|

市场调查报告书

商品编码

1640559

沥青改质剂:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asphalt Modifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

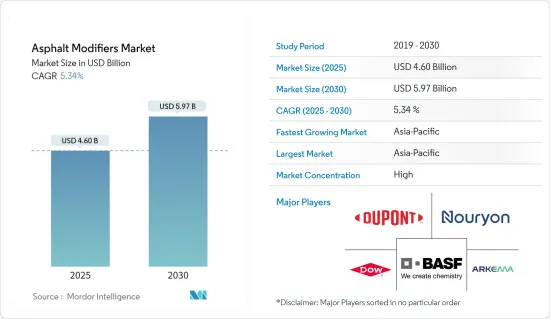

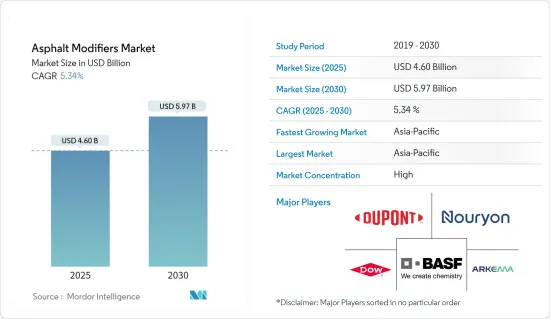

预计 2025 年沥青改质剂市场规模为 46 亿美元,到 2030 年预计将达到 59.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.34%。

COVID-19 对製造业产生了重大影响,阻碍了市场成长。不过,各行各业已从疫情中恢復过来。自那时起,建筑业的稳定成长推动了市场的发展。

关键亮点

- 预计预测期内市场需求将受到道路交通量和负载增加、满足超级节省设计规范、路面寿命延长以及 MRO 成本下降等因素的推动。

- 另一方面,使用改质沥青水泥的高成本以及与沥青相关的健康风险可能会减缓市场成长。

- 热拌沥青(HMA)需求的不断增长、再生沥青路面(RAP)的日益普及、生物可再生改质剂的发展、温拌沥青技术的改进、奈米技术改性沥青(奈米黏土)等,预计未来市场将面临以下机会:本研究使用。

- 亚太地区是最重要的地区,因为对沥青的需求很高,预计未来几年还会继续成长。

沥青改质剂的市场趋势

铺路应用需求增加

- 沥青和混凝土混合物已广泛应用于道路、机场跑道、滑行道、自行车道等的建设。黏合剂改质剂(聚合物、合成橡胶、纤维、橡胶等)和骨材改质剂(石灰、颗粒橡胶、抗剥落剂等)可提高沥青路面对热裂、车辙和剥落等问题的抵抗力。这将有助于您的路面使用寿命更长。

- 近年来,全球对沥青改质剂的需求一直经历着高于平均水准的成长。沥青改质剂的需求与世界各地正在进行的道路建设活动水准直接相关。

- 根据美国人口普查局的数据,2022 年联邦公路和道路建设金额约为 17 亿美元,比去年的约 14 亿美元总合增加 18%。随着越来越多的资金投入道路和高速公路,对沥青改质剂的需求可能会增加。

- 此外,波兰中央统计局在12月份的月报中公布,2022年波兰沥青总产量约164万吨,比上年的约154万吨产量高出约6%。

- 根据欧洲沥青路面协会 (EAPA) 的数据,2021 年欧洲生产了约 2.906 亿吨热拌沥青和温拌沥青。这仅比上年的产量高出 1,370 万吨。德国是最大的生产国,占总产量的13%以上,其次是义大利和法国。

随着世界各地建造越来越多的高速公路和道路,对沥青路面的需求预计将增加,这反过来又将推动对沥青改质剂的需求。

亚太地区占市场主导地位

- 由于中国、印度和日本等国家的建筑需求不断增长,亚太地区占据了沥青改质剂市场的主导地位。新机场跑道的建设和交通运输的扩展推动了该地区市场的成长。

- 儘管近年来房地产行业的成长并不稳定,但由于政府大力发展铁路和公路基础设施以支持不断扩张的工业服务业,中国建筑业近年来增长强劲。

- 中国对公路建设和维护的投资增加了一倍。此外,中国还有多个当前和未来的公路和高速公路建设计划。增佛高速公路是中国广东省的一个投资23.76亿美元的计划,将建造一条从增城至天河段长38.4公里的高速公路。建设工程预计于 2021 年第三季开工,并于 2025 年第四季完工。

