|

市场调查报告书

商品编码

1640570

印度风力发电-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

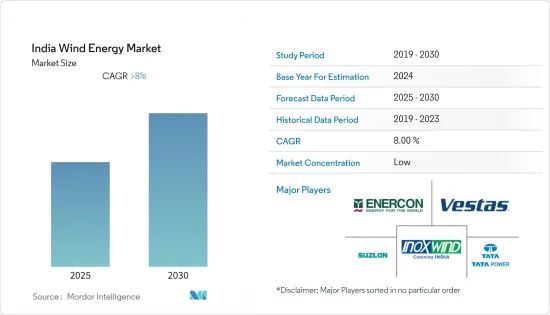

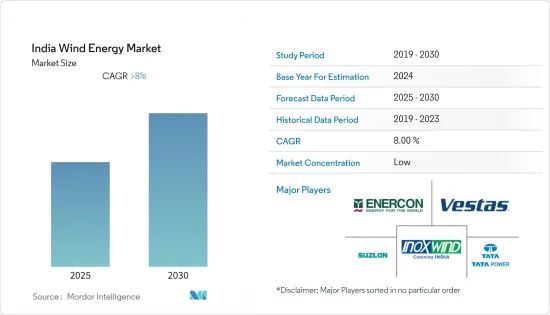

预计预测期内印度风力发电市场的复合年增长率将超过 8%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,预计在预测期内,政府的有利倡议、对即将出台的风力发电工程的投资增加以及风力发电成本的下降导致风力发电的更广泛采用将推动市场的发展。

- 另一方面,天然气和太阳能等替代能源能源的日益普及可能会阻碍市场的成长。

- 印度政府设定了2030年实现风电全国可再生能源目标:达到500吉瓦。这很可能在未来几年为市场创造广泛的商机。

印度风力发电市场趋势

陆上风力发电可望主导市场

- 印度是一个陆域风力发电市场。西高止山脉和不同的风季使南部地区成为印度的最佳位置。

- 印度风力发电产业在本土风力发电产业的主导下持续发展。风电产业的扩张创造了可持续的生态系统、计划营运能力和每年约10吉瓦的製造基地。

- 印度风电装置容量位居世界第四,总设备容量为40吉瓦(2021年终),较2020年的38.62吉瓦成长4%。

- 印度希望透过挖掘其 7,600 公里海岸线上尚未开发的离岸风电潜力来扩大其绿色能源组合。近年来,人们对离岸投资的兴趣日益浓厚。可再生能源部已设定了2030年安装30吉瓦离岸风电的目标。

- 根据印度风能地图集,可安装风电潜在容量在地面以上 80 公尺处约为 10,279 兆瓦,在地面以上 100 公尺处约为 30,225 兆瓦。不过,印度的离岸风电市场仍在发展中,其潜力约为60吉瓦。印度海上风电的潜在区域是古吉拉突邦和泰米尔纳德邦的沿海地区。

- 根据IRENA的数据,陆域风电装置容量将从2015年的25.08吉瓦成长到2022年的41.93吉瓦。预计这一趋势将在未来几年持续下去,从而推动市场成长。

- 因此,随着国内风电产业的成长,陆域风电的日益普及预计将推动市场发展。

投资增加推动市场

- 印度人口众多,对清洁能源的需求不断增长,尤其是在污染日益加剧的情况下。

- 2022年2月,塔塔电力与德国发电公司RWE同意建立合作关係,探讨在印度共同开发离岸风电发电工程的可能性。印度目前还没有投入运作中的离岸风电场。然而,此类合作有望帮助发展这一领域。

- 2021 年,Ayana Renewable Power Six 与西门子歌美飒签署合同,为印度卡纳塔克邦 300 兆瓦风电场计划交付3.X 涡轮机。根据合同,西门子歌美飒将为此计划供应和安装84台SG 3.6-145风力发电机。

- 2022 年 9 月,安得拉邦投资促进委员会 (SIPB)核准在绿色能源领域投资 98 亿美元,用于抽水蓄能、太阳能和发电工程,发电量达 7,200 兆瓦。

- 2022年12月,CleanMax Enviro Energy Solution(CleanMax)将与全球网路巨头Meta合作,在印度投资33.8兆瓦新的可再生能源计划。该计划将包括21.6MW风电和12.2MW太阳能发电设施。

- 电力需求的增加也是推动市场发展的因素之一。电力需求逐年大幅增加,从 2015 年的 28.68 艾焦耳增加到 2021 年的 35.43 艾焦耳。预计这一趋势将在未来几年持续下去,有助于推动市场成长。

