|

市场调查报告书

商品编码

1640535

水凝胶 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hydrogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

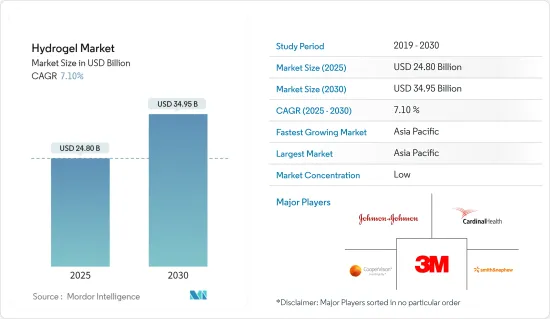

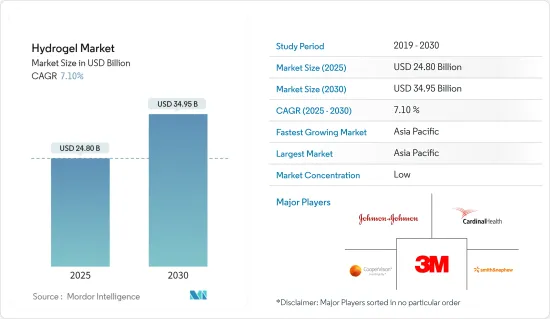

预计 2025 年水凝胶市场规模为 248 亿美元,预计到 2030 年将达到 349.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.1%。

新冠肺炎疫情严重影响了水凝胶市场。全球封锁和严格的政府规定导致我们大部分生产基地关闭,造成了毁灭性的打击。儘管如此,自 2021 年以来业务一直在復苏,预计未来几年将出现显着上升。

关键亮点

- 短期内,水凝胶在医疗产业的应用不断扩大以及在农业产业的快速应用预计将推动市场成长。

- 然而,水凝胶的高製造成本预计会阻碍市场的成长。

- 水凝胶新应用领域的出现以及生物医学和个人护理领域对水凝胶的认识和采用的提高预计将为研究市场带来机会。

- 亚太地区占据全球水凝胶市场的最大份额,预计在预测期内将以最快的复合年增长率成长。

水凝胶市场趋势

个人护理和卫生领域将占据市场主导地位

- 水凝胶非常适合用于卫生产品,因为它具有柔软、类似组织的物理特性、优异的吸水性、良好的透氧渗透性、优异的生物相容性以及可用于额外运输途径的微孔结构。

- 卫生产品的目标是製造更薄的垫片,在负载下具有更高的吸收性、更高的膨胀压力和更大的吸力。因此,水凝胶因其特性是最合适的选择。

- 世界卫生组织(WHO)、世界银行集团、联合国儿童基金会和其他一些政府机构正在提高人们对卫生重要性的认识,特别是妇女和青春期女孩的月经卫生管理(MHM)。

- 世界银行集团在印度启动了「清洁印度」运动下的旗舰卫生计画。这项活动旨在提高当地社区包括男孩和男人的意识,消除围绕月经的禁忌。

- 此外,个人护理行业的电子商务销售额也激增,市场参与企业包括宝洁公司、露华浓公司、Oliflame Cosmetics Global SA、雅芳公司和雅诗兰黛公司。

- 个人保健产品市场由几家主要企业主导,包括欧莱雅、宝洁、联合利华和资生堂。欧莱雅是所有公司中化妆品和个人护理销售额最高的,2022 年销售额约为 419.5 亿美元。

- 据个人护理协会欧洲化妆品协会 (Cosmetic Europe) 称,每天有 5 亿欧洲消费者使用化妆品和个人保健产品来保护自己的健康、增进幸福感并提高自尊。种类繁多,包括止汗剂、香水、化妆品、洗髮精、肥皂和防晒油。

- Oberlo 表示,美国个人护理产业预计将在 2022 年成长 2.95%,预计 2023 年成长额将达到 422 亿美元。预计这将刺激该国对水凝胶市场的需求。

- 在预测期内,所有这些因素都可能推动全球个人护理和卫生产品市场对水凝胶的需求。

亚太地区占市场主导地位

- 由于中国、印度和日本等国家的个人护理和卫生、农业、製药和医疗保健领域的成长,亚太地区占据了全球市场占有率的主导地位。

- 根据ECHEMI预测,2022年中国医药产业预计将年增与前一年同期比较%左右。消化器官系统及代谢药物约占全国医药市场总量的14%。

- 在中国,中产阶级的壮大、人口老化、收入的提高和都市化进程的加速正在推动药品销售。根据CEIC资料,2022年6月中国医药销售额为2,239.46亿美元,高于2022年4月的1,460.41亿美元。该国国内製药业规模庞大且种类多样,由约 5,000 家製造商和许多较小的公司组成。

