|

市场调查报告书

商品编码

1640547

氢气压缩机-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hydrogen Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

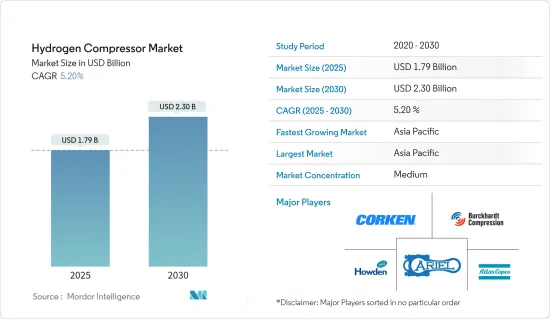

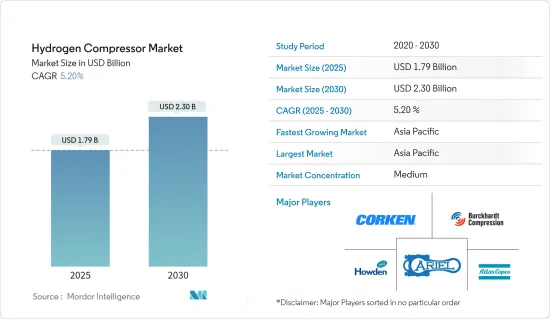

预计 2025 年氢气压缩机市场规模为 17.9 亿美元,到 2030 年将达到 23 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

关键亮点

- 预计在预测期内,化肥和精製等终端用户产业对氢气的需求不断增加,以及全球运输氢气管道基础设施部署不断增加等因素将推动氢气压缩机市场的发展。

- 另一方面,由于关税上调和贸易政策长期不确定性,製造业活动急剧下滑,全球贸易放缓,将减缓工业和经济活动,减少使用氢气的行业对资本财的需求。 ,从而抑制所研究市场的成长。

- 技术进步和透过电解生产氢气的新来源,再加上太阳能和风能等清洁能源,可能为市场成长提供充足的机会。

- 预计预测期内亚太地区将主导氢气压缩机市场,大部分需求来自中国、印度和日本。

氢气压缩机市场趋势

石油基产品占市场主导地位

- 油基润滑压缩机比无油压缩机成本更低,使用寿命更长。它们被认为最适合商业和工业应用,但在油污染影响很大而必须使用无油压缩机的行业除外。

- 油基压缩机被认为比无油压缩机更有效率。油作为冷却介质,在压缩过程中带走压缩机约80%的热量。它也适用于需要高压缩比的工业应用。

- 在资本支出方面,润滑油压缩机被认为比无油压缩机更便宜,价差通常在 30-40% 范围内。根据容量和行业特定要求等因素,这一比例甚至可以达到 50%,从而导致对油基氢气压缩机的需求增加。

- 油基压缩机比无油压缩机更便宜,但它们确实需要持续维护,并且需要更加註意更换过滤器和其他用于消除漏油风险的部件。持续的石油污染可能会带来严重后果,包括产品污染、安全性降低、生产停工和法律问题。

- 石油基氢气压缩机最受製造业的青睐,例如玻璃精製、钢铁工业、半导体製造、焊接、退火、发电厂金属热处理(发电机冷却水)、航太应用、製药等。

- 根据美国地质调查局预测,2023年美国粗钢产量将达8,000万吨。预计2023年美国钢铁业粗钢产量约1,100亿美元,较2022年的1,280亿美元下降15%。随着工业化持续发展,钢铁产量可能会继续增加,这反过来可能会产生对油基氢气压缩机的需求。

- 此外,根据世界钢铁协会的预测,2024年钢铁需求量预计将成长1.7%,2025年将成长1.2%,达到18.15亿吨。因此,未来钢铁需求的增加将推动市场成长。

- 润滑缺陷持续导致氢气压缩机零件过早磨损,可能增加油基氢气压缩机的维护成本并限制其需求。

- 由于这些因素,预计预测期内油基类型将主导氢气压缩机市场。

亚太地区可望主导市场

- 由于中国、日本和印度等国家的政府推出了优惠政策,预计未来几年亚太地区将成为燃料电池的广大市场。

- 中国是全球最大且成长最快的氢气压缩机市场之一。近年来,该国化学、石油天然气和製造业经历了显着成长。

- 氢气离心式压缩机用于精製和石化工业,如乙烯工厂的裂解气压缩和冷冻服务。由于乙烯和苯产量短缺,中国正在投资增加乙烯和苯的生产能力。

- 此外,一些压缩机公司正在亚洲国家投资以扩大压缩机市场。例如,2024 年 4 月,PDC Machines 与 Kirloskar Pneumatic Company Limited 签署了一项协议,为印度各地提供氢气压缩解决方案。该协议将使 PDC 能够支持印度国内氢气市场,并利用 KPCL 现有的客户群扩大其在亚洲的影响力。这将增加该地区氢气压缩机市场的重要性。

