|

市场调查报告书

商品编码

1640502

氯丁橡胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Neoprene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

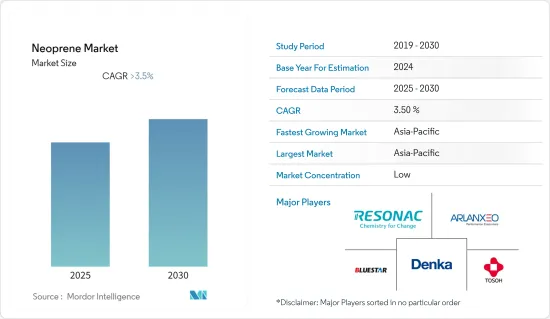

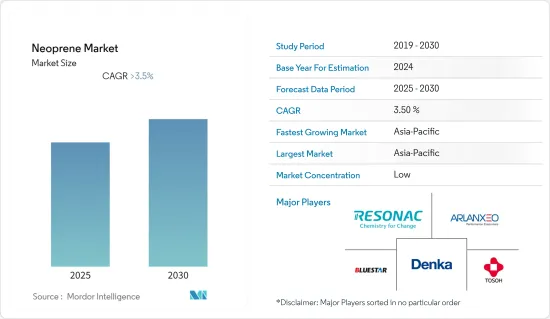

预测期内,氯丁橡胶市场预计将以超过 3.5% 的复合年增长率成长。

2020 年,新冠肺炎疫情对市场造成了严重影响。由于疫情封锁导致汽车业疲软、建筑业和汽车业活动暂时停止,对氯丁橡胶市场的需求产生了不利影响。然而,医用手套等氯丁橡胶产品的需求急剧增长,增加了市场对氯丁橡胶的需求。

主要亮点

- 短期内,电气和电子产业对电线电缆用氯丁橡胶的需求增加预计将推动市场成长。

- 然而,用于氯丁橡胶应用的热可塑性橡胶和聚氨酯合成橡胶等替代品的可用性阻碍了市场的成长。

- 氯丁橡胶手套的日益普及可能会为氯丁橡胶市场带来一大福音。

- 亚太地区占据全球市场主导地位,其中印度和中国等国家是最大的消费量国。

氯丁橡胶市场趋势

建筑和建设产业的需求不断增加

- 氯丁橡胶市场庞大且多样化,在建筑和施工领域有广泛的应用。就氯丁橡胶消费量而言,建筑市场是成长最快的终端使用产业之一。氯丁橡胶已在各种结构密封和防水应用中证明了其性能。

- 氯丁橡胶通常用于密封多层结构中的地板、防止屋顶漏水、保护特殊窗户免受风和撞击以及覆盖桥樑支撑垫片和电缆。氯丁橡胶的柔韧性使其成为结构工程计划中的热门材料,这些项目需要具有耐候、防水、防化学腐蚀和防火等特性的独特组件。

- 氯丁橡胶耐油脂、蜡和油,并且还具有很强的抵抗稀酸、碱和盐溶液的能力。氯丁橡胶的另一个主要优点是它能在 -20°C (-40°F) 至 95°C (2030°F) 的温度范围内保持高性能,甚至适应更极端的温度。这些优势使氯丁橡胶成为建筑应用领域最具吸引力的解决方案之一。

- 根据美国人口普查局的数据,2022年12月美国建筑业总支出为18,098亿美元。与2021年12月相比,12月建筑业年增约7.7%,当时总支出为1.681兆美元。这促进了氯丁橡胶市场的扩大。

- 欧盟统计局也报告中表示,2021年住宅将占欧盟GDP的5.6%左右。欧盟各地的比例有所不同:塞浦路斯为 7.6%,德国和芬兰为 7.2%,希腊为 1.3%,爱尔兰为 2.1%,拉脱维亚为 2.2%,波兰为 2.3%。