- 在全球製药领域,印度是一个突出的扩张型新参与企业。根据PIB India统计,印度是全球领先的学名药供应国,占全球整体供应量的20%。印度药品出口到200多个国家,其中美国是主要市场。

- 据印度药品出口促进委员会(Pharmexcil)总干事称,2021-22年,印度将出口价值17500.4亿印度卢比(246.2亿美元)的药品,包括原料药/医药中间体。此外,2022年4月至10月,印度医药出口成长4.22%,达145.7亿美元。去年同期为139.8亿美元。

- 此外,根据印度品牌资产基金会的数据,到2030年印度製药业的规模预计将达到1,300亿美元。同时,预计到 2023年终全球医药产值将达到近 1 兆美元。

- 因此,预计上述因素将在未来几年增加对水凝胶的需求。

水凝胶产业概况

水凝胶市场细分化,少数公司占相当大的份额。市场的主要企业(不分先后顺序)包括 3M、强生服务公司、Cardinal Health、CooperVision 和 Smith & Nephew。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 在医疗产业的应用日益广泛

- 农业领域采用率激增

- 其他驱动因素

- 限制因素

- 水凝胶製造成本高

- 其他限制因素

- 价值链分析

- 波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(以金额为准))

- 结构

- 非晶质

- 半结晶

- 结晶质

- 材料

- 聚丙烯酸酯

- 聚丙烯酰胺

- 硅胶

- 其他成分(琼脂、明胶、PVP、PEG)

- 最终用户产业

- 个人护理和卫生

- 药品和医疗保健

- 食物

- 农业

- 其他最终用户产业(法医和调查)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ambu A/S

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Bausch Health Companies Inc.

- Cardinal Health

- Coloplast Corp.

- ConvaTec Inc.

- CooperVision

- DSM

- Essity Health & Medical

- HOYA Corporation

- Integra LifeSciences Corporation

- Johnson & Johnson Medical Limited

- Molnlycke Health Care AB

- Medtronic

- Novartis AG

- PAUL HARTMANN Pty Ltd.

- SEIKAGAKU CORPORATION

- Sekisui Kasei Co. Ltd.

- Smith & Nephew

第七章 市场机会与未来趋势

- 新的应用领域不断涌现

- 提高生物医学和个人护理领域对水凝胶的认识和采用

- 其他机会

The Hydrogel Market size is estimated at USD 24.80 billion in 2025, and is expected to reach USD 34.95 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030).

The COVID-19 pandemic harmed the hydrogel sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the increasing application of hydrogel in the healthcare industry and the surge in adoption in the agriculture industry are expected to drive the market's growth.

- However, the high production cost of hydrogel is expected to hinder the market's growth.

- The emergence of a new application area for hydrogel and rising awareness and adoption of hydrogel in the biomedical and personal care sector will act as an opportunity for the market studied.

- The Asia-Pacific region dominated the global hydrogel market with a significant share, and it is expected to register the fastest CAGR during the forecast period.

Hydrogel Market Trends

Personal Care and Hygiene Segment to Dominate the Market

- Hydrogel is suitable for hygiene products due to its soft and tissue-like physical properties, superior water absorption, good oxygen permeability, superior biocompatibility, and micro-porous structure for additional transport channels.

- Hygiene products aim to make thinner pads with higher absorbency under load, increased swelling pressure, and increased suction power. Hence, the hydrogel is the most suitable option due to its properties.

- Several government organizations, such as the World Health Organization, World Bank Group, and UNICEF, are raising awareness about the importance of hygiene, especially menstrual hygiene management (MHM) for women and adolescent girls.

- The World Bank Group initiated a flagship sanitation operation under the Swachh Bharath Mission in India. This operation aims to increase awareness among the community, including boys and men, to break the taboo around menstruation.

- Further, the personal care industry is also expected to observe a surge in the number of young and independent brands, as e-commerce sales are surging and providing stiff competition to some of the major companies in the personal care industry, including Procter & Gamble, Revlon Inc. Oriflame Cosmetics Global SA, The Avon Company, The Estee Lauder Companies Inc., and Unilever.

