|

市场调查报告书

商品编码

1640554

钼 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Molybdenum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

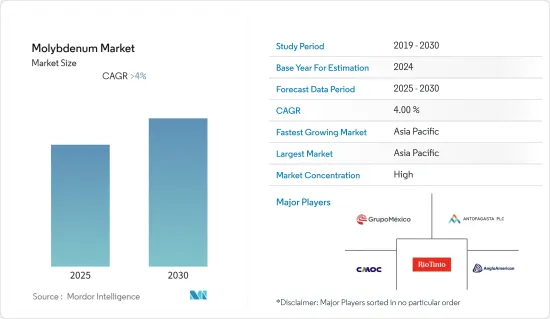

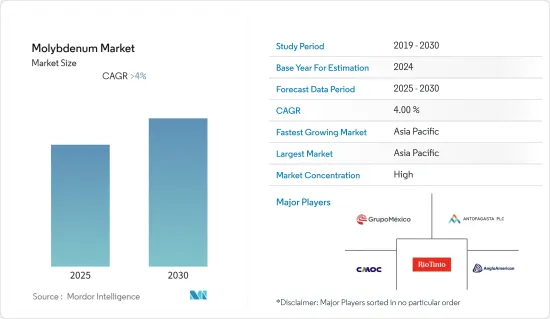

预计预测期内钼市场复合年增长率将超过 4%。

COVID-19 正在对钼市场产生负面影响。然而,各产业对钢铁的需求不断增长,正在推动钼的消费。

关键亮点

- 预计亚太地区钢铁产量的上升和能源产业需求的上升将推动市场成长。

- 钼的高成本可能会阻碍市场成长。

- 对含钼化学品的需求不断增加可能会推动未来市场的成长。

- 亚太地区占钼消费量的很大份额。由于中国汽车产量庞大且该地区建筑业的成长,预计预测期内该地区将以最快的速度成长。

钼市场趋势

航太和国防工业的需求不断增长

- 钼具有高温稳定性、抗拉强度、密度、防辐射和优异的材料加工性等多种特性,是航太和国防工业不可或缺的材料之一。

- 在航太工业中,钼的强度高、重量轻,有助于减少振动并提高飞行员和乘客的舒适度。它们也用于稳定飞机的副翼、升降舵和方向舵、直升机叶轮和驾驶座仪表等控制面。

- 印度是世界第九大民航市场,预计2030年将成为全球最大民航市场。该国目前有 153 个机场,预计到 2040 财年将增加到 190-200 个。预计到 2027 年,持有飞机数量将增加至 1,100 架。

- 2021 年 9 月,国防部与西班牙空中巴士防务与航太公司签署了为印度空军购买 56 架 C-295MW 运输机的合约。

- 根据美国联邦航空管理局(FAA)预测,由于航空货运量的增加,到2037年,民航机持有预计将达到8,270架。此外,由于现有机队老化,美国主干线航空公司预计每年将增加 54 架飞机。

- 根据美国国会预算办公室(CBO)预测,2021年美国国防支出为7,420亿美元,2022年将增加至7,600亿美元。此外,预计到 2032 年该价值将达到约 1 兆美元,从而推动该领域对钼的使用。

- 总体而言,航太和国防工业的稳定成长率以及钼在该领域的不断增加的应用预计将为钼市场提供巨大的成长机会。

中国主宰亚太地区

- 预计预测期内亚太地区将成为全球最大的钼市场。预计快速的工业化和不断增长的消费将推动市场发展。

- 中国是世界上最大的钼生产国之一。中国主要的钼生产商包括洛阳钼业、力拓集团和金堆城钼业集团。

- 根据国际钼协会(IMOA)统计,2022年第二季中国钼产量为6,310万磅,季增4%,年增14%。

- 钢铁业是我国最大的钼消费产业之一。 2021年粗钢产量为1,032.8吨,占全球产量的50%以上,这意味着钼的需求庞大。

- 中国将2022年国防预算增加7.1%,至1.45兆元(2,290亿美元)。此外,根据中国航空工业发展研究中心的报告,到2025年,中国飞机总数预计将达到5,343架,这将进一步扩大所研究的市场。

- 因此,随着各终端用户产业对钼的需求不断增加,预计预测期内产量将进一步增加。

钼行业概况

钼市场是一个整合的市场,主要企业占据市场主导地位。钼市场的主要企业包括英美资源集团、力拓集团、安託法加斯塔集团、墨西哥集团、洛阳钼业等(排名不分先后)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区钢铁产量上升

- 能源产业需求增加

- 限制因素

- 钼高成本

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 进出口趋势

- 价格趋势

第五章 市场区隔(市场规模(基于数量))

- 最终产品

- 钢

- 化学

- 铸件

- 莫金属

- 镍合金

- 其他最终产品(其他合金)

- 最终用户产业

- 石油和天然气

- 化工和石化

- 车

- 工业的

- 建筑和施工

- 航太和国防

- 其他的

- 地区

- 生产分析

- 中国

- 美国

- 智利

- 秘鲁

- 墨西哥

- 亚美尼亚

- 其他国家

- 消费分析

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 其他的

- 南美洲

- 中东和非洲

- 生产分析

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMERICAN CUMO MINING CORPORATION

- Anglo American

- Antamina

- Antofagasta PLC

- Centerra Gold Inc.

