|

市场调查报告书

商品编码

1640497

单乙二醇:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mono-ethylene Glycol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

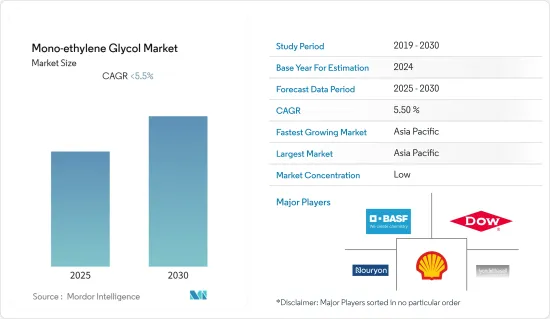

预测期内,单乙二醇市场预计将以高达 5.5% 的复合年增长率成长。

新冠肺炎疫情的蔓延导致全球主要国家停工,影响大多数产业,并导致炼油厂依照法规要求关闭。由于产量下降以及对各种衍生物和最终产品的需求减弱,对乙二醇(MEG)的需求下降。然而,2021 年汽车、纺织和其他活动的增加导致市场稳定成长。

关键亮点

- 短期内,包装领域对PET的需求增加是推动乙二醇市场成长的关键因素。

- 另一方面,原油价格波动导致的原物料价格波动可能会限制市场成长。

- 生物基 MEG 材料日益普及,很可能在不久的将来为全球市场创造丰厚的成长机会。

- 预计在评估期内,亚太地区的乙二醇市场将呈现健康成长。

乙二醇市场趋势

纺织业占市场主导地位

- 纺织业是乙二醇及其衍生物的主要终端用户产业,用于合成各种聚酯纤维。

- 2021 年全球纺织纤维产量达 1.136 亿吨,而 2020 年为 1.083 亿吨,成长 4.8%。

- 印度、中国和美国是世界主要纺织品生产国。由于投资增加和基础设施改善,预测期内该行业的需求可能会增加。

- 根据印度纺织品和服饰出口联合会(IBEF)统计,2021年4月至12月,包括手工艺品在内的印度纺织品和服装出口总额为298亿美元,高于去年同期的212亿美元。此外,有利的人口结构和对品牌产品的偏好偏好预计将提振纺织业的需求,从而促进单乙二醇市场的发展。

- 美国是纺织相关产品的主要出口国之一。根据美国全国纺织组织理事会的报告,2021年美国纤维、纺织品和服装出口总额为284亿美元,纺织品和服装出货收益为652亿美元。

- 因此,预计上述因素将对预测期内的市场成长产生重大影响。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率的主导地位。由于中国、印度和日本等国家的纺织和汽车工业不断发展,对乙烯的需求也不断增长,因此该地区对乙烯的需求也日益增长。

- 中国是世界上最大的乙二醇及其衍生对苯二甲酸乙二醇酯(PET)消费国之一。充足的原料供应和低廉的生产成本支持了该地区的生产扩张。

- 中国是PET树脂的重要生产国,其中中油集团、江苏三房巷等企业产量位居世界前列,产能超过200万吨。因此,终端用户产业对 PET 的需求不断增加,也增加了对单乙二醇的需求。

- 中国纺织业是全球主要产业之一,也是全球最大的服饰出口国。据中国工业和资讯化部(MIIT)称,2021年前9个月,中国纺织业实现稳定成长,利润总额较去年同期成长31.7%,至人民币1,711亿元(约268亿美元)。

- 据印度化学和石化工业协会称,2020-2021财年MEG年产能为2,215吨,产量约2,000吨。

- 该地区也是最大的汽车製造地。根据OICA统计,2021年汽车总产量为46,732,785辆,较去年同期成长6%。

- 因此,预计上述因素将在整个预测期内推动该地区对乙二醇的需求。

乙二醇产业概况

单乙二醇市场依其性质可分为部分细分市场。主要参与企业(不分先后顺序)包括 Nouryon、 BASF SE、Dow、LyondellBasell Industries Holdings BV 和 Shell PLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装领域对 PET 的需求不断增加

- 其他驱动因素

- 限制因素

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 贸易分析

- 价格趋势

- 技术简介

- 监理政策分析

第五章 市场区隔(市场规模:数量)

- 应用

- 聚酯纤维

- 宝特瓶

- PET 薄膜

- 防冻液

- 工业的

- 最终用户产业

- 纤维

- 包装

- 塑胶

- 汽车和运输

- 其他终端用户产业(电子、涂料)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率**/排名分析

- 主要企业策略

- 公司简介

- Nouryon

- BASF SE

- Dow

- India Glycols Limited

- LACC

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Reliance Industries Limited

- Royal Dutch Shell PLC

- SABIC

- Solventis

第七章 市场机会与未来趋势

- 生物基 MEG 材料日益流行

The Mono-ethylene Glycol Market is expected to register a CAGR of less than 5.5% during the forecast period.

