|

市场调查报告书

商品编码

1640503

合成橡胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Elastomers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

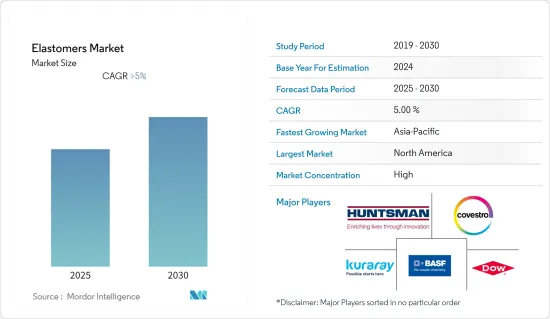

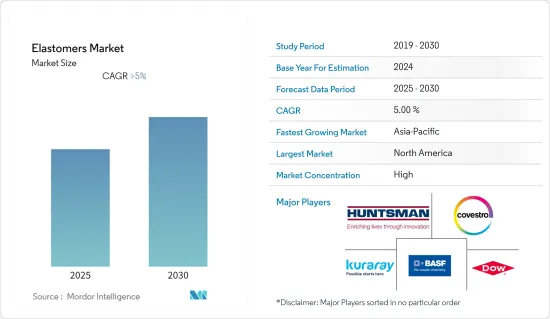

预测期内合成橡胶市场预期复合年增长率超过 5%

关键亮点

- 随着汽车工业和合成橡胶工业对合成橡胶作为黏合剂、管材、被覆剂等原料的需求不断增加,预计市场将会成长。

- 对合成橡胶在医疗应用中的生物相容性的担忧可能会减缓市场的成长。

- 对生产生物基产品的重视程度提高以及在医疗器材製造中更多地使用合成橡胶可能会创造商机。

- 亚太地区是全球最大的市场,其中印度和中国等国家使用率最高。

合成橡胶市场趋势

扩大汽车领域的应用

- 合成橡胶用于皮带、软管、波纹管、垫圈、内部隔音材料、地板和仪表板外皮。在非车辆方面,它可用于涂覆轮胎(基胎、胎侧和胎面)、电线、电缆和几乎所有汽车零件。

- 热塑性烯烃 (TPO) 化合物可作为仪表板盖和其他内装应用中柔性 PVC 的替代品。

- 热可塑性橡胶(TPE) 因其重量轻、易于加工、设计自由、多功能和可回收性而广泛应用于汽车和运输行业。热固性橡胶是一种主要用于汽车轮胎的合成橡胶。

- 全球消耗的所有 TPE 产品中约有 40% 用于汽车製造。因此,汽车和运输产业及其零件和OEM供应商的发展将成为未来 TPE 需求的关键指标。

- 2021年全球汽车产量将达8,000万辆以上。与前一年相比,这项数据成长了约3%。因此,这对合成橡胶市场的成长产生了正面的影响。

- 随着汽车行业寻求更轻的材料来提高汽车的效率,TPE 的市场正在不断增长,为设计师提供了更多的汽车製造选择。高性能热可塑性橡胶使製造商能够设计出像钢一样坚固的产品。这减轻了整体重量并有助于减少温室气体排放。

- 中国是全球电动车市场的领导者。根据中国汽车工业协会统计,2022年12月,全国新能源汽车产量年增96.9%。因此,电动车市场的扩大预计将增加对合成橡胶的需求。

- 因此,由于上述因素,预测期内合成橡胶市场预计将大幅成长。

亚太地区占市场主导地位

- 由于中国、印度、台湾、泰国和印尼等国家的汽车製造和销售成长,预计亚太地区将引领市场。

- 中国是建筑、汽车、电气电子和鞋类产业最大的合成橡胶市场。

- 汽车工业是合成橡胶的主要消费者之一。中国电动车市场规模不断扩大,电动车新车销量大幅增加。 2021年中国电动车总合将达330万辆,较2020年的130万辆成长154%。因此,对轮胎、皮带、软管等汽车零件的需求增加将对合成橡胶市场的需求产生正面影响。

- 此外,印度的汽车工业正在崛起。该国乘用车产量大幅增加。例如,2021-2022 财年的乘用车产量达到 3,650,698 辆,比 2020-21 财年增加 19%。

- 合成橡胶用于製造各种建筑材料,包括黏合剂、密封剂和填缝剂。根据中国国家统计局数据,2021年全国建筑业总产值25.92兆元,比2020年增加11%以上。

- 此外,根据韩国统计局的数据,2021年,国内外建筑公司共订单2,459亿美元的建筑订单。这比去年有了很大的飞跃。

- 预计在日本举办的活动也将促进日本建筑业的发展。东京将于2020年举办奥运(因疫情延后至2021年),大阪将于2025年举办世博会。

- 由于这些因素和其他因素,预计亚太地区将在未来几年引领合成橡胶市场。

合成橡胶产业概况

合成橡胶市场部分整合。该市场的主要公司包括(不分先后顺序)BASF公司、陶氏化学公司、科思创公司、可乐丽公司和亨斯迈国际有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产业需求增加

- 建筑业需求增加

- 限制因素

- 对某些医用合成橡胶的生物相容性的担忧

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 产品类型

- 热固性合成橡胶

- 热可塑性橡胶

- 应用

- 车

- 运动的

- 电子产品

- 工业的

- 胶水

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Ace Elastomer

- Avient Corporation

- Arkema

- BASF SE

- Exxon Mobil Corporation

- Covestro AG

- DingZing Advanced Materials Inc.

