|

市场调查报告书

商品编码

1640560

LTE(长期演进):市场占有率分析、产业趋势与统计、成长预测(2025-2030)Long-term Evolution (LTE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

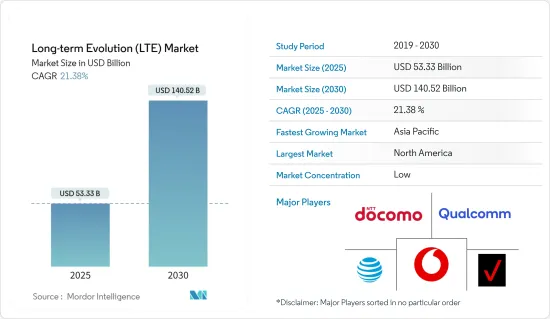

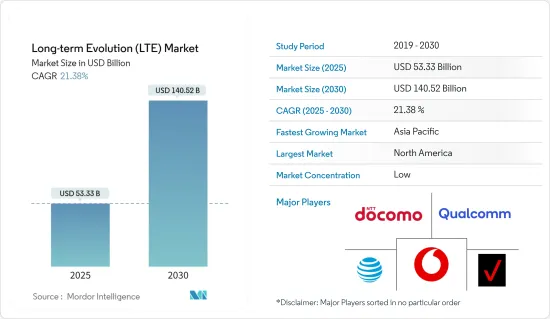

长期演进 (LTE) 市场规模预计在 2025 年为 533.3 亿美元,预计到 2030 年将达到 1405.2 亿美元,在预测期内(2025-2030 年)的复合年增长率为 21.38%。

全球智慧型手机普及率的持续上升,增加了一般人的平均资料消费量,刺激了对长期演进 (LTE) 服务的需求,从而推动了市场的发展。

主要亮点

- 世界各地的许多企业都在发展,其业务的各个方面在数位化,因此需要资料。电信业者正在对新的和先进的无线技术进行大量投资,以寻找更好的应用。

- 长期演进 (LTE) 网路必须提供更高的资料速率和频谱效率,以满足对这些行动资料服务日益增长的需求。更高的资料速率使用户能够更快地下载和上传资料,而提高的频谱效率使通讯业者能够更有效地利用现有频谱,从而能够为用户提供更多的资料服务。

- 公共LTE(PS-LTE)的日益普及是推动 LTE(长期演进)市场成长的因素之一。 PS-LTE 是一种专为公共机构(例如警察局、消防部门和紧急医疗服务部门)使用而设计的行动通讯标准。为公共人员提供专用无线宽频连接,提供对关键资料和通讯服务的即时存取。

- 相容性问题可能会阻碍 LTE(长期演进)的发展。相容性问题可能会成为采用的障碍,限制使用者充分利用该技术的能力。相容性问题可能会对长期演进(LTE)技术的发展和采用构成重大挑战。

- COVID-19 疫情对长期演进 (LTE) 产业产生了好坏参半的影响。然而,对行动资料的需求不断增长以及远端医疗和电子商务服务的扩展凸显了长期演进 (LTE) 技术在实现远距工作和其他线上活动方面的重要性。

LTE(长期演进)市场的趋势

VoLTE(长期演进)应用领域预计将占据较大的市场占有率

- VoLTE(长期演进语音)是一种透过 LTE(长期演进)网路而非传统电路交换网路实现语音通话的技术。该技术在长期演进(LTE)市场越来越受欢迎,因为它比传统网路提供更好的语音品质和更快的通话建立时间。

- 由于对高速资料服务的需求不断增长,长期演进(LTE)市场近年来迅速成长。 VoLTE 是长期演进 (LTE) 市场的关键应用,允许营运商使用长期演进 (LTE) 网路提供语音服务,而不是依赖传统的电路交换网路。这将使营运商能够释放先前用于语音服务的频宽和网路资源,并利用它们来提供更好的资料服务。

- VoLTE 还透过提供高清 (HD) 语音(提供更好的通话品质)和视讯通话(可透过长期演进 (LTE) 网路进行视讯通话)等功能,提供更好的行动连线。 VoLTE 支援丰富通讯服务 (RCS),让您在通话过程中共用照片和影片等多媒体内容。

- 许多最新技术趋势正在推动此类服务在印度等新兴国家的普及和采用。印度电讯监理局(TRAI)建议政府竞标3.3-3.6GHz 频段的 5G 服务频谱。印度政府也允许通讯业者在印度进行 5G 技术试验。