- 同时,印度拥有超过580万公里的公路,是世界第二大公路系统。 2022-23 年联邦预算中,公路运输和公路部获得了 1,991,071.4 亿印度卢比(260.4 亿美元)的拨款。

- 此外,根据印度品牌资产基金会的报告,印度国家公路管理局(NHAI)计划在 2022-23 年以每天 50 公里的速度建造 25,000 公里的国家高速公路。 NHAI 还打算透过基础设施投资信託筹集 4,000 亿印度卢比(57.2 亿美元),将公路资产收益(InvIT)。

- 据国土交通省预计,2021财年日本国内建筑沥青需求量约106万吨。这比上年度的约 120 万吨有所下降。

预计未来几年计划实施步伐将进一步加快。预测期内,该地区对道路和高速公路基础设施建设的投资预计将增加。总体而言,此类投资和发展预计将推动亚太地区沥青改质剂市场的发展。

沥青改质剂产业概况

沥青改质剂市场部分整合,主要企业占据相当大的份额。沥青改质剂市场的主要企业包括杜邦、BASF、阿科玛、诺力昂、陶氏等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 交通繁忙,载重重

- 超级节省:强调符合设计规范

- 受益于更长的路面寿命和更低的维护、维修和大修 (MRO) 成本

- 限制因素

- 使用改质沥青水泥的初始成本较高

- 与沥青有关的职业健康危害

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监管措施

第 5 章 市场区隔(以金额为准的市场规模)

- 应用

- 路面

- 屋顶

- 其他的

- 最终用户产业

- 物理改质剂

- 塑胶

- 橡皮

- 其他物理改质剂

- 化学改质剂

- 纤维

- 附着力改善剂

- 填充剂

- 填料

- 抗氧化剂

- 防剥落剂

- 其他的

- 物理改质剂

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)分析**/市占分析

- 主要企业策略

- 公司简介

- Arkema

- ArrMaz Products, Inc.

- BASF SE

- Cargill

- Dow

- DuPont

- Engineered Additives LLC

- Evonik Industries AG

- Exxon Mobil Corporation

- Genan Holding A/S

- Honeywell International Inc.

- Kao Corporation

- Kraton Corporation

- McAsphalt Industries Limited

- Nouryon

- PQ Corporation

- Sasol

第七章 市场机会与未来趋势

- 热拌沥青 (HMA) 越来越偏好

- 再生沥青路面(RAP)越来越受欢迎

- 可再生改质剂的开发

- 温拌沥青混合料技术的进步

- 将奈米技术融入沥青改质的研究(奈米黏土)

The Asphalt Modifiers Market size is estimated at USD 4.60 billion in 2025, and is expected to reach USD 5.97 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

COVID-19 had a major impact on the manufacturing industry, thus hampering market growth. However, the industries have since recovered from the pandemic. Since then, the construction industry's steady growth has been the market's main driver.

Key Highlights

- During the forecast period, the demand for the market is likely to be driven by things like more traffic and heavier loads on roads, a focus on meeting super-save design specifications, longer pavement life, and lower MRO costs.

- On the other hand, the high cost of using modified asphalt cement and the health risks of working with asphalt are likely to slow the growth of the market.

- Future opportunities for the market are expected to come from the growing demand for HMA (Hot Mix Asphalt), the growing popularity of RAP (Reclaimed Asphalt Pavement), the development of bio-renewable modifiers, the improvement of warm mix asphalt technologies, and research into using nanotechnology to change asphalt (Nano-Clay).

- Due to the high demand for asphalt, the Asia-Pacific region has been the most important and will continue to grow over the next few years.

Asphalt Modifiers Market Trends

Increasing Demand from Paving Application

- Mixtures of asphalt and concrete have been used a lot to build roads, airport runways, taxiways, and bike lanes, among other things. Binder modifiers (like polymers, elastomers, fibers, and rubber) and aggregate modifiers (like lime, granulated rubber, and anti-strip agents) are used to improve the performance of asphalt pavements by making them more resistant to problems like thermal cracking, rutting, stripping, and so on. This makes the pavement last longer.

- In recent years, the global demand for asphalt modifiers has been witnessing above-average growth. The demand for asphalt modifiers has a direct correlation with the level of ongoing road construction activities around the world.

- According to the US Census Bureau, the value of federal highway and street construction put in place in the United States in 2022 will be around USD 1.7 billion, representing an increase of 18% over the previous year's total value of approximately USD 1.4 billion. With more money going into roads and highways, there would be more demand for asphalt modifiers, which are an important part of the business.

