|

市场调查报告书

商品编码

1640571

己二胺 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hexamethylenediamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

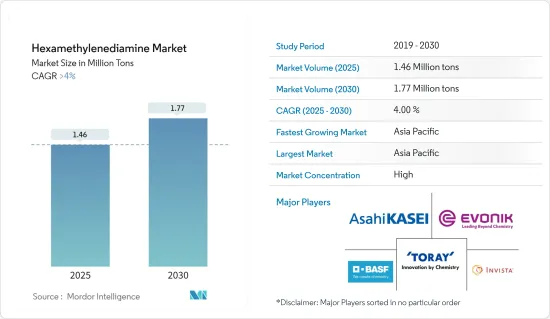

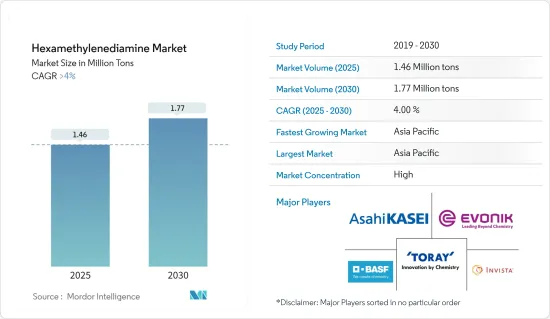

预计 2025 年己二胺市场规模为 146 万吨,预计 2030 年将达到 177 万吨,预测期内(2025-2030 年)的复合年增长率将超过 4%。

COVID-19疫情对己二胺市场产生了负面影响。由于多个国家实施全国封锁以及社交距离措施导致劳动力短缺,汽车製造地停工,对己二胺市场造成了影响。然而,在疫情过后,由于纺织和汽车终端用户产业的需求增加,己二胺市场已经顺利復苏。

关键亮点

- 尼龙 6,6 树脂消费量的增加以及汽车和纺织业对己二胺的需求增加预计将推动己二胺市场的发展。

- 在尼龙製造过程中使用蓖麻油作为替代原料预计会阻碍市场成长。

- 预计预测期内对生物基己二胺产品的需求不断增加将为市场创造机会。

- 由于纺织和汽车终端用户产业对六亚甲基二胺的需求不断增长,预计亚太地区将占据市场主导地位。

己二胺市场趋势

纺织终端用户产业主导市场

- 在尼龙66的生产过程中,需要大量消耗己二胺。尼龙 66 由两种单体製成,即己二胺和己二酸,每个单体含有六个碳原子。尼龙66在纺织业中有着广泛的应用。

- 尼龙66用于製造具有更好耐用性和抗撕裂性的织物。尼龙基织品有多种用途,可用于加固户外装备的纺织品。

- 亚太地区和欧洲是世界上最大的纺织品市场。欧盟委员会表示,欧盟的纺织生态系统创造了价值并提供了投资和创新的机会。纺织和服饰(T&C) 产业是欧洲规模最大、最多样化的工业产业之一,僱用了 150 万人。

- 据Apparel Resources称,2022年,欧盟纺织品和服饰市场的销售额将达到2,000亿欧元(2,170亿美元)。预计未来几年这数字还会进一步增加。因此,纺织市场的扩张预计将推动该地区对己二胺的需求。

- 同样,根据世界贸易组织 (WTO) 的数据,中国将在 2022 年成为世界最大的纺织品出口国,出口额约为 1,480 亿美元。同样,欧盟位居第二,出口额约 710 亿美元。未来纺织品出口额可望进一步增加,推动目前研究市场的发展。

- 例如,在印度,自过去十年以来,纺织业的外国直接投资(FDI)不断增加,导致纺织品产量增加,增加了植绒胶的使用。根据印度品牌资产基金会预测,到2025-26年,印度纺织服装产业规模将达到1,900亿美元。

- 因此,预计预测期内纺织终端用户产业将主导己二胺市场。

亚太地区占市场主导地位

- 由于纺织、汽车和塑胶终端用户产业的需求不断增加,预计亚太地区将主导己二胺市场。

- 预计未来几年纺织业对尼龙纤维的使用量的增加将推动该地区六亚甲基二胺市场的发展。由于中国纺织业的高速发展和汽车产业的持续投资,预计亚太地区将主导全球市场。

- 中国和孟加拉是该地区纺织品最大的市场。根据中国国家统计局预测,2022年中国纺织品产量将达382亿米,去年同期为235亿米。因此,预计纺织产品产量的增加将推动当前的研究市场。

