|

市场调查报告书

商品编码

1640513

氧气感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Oxygen Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

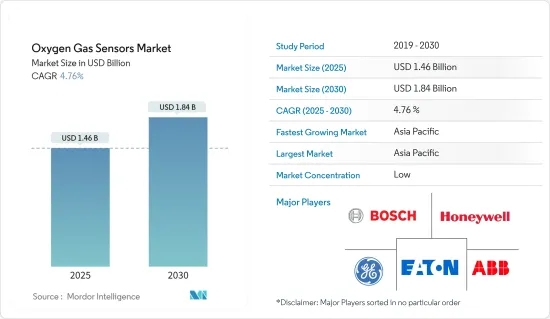

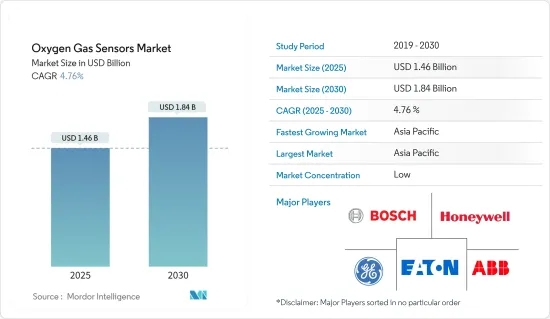

预计2025年氧气感测器市场规模为14.6亿美元,预计到2030年将达到18.4亿美元,预测期内(2025-2030年)的复合年增长率为4.76%。

关键亮点

- 在矿场、石油生产设施和化工厂等工业安全环境中,可靠地测量氧气浓度或氧气分压并警告异常情况的能力至关重要。这就是推动市场成长的因素。

- 市场成长的动力来自于医疗、汽车和工业等各种应用领域对氧气感测器的需求不断增长。此外,加上传感技术的快速进步,氧气感测器的应用日益广泛。此外,人们的安全意识不断增强也推动了该市场的成长。

- 此外,环境因素也在推动氧气感测器的发展方面发挥关键作用。众所周知,溶氧是维持河口水域和近岸海洋中贝类、鱼类和其他水生生物族群平衡的关键要求。已经并将继续进行各种计划来测量水中的溶解氧。此外,氨、臭氧和氯都是污水处理和水质净化厂净化阶段使用的有毒气体。这些因素预计将推动对氧气感测器的需求。

- 此外,准确了解氧气水平对于调节汽车空燃比到控制工业过程等一切都至关重要,这推动了对氧气感测器的需求。例如,2022 年 8 月,Premier Auto Trade 宣布大幅扩展其氧气和空燃比感测器产品范围。 PAT 目前为汽油、液化石油气和柴油车辆提供 800 多种不同的直接安装氧气感测器,并将其供应给日本、韩国、美国和欧洲的製造商。这涵盖了澳洲和纽西兰超过 1400 万辆汽车的应用,使其成为澳洲售后市场上最广泛的产品系列。

- 例如,2022 年 8 月,马哈拉斯特拉邦的新兴企业获得政府 3,290 万印度卢比(40 万美元)的支持,用于自主开发氢气检测技术。 Multi-Nanosense Technologies 已与 DST 下属的技术发展委员会签署了一份谅解备忘录,用于内部开发氢检测和分析技术。

- 此外,由于医院和其他医疗机构对能够测量低浓度氧气的精密仪器的需求不断增加,这些氧气感测器的医疗应用预计将快速增长。这些设备用于监测缺氧、缺氧和心臟骤停的患者。此外,它也用于气喘和慢性阻塞性肺病(COPD) 等呼吸系统疾病患者的非侵入性通气程序。

- 该公司最近推出了新产品以保持市场竞争力。此外,Crowcon Detection Instruments Ltd 在其 Gasman可携式气体检测仪中推出了长寿命氧气感测器。新型感测器的使用寿命更长、整体拥有成本更低,而且完全不含铅,可帮助企业遵守即将出台的《有害物质限制指令》(RoHS)并减少对环境的危害。