- 因此,预计未来几年投资增加将推动市场发展。

印度风力发电产业概况

印度风力发电市场比较分散。市场的主要企业(不分先后顺序)包括 Suzlon Energy Limited、Inox Wind Limited、Vestas Wind Systems AS、Tata Power Company 和 Enercon GmBH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年风力发电装置容量及预测(单位:吉瓦)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第 5 章 市场细分

- 陆上

- 海上

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Inox Wind limited

- Suzlon Energy Limited

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- Envision Group

- Wind World India Ltd

- Tata Power Company

- Enercon GmBH

第七章 市场机会与未来趋势

简介目录

Product Code: 55017

The India Wind Energy Market is expected to register a CAGR of greater than 8% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, favorable government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy, which has led to increased adoption of wind energy, are expected to drive the market during the forecast period.

- On the other hand, the increasing adoption of alternative energy sources, such as gas-based and solar power, will likely hinder market growth.

- Nevertheless, the Government of India established a national renewable energy target of wind is 500 GW by 2030. This will likely provide widespread business opportunities to the market in the coming years.

India Wind Energy Market Trends

Onshore Wind Energy is Expected to Dominate the Market

- India is an onshore wind energy market as most significant wind-producing areas are on land. The southern regions provide the most optimum location in India due to the Western Ghats and different wind seasons.

- India's wind energy sector is led by the indigenous wind power industry and has created consistent progress. The expansion of the wind industry has resulted in a sustainable ecosystem, project operation capabilities, and a manufacturing base of about 10 GW per annum.

- The country has the fourth-highest wind installed capacity in the world, with a total installed capacity of 40 GW (end of 2021), witnessing an increase of 4% compared to 38.62 GW in 2020.

- India is trying to expand its green energy portfolio by harnessing the unexploited offshore wind energy potential along its 7,600 km coastline. The focus on offshore increased in recent years. The renewable energy ministry has set a target of 30 GW offshore wind installations by 2030.

- According to the Indian Wind Atlas, the installable wind potential capacity is around 102.79 GW and 302.25 GW at 80 m and 100 m, respectively, above the ground level. However, India's offshore wind power market is still nascent, with a potential of around 60 GW. The potential areas of India's offshore wind power are on the Gujarat and Tamil Nadu coasts.

- According to IRENA, the onshore wind energy installed capacity increased to 41.93 GW in 2022 from 25,088 MW in 2015. The trend is expected to increase in the coming years, aiding the market's growth.

- Hence, increasing deployment of onshore wind energy is expected to drive the market due to the growing indigenous wind industry.

Increasing Investment to Drive the Market

- India has a large population with increasing demand for clean energy, especially with the rising pollution.

- In February 2022, Tata Power and German electricity generating company RWE agreed on a partnership to explore the potential for joint development of offshore wind projects in India. India currently has no working offshore wind energy plant. However, it is expected that collaborations like these will be able to develop this segment.

- In 2021, Ayana Renewable Power Six awarded a contract to Siemens Gamesa to deliver 3. X turbines for a 300MW wind farm project in the Indian state of Karnataka. Under the agreement, Siemens Gamesa is expected to supply and install 84 units of the SG 3.6-145 wind turbines for the project.

- In September 2022, The Andhra Pradesh State Investment Promotion Board (SIPB) approved investments worth USD 9.8 billion in the green energy sector to generate 7,200 MW in pumped hydro, solar, and wind power projects.

- In December 2022, CleanMax Enviro Energy Solutions (CleanMax) partnered with global internet giant Meta to invest 33.8 MW of new renewable energy projects in India. The projects will comprise 21.6 MW wind and 12.2 MW solar installations.

- The increasing demand for electricity is another primary driver for the market. It has been growing substantially over the years, from 28.68 Exajoules in 2015 to 35.43 Exajoules in 2021. This trend is accepted to increase in the coming years, aiding the growth of the market.

- Hence, increasing investment is expected to drive the market in the coming years.

India Wind Energy Industry Overview

The Indian Wind Energy Market is fragmented. Some of the major players in the market (in no particular order) include Suzlon Energy Limited, Inox Wind Limited, Vestas Wind Systems AS, Tata Power Company, and Enercon GmBH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION - BY SECTOR

- 5.1 Onshore

- 5.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Inox Wind limited

- 6.3.2 Suzlon Energy Limited

- 6.3.3 General Electric Company

- 6.3.4 Siemens Gamesa Renewable Energy SA

- 6.3.5 Vestas Wind Systems AS

- 6.3.6 Envision Group

- 6.3.7 Wind World India Ltd

- 6.3.8 Tata Power Company

- 6.3.9 Enercon GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219