- 德国是欧洲最大的建筑市场,拥有欧洲最大的建筑存量。德国政府已将经济适用住宅作为国家的主要目标之一。政府计划每年建造40万套住宅,其中10万套将由公共补贴。

- 投资的扩大将导致建设活动的增加,预计这将在预测期内推动对丙烯酸酯单体的需求。

亚太地区可望主导市场

- 由于中国和印度等国家的建筑、汽车和电气行业的需求不断增加,预计亚太地区将占据市场主导地位。

- 中国汽车产销量已连续14年位居世界第一。 2022年预计汽车产销2,702.1万辆,与前一年同期比较分别成长3.4%及2.1%。

- 日本电子情报技术产业协会(JEITA)预计,截至2022年11月,日本电子产业整体产值约10.1兆日圆(845亿美元),与前一年同期比较约100.7%。截至 11 月份,日本的电子产品出口也比去年同期成长了近 15%。

- 根据IBEF的报告,到2026年印度汽车产业规模预计将达到3,000亿美元。 2022年10月乘用车、三轮车、摩托车和四轮车总产量为2,191,090辆。

- 菲律宾统计局在2022年年度报告中也表示,机动车和摩托车维修对该国GDP与前一年同期比较增7.6%做出了重大贡献。该行业是最重要的贡献者,贡献了整体成长率的约8.7%。

- 电子业是氯丁橡胶的主要消费者之一。智慧型手机、OLED电视、平板电脑等电子产品是中国电力领域成长最快的领域。随着中阶可支配收入的提高和廉价劳动力的供给,电子产品的国内生产预计很快就会蓬勃发展,从而推动氯丁橡胶市场的发展。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

氯丁橡胶产业概况

氯丁橡胶市场部分分散。主要参与者包括(不分先后顺序):Denka Company Limited、ARLANXEO、Resonac Holdings Corporation、Tosoh Corporation和中国蓝星(集团)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电气和电子产业的需求增加

- 其他驱动因素

- 限制因素

- 热可塑性橡胶和聚氨酯合成橡胶等替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

- 技术简介

- 製造过程

第五章 市场区隔(市场规模:数量)

- 按类型

- 正常线性等级

- 预交交联级

- 硫磺改性级

- 低结晶等级

- 按应用

- 乳胶

- 合成橡胶

- 胶水

- 按最终用户产业

- 建筑和施工

- 车

- 电气和电子

- 医疗

- 其他最终用户产业(海洋、包装等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ARLANXEO

- CHANG HORING RUBBER CO., LTD

- China National Bluestar(Group)Co. Ltd

- Chongqing ChangFeng Chemical Co.,Ltd.

- Denka Company Limited

- PAR Group

- Quanex Building Products

- Resonac Holdings Corporation

- Tosoh Corporation

第七章 市场机会与未来趋势

- 氯丁橡胶手套越来越受欢迎

- 其他机会

The Neoprene Market is expected to register a CAGR of greater than 3.5% during the forecast period.

COVID-19 harmed the market in 2020. The weakening automobile industry and a brief halt in construction and automotive activity owing to the pandemic lockdown had a detrimental impact on neoprene market demand. However, demand for neoprene products such as medical gloves had expanded dramatically, increasing neoprene demand in the market.

Key Highlights

- Over the short term, increasing demand for neoprene from the electrical and electronics industry for application in wire and cables is expected to drive the market's growth.

- On the flip side, the availability of substitutes like thermoplastic and polyurethane elastomers in neoprene applications is hindering the market's growth.

- The augmenting popularity of neoprene gloves will likely act as an opportunity for the neoprene market.

- Asia-Pacific dominated the market across the world with the largest consumption in the countries such as India, China, etc.

Neoprene Market Trends

Increasing Demand from Building and Construction Industry

- The neoprene market is large and diverse, with many applications in building and construction. In terms of neoprene consumption, the building and construction market is one of the fastest-growing end-use industries. Neoprene proved its performance in a variety of structural sealing and waterproofing applications.

- Neoprene is commonly used to seal floors of multi-story structures, prevent roof leaks, protect specialty windows from winds and shocks, and sheathe bridge-bearing pads and cables. Because of its great flexibility, neoprene is a popular material for structural engineering projects requiring unique parts with exceptional weather-, water-, chemical-, and fire-resistance qualities.