氧气感知器市场趋势

汽车产业占主要市场需求

- 氧气感知器主要用于汽车废气中,以精确测量进入车辆汽缸的氧气量。该仪器用于汽油、柴油和燃气引擎的排放气体控制。预计未来汽车持有的增加加上政府排放法规的严格度将刺激汽车氧气感知器的销售。

- 此外,在復古车辆中改装汽车氧气感测器的趋势日益增长,预计将在未来几年为相关人员提供巨大的商机。 2022年8月,印度政府在孟买推出印度首辆双层电动巴士。该国优先考虑城市交通改革,并致力于打造低碳足迹、高乘客密度的综合电动车(EV)移动生态系统。

- 汽车氧气感知器涂层材料的快速进步有望为全球汽车氧气感知器市场带来新的范式。目前,大多数公司采用高温共烧陶瓷(HTCC)绿带作为氧气感测器,以生产用于汽车的高强度、长寿命的感测器。

- 此外,2022年8月,博世宣布将投资超过2亿美元在南卡罗来纳州安德森生产燃料电池堆。当氢离子穿过燃料电池的板时,它们与氧结合产生电能。产生的唯一产品是水,并且车辆运行不会排放二氧化碳。

- 此外,该行业受到国内外当局的严格法规和政策的管制,因此必须使用这些系统。各行各业都依赖氧气感测器来满足政府和监管机构制定的排放标准。例如,大多数汽油动力汽车都配备了触媒转换器,以符合美国环保署日益严格的排放标准。

亚太地区成长速度最快

- 由于汽车产量的增加,该地区的汽车产业预计将成为氧气感知器安装的主要驱动力。根据印度品牌资产基金会(IBEF)的数据,到 2027 年印度乘用车市场规模预计将达到 548.4 亿美元。印度汽车产业的目标是在2016年至2026年间将汽车出口量增加五倍。此外,2022 财年印度的汽车出口总量为 5,617,246 辆。

- 此外,2022 年 3 月,中国上汽集团旗下的 MG Motors 表示,计划在印度透过非上市股票融资3.5 亿至5 亿美元,以满足未来的需求,包括电动车(EV) 的扩张。 3 月宣布。此外,两轮电动车製造商HOP Electric Mobility(Rays Power Infra 旗下的多元化商业企业)计划在未来两年内投资10 亿印度卢比(1,324 万美元)来扩大其电动车生产能力。做。该地区汽车使用量的不断增加正在推动氧气感测器市场的发展。

- 此外,印度政府鼓励外商对汽车领域进行投资,并允许透过自动途径进行100%的外商直接投资。此外,2022 年2 月,塔塔汽车有限公司、铃木汽车古吉拉特邦分公司、马恆达汽车、现代起亚印度私人有限公司等汽车製造商与印度政府签署了一份谅解备忘录(MOU),以增加本地汽车製造并吸引新的投资。 20 家汽车公司提案投资约 4,500 亿印度卢比(59.5 亿美元)。政府在汽车领域的政策和措施可能在未来几年进一步推动研究市场的需求。

- 由于新兴经济体和「中国製造」和「印度製造」等政府倡议,该地区的工业产量预计也将增加。由于氧气感测器在工业领域的广泛应用,预计工业领域的成长将推动氧气感测器市场的发展。

- 氧气感测器广泛应用于化工和石化领域。该地区是世界上探索最广泛的地区之一。例如,根据 IBEF 的数据,在 2022-2023 年联邦预算中,政府向化学和石化部拨款 20.9 亿印度卢比(2,743 万美元)。此外,预计到 2025 年,印度化工和石化产业将吸引 8 兆印度卢比(1,073.8 亿美元)的投资。

氧气感知器产业概况

氧气感知器市场由于参与企业数量众多、进入门槛相对较低,因此具有明显的细分化特性。 ABB、霍尼韦尔、伊顿和通用电气等主要市场参与企业正在不断建立策略伙伴关係和进行产品开发,以增加市场占有率。