- China Molybdenum Co. Ltd

- Codelco

- Freeport-McMoRan

- Grupo Mexico

- Jinduicheng molybdenum group Co. Ltd

- MOLTUN

- Rio Tinto

第七章 市场机会与未来趋势

- 含钼化学品的需求不断增加

简介目录

Product Code: 54707

The Molybdenum Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 has negatively affected the Molybdenum Market. However, the rising demand for steel in various industries is propelling the consumption of molybdenum.

Key Highlights

- The increasing steel production in Asia-Pacific and growing demand from the energy sector are expected to drive market growth.

- The high cost of molybdenum will likely hinder the market's growth.

- Increasing demand for molybdenum-bearing chemicals is likely to augment the market's growth in the future.

- Asia-Pacific holds the major share in the consumption of molybdenum. The region is also expected to witness the fastest growth during the forecast period, owing to the largest automotive production in China and the growing construction industry within the region.

Molybdenum Market Trends

Increasing Demand from the Aerospace and Defense Industry

- Molybdenum is one of the essential materials for the aerospace and defense industry because of its various properties, such as high-temperature stability, tensile strength, density, radiation protection, and excellent material machinability.

- In the aerospace industry, molybdenum reduces vibration and improves pilot and passenger comfort, as the material has high strength and less weight. It is also used to stabilize control surfaces for ailerons, elevators, and rudder sections of aircraft, helicopter rotor blades, and cockpit instrumentation.

- India is the ninth-largest civil aviation market in the world and is projected to become the largest by 2030. At present, there are 153 airports in the country, and it is anticipated to increase to 190-200 by FY 2040. The rising fleet size is expected to escalate the number of airplanes to 1,100 by 2027.

- In September 2021, the Ministry of Defence (MoD) signed a contract with M/s Airbus Defence and Space, Spain, for the acquisition of 56 C-295MW transport aircraft for the Indian Air Force.

- According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 in 2037, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow at a rate of 54 aircraft per year due to the existing fleet getting older.

- According to the CBO (Congressional Budget Office), the UStates'States defense spending was USD 742 billion in 2021 and increased to USD 760 billion in 2022. Further, it is expected to reach around USD 1 trillion by 2032, propelling molybdenum usage in the sector.

- Overall, a steady growth rate in the aerospace and defense industry and an increase in molybdenum applications in the segment are expected to provide a huge opportunity for the molybdenum market to grow.

China to Dominate the Market in the Asia-Pacific Region

- Asia-Pacific is expected to have the largest market globally for molybdenum during the forecast period. Rapid industrialization and rising consumption are expected to boost the market.

- China is among the largest producer of molybdenum in the world. Major producers of molybdenum in the country are China Molybdenum Co. Ltd, Rio Tinto, and Jjinduicheng Molybdenum Group Co. Ltd, among others.

- According to International Molybdenum Association (IMOA), China's produced 63.1 million pounds of molybdenum in Q2 2022, an increase of 4% when compared to the previous quarter but a rise of 14% when compared to the same quarter of the previous year.

- The steel industry is one of the largest consumers of molybdenum in the country. In 2021, the annual production capacity of crude steel in the country stood at 1,032.8 metric tons registering more than 50% of global production, hence providing huge demand for molybdenum in the country.

- China has increased its 2022 defense budget by 7.1 percent to CNY 1.45 trillion (USD 229 billion) at a quicker pace than last year's growth. Also, by 2025, China's total number of aircraft will likely reach 5,343, according to the reports issued by the Aviation Industry Development Research Center of China, thus augmenting the market studied.

- Therefore, with the increasing demand for molybdenum from various end-user industries, production is expected to increase further during the forecast period.

Molybdenum Industry Overview

The Molybdenum Market is a consolidated market, with the top players accounting for a major chunk of the market. Key players in the molybdenum market include Anglo American, Rio Tinto, Antofagasta PLC, Grupo Mexico, and China Molybdenum Co. Ltd, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Steel Production in the Asia-Pacific Region

- 4.1.2 Growing Demand from the Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost of Molybdenum

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export Trends

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End Product

- 5.1.1 Steel

- 5.1.2 Chemical

- 5.1.3 Foundry

- 5.1.4 MO-Metal

- 5.1.5 Nickel Alloy

- 5.1.6 Other End Products (Other Alloys)

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Automotive

- 5.2.4 Industrial Usage

- 5.2.5 Building and Construction

- 5.2.6 Aerospace and Defense

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 United States

- 5.3.1.3 Chile

- 5.3.1.4 Peru

- 5.3.1.5 Mexico

- 5.3.1.6 Armenia

- 5.3.1.7 Other Countries

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Russia

- 5.3.2.3.6 Rest of Europe

- 5.3.2.4 Rest of the World

- 5.3.2.4.1 South America

- 5.3.2.4.2 Middle-East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMERICAN CUMO MINING CORPORATION

- 6.4.2 Anglo American

- 6.4.3 Antamina

- 6.4.4 Antofagasta PLC

- 6.4.5 Centerra Gold Inc.

- 6.4.6 China Molybdenum Co. Ltd

- 6.4.7 Codelco

- 6.4.8 Freeport-McMoRan

- 6.4.9 Grupo Mexico

- 6.4.10 Jinduicheng molybdenum group Co. Ltd

- 6.4.11 MOLTUN

- 6.4.12 Rio Tinto

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Molybdenum-bearing Chemicals

02-2729-4219

+886-2-2729-4219