- 孟加拉是该地区第二大纺织品市场。根据《2023年世界贸易统计评论》,2022年该国纺织品出口额达450亿美元。该国在全球服饰出口中的份额将从上一年的 6.4% 增加到 2022 年的 7.9%。因此,纺织市场的成长可望带动该国己二胺市场的发展。

- 随着人们重视减轻汽车重量以提高燃油经济性和减少排放气体,汽车引擎盖下零件对轻质复合尼龙树脂的需求将会增加。中国是该地区最大的汽车製造国。根据国际汽车製造商协会(OICA)预测,2022年中国汽车产量将达2,702总合,与前一年同期比较去年同期成长3%。

- 同样,印度已成为该地区第二大汽车製造国。 OICA预计2022年汽车产量将达545万辆,较2021年的439万辆成长24%。

- 此外,为了满足印度日益增长的需求,各製造商已宣布扩张计划,以增加其在印度的汽车生产能力。例如,MG Motor India 在 2023 年 1 月宣布将投资 1 亿美元扩大生产能力,并在 2023年终前实现 70% 的成长。因此,汽车产量的增加预计将推动尼龙纤维市场并促进当前的研究市场。

- 总体而言,预计预测期内纺织和汽车终端用户等行业的成长将推动该地区六亚甲基二胺市场的发展。

己二胺产业概况

己二胺市场本质上呈现部分整合状态。市场的主要企业(不分先后顺序)包括BASF SE、旭化成公司、赢创工业股份公司、东丽工业公司和英威达。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 尼龙66树脂消耗量增加

- 汽车和纺织业对己二胺的需求不断增加

- 其他驱动因素

- 限制因素

- 尼龙生产中生物基原料的使用增加

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 应用

- 尼龙生产

- 涂料中间体

- 除生物剂

- 其他用途(硬化剂、润滑剂等)

- 最终用户产业

- 纤维

- 塑胶

- 汽车

- 其他最终用户产业(油漆和涂料、石化产品等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alfa Aesar

- Asahi Kasei Corporation

- Ascend Performance Materials

- BASF SE

- DOW

- Evonik Industries AG

- Genomatica Inc.

- INVISTA

- Radici Partecipazioni SpA

- Shenma Industrial Co., Ltd.

- Solvay

- TORAY INDUSTRIES INC.

第七章 市场机会与未来趋势

- 生物基己二胺产品需求不断成长

- 其他机会

The Hexamethylenediamine Market size is estimated at 1.46 million tons in 2025, and is expected to reach 1.77 million tons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the market for hexamethylenediamine. The nationwide lockdowns in several countries and the labor shortage due to social distancing measures resulted in the suspension of manufacturing sites for automotive vehicles, which affected the market for hexamethylenediamine. However, post-COVID pandemic, the market for hexamethylenediamine recovered well due to increasing demand from textile and automotive end-user industries.

Key Highlights

- The increasing consumption of Nylon 66 resins and the rising demand for hexamethylenediamine in the automotive and textile industries are expected to drive the market for Hexamethylenediamine.

- The usage of castor oil as an alternative raw material for the nylon production process is expected to hinder market growth.

- The increasing demand for bio-based hexamethylenediamine products is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market due to the rising demand for hexamethylenediamine from textile and automotive end-user industries.

Hexamethylenediamine Market Trends

Textile End-User Industry to Dominate the Market

- A high amount of hexamethylenediamine produced is consumed for the manufacturing of nylon 66. Nylon 66 is made of two monomers, each containing six carbon atoms, hexamethylenediamine and adipic acid. The nylon 66 is widely used in the textile industry.

- Nylon 66 is used to manufacture fabric materials that provide better durability and tearing resistance. The nylon-based fabrics are used for various applications and reinforcement for outdoor equipment textiles.

- Asia-Pacific and Europe are the largest markets for textiles across the globe. According to the European Commission, The EU's textiles ecosystem generates value and opens up opportunities for investment and innovation. Textiles and clothing (T&C) is one of Europe's largest and most diversified industrial sectors, with a workforce of 1.5 million.