2023 年 3 月,LogiDataTech 推出了 MF420-O-Zr 氧气感测器,这是一种旨在精确测量气体混合物中氧气浓度的尖端解决方案。该感测器采用动态过程,利用两个二氧化锆片形成密封腔,从而可以在整个范围内进行精确的线性测量。此外,此氧气感知器具有内建诊断功能,可在使用过程中监控其性能并提醒您注意潜在的硬体或感测器问题。因此,不需要额外的氧气感知器。

2022 年 5 月,Angst+Pfister Sensors and Power 推出了专为金属、陶瓷和聚合物增材製造设计的创新氧气感测器。这些用于积层製造的长寿命数位氧气感测器和感测器模组可提供高 ppm 讯号分辨率,并且不受大多数其他气体的干扰。

2022 年 3 月,Sea-Bird Scientific 宣布推出其 SBS 83 光学氧气感测器,该感测器将作为 GO-BGC 计画的一部分成为 Navis 浮标上的标准感测器。 GO-BGC 计画旨在建立一个化学和生物感测器网路来监测世界海洋的健康状况。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 政府职场安全法规

- 市场限制

- 中小企业对氧气感知器的应用和使用缺乏认识

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 电位差

- 安培法

- 阻力类型

- 其他的

- 依技术分类

- 红外线的

- 催化

- 其他的

- 按最终用户产业

- 化工和石化

- 车

- 医学生命科学

- 工业

- 用水和污水

- 智慧建筑

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第六章 竞争格局

- 公司简介

- Robert Bosch GmbH

- ABB Limited

- Honeywell International Corporation

- Eaton Corporation

- General Electric Company

- Figaro Engineering Inc.

- Advanced Micro Instruments Inc.

- Yokogawa Electric Corporation

- City Technology Limited

- Delphi Automotive PLC

- Hamilton Company

- Sensore Electronic GmbH

- Aeroqual Limited

- AlphaSense Inc.

- Control Instruments Corporation

- Fujikura Limited

- Membrapor AG

- Mettler-Toledo International Inc.

- Francisco Albero SAU

- Maxtec LLC

第七章投资分析

第 8 章:市场的未来

The Oxygen Gas Sensors Market size is estimated at USD 1.46 billion in 2025, and is expected to reach USD 1.84 billion by 2030, at a CAGR of 4.76% during the forecast period (2025-2030).

Key Highlights

- The ability to reliably measure oxygen concentration or partial pressure and warn about abnormal conditions is critical in industrial safety environments, such as mines, oil production facilities, and chemical plants. This helps in driving the growth of the market.

- The growth in the market can be attributed to the rising demand for oxygen gas sensors in a range of applications, including medical, automotive, and industrial sectors. Also, the increasing number of applications for oxygen sensors, coupled with rapid technological advancements in sensing technologies. Furthermore, the increasing awareness regarding safety and security is also driving the growth of this market.

- Moreover, environmental concerns play a crucial role in driving the growth of oxygen gas sensors. It is known that dissolved oxygen is a critical requirement for the maintenance of balanced populations of shellfish, fish, and other aquatic organisms in both estuarine and nearshore coastal waters. Various projects have been and are expected to be implemented to measure the dissolved oxygen in the water. Furthermore, ammonia, ozone, and chlorine are all toxic gases used in the decontamination stage of wastewater treatment and water purification plants. Such factors will boost the demand for oxygen gas sensors.

- Furthermore, applications ranging from adjusting the air-fuel ratio in automobiles to controlling industrial processes increasingly demand oxygen sensors, as ascertaining oxygen levels accurately is essential. For instance, in August 2022, Premier Auto Trade announced a significant expansion to its Oxygen and Air Fuel Ratio Sensors range. The PAT range now includes over 800 Direct Fit Oxygen Sensors for petrol, LPG, and diesel vehicles with a spread across Japanese, Korean, USA, and European manufacturers. This covers over 14 million vehicle applications in Australia and New Zealand, making it the most extensive range in the Australian Aftermarket.