- The market for personal care products is dominated by a few key players, such as L'Oreal, Procter & Gamble, Unilever, and Shiseido Co., Ltd. L'Oreal has the highest cosmetics and personal care sales among the companies, and the company generated sales of around USD 41.95 billion in 2022.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, shampoos, soaps, and sunscreens, to many others.

- Oberlo stated that, in the United States, the personal care industry grew by 2.95% in 2022, and this growth is expected to outpace in 2023 to reach USD 42.2 billion. This is expected to stimulate the demand for the hydrogel market in the country.

- Owing to all these factors, the personal care and hygiene products in the world may drive the demand for hydrogel during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share due to the growing personal care and hygiene, agriculture, pharmaceuticals, and healthcare sectors in countries such as China, India, and Japan.

- The pharmaceutical industry in China was anticipated to grow by about 17% year-on-year in 2022 stated by ECHEMI. Digestive and metabolic drugs account for around 14% of the total pharmaceutical market of the country.

- The growing middle-class and aging population in China, rising incomes, and increasing urbanization drive pharmaceutical sales in the country. According to CEIC Data, the pharmaceutical sales revenue in China in June 2022 accounted for USD 223,946 million, up compared to USD 146,041 million in April 2022. The country has a large and diverse domestic drug industry, comprising around 5,000 manufacturers and many small or medium-sized companies.

- In the global pharmaceuticals sector, India is a prominent and expanding player. According to PIB India, India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries, with the United States being the key market.

- According to the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil), India exported INR 1,75,040 crore (USD 24.62 billion) worth of pharmaceutical products, including bulk drugs/drug intermediates, in FY2021-22. Furthermore, India's pharmaceutical exports increased by 4.22% from April to October 2022, reaching USD 14.57 billion. The exports were valued at USD 13.98 billion during the same period in the previous fiscal.

- Further, according to Indian Brand Equity Foundation, by 2030, the Indian Pharma industry is expected to reach USD 130 billion. In contrast, global pharmaceutical production's revenue is forecasted to reach nearly USD 1 trillion by the end of 2023.

- Therefore, the abovementioned factors are expected to increase the demand for hydrogel in the coming years.

Hydrogel Industry Overview

The hydrogel market is fragmented, with a few players holding a considerable share in the market. Some of the market's key players (not in any particular order) include 3M, Johnson & Johnson Services, Inc., Cardinal Health, CooperVision, and Smith & Nephew.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Healthcare Industry

- 4.1.2 Surge in Adoption in Agriculture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Production Cost of Hydrogel

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Structure

- 5.1.1 Amorphous

- 5.1.2 Semi-crystalline

- 5.1.3 Crystalline

- 5.2 Material

- 5.2.1 Polyacrylate

- 5.2.2 Polyacrylamide

- 5.2.3 Silicone

- 5.2.4 Other Materials (Agar, Gelatin, PVP, and PEG)

- 5.3 End-user Industry

- 5.3.1 Personal Care and Hygiene

- 5.3.2 Pharmaceuticals and Healthcare

- 5.3.3 Food

- 5.3.4 Agriculture

- 5.3.5 Other End-user Industries (Forensics and Research)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ambu A/S

- 6.4.3 Ashland

- 6.4.4 Axelgaard Manufacturing Co., Ltd.

- 6.4.5 Bausch Health Companies Inc.

- 6.4.6 Cardinal Health

- 6.4.7 Coloplast Corp.

- 6.4.8 ConvaTec Inc.

- 6.4.9 CooperVision

- 6.4.10 DSM

- 6.4.11 Essity Health & Medical

- 6.4.12 HOYA Corporation

- 6.4.13 Integra LifeSciences Corporation

- 6.4.14 Johnson & Johnson Medical Limited

- 6.4.15 Molnlycke Health Care AB

- 6.4.16 Medtronic

- 6.4.17 Novartis AG

- 6.4.18 PAUL HARTMANN Pty Ltd.

- 6.4.19 SEIKAGAKU CORPORATION

- 6.4.20 Sekisui Kasei Co. Ltd.

- 6.4.21 Smith & Nephew

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Application Areas

- 7.2 Rising Awareness and Adoption of Hydrogel in Biomedical and Personal Care Sector

- 7.3 Other Opportunities