|

市场调查报告书

商品编码

1640569

玻璃纤维 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Glass Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

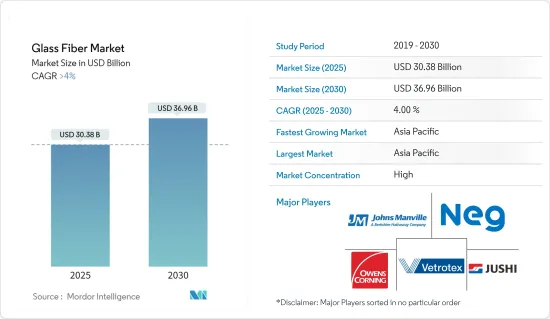

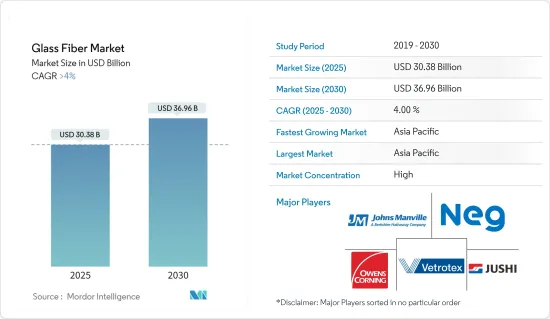

玻璃纤维市场规模预计在 2025 年为 303.8 亿美元,预计到 2030 年将达到 369.6 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4%。

关键亮点

- 预计推动玻璃纤维市场发展的关键因素是建筑业的需求不断增加以及汽车行业对玻璃纤维复合材料的需求不断增加。

- 然而,较低的销售利润率以及来自碳纤维和岩绒的竞争可能会抑制未来玻璃纤维市场的成长。

- 轻质玻璃纤维增强塑胶(GFRP)复合材料的使用日益增多以及风力发电领域对复合材料的需求不断增加是未来将要探索的市场机会。

- 亚太地区可能主导玻璃纤维市场。

玻璃纤维市场趋势

建筑和施工领域的需求增加

- 玻璃纤维是一种环保的建筑材料。它采用玻璃纤维增强混凝土(GRC)的形式。 GRC 使建筑物外观坚固,且不会造成重量或环境损害。

- 水泥混合物中使用玻璃纤维可使材料具有强耐腐蚀纤维的强度,使 GRC 能够持久满足任何建筑要求。 GRC 重量轻,使墙壁、地基、面板和建筑幕墙的建造更容易、更快捷。

- 世界上最大的建筑业之一位于美国。根据美国人口普查局的数据,2024 年 2 月的建筑支出较 2023 年 2 月的预测增加了 10.7%。此外,2024年1月至2月的建筑支出较2023年增加11.9%,凸显美国建筑支出的逐步改善。

- 根据欧盟统计局的数据,2023 年 12 月欧元区建筑支出与 2022 年 12 月相比成长了 1.9%,欧盟成长了 2.4%。

- 因此,预计预测期内建筑业的成长将增加对玻璃纤维的需求。

亚太地区占市场主导地位

- 亚太地区,特别是中国、印度、日本等国家,正经历快速的工业化和都市化。这推动了对建筑材料、汽车零件和基础设施发展的需求,从而推动了对玻璃纤维的需求。

- 受都市化、人口成长和基础设施发展倡议的推动,亚太地区的建筑业正在蓬勃发展。玻璃纤维广泛用于钢筋混凝土、隔热材料和复合板等建筑材料,推动了该地区的需求。

- 中国的建筑业正在快速成长。中国的建筑市场是全球最大的建筑市场,占全球建筑投资的20%。中国的「十四五」规划强调交通、能源、水利和城市发展等领域的新基础建设计划。根据国际贸易部估计,中国预计将在2021年至2025年的「十四五」期间向新基础设施投资约27兆美元,金额估计为4.2兆欧元。

- 根据国家投资促进和便利化局的资料,印度的基础设施预算设定为1.4兆美元。

- 亚太地区是全球最大的汽车製造基地,占全球产量的近60%。在亚太地区,中国和印度是主要的汽车製造国。根据OICA预测,中国将成为全球最重要的汽车生产基地,2023年汽车总产量预计将达到3,016万辆,较去年的2,702万辆成长16%。

- 总体而言,对各个终端用户领域的持续投资可能会推动亚太地区的玻璃纤维消费。

玻璃纤维产业概况

玻璃纤维市场正在整合。主要企业(排名不分先后)包括欧文斯科宁、圣戈班维特克斯、佳士得、日本电气硝子、中国巨石。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业需求增加

- 汽车产业对玻璃纤维复合材料的需求不断增加

- 限制因素

- 碳纤维与岩绒的竞争

- 销售利润率低

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 树脂类型

- 短切纤维

- 玻璃棉

- 粗纱

- 线

- 应用

- 复合材料

- 隔热材料

- 最终用户产业

- 建筑和施工

- 车

- 航太和国防

- 替代能源

- 消费品

- 工业

- 其他终端用户产业(电子)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧的

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ASAHI FIBER GLASS Co. Ltd

- Binani Industries Ltd

- China Jushi Co. Ltd

- Chongqing Polycomp International Corp.(CPIC)

- CTG Group

- Heraeus Holding

- Johns Manville

- Nippon Electric Glass Co. Ltd

- Owens Corning

- PFG FIBER GLASS CORPORATION

- Saint-Gobain Vetrotex

- TAIWAN GLASS IND. CORP.