Due to the COVID-19 spread, major economies imposed lockdowns globally, which impacted most industries, and refineries went non-operational following regulations and rules. There was a decline in the demand for mono ethylene glycol (MEG) due to the dip in the production and various derivatives and end product demand. However, the market is growing steadily, owing to increased automotive, textile, and other activities in 2021.

Key Highlights

- Over the short term, the growing demand for PET in the packaging sector is a significant factor driving the growth of the mono-ethylene glycol market.

- On the flip side, the fluctuation in raw material prices due to volatility in crude oil prices can restrict market growth.

- Nevertheless, the increased popularity of bio-based MEG materials will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific is estimated to witness healthy growth in the momo-ethylene glycol market over the assessment period.

Monoethylene Glycol Market Trends

Textile Sector to Dominate the Market

- Textile is a primary end-user industry for mono-ethylene glycol, as the derivatives synthesize a wide variety of polyester fibers.

- The global production volume of textile fibers reached volume of 113,600 thousand metric tons in 2021 and registered a growth of 4.8% compared to 108,300 thousand metric tons in 2020.

- India, China, and the United States represent major textile manufacturing countries in the world. With growing investments and improved infrastructure facilities, the demand from the sector is likely to increase in the forecast period.

- According to the IBEF, in India, exports of textiles and apparel, including handicrafts, totaled USD 29.8 billion from April to December 2021, up from USD 21.2 billion in the same period last year, thus registering a robust 41% increase over the previous year. Furthermore, favorable demographics and a shift in preference for branded products are expected to boost demand for the textile sector, thus boosting the mono-ethylene glycol market.

- The United States is among the key countries in exports of textile-related products. In 2021, US Fiber, textile, and apparel exports combined were USD 28.4 billion, and the value of shipments for textiles and apparel was USD 65.2 billion, according to the National Council of Textile Organizations report.

- Thus, the abovementioned factors are expected to significantly impact market growth during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing, textile and automotive activities and the increasing demand for mono-ethylene in countries such as China, India, and Japan, the need for mono-ethylene is increasing in the region.

- China is one of the largest global consumers of mono-ethylene glycol and its derived polyethylene terephthalate (PET). The abundant raw materials availability and low-cost production supported the region's production growth.

- China is a significant PET resin producer, home to companies such as PetroChina Group and Jiangsu Sangfangxiang, among the most prominent manufacturers globally in terms of volume, with capacities of more than 2 million tons. Thus, the rising demand for PET from end-user industries is driving the need for mono-ethylene glycol.

- China's textile sector is one of its major sectors, and the country is the largest clothing exporter in the world. China's textile industry grew steadily during the first nine months of 2021 with collective profits worth CNY 171.1 billion (~ USD 26.80 billion), a 31.7% year-on-year (YoY) increase, according to the Ministry of Industry and Information Technology (MIIT).

- According to the Chemical and Petrochemicals Manufacturers Association, India, in FY2020-21, the annual capacity of MEG stood at 2,215 KT, with production amounting to almost 2000 KT.

- Also, the region is the largest automotive manufacturing hub. According to OICA, in 2021, the total production of vehicles stood at 46,732,785 units, which was an increase of 6% compared to the same period last year.

- Thus, the factors mentioned above are expected to boost the mono-ethylene glycol demand through the forecast period in the region.

Monoethylene Glycol Industry Overview

The mono-ethylene glycol market is partially fragmented in nature. Major players (not in any particular order) include Nouryon, BASF SE, Dow, LyondellBasell Industries Holdings BV, and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for PET in the Packaging Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Trade Analysis

- 4.6 Price Trends

- 4.7 Technological Snapshot

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Polyester Fiber

- 5.1.2 PET Bottle

- 5.1.3 PET Film

- 5.1.4 Antifreeze

- 5.1.5 Industrial

- 5.2 End-user Industry

- 5.2.1 Textile

- 5.2.2 Packaging

- 5.2.3 Plastic

- 5.2.4 Automotive and Transportation

- 5.2.5 Other End-user Industries (Electronics, Paints)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 US

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 UK

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Nouryon

- 6.4.2 BASF SE

- 6.4.3 Dow

- 6.4.4 India Glycols Limited

- 6.4.5 LACC

- 6.4.6 LyondellBasell Industries Holdings BV

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Nan Ya Plastics Corporation

- 6.4.9 Reliance Industries Limited

- 6.4.10 Royal Dutch Shell PLC

- 6.4.11 SABIC

- 6.4.12 Solventis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Popularity of Bio-based MEG Materials