|

市场调查报告书

商品编码

1640574

计划管理软体 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Project Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

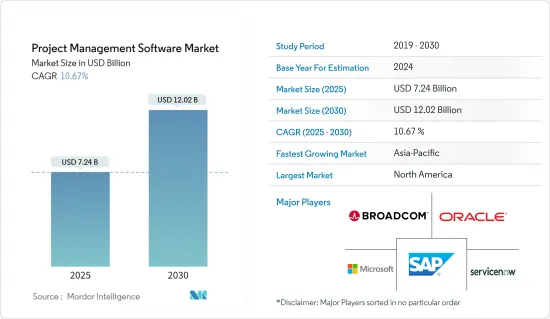

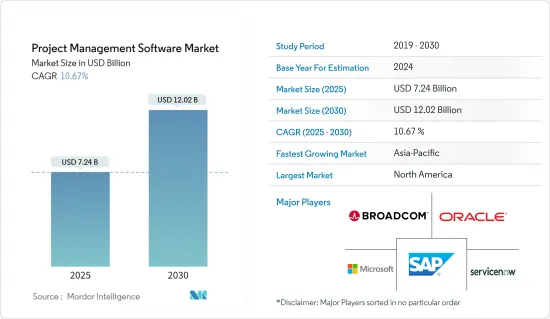

计划管理软体市场规模预计在 2025 年为 72.4 亿美元,预计到 2030 年将达到 120.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.67%。

随着当今企业规模和复杂性的成长,他们需要全面的解决方案来管理和协调整个组织的计划合。这些解决方案可协助经营团队调整计划、工作量、预算和资源,密切注意计划进展并报告成功交货的情况。

关键亮点

- 由于几乎每个产业的发展速度不断加快、技术进步、数位转型和颠覆,计划管理软体 (PMS) 已发展成为当今企业的策略职能。

- 预计推动计划管理软体 (PMS) 系统市场成长的因素包括提高软体利用率来管理资源、最大限度地降低计划风险和计划成本、预算和改组规划以及随时随地的即时性。这有助于存取仪表板。然而,预计在预测期内,提醒和截止日期等日益复杂的功能也将进一步推动市场成长。

- 软体系统日益复杂化、最终用户意识不断增强以及连接和整合多个不同系统的能力等因素预计会推动需求,但高实施成本和构建这些系统的高成本预计也会推动需求。用户公司投资计划管理软体系统,从而导致市场渗透缓慢。

- 随着物联网的出现和敏捷新产品开发方法的采用,计划管理也逐渐成为新产品开发的一种手段,目前正与专案管理系统(PMS) 相结合,成为企业产品创建领域的热门话题,UMT360、 GenSight 等公司都参与其中以及决策镜头。

- 在 COVID-19 疫情期间,计划管理软体提供了进口和货运管理分析、灵活性链、地方政府策略以及未来对业务的影响的 360 度视图。因此,预计对此类数位解决方案的依赖将大幅增加,即使在后疫情时代也不会消退。

- 这些软体系统还帮助计划经理评估疫情对其团队造成的重大影响,并制定计划以减轻负面影响,甚至透过远端进行恢復。企业希望利用数位管道提供更好的规划和调度、团队协作、计划预算等,最终补充和加强客户关係。

计划管理软体 (PMS) 市场趋势

石油和天然气产业将经历高成长

- 数位转型和紧张的预算是由全球经济状况以及在快速变化时期为石油和天然气行业提供成长平台的需求所驱动。对于石油天然气和化学公司来说,即使是很小的延误也可能造成数十万美元的损失。

- 公司不断利用计划管理软体的优势来提高业务生产力、简化沟通、改善计划品质并降低整体计划成本。

- 计划的数量、规模和范围不断增长,需要可扩展性。依赖手动流程和分散的电子表格会使计划面临风险,并且需要时间来防止错误。准确的预测和有用的进度报告至关重要。准确的预测和有用的进度报告对于您的业务运作至关重要。