- According to Apparel Resources, in 2022, the textile and clothing market in the European Union registered EUR 200 billion (USD 217 billion) in revenue. It is further expected to increase in the coming years. Thus, the increasing market for textile products is expected to drive the demand for hexamethylenediamine in the region.

- Similarly, according to the World Trade Organization, in 2022, China was the top-ranked global textile exporter, with a value of approximately USD 148 billion. Similarly, the European Union ranked in second place, with an export value of around USD 71 billion. The export value of textiles is further expected to increase in the coming years, thereby driving the current studied market.

- For instance, in India, with an increase in foreign direct investment (FDI) in the textile industry from the past decade, the production of textiles is increasing, thus resulting in increased use of flock adhesives. According to the Indian Brand Equity Foundation, India's textile and apparel industry is expected to reach USD 190 billion by 2025-26.

- Thus, the textile end-user industry segment will dominate the market for hexamethylenediamine during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for hexamethylenediamine due to rising demand from the textile, automotive, and plastics end-user industries.

- The increasing usage of nylon fibers is increasing in the textile industry expected to drive the market for hexamethylenediamine in the region through the years to come. Asia-Pacific is expected to dominate the global market, owing to the highly developed textile sector in China, coupled with continuous investments in the automotive sectors.

- China and Bangladesh are the largest markets for Textiles in the region. According to the National Bureau of Statistics of China, the textile production volume in China accounted for 38.2 billion meters in 2022, compared to 23.5 billion meters during the same period in the previous year. Thus, the increase in the production volume of textiles is expected to drive the current studied market.

- Bangladesh is the second-largest market for textiles in the region. According to the World Trade Statistical Review 2023, the country exported textiles worth USD 45 billion in the year 2022. The country's share in global clothing exports increased to 7.9% in the year 2022, as compared to 6.4 % registered in the previous year. Thus, the growth in the textile market will drive the market for hexamethylenediamine in the country.

- The focus on reducing vehicle weight for greater fuel efficiency and lower emissions will increase the demand for lightweight composite nylon resins in automotive under-the-hood components. China is the largest automotive vehicle manufacturer in the region. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- Similarly, India has become the second-largest automotive vehicle manufacturer in the region. According to OICA, the total production volume of automotive vehicles reached 5.45 million units in 2022, indicating a growth of 24% as compared to 4.39 million units registered in 2021.

- Furthermore, to meet the growing demand in India, various manufacturers have announced their expansion plans to increase the production capacity of automotive vehicles in the country. For instance, in January 2023, MG Motor India announced to invest USD 100 million to expand capacity and register a growth of 70% by the end of 2023. Thus, an increase in automotive vehicle production is expected to drive the market for nylon fibers, thereby driving the current studied market.

- Overall, the growth in industries such as textile and automotive end-user industries is likely to drive the market for hexamethylenediamine in the region during the forecast period.

Hexamethylenediamine Industry Overview

The hexamethylenediamine market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include BASF SE, Asahi Kasei Corporation, Evonik Industries AG, TORAY INDUSTRIES INC., and INVISTA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Consumption of Nylon 66 Resins

- 4.1.2 The Rising Demand for Hexamethylenediamine in Automotive and Textile Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increased Usage of of Bio-based Raw Materials for Nylon Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Nylon Production

- 5.1.2 Intermediate for Coatings

- 5.1.3 Biocides

- 5.1.4 Other Applications (Curing Agents, Lubricants, etc.)

- 5.2 End-user Industry

- 5.2.1 Textile

- 5.2.2 Plastics

- 5.2.3 Automotive

- 5.2.4 Other End-user Industries (Paints and Coatings, Petrochemicals, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Aesar

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 Ascend Performance Materials

- 6.4.4 BASF SE

- 6.4.5 DOW

- 6.4.6 Evonik Industries AG

- 6.4.7 Genomatica Inc.

- 6.4.8 INVISTA

- 6.4.9 Radici Partecipazioni SpA

- 6.4.10 Shenma Industrial Co., Ltd.

- 6.4.11 Solvay

- 6.4.12 TORAY INDUSTRIES INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-Based Hexamethylenediamine Products

- 7.2 Other Opportunities