- Neoprene is resistant to grease, wax, and oil and highly resistant to diluting acids, bases, and salt solutions. Another chief advantage of neoprene is that it maintains high performance at a range of temperatures, ranging from -20°C (-40F) to 95°C (2030F), and can even be compounded for more extreme temperatures. These advantages make neoprene one of the most attractive solutions in building and construction applications.

- According to the United Census Bureau, the total spending in the construction sector during December 2022 in the US was USD 1,809.8 billion. The construction sector saw an increase of about 7.7% in December compared to December 2021 on a year-on-year basis, in which the total spending was USD 1,681.0 billion. It, in turn, would have assisted in expanding the neoprene market.

- Eurostat, in its report, also stated that construction in housing accounted for about 5.6% of the EU GDP in 2021. This proportion varied across the EU, ranging from 7.6% in Cyprus to 7.2% in Germany and Finland, to 1.3% in Greece, 2.1% in Ireland, 2.2% in Latvia, and 2.3% in Poland.

- Germany is Europe's biggest construction market, with the continent's largest building stock. The German government set affordable housing as one of the major objectives for the country. The government plans to build 400,000 new housing units every year, 100,000 of which are publicly subsidized.

- This investment growth led to an increase in construction activities, leading to an expected increase in the demand for acrylate monomers over the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market due to increasing demand from the construction, automotive, and electrical industries in countries such as China and India.

- China's total automobile production and sales volume is the first in the world for 14 consecutive years. In 2022, the production and sales of automobiles were 27.021 million and 26.864 million, up 3.4% and 2.1% year on year, respectively.

- The Japan Electronics and Information Technology Industries Association (JEITA) estimated the overall production value of the electronics sector in Japan to be around JPY 10.1 trillion (84.5 USD billion) as of November 2022, roughly 100.7% of the value from the previous year. Compared to the prior year, electronics exports from Japan also increased by almost 15% up until November compared to the previous year.

- According to the IBEF report, the Indian automotive industry is expected to reach USD 300 billion by 2026. In October 2022, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 2,191,090.

- In its annual report for 2022, the Philippine Statistics Authority also stated that motor cars and motorbike maintenance contributed significantly to the country's 7.6% GDP growth over the previous year. The sector was the most important contributor, providing approximately 8.7% of overall growth.

- The electronics industry is one of the key consumers of neoprene. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth in the consumer electronics segment in China. With the increase in the disposable income of the middle-class population and cheap labor availability, the domestic production of electronic products is projected to grow rapidly shortly, thereby driving the neoprene market.

- Therefore, the above factors are expected to significantly impact the market in the coming years.

Neoprene Industry Overview

The neoprene market is partially fragmented. Some of the major players include (not in any particular order) Denka Company Limited, ARLANXEO, Resonac Holdings Corporation, Tosoh Corporation, and China National Bluestar (Group) Co, Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Electrical and Electronics Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes like Thermoplastic and Polyurethane Elastomers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

- 4.6 Technological Snapshot

- 4.7 Manufacturing Process

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Normal Linear Grades

- 5.1.2 Pre-cross Linked Grades

- 5.1.3 Sulfur-modified Grades

- 5.1.4 Slow Crystallizing Grades

- 5.2 Application

- 5.2.1 Latex

- 5.2.2 Elastomers

- 5.2.3 Adhesives

- 5.3 End-user Industry

- 5.3.1 Building & Construction

- 5.3.2 Automotive

- 5.3.3 Electrical & Electronics

- 5.3.4 Medical

- 5.3.5 Other End-user Industries ( Marine and Packaging etc)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARLANXEO

- 6.4.2 CHANG HORING RUBBER CO., LTD

- 6.4.3 China National Bluestar (Group) Co. Ltd

- 6.4.4 Chongqing ChangFeng Chemical Co.,Ltd.

- 6.4.5 Denka Company Limited

- 6.4.6 PAR Group

- 6.4.7 Quanex Building Products

- 6.4.8 Resonac Holdings Corporation

- 6.4.9 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Augmenting Popularity of Neoprene Gloves

- 7.2 Other Opportunities