- For instance, in August 2022, a Maharashtra Startup Got INR 32.9 million (USD 0.40 million) support from the Government for Indigenous Development of Hydrogen Gas Detecting Technology. Multi Nano Sense Technologies signed a memorandum of understanding (MoU) Technology Development Board under DST for the indigenous development of hydrogen sensing and analysis technology.

- Also, the medical application of these oxygen gas sensors is expected to experience rapid growth due to a rising need for precise devices that can measure low levels of oxygen in hospitals and other healthcare facilities. These devices are utilized for monitoring patients who have hypoxic or anoxic injuries, as well as those experiencing cardiopulmonary arrest. Additionally, they are also employed in non-invasive ventilation procedures for patients with respiratory disorders like asthma or chronic obstructive pulmonary disease (COPD).

- Companies are rolling out new products lately to remain competitive in the market. Further, Crowcon Detection Instruments Ltd launched a long-life oxygen sensor in its Gasman portable gas detector. The new sensor has an extended lifespan, which reduces the total cost of ownership and is also completely free of lead, helping organizations to comply with imminent changes to the restriction of hazardous substances (RoHS) regulations and reducing harm to the environment.

Oxygen Gas Sensors Market Trends

Automotive Sector to Occupy a Significant Market Demand

- Oxygen gas sensors are majorly employed in automobile exhausts to measure the amount of oxygen entering the car cylinders accurately. This instrument is used to manage the released emissions of petrol, diesel, and gas engines. The growing fleet of automotive vehicles, combined with tight government emission control regulations, is expected to stimulate automotive oxygen gas sensor sales in the future.

- Furthermore, the growing retrofitting of automotive oxygen gas sensors for vintage vehicles is expected to provide considerable opportunities for stakeholders in the coming years. In August 2022, the Indian government launched India's first double-decker electric bus in Mumbai. It is working to create an integrated electric vehicle (EV) mobility ecosystem with a low carbon footprint and high passenger density, emphasizing urban transportation reform.

- Rapid advancements in coating materials for automotive oxygen gas sensors are expected to usher in new paradigms in the worldwide automotive oxygen sensor market. Most players now use high-temperature co-fired ceramic (HTCC) green tapes with oxygen sensors to create high-strength and long-lasting vehicle sensors.

- Furthermore, in August 2022, Bosch announced a more than USD 200 million investment to produce fuel cell stacks in Anderson, S.C. A fuel cell operates by using hydrogen to generate electrical energy. As the hydrogen ions pass over the fuel cell plates, they combine with oxygen to create electricity. The only by-product is water, allowing the vehicle to run with zero local carbon emissions.

- Moreover, the industry is governed by strict policies and regulations employed by both national and international authorities, making it mandatory to utilize these systems. The industry depends on oxygen sensors to meet the emission standards governments and concerned authorities set. For instance, most gasoline-powered vehicles are equipped with catalytic converters to comply with the US Environmental Protection Agency's stricter regulation of exhaust emissions.

Asia-Pacific to Mark the Fastest Growth Rate

- The automotive sector in this region is expected to be the significant driver for incorporating oxygen sensors due to the increasing automobile production. According to the India Brand Equity Foundation (IBEF), the Indian passenger car market is predicted to reach a value of USD 54.84 billion by 2027. Indian automotive industry is targeting to increase the export of vehicles by five times during 2016-2026. Furthermore, in FY 2022, total automobile exports from India stood at 5,617,246.

- In addition, in March 2022, MG Motors, owned by China's SAIC Motor Corp, announced plans to raise USD 350-500 million in private equity in India to fund its future needs, including electric vehicle (EV) expansion. In addition, Two-wheeler EV maker HOP Electric Mobility, a diversified business venture of Rays Power Infra, is looking at investing INR 100 crore (USD 13.24 million) over the next two years to extend manufacturing capacity for Electric Vehicles. The increased usage of automobiles in the region consequently drives the market for oxygen gas sensors.

