22.1% and 26.8%, respectively, reaching 4.03 million and 4.04 million units, according to CAAM data. This surge in automotive sales and production directly amplifies the demand for lubricants.

- In 2023, India's passenger vehicle sales surpassed the 4 million milestone for the first time, fueled by rising disposable incomes, a boom in new sport-utility vehicles, and attractive loan rates. The domestic market reported sales exceeding 4.1 million cars, sedans, and utility vehicles, marking an 8.2% increase from 2022's 3.79 million, as per the Society of Indian Automobile Manufacturers (SIAM). Notably, utility vehicles made up 57.4% of total sales.

- In 2023, Japan saw a notable uptick in new passenger car registrations, hitting approximately 3.99 million-a significant rise from the 3.45 million recorded in the previous year. Overall, the country registered about 4.78 million new motor vehicles, with passenger cars leading the charge.

- These factors, coupled with favorable government regulations, are driving the heightened demand for automotive lubricants across the region.

Automotive Lubricants Industry Overview

The automotive lubricants market is partially consolidated in nature. The major players (not in any particular order) include Shell PLC, China Petrochemical National Corporation, BP p.l.c., Exxon Mobil Corporation, and TotalEnergies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Vast Penetration Of Used Vehicles Increasing Lubricant Demand

- 4.1.2 Increase in Vehicle Manufacturing Bolstering Lubricant Consumption

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Adoption of Electric Vehicles

- 4.2.2 Counterfeiting of Engine Oils

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Motorcycles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP p.l.c.

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation (CNPC)

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 Gazprom Neft PJSC

- 6.4.11 Gulf Oil International Ltd

- 6.4.12 Hindustan Petroleum Corporation Limited

- 6.4.13 Indian Oil Corporation Ltd

- 6.4.14 Lukoil

- 6.4.15 Motul

- 6.4.16 Petrobras

- 6.4.17 PETRONAS Lubricants International

- 6.4.18 Phillips 66 Company

- 6.4.19 PT Pertamina Lubricants

- 6.4.20 Repsol

- 6.4.21 Shell PLC

- 6.4.22 SK Lubricants Co. Ltd

- 6.4.23 TotalEnergies

- 6.4.24 Valvoline Inc.

- 6.4.25 Veedol International Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for Bio Lubricants

- 7.2 Other Opportunities