- The Central Statistical Office of Poland in its December monthly report also stated that the total production of asphalt in Poland in 2022 was about 1.64 million metric tons, about 6% more than the previous year's production value of about 1.54 million metric tons.

- According to the European Asphalt Pavement Association (EAPA), Europe made about 290.6 million metric tons of hot and warm mix asphalt in 2021. This is just 13.7 million metric tons more than what was made the year before. Germany produced the most, making up over 13% of the total output, followed by Italy and France.

With more highways and roads being built in different parts of the world, this is likely to increase the demand for asphalt pavements, which will in turn increase the demand for asphalt modifiers.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the asphalt modifier market as a result of the expanding need for construction in nations like China, India, and Japan. Market growth in the area is being fueled by the construction of new airport runways and transportation expansions.

- The significant development of rail and road infrastructure by the Chinese government to withstand the expanding industrial and service sectors has resulted in significant growth of the Chinese construction industry in recent years, despite the volatile growth in the real estate sector in the last couple of years.

- China has doubled its investment in road development and maintenance. Furthermore, the country has several present and prospective road and highway construction projects. The Zengcheng-Foshan Expressway is a USD 2,376 million project in Guangdong, China, that involves the construction of a 38.4-km highway from Zengcheng to Tianhe Section. Construction began in the third quarter of 2021 and is scheduled to finish in the fourth quarter of 2025.

- India, on the other hand, has over 5.8 million kilometers of roads, which makes it the second-largest road system in the world.The Ministry of Road Transport and Highways has been given INR 199,107.71 crore (USD 26.04 billion) in the Union Budget 2022-23.

- Furthermore, the India Brand Equity Foundation reports that the National Highway Authority of India (NHAI) intends to build 25,000 kilometers of national highways in 2022-23 at a rate of 50 kilometers per day. In addition, NHAI intends to raise INR 40,000 crore (USD 5.72 billion) through an infrastructure investment trust to monetize its motorway assets (InvIT).

- According to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), Japan's domestic demand for asphalt for construction in fiscal year 2021 was about 1.06 million metric tons. This was down from about 1.2 million tons in the prior fiscal year.

The pace of project execution is likely to increase further in the coming years. Investments in the development of roads and highway infrastructure in the region are anticipated to rise during the forecast period. Overall, such investments and development are expected to drive the asphalt modifiers market in the Asia-Pacific region.

Asphalt Modifiers Industry Overview

The asphalt modifiers market is partially consolidated, with the top players having a significant share of the market. Key players in the asphalt modifiers market include (not in any particular order) DuPont, BASF SE, Arkema, Nouryon, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Traffic Volume and Heavier Loads

- 4.1.2 Emphasis on Meeting Super-save Design Specifications

- 4.1.3 Increased Pavement Work-life and Reduced MRO Cost Advantages

- 4.2 Restraints

- 4.2.1 High Initial Cost for Using Modified Asphalt Cement

- 4.2.2 Occupational Health Hazards Regarding Asphalt

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Paving

- 5.1.2 Roofing

- 5.1.3 Other Applications

- 5.2 End-user Industry

- 5.2.1 Physical Modifiers

- 5.2.1.1 Plastics

- 5.2.1.2 Rubbers

- 5.2.1.3 Other Physical Modifiers

- 5.2.2 Chemical Modifiers

- 5.2.3 Fibers

- 5.2.4 Adhesion Improvers

- 5.2.5 Extenders

- 5.2.6 Fillers

- 5.2.7 Antioxidants

- 5.2.8 Anti-strip Modifiers

- 5.2.9 Other End-user Industries

- 5.2.1 Physical Modifiers

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 ArrMaz Products, Inc.

- 6.4.3 BASF SE

- 6.4.4 Cargill

- 6.4.5 Dow

- 6.4.6 DuPont

- 6.4.7 Engineered Additives LLC

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Genan Holding A/S

- 6.4.11 Honeywell International Inc.

- 6.4.12 Kao Corporation

- 6.4.13 Kraton Corporation

- 6.4.14 McAsphalt Industries Limited

- 6.4.15 Nouryon

- 6.4.16 PQ Corporation

- 6.4.17 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Preference for HMA (Hot Mix Asphalt)

- 7.2 Growing Popularity of Reclaimed Asphalt Pavement (RAP)

- 7.3 Development of Bio-renewable Modifiers

- 7.4 Advancement in Warm Mix Asphalt Technologies

- 7.5 Research for Incorporating Nanotechnology in Asphalt Modification (Nano-clay)