|

市场调查报告书

商品编码

1640577

金属加工液:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Metal Working Fluids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

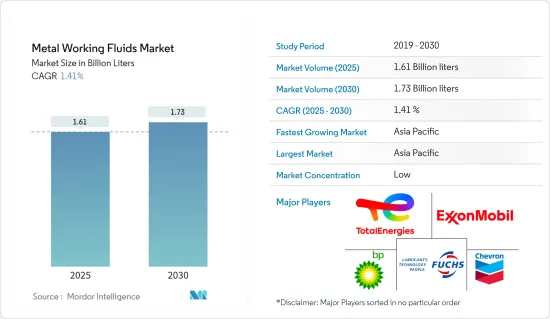

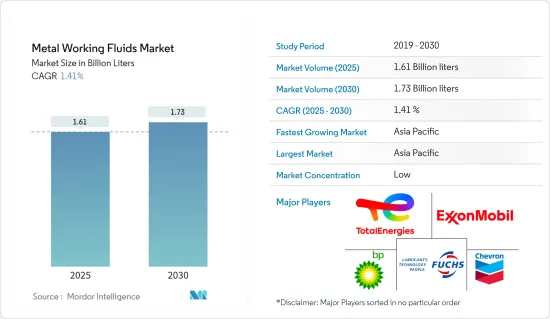

预计2025年金属加工液市场规模为16.1亿公升,到2030年预计将达到17.3亿公升,预测期间(2025-2030年)复合年增长率为1.41%。

关键亮点

- 汽车产业和重型机械产业的需求不断增长是推动金属加工液需求的主要因素。

- 然而,干式加工技术的采用和严格的环境法规预计会阻碍市场的发展。

- 多相金属加工液的出现和技术进步预计将为市场创造新的机会。

- 亚太地区占市场主导地位,其中中国、印度和日本是最大的消费国。

金属加工油市场趋势

汽车产业需求不断成长

- 金属加工液在汽车工业中极为重要。它可以减少刀具和工件之间的摩擦,提高表面质量,有利于金属屑的去除并延长刀具寿命。提高机械加工效率有助于提高机器的生产产量。

- 根据国际汽车製造商组织(OICA)预测,2023年全球汽车产量将达到约9,355万辆,而2022年则为8,483万辆,成长率约10.26%。

- 亚洲-大洋洲地区已成为汽车製造业的领导者,主导其他地区。根据OICA资料,该地区汽车产量将在2023年达到5,511万辆,较2022年的5,002万辆成长10.18%。值得注意的是,该系列产品的製作由中国、日本、韩国和印度的主要企业主导。

- 根据国际汽车製造商协会(OICA)预测,2023年中国汽车产量将达3,016万辆,巩固世界最大汽车生产基地地位。这比 2022 年的 2,702 万辆汽车的产量增加了 12%。

- 同时,美国巩固了其世界第二大汽车製造国的地位。汽车业是美国经济的重要组成部分,2023年对GDP的贡献率为3%至3.5%。美国拥有许多大型汽车製造商,这些製造商不仅满足国内需求,也向美洲、欧洲和亚太地区的市场出口汽车。

- 根据国际汽车製造商组织(OICA)的报告,2023年美国汽车产量将达到1,061万辆,与前一年同期比较增加6%。

- 2023年欧洲汽车产量将显着成长。整体而言,产量年与前一年同期比较13%。其中,乘用车和轻型商用车产量预计到2023年将分别成长12%和19%,达到1,540万辆和160万辆。

- 由于汽车产业的扩张,预计预测期内对金属加工液的需求将会增加。

亚太地区发展迅速

- 受汽车和重型机械设备行业需求不断增长的推动,亚太地区引领市场。在中国、印度和日本等国家,受工业化和经济成长的推动,重型机械产业蓬勃发展。

- 金属加工液在重型机械和设备的製造中起着至关重要的作用。

- 重型机械产业包括多子部门,例如工具机、重型电气设备、水泥机械、物料输送、塑胶加工、製程厂设备以及土木工程、建筑和采矿设备。

- 中国「十四五」规划提出加强农业和农村转型力度,这与农业和建筑业重型机械的使用增加直接相关。

- 我国农机产业发展呈现稳定上升势头,现有农机企业近1万家,农机流通营业单位2万余个。根据AgroPage 2023年通报,在14个外贸分行业中,农业机械出口表现与前一年同期比较,年增33.5%,尤其是大中型拖拉机的成长。