- 随着5G普及,预计全球主要地区的市场将进一步成长。根据思科年度网路报告,到 2023 年,预计中国(20.7%)、日本(20.6%)和英国(19.5%)将成为设备和连接份额排名前三的 5G 国家。

亚太地区预计将占据主要市场占有率

- (LTE(长期演进))技术最近在亚洲国家得到了显着的成长和应用。这一增长主要得益于这些国家对高速资讯服务的需求不断增长以及行动用户数量的增长。

- 此外,近年来该地区经济成长领域的智慧型手机普及率迅速成长。预计它将继续成长,并引领该地区的市场。

- 中国是亚洲最大的长期演进(LTE)市场,用户超过12亿。中国正大力投资4G和5G基础设施,到2023年将拥有全球最大的5G网络,占超过20.7%的设备和连线数。韩国是亚洲重要的LTE(长期演进)市场,也是全球5G普及率最高的国家之一。

- 此外,亚太地区消费者偏好的变化和对高速行动宽频日益增长的需求为亚太地区产业创造了巨大的机会。此外,该地区的通讯业者正计划在这些新兴国家部署更多的长期演进(LTE)。

- 快速的都市化、蓬勃发展的工业和通讯技术的进步是推动该地区先进无线网路和解决方案的关键因素。

LTE(长期演进)产业概况

长期演进(LTE)市场高度分散,主要参与者包括 AT&T Inc.、Verizon Communication Inc.、Vodafone Inc.、NTT DoCoMo Inc. 和 Qualcomm Inc.。市场参与者正在采用合作、创新和收购等策略来加强其产品供应并获得永续的竞争优势。

2023 年 1 月,沃达丰成功透过新网路拨打了网路电话,实现了设备互联,为远端紧急监控和快速医疗等关键应用铺平了道路。该 VoLTE 电话(即 4G 电话)是在义大利透过沃达丰的商用 M 类(CAT-M)网路拨打的。此网路非常适合在单一行动电话站点为许多物联网 (IoT) 设备提供服务,同时不会降低智慧型手机用户的服务品质。这是欧洲首次透过活跃的商业 CAT-M 网路基础设施进行的 VoLTE 通话。

2022 年 7 月,诺基亚与 AT&T 墨西哥公司建立伙伴关係,将 5G 的优势带到该国。诺基亚也被选为 AT&T 墨西哥 5G 创新实验室的策略合作伙伴,以开发墨西哥特定的 5G使用案例并探索当地的 5G 生态系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 资料使用量的增加推动了对更高资料速率和频谱效率的需求

- 公共LTE 采用率不断提高

- 市场限制

- 有限的频宽可用性

第六章 市场细分

- 依技术分类

- LTE(Long-term Evolution)-TDD

- LTE(长期演进)进阶版

- LTT-FDD

- 按应用

- 视讯点播

- VoLTE

- 高速资讯服务

- 国防和安全

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- AT&T Inc.

- Verizon Communication Inc

- Vodafone Inc

- NTT DoCoMo Inc.

- Qualcomm Inc.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Ericsson Inc.

- Broadcom Corporation

- Microsoft Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Long-term Evolution Market size is estimated at USD 53.33 billion in 2025, and is expected to reach USD 140.52 billion by 2030, at a CAGR of 21.38% during the forecast period (2025-2030).

The continuous proliferation of smartphones across the globe has increased the average data consumption by an average man, which has increased the need for LTE services, driving the market.

Key Highlights

- Many businesses across the globe have been growing, and so require data, owing to the digitization of every aspect of the business. Telecommunication companies are making enormous investments in new and advanced wireless technologies and looking for better applications to provide payoffs.

- LTE networks need to provide higher data rates and spectral efficiency to meet this growing demand for mobile data services. Higher data rates enable users to download and upload data more quickly, while greater spectral efficiency enables operators to use their existing spectrum more efficiently, allowing them to provide more data services to more users.

- The increased adoption of Public Safety LTE (PS-LTE) is one of the key drivers of growth in the Long-Term Evolution (LTE) market. PS-LTE is a standard for mobile communications that are designed specifically for use by public safety agencies such as police, fire, and emergency medical services. It provides dedicated wireless broadband connectivity for public safety personnel, enabling them to access critical data and communication services in real time.

- Compatibility issues can restrain LTE's growth, as they can create barriers to adoption and limit the ability of users to utilize the technology entirely. Compatibility issues can pose significant challenges to the growth and adoption of LTE technology.

- The COVID-19 pandemic had a mixed impact on the LTE industry, with both positive and negative effects. However, the increased demand for mobile data and the expansion of telemedicine and e-commerce services highlighted the importance of LTE technology in enabling remote work and other online activities.