- 石油和燃气公司正在使用计划管理软体来获取即时、准确的计划资料,使他们能够花更多时间分析资料而不是输入资料。工业公司正致力于调整资本支出决策并利用数位技术来实现更高的资本生产力。例如,2022 年 9 月,美国最大的私人合约天然气压缩机公司 Kodiak Gas Services LLC(Kodiak)选择了 IFS Cloud(TM) 来支援其跨职能业务营运。这使得 Kodiak 能够将三个主要记录系统与多个功能领域和业务流程(包括销售、供应链、采购、人力资本管理 (HCM) 和财务)整合到一个系统中。此外,IFS 白金合作伙伴 Astra Canyon 已实施该解决方案并将其部署到 Kodiak 的整个美国业务(16 个地点,1,157 名用户)。

北美占有最大市场占有率

- 由于采用计划管理软体解决方案的企业数量不断增加,北美预计将主导计划管理软体市场。企业对于高效追踪和管理计划的需求不断增长,预计将刺激该地区采用 PMS。

- 预计在预测期内,采用 PMS 解决方案进行任务管理和灵活的工作规划以成功执行任务将推动市场发展。此外,组织越来越注重改善员工之间的协作和提高团队效率,这也推动了市场成长。

- 2022 年 1 月,TD SYNNEX Corporation 宣布与亚马逊网路服务公司 (AWS) 达成新的策略合作协议 (SCA),涵盖北美、拉丁美洲和加勒比地区。此次合作大大扩展了独立软体供应商(ISV)和云端技术所提供的云端解决方案,使合作伙伴能够透过通路扩展提案以覆盖更大的市场。

计划管理软体 (PMS) 产业概览

计划管理软体市场竞争激烈。市场参与企业,大小不一,集中度适中。主要企业采取的关键策略是併购和产品创新,以在竞争中生存并扩大全球业务。

2022 年 7 月,Arcadis 与 IBI Group 达成协议,Arcadis 以每股 19.50 美元的全现金报价收购 IBI Group 全部已发行股。此次收购增强了我们在全球和本地提供最具创新性和影响力的计划管理软体的能力,所有这些都面向新的和创新的技术支援的解决方案。

2022 年 2 月,领先的建筑管理软体供应商 RedTeam Software LLC 宣布收购云端基础的建筑管理解决方案 paskr Inc.。此次收购增强了该公司为各种规模的商业建筑营业单位构建的整合软体解决方案套件。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 最终用户变得越来越成熟和有意识

- 能够连接和整合多个不同的系统

- 市场限制

- 初期投资高

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 按部署

- 云

- 本地

- 按最终用户产业

- 石油和天然气

- 资讯科技/通讯

- 医疗

- 政府

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Broadcom Inc.(CA Technologies)

- Basecamp LLC

- AEC Software

- Workfront Inc.

- ServiceNow Inc.

- Unit4 NV

- Atlassian Corporation PLC

第七章投资分析

第八章 市场机会与未来趋势

The Project Management Software Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 12.02 billion by 2030, at a CAGR of 10.67% during the forecast period (2025-2030).

As today's corporations increase in size and complexity, an all-inclusive solution is needed to manage and coordinate an entire organization's portfolio of different projects. These solutions help the management to shuffle between plans, workload, budgets, and resources, carefully observe the project progress and report on delivery success.

Key Highlights

- Project management software (PMS) has evolved into a strategic function of today's business due to the accelerating pace, technological advancements, digital transformations, and disruptions happening across almost every industry.

- Some of the factors that are expected to enhance the growth of the project management software (PMS) systems market include the increasing use of software to manage resources, the rising demand for software that minimizes project risks and project costs, budget and shuffle plans, and help in accessing real-time dashboard anywhere and anytime. On the other hand, increasing sophistication and rising capabilities, such as reminders and setting due dates, are also anticipated to provide further impetus to the market's growth during the forecast period.

- While the factors such as increased sophistication of software systems, growing awareness among end users, and ability to connect and integrate multiple disparate systems are anticipated to drive the demand, the high installation costs of setting up these systems, coupled with high maintenance costs, are dissuading the enterprises in the end user from investing in project management software systems, thus leading to slow market penetration.

- Project management has also evolved into a means of new product development, owing to the emergence of the Internet of Things and the adoption of agile NPD, which has now merged with PMS and has led to the development of new firms like UMT360, GenSight, and Decision Lens in the field of enterprise product creation.