- 此外,根据中国施工机械协会 (CCMA) 的资料,2024 年 6 月挖土机销量与前一年同期比较去年同期成长 5.31%,总合16,603 台。国内销量达7,661辆,较去年成长25.6%,表现强劲。

- 印度农业机械产业在全球占有重要地位,拥有大量印度製造商,同时满足国内和国际市场的需求。根据拖拉机製造商协会的数据,2023 年 12 月拖拉机销量从 2022 年的 55,390 台下降 19.24% 至 44,735 台。不过,海外出口虽然较 2022 年的 131,850 辆有所下降,但 2023 年仍保持强劲,达到 96,223 辆。

- 印度施工机械产业预计在 2023-24 财年将成长 26%,这主要归功于政府的基础设施主导议程。根据印度施工机械工业协会 (ICEMA) 的数据,预计 2023 年销售量将达到 135,650 台,高于去年的 107,779 台。值得注意的是,作为行业最大细分市场的土木机械销量在23-24财年增长了21%,达到93,531台,占总销量的70%左右。

- 印度汽车经销商协会联合会报告称,2023财年印度乘用车销售将飙升23%。大型製造商经历了间歇性的供应链挑战,特别是在半导体和电子产品领域。在可支配收入不断提高、新型运动型和公共产业车热潮以及诱人的贷款利率的推动下,印度的乘用车销量将在 23 财年首次突破 400 万辆大关。

- 根据印度汽车工业协会 (SIAM) 的数据,23 财年乘用车、轿车和多功能车的销量突破了 410 万辆。这比 2022 年的 379 万台成长 8.2%。推动这一成长的主要动力是多功能车,占总销量的 57.4%。

- 鑑于这些动态,亚太地区将在未来几年引领金属加工液市场。

金属加工液产业概况

金属加工液市场部分合併。主要参与企业(不分先后顺序)包括埃克森美孚、福斯、道达尔能源、英国石油公司和雪佛龙公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 汽车产业需求不断成长

- 重型机械产业需求增加

- 其他驱动因素

- 市场限制

- 采用干式加工技术

- 严格的环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 依产品类型

- 清除溶液

- 成型液

- 保护液

- 处理溶液

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BP PLC

- Carl Bechem Lubricants India Private Limited

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- Kemipex

- SKF

- Motul

- PETRONAS Lubricants International

- TotalEnergies

- Saudi Arabian Oil Co.

第七章 市场机会与未来趋势

- 多相金属加工液的出现。

- 技术进步

- 其他机会

简介目录

Product Code: 55158

The Metal Working Fluids Market size is estimated at 1.61 billion liters in 2025, and is expected to reach 1.73 billion liters by 2030, at a CAGR of 1.41% during the forecast period (2025-2030).

Key Highlights

- The growing demand from the automotive sector and the heavy machinery industry are the major factors driving the demand for metalworking fluids.

- However, the adoption of dry machining technologies and stringent environmental regulations are expected to hinder the market.

- Nevertheless, the emergence of multi-phase metal working fluids and advancements in technology are expected to create new opportunities for the market studied.

- Asia-Pacific dominates the market, with countries like China, India, and Japan being the biggest consumers.

Metal Working Fluids Market Trends

Growing Demand from the Automotive Sector

- Metalworking fluids are crucial in the automotive sector. They reduce friction between tools and workpieces, enhance surface quality, facilitate metal chip removal, and extend tool life. By boosting the efficiency of machining operations, these fluids contribute to heightened machine output.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2023, around 93.55 million units of vehicles were produced worldwide, witnessing a growth rate of around 10.26% compared to 84.83 million units of vehicles in 2022, thereby indicating an increased demand for metalworking fluids from the automotive industry.