- 氢燃料电池汽车的发展以及日本为这些汽车充电而建造加氢站的努力预计将推动氢气压缩机市场的发展。

- 例如,根据日本AIRIA的数据,截至2023年3月,日本共有7,470辆燃料电池电动车投入使用,而2015年数字还不到200辆。这些车辆中的大多数都是主要以氢燃料为动力的乘用车。预计这将在预测期内推动对加氢站氢气压缩机的需求。

- 因此,由于这些因素,预计亚太地区将在预测期内主导氢气压缩机市场。

氢气压缩机产业概况

氢气压缩机市场适度细分。主要企业包括(不分先后顺序):Corken Inc.、Ariel Corporation、Burckhardt Compression AG、Howden Group Ltd 和 Atlas Copco Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 终端用户产业对氢气的需求不断增加

- 增加运输氢气管道基础设施的部署

- 限制因素

- 由于製造业活动和世界贸易急剧下滑,工业和经济活动放缓

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 科技

- 单级

- 多级

- 类型

- 油性

- 无油

- 最终用户产业

- 化学

- 石油和天然气

- 其他的

- 市场分析:2028 年前各地区市场规模及需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 北欧的

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 马来西亚

- 印尼

- 泰国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Corken Inc.

- Ariel Corporation

- Burckhardt Compression AG

- Hydro-Pac Inc.

- Haug Kompressoren AG

- Sundyne Corp.

- Howden Group Ltd

- Indian Compressors Ltd

- Atlas Copco Group

- Ingersoll Rand Inc.

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 技术进步与新的氢气生产来源

简介目录

Product Code: 54577

The Hydrogen Compressor Market size is estimated at USD 1.79 billion in 2025, and is expected to reach USD 2.30 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Factors such as the increase in demand for hydrogen from end-user industries, such as fertilizers and oil refineries, and increasing deployment of hydrogen pipeline infrastructure globally for transportation are expected to drive the hydrogen compressor market during the forecast period.

- On the other hand, the slowdown in industrial and economic activities due to a sharp decline in manufacturing activity and global trade, with higher tariffs and prolonged trade policy uncertainty, is expected to decrease the demand for capital goods from industries using hydrogen, thereby restraining the growth of the market studied.

- Nevertheless, the technological advancements and emerging sources for hydrogen production using electrolysis in combination with cleaner sources, such as solar and wind, are likely to provide ample opportunities for the market's growth.

- Asia-Pacific is expected to dominate the hydrogen compressor market during the forecast period, with the majority of the demand coming from China, India, and Japan.

Hydrogen Compressor Market Trends

Oil-based Segment Expected to Dominate the Market

- Oil-based lubricated compressors cost less and provide a longer service life than oil-free compressors. They are considered ideal for commercial and industrial applications until and unless they are used in industries where the consequences of oil contamination are considered very high and having an oil-free compressor is a must.

- Oil-based compressors are considered more efficient than oil-free compressors, as oil acts as a cooling medium, taking out approximately 80% of the compressor's heat during the compression process. They are also considered more suitable for industrial usage with requirements of a high compression ratio.

- In terms of capital outlay, lubricated oil-based compressors are often considered less expensive than oil-free compressors, with price differences often varying in the range of 30-40%. It may even reach 50%, depending upon factors such as capacity and industry-specific requirements, resulting in increased demand for oil-based hydrogen compressors.

- Although oil-based compressors are more affordable than oil-free compressors, they require continuous maintenance and greater attention to replacing filters and other components used to eliminate the risk of oil leakage. Ongoing oil contamination may result in severe consequences, such as spoiled or unsafe products, production downtime, and legal issues.

