|

市场调查报告书

商品编码

1640564

英国太阳能光电 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)UK Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

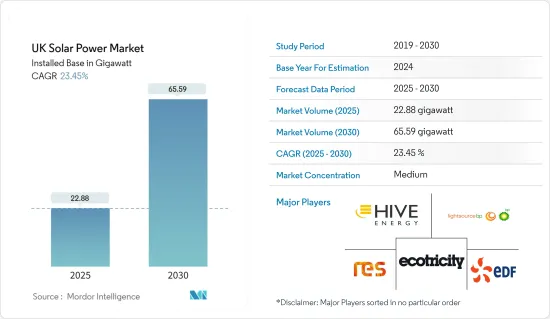

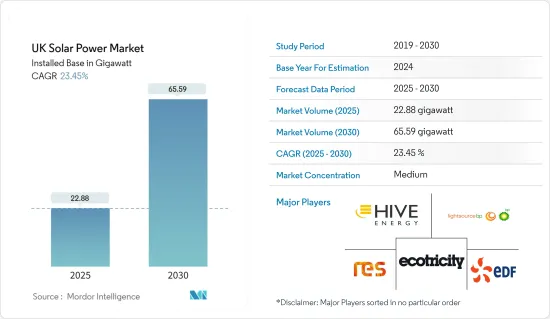

基于安装基数,英国太阳能光电市场规模预计将从 2025 年的 22.88 吉瓦成长到 2030 年的 65.59 吉瓦,预测期内(2025-2030 年)的复合年增长率为 23.45%。

关键亮点

- 从中期来看,政府支持政策以及减少对石化燃料依赖和碳足迹的再生能源来源需求等因素预计将在预测期内推动英国太阳能光电市场的发展。

- 然而,土地供应有限和再生能源来源的日益普及等因素预计将在预测期内阻碍英国太阳能市场的成长。

- 该国制定了雄心勃勃的太阳能发电目标,即在 2030 年实现 40GW 的装置容量。预计这些因素将在预测期内为在市场上运营的公司创造商机。

英国太阳能市场趋势

住宅领域预计将显着成长

- 过去十年,在政府激励措施的支持下,英国太阳能光电发电的采用大幅增加。

- 截至2023年,英国太阳能光电装置容量为15,993MW,占总发电量的4.8%。这与前一年同期比较增长了 9.1%。报告称,太阳能的成长将由大量50kW以下的装机量推动,2023年将新增172,000个家庭装机量,这是自2015年以来年度最高数量。

- 在英国,普通家庭每天消耗 3kWh 至 6kWh 的能源,因此系统的规模也有所不同。最常见的系统容量之一是4kW系统,适合满足3-4人家庭的能源需求。然而,5kW 太阳能发电系统通常适用于有 4-5 人的家庭,而 6kW 太阳能板系统则建议用于有 5 人或更多居住者的家庭。因此,大多数住宅太阳能发电系统的容量为10kW或更低。

- 推动住宅市场成长的关键因素是国内市场能源价格的上涨。由于最近的能源危机,据估计自 2000 年以来能源价格几乎上涨了两倍。能源价格的大幅上涨使得许多住宅转向使用太阳能来降低家庭能源成本。

- 由于技术进步和智慧家庭技术的日益普及,预计预测期内住宅领域对太阳能的需求将会增加。

小型太阳能发电安装成本下降推动市场需求

- 小型太阳能光电系统及其安装成本的下降是过去几年推动英国分散式太阳能市场发展的关键因素之一。 2013年至2023年间,0至4千瓦太阳能光电系统的平均安装、连接电力供应和增值税成本下降。

- 这一趋势推动了英国住宅、商业和工业领域的太阳能安装总量增加。 2022-2023财年,全国系统规模为4kW或以下的太阳能发电设施(主要是住宅)总数将达到115,648个系统,创下历年最高纪录。

- 4kW以下的太阳能发电系统主要部署在住宅领域作为屋顶系统。 50kW 至 5MW 的系统正在大型住宅、商业和工业(C&I) 领域作为屋顶和地面安装系统部署。

- 在英国,政府的支持政策、补贴和奖励支持了小规模和分散式太阳能市场的成长,但预计在预测期内,太阳能发电和相关系统成本的下降将推动市场的发展。

- 在研究期间,英国小型太阳能光电系统的平均安装成本出现波动。 0-4kW 范围内的太阳能安装成本从 2022 年 4 月开始上涨,增幅超过 4-10kW 范围内的增幅。 0-4kW 频段的价格在 2023 年 1 月达到峰值,为每千瓦安装价 2,622 英镑。由于技术的发展,预计预测期内安装太阳能光电发电的成本将会下降。

- 鑑于上述情况,小型太阳能发电安装成本的下降预计将推动市场发展。

英国太阳能产业概况

英国太阳能光电市场中等程度细分。市场的主要企业包括法国电力公司(Electricite de France SA)、Ecotricity Group Ltd、再生能源系统有限公司(Renewable Energy Systems Ltd)、Lightsource BP、再生能源投资有限公司(Renewable Energy Investments Limited) 和Hive Energy。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2029年太阳能发电装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府政策与再生能源来源需求

- 太阳能技术成本下降

- 限制因素

- 土地有限和对替代再生能源来源的需求

- 驱动程式

- 供应链分析

- PESTLE分析

第 5 章市场区隔(按最终用户)

- 住宅

- 商业和工业

- 公共产业

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- First Solar Inc.