- During the COVID-19 pandemic, project management software provided a 360-degree view of import and fare control analysis, flexibility chain, provincial government strategy, and future impact on the business, among others. Hence, the reliance on such digital solutions has greatly increased and is anticipated to witness no retreat even in the post-pandemic era.

- These software systems also helped project managers evaluate the critical ways the pandemic affected their teams to mitigate the adverse effects and plans to recover, even remotely. Enterprises intend to harness digital channels that can provide proper planning and scheduling, team collaboration, and project budgeting, among others, ultimately leading to supplementing and further strengthening their relationships with their customers.

Project Management Software (PMS) Market Trends

Oil and Gas Segment to Witness High Growth

- Digital transformation and tight budgets are due to global economic conditions and the need to provide a growth platform that can cause an intense change in the oil and gas industry. The smallest delays can cost millions of dollars to an oil and gas or chemical company.

- Enterprises are continuously leveraging the benefits of project management software to increase business productivity, streamline communication, improve project quality, and minimize overall project costs.

- Projects are increasing in volume, size, and scope and need to be scalable. Relying on manual processes and decentralized spreadsheets exposes projects to risks and time to prevent errors. The need for accurate forecasts and useful progress reports is essential. Accurate forecasts and useful progress reports are crucial for business operations.

- Oil and gas organizations are utilizing project management software for real-time accurate project data to focus more time on data analysis over data entry. Industry players focus on adopting capital investment decisions and leveraging digital technologies to achieve higher capital productivity. For instance, in September 2022, Kodiak Gas Services LLC (Kodiak), the largest privately-owned contract compression company in the United States, selected IFS Cloud(TM) to enhance its cross-functional business operations, This allows Kodiak to consolidate its three main systems of record into one system with multiple functional areas and business processes, including sales, supply chain, procurement, human capital management (HCM), and finance. Furthermore, IFS Platinum Partner, Astra Canyon, implements the solution and rolls it out across Kodiak's entire US operations, encompassing 16 sites and 1,157 users.

North America Occupies the Largest Market Share

- The North American region is expected to dominate the project management software market due to the increasing number of enterprises adopting project management software solutions. The increasing demand among organizations to efficiently track and manage their projects is expected to act as a stimulator for adopting PMS in the region.

- The deployment of PMS solutions for task management for successfully executing tasks and flexible work planning is anticipated to drive the market during the forecast period. Additionally, organizations' increased focus on promoting collaborations among the workforce and boosting the team's efficiency drives the market growth.

- In January 2022, TD SYNNEX Corporation announced a new strategic collaboration agreement (SCA) with Amazon Web Services Inc. (AWS) that covers North America, Latin America, and the Caribbean regions. This partnership significantly expands cloud solutions for independent software vendors (ISV) and in cloud technology, enabling partners to expand their offerings to reach larger markets throughout the channel.

Project Management Software (PMS) Industry Overview

The project management software market is very competitive. The market is mildly concentrated because of many small and large players. The key strategies adopted by the major players are mergers and acquisitions and product innovations to stay ahead of the competition and to expand their global reach.

In July 2022, Arcadis and IBI Group agreed to a recommended all-cash offer of USD 19.50 per share for Arcadis to acquire all issued and outstanding shares of IBI Group. This acquisition amplifies the ability to deliver the most innovative and impactful project management software globally and locally, all aimed at new and innovative technology-enabled solutions.

In February 2022, RedTeam Software LLC, a leading construction management software provider, announced the acquisition of paskr Inc., a cloud-based construction management solution. This acquisition robusts a suite of integrated software solutions purpose-built for commercial construction entities of all sizes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Sophistication and Growing Awareness Among End Users

- 4.2.2 Ability to Connect and Integrate Multiple Disparate Systems

- 4.3 Market Restraints

- 4.3.1 High Initial Investment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Vertical

- 5.2.1 Oil and Gas

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Government

- 5.2.5 Other End-user Verticals

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Oracle Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 SAP SE

- 6.1.4 Broadcom Inc. (CA Technologies)

- 6.1.5 Basecamp LLC

- 6.1.6 AEC Software

- 6.1.7 Workfront Inc.

- 6.1.8 ServiceNow Inc.

- 6.1.9 Unit4 NV

- 6.1.10 Atlassian Corporation PLC