Long-term Evolution (LTE) Market Trends

VoLTE Application Segment is Expected to Hold Significant Market Share

- Voice over Long-Term Evolution (VoLTE) is a technology that allows voice calls to be made over LTE networks rather than using traditional circuit-switched networks. This technology has been gaining popularity in the LTE market, offering better voice quality and faster call setup times than conventional networks.

- The LTE market has grown rapidly in recent years due to the increasing demand for high-speed data services. VoLTE is an important application in the LTE market as it allows operators to use their LTE networks to provide voice services rather than relying on legacy circuit-switched networks. This allows operators to free up spectrum and network resources previously used for voice services, which can be used to provide better data services.

- VoLTE also provides a better user experience by offering features such as high-definition (HD) voice, which provides better call quality, and video calling, which allows users to make video calls over LTE networks. VoLTE supports rich communication services (RCS), allowing users to share multimedia content such as photos and videos during calls.

- Many recent technological advancements have contributed to popularizing and adopting such services in developing countries, such as India. The Telecom Regulatory Authority of India (TRAI) has recommended that the government auction spectrum for 5G services in the 3.3-3.6 GHz frequency band. The government has also allowed telecom operators to conduct trials of 5G technology in India.

- With the increasing 5G coverage, the market is expected to witness further growth across major regions of the globe. According to Cisco Annual Internet Report, China (20.7%), Japan (20.6%), and the United Kingdom (19.5%) will likely be the top three 5G countries in terms of device and connection share by 2023.

Asia-Pacific is Expected to Hold Significant Market Share

- Long-Term Evolution (LTE) technology has seen significant growth and adoption in Asian countries recently. The main driving factors behind this growth are the increasing demand for high-speed data services and the growing number of mobile subscribers in these countries.

- Moreover, smartphone penetration in growing economies in this region has grown exponentially in recent years. It is expected to grow in the coming years, which drives the market in this region.

- China is the largest LTE market in Asia, with more than 1.2 billion mobile subscribers. The country has invested heavily in 4G and 5G infrastructure, and by 2023, the country will have the largest global 5G network with over 20.7% of devices and connections. South Korea is also a significant LTE market in Asia, with one of the highest 5G penetration rates globally.

- Furthermore, shifting consumer preferences and increased demand for high-speed mobile broadband in the Asia-Pacific region have created enormous opportunities in the APAC industry. In addition, telecom carriers in this area have more LTE deployments planned in these emerging nations.

- Rapid urbanization, fast industrial growth, and advancement in communication technology are important factors leading the way for advanced wireless networks and solutions in this region.

Long-term Evolution (LTE) Industry Overview

The Long-term Evolution (LTE) Market is highly fragmented, with major players like AT&T Inc., Verizon Communication Inc, Vodafone Inc, NTT DoCoMo Inc., and Qualcomm Inc. The players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Vodafone successfully performed an internet call using its new network to enable connected devices, opening the path for crucial applications such as emergency monitoring and responsive healthcare in distant locations. The Voice over Long-Term Evolution (VoLTE) call, often known as 4G calling, was made in Italy over Vodafone's commercial Category M (CAT-M) network. The network is perfect for serving many Internet of Things (IoT) devices across a single mobile phone site without reducing service to smartphone users. This is Europe's first VoLTE call on active commercial CAT-M network infrastructure.

In July 2022, Nokia and AT&T Mexico established a partnership to deliver the benefits of 5G to the country. Nokia was also chosen as a strategic partner for AT&T Mexico's 5G Innovation Lab to investigate the creation of 5G use cases specific to Mexico and the local 5G ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need For Higher Data Rates and Greater Spectral Efficiency Driven By Increased Data Usage

- 5.1.2 Increased Adoption of Public Safety LTE

- 5.2 Market Restraints

- 5.2.1 Availability of Limited Spectrum

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LTE-TDD

- 6.1.2 LTE Advanced

- 6.1.3 LTT-FDD

- 6.2 By Application

- 6.2.1 Video on Demand

- 6.2.2 VoLTE

- 6.2.3 High Speed Data Services

- 6.2.4 Defense and Security

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Verizon Communication Inc

- 7.1.3 Vodafone Inc

- 7.1.4 NTT DoCoMo Inc.

- 7.1.5 Qualcomm Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Samsung Electronics Co. Ltd.

- 7.1.8 Ericsson Inc.

- 7.1.9 Broadcom Corporation

- 7.1.10 Microsoft Corporation