- Electricite de France SA

- Ecotricity Group Ltd

- Renewable Energy Systems Ltd

- Lightsource bp Renewable Energy Investments Limited

- Hive Energy

- Ameresco Inc.

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 雄心勃勃的太阳能发电目标:到 2030 年达到 40 吉瓦

The UK Solar Power Market size in terms of installed base is expected to grow from 22.88 gigawatt in 2025 to 65.59 gigawatt by 2030, at a CAGR of 23.45% during the forecast period (2025-2030).

Key Highlights

- In the medium period, factors such as supportive government policies and demand for renewable energy sources to decrease dependency on fossil fuels and carbon footprints are driving the UK solar power market during the forecast period.

- On the other hand, factors such as limited land and increasing adoption of alternative renewable energy sources are expected to hinder the growth of the UK solar power market during the forecast period.

- Nevertheless, the country has ambitious solar power targets to reach 40GW installed capacity by 2030. Such factors are expected to create opportunities for companies operating in the market during the forecast period.

UK Solar Power Market Trends

The Residential Segment is Expected to Witness Significant Growth

- The United Kingdom has witnessed significant solar PV installations over the past decade, supported by the government's incentives, which can be credited to the increasing demand for clean electricity.

- As of 2023, the United Kingdom registered 15,993 MW of solar capacity, which accounted for 4.8% of total electricity generation. This is an increase of 9.1% compared to the previous year. As per the report, the growth in solar PV has been dominated by numerous installations of less than 50 kW, including 172,000 new domestic installations in 2023, the most in a calendar year since 2015.

- In the United Kingdom, an average home consumes between 3 kWh and 6 kWh of energy daily, and accordingly, system sizes may vary. One of the most common system capacities installed is a 4 kW system, which is suited to satisfy the energy needs of a household of 3-4 people. However, a 5 kW solar system is typical for a home with 4-5 people, while a 6 kW solar panel system is suggested for a home with over five residents. Thus, most residential PV systems have a capacity below 10 kW.

- The primary factor driving the growth of the residential segment is the increasing energy prices in the domestic market. It is estimated that due to the recent energy crisis, energy prices have nearly tripled since 2000. Due to this significant rise in energy prices, many homeowners are turning toward solar to reduce home energy costs.

- With technological advancements and the increasing adoption of smart home technologies, the demand for solar power is expected to increase in the residential sector during the forecast period.

Declining Small Scale Solar PV Installation Costs is Driving the Demand in the Market

- The declining cost of small-scale solar PV systems and their installation has been one of the major factors driving the distributed solar power generation market in the United Kingdom for the past few years. The average cost of solar PV generating equipment, installing and connecting to electricity supply, and VAT of the systems between 0 kW and 4 kW declined between 2013 and 2023.

- This trend has led to a growth in the total number of solar PV installations in the residential, commercial, and industrial sectors in the United Kingdom. In FY 2022-3023, the country's total number of solar PV installations with a system size of less than 4 kW (primarily residential) stood at 1,15,648 systems, representing the highest number this year.

- Solar PV systems under 4 kW are majorly deployed as rooftop systems in the residential sector. Systems between 50 kW and 5 MW are deployed as rooftop and ground-mounted systems in large housing communities and commercial and industrial (C&I) sectors.

- Although supportive government policies, subsidies, and incentives supported the growth of small-scale and distributed solar PV markets in the United Kingdom until 2023, the declining cost of solar PV and associated systems are expected to drive the market during the forecast period.

- The average installation costs of small-scale solar photovoltaic systems in the United Kingdom fluctuated during the study period. Solar installation costs in the 0-4 kW range began to rise in April 2022, exceeding increases in the 4-10 kW range. The 0-4 kW band prices peaked at 2,622 British pounds per kilowatt installed in January 2023. With technological developments, solar PV installation cost is expected to decrease during the forecast period.

- Thus, owing to the above points, declining small-scale solar PV installation costs are expected to drive the market.

UK Solar Power Industry Overview

The UK solar power market is moderately fragmented. Some of the major players in the market are Electricite de France SA, Ecotricity Group Ltd, Renewable Energy Systems Ltd, Lightsource BP, Renewable Energy Investments Limited, and Hive Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Power Installed Capacity and Forecast in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Demand for Renewable Energy Sources

- 4.5.1.2 The Declining Costs of Solar Technologies

- 4.5.2 Restraints

- 4.5.2.1 Limited Land and Demand for Alternative Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION - BY END USER

- 5.1 Residential

- 5.2 Commercial and Industrial

- 5.3 Utilities

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Electricite de France SA

- 6.3.3 Ecotricity Group Ltd

- 6.3.4 Renewable Energy Systems Ltd

- 6.3.5 Lightsource bp Renewable Energy Investments Limited

- 6.3.6 Hive Energy

- 6.3.7 Ameresco Inc.

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Solar Power Targets to Reach 40 GW by 2030