|

市场调查报告书

商品编码

1640472

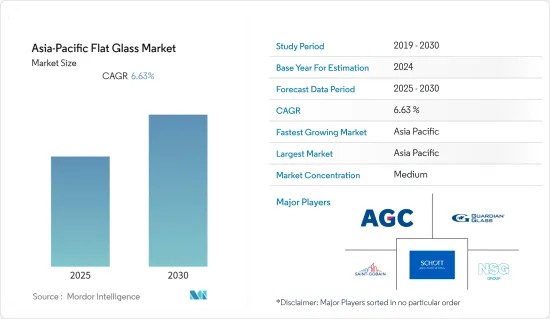

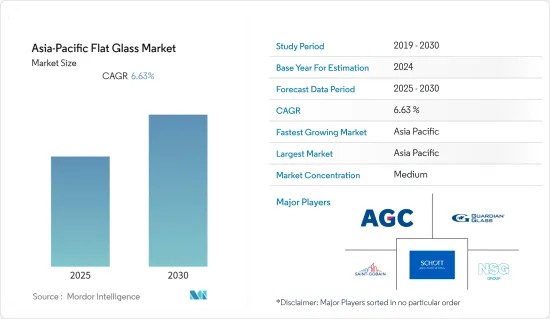

亚太平板玻璃:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内亚太平板玻璃市场复合年增长率将达到 6.63%。

市场受到了 COVID-19 的负面影响。此次疫情导致亚太地区多个国家进入封锁状态,以遏止病毒传播。许多公司和工厂的关闭扰乱了供应链,影响了生产、交货时间和产品销售。市场已从 COVID-19 疫情中恢復,该地区正在显着增长。

主要亮点

- 预测期内,建设产业的需求不断增长以及电子显示器的需求不断增长将推动市场的发展。

- 原材料价格的波动和政府有关碳排放的监管可能会在未来几年阻碍市场的成长。

- 由于汽车产业的进步以及中国、马来西亚、泰国和印尼太阳能产业的不断发展,市场提供了巨大的机会。

亚太平板玻璃市场趋势

建筑业占据市场主导地位

- 建筑业是所研究市场中最大的终端用户领域。此外,智慧城市计划的趋势也有望推动平板玻璃的需求。人口成长和快速都市化预计将推动基础设施开发和建设活动,主要是在中国和印度,从而增加对建筑应用的需求。

- 玻璃在建筑中的使用使得建筑更加美观和有吸引力。玻璃广泛应用于建筑业的窗户、建筑幕墙、门、隔间、栏桿、店面、楼梯和阳台栏桿等,为浮法玻璃提供了潜在的机会。

- 本体着色浮法玻璃是在熔融状态下添加着色剂以获得着色力和吸收太阳辐射性能的新型玻璃。这种玻璃可以节省能源,减少建筑物的热量侵入,并提供令人印象深刻的视觉效果。

- 亚太地区的建筑业是最大的行业之一,由于经济快速成长、都市化迅速发展以及基础设施支出不断增加,该行业正在稳步增长。预计2020年至2030年间亚太地区建筑产值将成长50%,达到2.5兆美元,到2030年成为价值7.4兆美元的市场。

- 中国是全球最大的建筑市场,占全球建筑投资总额的20%。预计未来七年该国将在建设上投入约 13 兆美元。

- 据印度基础设施基金会称,印度计划在2019年至2023年期间透过国家基础设施管道(NIP)投资1.4兆美元用于基础设施计划,以确保印度的永续发展。

- 由于上述因素,预计平板玻璃市场在预测期内将会成长。

中国主导市场

- 中国在亚太平板玻璃市场规模中占据主导地位,并且由于建设产业的成长,预计在预测期内将继续保持主导地位。

- 该地区经济状况的持续改善正在提高消费者的经济地位并刺激该国对建筑和其他基础设施活动的需求。

- 根据国际贸易办公室的数据,中国是世界上最大的建筑市场。 「十四五」期间(2021-2025年)新基建总投资预计达约4.2兆美元。新计划强调了节能和绿色建筑发展的九个重点领域。维修建筑面积3.5亿平方公尺以上,新建净零能耗建筑5000万平方公尺以上。

- 中国拥有全球最大的电子产品製造基地,为韩国、新加坡和台湾等现有的上游製造商带来了激烈的竞争。随着中产阶级可支配收入的上升,预计未来对电子产品的需求将稳定成长。

- 在汽车和运输应用中,平板玻璃用于背光、挡风玻璃、窗户和天窗。

- 以产量和年销量计算,中国仍然是世界上最大的汽车市场,预计到 2025 年国内产量将达到 3,500 万辆。根据国际汽车製造商组织(OICA)的数据,2022年中国共生产汽车27,020,615总合。

- 预计所有这些因素都将在预测期内推动中国亚太平板玻璃市场的发展。

亚太平板玻璃产业概况

亚太地区的平板玻璃市场本质上是相互关联的。市场的主要企业包括 AGC Inc.、Nippon Sheet Glass、Saint-Gobain、Schott AG 和 Guardian Glass LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建设产业需求增加

- 电子显示器需求不断成长

- 其他驱动因素

- 限制因素

- 原物料价格波动

- 政府碳排放法规

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 中空玻璃

- 强化玻璃

- 夹层玻璃

- 其他产品类型

- 按最终用户产业

- 建造

- 车

- 电气和电子

- 其他最终用户产业

- 按地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析**/市占分析

- 主要企业策略

- 公司简介

- AGC Inc.