- Dow

- HEXPOL AB

- Huntsman International LLC

- KURARAY CO., LTD.

- Miracll Chemicals Co., Ltd.

- Sirmax SpA

- Suzhou Austin Novel Materials Technology Co. Ltd.

- Trinseo

- The Lubrizol Corporation

第七章 市场机会与未来趋势

- 转向生物基产品开发

- 扩大应用范围至医疗器材製造

简介目录

Product Code: 53880

The Elastomers Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The market is expected to grow because the automotive industry needs more elastomers and the construction industry needs more elastomers to make things like adhesives, tubes, coatings, and other materials.

- Biocompatibility worries about how elastomers are used in medicine are likely to slow the market's growth.

- Opportunities are likely to come from putting more effort into making bio-based products and using them more in making medical instruments.

- Asia-Pacific was the biggest market in the world, with countries like India, China, and others using the most.

Elastomers Market Trends

Increasing Usage in the Automotive Segment

- Elastomers are used in belts and hoses, bellows, gaskets, sound management inside the car, floors, and instrument panel skins. Moreover, outside the car, it can be used in tires (base tires, sidewalls, and treads), wire, cables, and coatings in almost all car parts.

- The automotive industry has gotten better in part because more cars are being made and each car uses more polypropylene.Compounds of thermoplastic olefin (TPO) are used instead of flexible PVC to cover instrument panels and for other interior uses.

- The automotive and transportation industries use thermoplastic elastomers (TPEs) a lot because they are lightweight, easy to process, give designers more freedom, are versatile, and can be recycled.And thermoset rubber is a type of elastomer that is mainly used to make automotive tires.

- About 40% of all TPE products consumed worldwide are used in vehicle manufacturing. Therefore, the development of the automotive and transport industries and their parts, components, and OEM suppliers is an important indicator for future TPE demand.

- The global production of automobiles reached over 80 million units in 2021. In comparison to the previous year, this statistic represents a rise of about 3%. Hence, this is positively impacting the market growth of elastomers.

- The TPE market is growing because the automotive industry wants lighter materials to make cars more efficient and give designers more options for how to make them. High-performance thermoplastic elastomers give manufacturers the ability to design products and give them the same strength as steel. This helps reduce the weight of the whole thing and keep greenhouse gas emissions in check.

- China is a global leader in the electric car market. According to the China Association of Automobile Manufacturing, the production of new energy vehicles in the country witnessed a year-on-year increase of 96.9 percent in December 2022. Thus, the expanding electric vehicle market is expected to increase the demand for elastomers.

- Hence, owing to the abovementioned factors, the elastomers market is expected to grow significantly during the forecast period.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be at the top of the market because countries like China, India, Taiwan, Thailand, and Indonesia are making and selling more cars.

- In the construction, automotive, electrical and electronics, and footwear industries, China is the biggest market for elastomers.

- The automotive industry is one of the major consumers of elastomers. China's electric car market is expanding considerably, with a significant increase in the sales of new electric vehicles. A total of 3.3 million units of electric vehicles (EVs) were sold in China in 2021, representing an increase of 154% compared to the 1.3 million units sold in 2020. Hence, an increase in demand for automotive parts like tires, belts, hoses, and others positively impacts the market demand for elastomers.

- Also, the automotive industry in India is rising. The country witnessed a significant increase in the production of passenger vehicles. For instance, the production of passenger vehicles reached 3,650,698 for the FY 2021-2022, representing an increase of 19% compared to the FY 2020-21.

- Elastomers are used in manufacturing various construction materials, such as adhesives, sealants, and caulking. According to the National Bureau of Statistics of China, the output value of the construction works in the country accounted for CNY 25.92 trillion in 2021, representing an increase of more than 11% compared to 2020, thereby enhancing the demand for the market studied.

- Statistics Korea also says that in 2021, local builders at home and abroad received construction orders worth a total of USD 245.9 billion. This is a big jump from the previous year.

- Also, events that will be held in Japan are expected to boost the construction industry there. Tokyo will host the Olympics in 2020 (postponed to 2021 due to the pandemic), and Osaka will host the World Expo in 2025.

- Due to these and other factors, the Asia-Pacific region is expected to lead the market for elastomers over the next few years.

Elastomers Industry Overview

The elastomers market is partially consolidated in nature. Some of the major players in the market include BASF SE, Dow, Covestro AG, Kuraray Co., Ltd., and Huntsman International LLC, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Automotive Industry

- 4.1.2 Rising Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Biocompatibility Concerns of Some Medical Elastomers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Thermoset Elastomers

- 5.1.2 Thermoplastic Elastomers

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Sports

- 5.2.3 Electronics

- 5.2.4 Industrial

- 5.2.5 Adhesives

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ace Elastomer

- 6.4.2 Avient Corporation

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Covestro AG

- 6.4.7 DingZing Advanced Materials Inc.

- 6.4.8 Dow

- 6.4.9 HEXPOL AB

- 6.4.10 Huntsman International LLC

- 6.4.11 KURARAY CO., LTD.

- 6.4.12 Miracll Chemicals Co., Ltd.

- 6.4.13 Sirmax S.p.A

- 6.4.14 Suzhou Austin Novel Materials Technology Co. Ltd.

- 6.4.15 Trinseo

- 6.4.16 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward the Development of Bio-based Products

- 7.2 Increasing Application in Fabrication of Medical Instruments

02-2729-4219

+886-2-2729-4219