第七章 市场机会与未来趋势

- 轻质玻璃纤维增强塑胶 (GFRP) 复合材料的应用不断扩大

- 风力发电领域对玻璃纤维复合材料的需求不断增加

简介目录

Product Code: 55005

The Glass Fiber Market size is estimated at USD 30.38 billion in 2025, and is expected to reach USD 36.96 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- The significant factors expected to drive the glass fiber market are the increasing demand from the construction industry and the rising demand for fiberglass composites from the automotive industry.

- However, the low-profit margin on sales and competition from carbon fiber and rock wool are likely to restrain the growth of the glass fiber market in the upcoming period.

- The increase in the use of lightweight glass fiber-reinforced plastic (GFRP) composites and the increase in the demand for composite materials from the wind energy sector are opportunities for the market to be studied in the upcoming period.

- Asia-Pacific is likely to dominate the glass fiber market.

Glass Fiber Market Trends

Rising Demand from the Building and Construction Sector

- Glass fiber is an eco-friendly construction material. It is available in the form of glass-fiber reinforced concrete (GRC). Without causing weight and environmental damage, the GRC provides buildings with a solid appearance.

- The use of glass fibers in the cement mix strengthens the material with corrosion-resistant strong fibers, which makes GRC long-lasting for any construction requirement. The construction of walls, foundations, panels, and facades will be made much easier and quicker because of GRC's low weight.

- One of the world's largest construction industries is based in the United States. According to the United States Census Bureau, construction spending in February 2024 grew by 10.7% from February 2023 estimate. In addition, construction spending in the first two months of 2024 was up 11.9% from 2023, thus highlighting the gradual improvement in construction spending in the United States.

- Eurostat stated that building construction increased by 1.9% in the Euro area and 2.4% in the European Union in December 2023 compared to December 2022.

- Thus, due to this growth in the building and construction sector, the demand for glass fiber will increase during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region, particularly countries like China, India, and Japan, has been experiencing rapid industrialization and urbanization. This has increased demand for construction materials, automotive components, and infrastructure development, driving the demand for glass fiber.

- The construction industry in the Asia-Pacific region is booming and fueled by urbanization, population growth, and infrastructure development initiatives. Glass fibers are widely used in construction materials such as reinforced concrete, insulation, and composite panels, driving their demand in the region.

- The construction sector in China is increasing rapidly. The country has the most significant building market globally, making up 20% of all construction investment worldwide. The 14th Five-Year Plan of China is focused on new infrastructure projects for transport, energy, water, and urban development. According to the International Trade Administration, approximately USD 27 trillion will be spent on new infrastructure in China during the 14th Five-Year Plan between 2021 and 2025, with an estimated value of EUR 4.2 trillion.

- The Indian budget for infrastructure has been set at USD 1.4 trillion, according to the National Investment Promotion and Facilitation Agency's data.

- The Asia-Pacific region is the world's largest automotive manufacturing hub, accounting for almost 60% of global production. China and India are significant vehicle manufacturers within Asia-Pacific. According to OICA, China, with a total vehicle production of 30.16 million units in 2023, an increase of 16% compared to 27.02 million units produced last year, has the most significant automotive production base in the world, according to the China Automobile Manufacturers' Association.

- Overall, continuous investments in various end-user sectors are likely to boost the consumption of glass fiber in Asia-Pacific.

Glass Fiber Industry Overview

The glass fiber market is consolidated. The major players (not in any particular order) include Owens Corning, Saint-Gobain Vetrotex, Johns Manville, Nippon Electric Glass Co. Ltd, and China Jushi Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Increasing Demand for Fiberglass Composites from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Competition from Carbon Fiber and Rockwool

- 4.2.2 Low Profit Margin on Sales

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Chopped Strands

- 5.1.2 Glass Wool

- 5.1.3 Roving

- 5.1.4 Yarn

- 5.2 Application

- 5.2.1 Composites

- 5.2.2 Insulation

- 5.3 End-user Industry

- 5.3.1 Buildings and Construction

- 5.3.2 Automotive

- 5.3.3 Aerospace and Defense

- 5.3.4 Alternative Energy

- 5.3.5 Consumer Goods

- 5.3.6 Industrial

- 5.3.7 Other End-user Industries (Electronics)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 NORDIC

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ASAHI FIBER GLASS Co. Ltd

- 6.4.2 Binani Industries Ltd

- 6.4.3 China Jushi Co. Ltd

- 6.4.4 Chongqing Polycomp International Corp. (CPIC)

- 6.4.5 CTG Group

- 6.4.6 Heraeus Holding

- 6.4.7 Johns Manville

- 6.4.8 Nippon Electric Glass Co. Ltd

- 6.4.9 Owens Corning

- 6.4.10 PFG FIBER GLASS CORPORATION

- 6.4.11 Saint-Gobain Vetrotex

- 6.4.12 TAIWAN GLASS IND. CORP.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Usage of Lightweight Glass Fiber Reinforced Plastic (GFRP) Composites

- 7.2 Increasing Demand for Fiberglass Composite Materials for the Wind Energy Sector

02-2729-4219

+886-2-2729-4219