- Borosil Renewables Ltd.

- Emerge Glass

- Gold Plus Float Glass

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd

- Qingdao Laurel Glass Technology Co.,Ltd

- Saint-Gobain

- SCHOTT AG

- Sisecam

- TAIWAN GLASS IND. CORP

第七章 市场机会与未来趋势

- 汽车工业的发展

- 中国、马来西亚、泰国和印尼对太阳能产业的投入不断增加

The Asia-Pacific Flat Glass Market is expected to register a CAGR of 6.63% during the forecast period.

The market was negatively impacted due to COVID-19. Due to the pandemic, several countries in the Asia-Pacififc region went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories has disrupted supply networks and hampered production, delivery schedules, and product sales. The market has recovered from the COVID-19 pandemic and is increasing significantly in the region.

Key Highlights

- Increasing demand from the construction industry and growing demand for electronic displays drive the market during the forecast period.

- Fluctuating raw material prices and government regulations on carbon emissions will likely hinder the market's growth in the coming years.

- The market has key opportunities due to advancements in the automotive industry and rising initiatives in the solar industry in China, Malaysia, Thailand, and Indonesia.

Asia-Pacific Flat Glass Market Trends

Construction Industry to Dominate the Market

- The construction industry is the largest end-user segment of the market studied. Moreover, the ongoing trend of smart city projects is also anticipated to drive flat glass demand. Due to the growing populace and rapid urbanization, the rising infrastructural developments and construction activities, mainly in China and India, are anticipated to augment the demand for architectural applications.

- The use of glass in construction provides a more pleasing and attractive look to buildings. Glasses are being used extensively in the construction industry in windows, facades, doors, interior partitions, balustrades, shop fronts, and railings for stairs and balconies, among other building parts, providing a potential opportunity to float glasses.

- Body-tinted float glass is a new type of glass in which melted colorants are added for coloring and solar radiation absorption properties. This type of glass saves energy, reduces heat penetration into buildings, and provides a striking visual effect.

- The construction sector in the Asia-Pacific region is one of the largest, and it has been witnessing steady growth owing to the presence of fast-growing economies, rapid urbanization, and rising spending on infrastructure. The construction output growth in Asia-Pacific is expected to grow by 50%, or USD 2.5 trillion, between 2020 and 2030, to a USD 7.4 trillion market in 2030.

- China has the largest building market globally, accounting for 20% of all construction investment. The country is expected to spend around USD 13 trillion on buildings over the next seven years.

- According to IBEF, the country planned to spend USD 1.4 trillion on infrastructure projects from 2019 to 2023 through the National Infrastructure Pipeline (NIP) to ensure India's sustainable development.

- Owing to all the aforementioned factors, the market for flat glass is projected to grow during the forecast period.

China to Dominate the Market

- China dominated the Asia-Pacific flat glass market size and is projected to continue its dominance during the forecast period due to the rising construction industry.

- The continuous improvements in economic conditions in the region have enhanced the financial status of consumers, boosting the demand for buildings and other infrastructural activities in the country.

- According to the International Trade Administration, China is the world's largest construction market. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) is expected to reach roughly USD 4.2 trillion. The new plan emphasizes nine key items for energy efficiency and green building development; it also calls for retrofitting over 350 million square meters of buildings and constructing over 50 million square meters of net-zero energy-consumption buildings.

- China has the world's largest electronics production base and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. With the increase in disposable incomes of the middle-class population, the demand for electronic products is projected to increase steadily in the future.

- In automobile and transport applications, flat glass is used to make backlights, windscreens, windows, and sunroofs.

- China continues to be the world's largest vehicle market by manufacturing output and annual sales, with domestic production expected to reach 35 million vehicles by 2025. In 2022, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), a total of 27,020,615 vehicles were produced in China.

- All these factors are expected to drive China's Asia-Pacific flat glass market during the forecast period.

Asia-Pacific Flat Glass Industry Overview

The Asia-Pacific flat glass market is consolidated in nature. Key players in the market include AGC Inc., Nippon Sheet Glass Co. Ltd, Saint-Gobain, and SCHOTT AG, and Guardian Glass LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Growing Demand for Electronic Displays

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Government Regulations on Carbon Emission

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Insulated Glass

- 5.1.2 Tempered Glass

- 5.1.3 Laminated Glass

- 5.1.4 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Construction

- 5.2.2 Automotive

- 5.2.3 Electrical & Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Borosil Renewables Ltd.

- 6.4.3 Emerge Glass

- 6.4.4 Gold Plus Float Glass

- 6.4.5 Guardian Industries Holdings

- 6.4.6 Nippon Sheet Glass Co. Ltd

- 6.4.7 Qingdao Laurel Glass Technology Co.,Ltd

- 6.4.8 Saint-Gobain

- 6.4.9 SCHOTT AG

- 6.4.10 Sisecam

- 6.4.11 TAIWAN GLASS IND. CORP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in the Automotive Industry

- 7.2 Rising Initiatives in the Solar Industry in China, Malaysia, Thailand, and Indonesia