- Oil-based hydrogen compressors are mostly preferred in the manufacturing industry for glass purification, iron and steel industry, semiconductor manufacturing, welding, annealing, and heat-treating metals in power plants (coolant for generators), aerospace applications, pharmaceuticals, etc.

- According to the United States Geological Survey, in 2023, raw steel production in the United States was estimated to be 80 million metric tons. The US iron and steel industry produced raw steel in 2023 with an estimated value of about USD 110 billion, a 15% decrease from USD 128 billion in 2022. With the increasing industrialization, steel production may continue to increase, which, in turn, may create demand for oil-based hydrogen compressors.

- Furthermore, according to the World Steel Association, steel demand is expected to increase by 1.7% in 2024 and grow by 1.2% in 2025 to reach 1,815 million tonnes. Thus, the increase in demand for steel will drive the market's growth in the future.

- Insufficient lubrication persistently threatens premature wear of hydrogen compressor components, which may increase the maintenance cost of oil-based hydrogen compressors and limit their demand.

- Therefore, based on such factors, the oil-based type segment is expected to dominate the hydrogen compressor market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to be a promising market for fuel cells in the coming years because of the favorable government policies in countries such as China, Japan, and India.

- China is one of the world's largest and fastest-growing hydrogen compressor markets. The country has witnessed significant growth in its chemical, oil, gas, and manufacturing sectors in recent years.

- Hydrogen centrifugal compressors are used in refining and petrochemical industries, such as ethylene plants, for cracked-gas compression and refrigeration services. Due to ethylene and benzene production shortages, China has been investing in increasing its ethylene and benzene production capacities.

- Furthermore, several compressor companies are investing in Asian countries to expand the compressor market. For instance, in April 2024, PDC Machines and Kirloskar Pneumatic Company Limited agreed to provide hydrogen compression solutions throughout India. As per the agreement, PDC will support the local Indian hydrogen market, amplifying its reach in Asia by leveraging KPCL's existing customer base. This will boost the significance of the hydrogen compressor market in the region.

- The development of hydrogen fuel cell vehicles and Japan's aim to build hydrogen fuel stations for recharging the vehicles are expected to drive the hydrogen compressor market.

- For instance, according to AIRIA (Japan), as of March 2023, 7.47 thousand fuel-cell electric vehicles were in use in Japan, increasing from less than 200 in 2015. The majority of these vehicles were primarily hydrogen-fueled passenger cars. This, in turn, is expected to drive the demand for hydrogen compressors for hydrogen fuel stations during the forecast period.

- Therefore, based on such factors, Asia-Pacific is expected to dominate the hydrogen compressor market during the forecast period.

Hydrogen Compressor Indsutry Overview

The hydrogen compressor market is moderately fragmented. Some of the major companies include (in no particular order) Corken Inc., Ariel Corporation, Burckhardt Compression AG, Howden Group Ltd, and Atlas Copco Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Demand for Hydrogen from End-user Industries

- 4.5.1.2 Increasing Deployment of Hydrogen Pipeline Infrastructure for Transportation

- 4.5.2 Restraints

- 4.5.2.1 The Slowdown in Industrial and Economic Activities Due to a Sharp Decline in Manufacturing Activity and Global Trade

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Single-stage

- 5.1.2 Multistage

- 5.2 Type

- 5.2.1 Oil-based

- 5.2.2 Oil-free

- 5.3 End-user Industry

- 5.3.1 Chemical

- 5.3.2 Oil and Gas

- 5.3.3 Other End-user Industries

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (For Regions Only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 NORDIC

- 5.4.2.7 Spain

- 5.4.2.8 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Malaysia

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 South Africa

- 5.4.4.3 Qatar

- 5.4.4.4 United Arab Emirates

- 5.4.4.5 Nigeria

- 5.4.4.6 Egypt

- 5.4.4.7 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Colombia

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Corken Inc.

- 6.3.2 Ariel Corporation

- 6.3.3 Burckhardt Compression AG

- 6.3.4 Hydro-Pac Inc.

- 6.3.5 Haug Kompressoren AG

- 6.3.6 Sundyne Corp.

- 6.3.7 Howden Group Ltd

- 6.3.8 Indian Compressors Ltd

- 6.3.9 Atlas Copco Group

- 6.3.10 Ingersoll Rand Inc.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Emerging Sources for Hydrogen Production

02-2729-4219

+886-2-2729-4219