- Furthermore, the government of India encourages foreign investment in the automobile sector and has allowed 100% FDI under the automatic route. Furthermore, in February 2022, carmakers, including Tata Motors Ltd, Suzuki Motor Gujarat, Mahindra and Mahindra, Hyundai, and Kia India Pvt. Ltd received PLI as part of the government's plan to increase local vehicle manufacturing and attract new investment. The 20 automobile companies proposed an investment of around INR 45,000 crore (USD 5.95 billion). Government policies and initiatives in the automotive sector may further drive the studied market demand in the future.

- The region's industrial manufacturing is also set to increase due to developing economies and government initiatives like "Make in China" and "Make in India." The growth of the industrial sector is expected to boost the oxygen sensors market due to its wide applications in the industrial sector.

- The chemical and petrochemical sectors have many applications for oxygen sensors. The region is home to one of the most extensive explorations in the world. For instance, According to IBEF, under the Union Budget 2022-2023, the government allotted INR 209 crores (USD 27.43 million) to the Department of Chemicals and Petrochemicals. Furthermore, an investment of INR 8 lakh crore (USD 107.38 billion) is estimated in the Indian chemicals and petrochemicals sector by 2025.

Oxygen Gas Sensors Industry Overview

The oxygen gas sensors market is characterized by significant fragmentation due to the presence of numerous players and relatively low entry barriers. Key industry participants, including ABB, Honeywell, Eaton, and GE, continuously engage in strategic partnerships and product development initiatives to expand their market share.

In March 2023, LogiDataTech introduced the MF420-O-Zr oxygen sensor, a cutting-edge solution designed for precise measurement of oxygen concentration in gas mixtures. This sensor employs a dynamic process that utilizes two zirconium dioxide slices to create a sealed chamber, enabling accurate linear measurement across the entire range. Additionally, the oxygen sensor features a built-in diagnostic function that monitors its performance during use and provides alerts about potential hardware or sensor issues. Consequently, there is no need for an extra oxygen sensor.

In May 2022, Angst+Pfister Sensors and Power unveiled an innovative oxygen sensor designed specifically for metal, ceramic, and polymer Additive Manufacturing procedures. These long-life digital oxygen sensors and sensor modules for Additive Manufacturing offer high ppm signal resolution and are not affected by interference from most other gases.

In March 2022, Sea-Bird Scientific announced the launch of the SBS 83 Optical Oxygen Sensor, which is set to become the standard sensor for Navis floats as part of the GO-BGC program. The GO-BGC program aims to create a network of chemical and biological sensors to monitor the health of the global oceans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Government Regulations to Ensure Safety in Work Places

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Potentiometric

- 5.1.2 Amperometric

- 5.1.3 Resistive

- 5.1.4 Other Types

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Catalytic

- 5.2.3 Other Technologies

- 5.3 By End-User Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Automotive

- 5.3.3 Medical and Life Sciences

- 5.3.4 Industrial

- 5.3.5 Water and Wastewater

- 5.3.6 Smart Buildings

- 5.3.7 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Robert Bosch GmbH

- 6.1.2 ABB Limited

- 6.1.3 Honeywell International Corporation

- 6.1.4 Eaton Corporation

- 6.1.5 General Electric Company

- 6.1.6 Figaro Engineering Inc.

- 6.1.7 Advanced Micro Instruments Inc.

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 City Technology Limited

- 6.1.10 Delphi Automotive PLC

- 6.1.11 Hamilton Company

- 6.1.12 Sensore Electronic GmbH

- 6.1.13 Aeroqual Limited

- 6.1.14 AlphaSense Inc.

- 6.1.15 Control Instruments Corporation

- 6.1.16 Fujikura Limited

- 6.1.17 Membrapor AG

- 6.1.18 Mettler-Toledo International Inc.

- 6.1.19 Francisco Albero SAU

- 6.1.20 Maxtec LLC