- The Asia-Oceania region emerged as the frontrunner in vehicle manufacturing, outpacing other regions. OICA data highlights that automotive production in this region reached 55.11 million units in 2023, up by 10.18% from 50.02 million units in 2022. Notably, this production is spearheaded by key players like China, Japan, South Korea, and India.

- According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2023, China solidified its position as the world's largest automotive production hub, churning out 30.16 million vehicles. This marks a notable 12% uptick from the 27.02 million units produced in 2022.

- Meanwhile, the United States solidified its position as the world's second-largest automotive manufacturer. The automotive sector stands as a cornerstone of the US economy, contributing between 3% and 3.5% to the nation's GDP in 2023. The United States is home to major automakers who not only meet domestic demands but also export vehicles to markets spanning the Americas, Europe, and the Asia-Pacific.

- The Organisation Internationale des Constructeurs d'Automobiles (OICA) reported that the United States produced 10.61 million units of vehicles in 2023, marking a 6% increase from the previous year.

- Europe witnessed a notable growth in motor vehicle production in 2023. Overall, production surged by 13% compared to the previous year. Specifically, passenger car and LCV production saw increases of 12% and 19%, culminating in 15.4 million units and 1.6 million units, respectively, in 2023.

- Given the expanding automotive industry, the demand for metalworking fluids is poised to rise during the forecast period.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific leads the market, driven by rising demand from the automotive and heavy machinery and equipment sectors. Countries like China, India, and Japan are witnessing a surge in their heavy machinery industry, fueled by industrialization and economic growth.

- Metalworking fluids play a crucial role in manufacturing heavy machinery and equipment.

- The heavy machinery industry encompasses diverse sub-sectors, including machine tools, heavy electrical equipment, cement machinery, material handling, plastics processing, process plant equipment, and equipment for earth moving, construction, and mining.

- China's 14th Five-Year Plan aims to bolster its agricultural and rural transformation, which is directly related to the heightened use of heavy machinery in agriculture and construction.

- China's agricultural equipment sector has been on a steady upward trajectory, featuring close to 10,000 farming machinery firms and over 20,000 distribution entities. As highlighted by AgroPages in 2023, amidst 14 foreign trade sub-sectors, agricultural machinery exports showcased a robust 33.5% year-on-year surge, particularly in large and medium-sized tractors.

- Moreover, data from the China Construction Machinery Association (CCMA) indicates a 5.31% year-on-year rise in excavator sales, totaling 16,603 units in June 2024. Domestic sales reached 7,661 units, reflecting a strong 25.6% annual growth.

- India's agricultural equipment sector holds immense weight in the global arena, with numerous Indian manufacturers catering to both domestic and international markets. The Tractor Manufacturers Association reported a 19.24% dip in tractor sales in December 2023, with figures dropping from 55,390 units in 2022 to 44,735 units. However, overseas exports remained robust at 96,223 units in 2023, albeit down from 131,850 units in 2022.

- The Indian construction equipment industry experienced a 26% growth in the fiscal year 2023-24, largely due to the government's infrastructure-driven agenda. According to the Indian Construction Equipment Manufacturers' Association (ICEMA), 2023 sales reached 135,650 units, up from 107,779 units the previous year. Notably, earthmoving equipment sales, the industry's largest segment, rose by 21% to 93,531 units in FY 2023-24, constituting about 70% of the total sales.

- Passenger vehicle sales in India jumped 23% in the financial year 2023, as reported by the Federation of Automobile Dealers Associations. Leading manufacturers navigated intermittent supply chain challenges, particularly with semiconductors and electronics. Driven by rising disposable incomes, a wave of new sport-utility vehicles, and attractive loan rates, India's passenger vehicle sales touched 4 million units for the first time in FY 2023.

- According to the Society of Indian Automobile Manufacturers (SIAM), in 2023, sales of cars, sedans, and utility vehicles surpassed 4.1 million. This marks an 8.2% rise from the 3.79 million sold in 2022. The surge was predominantly fueled by utility vehicles, making up 57.4% of the total sales.

- Given these dynamics, Asia-Pacific is poised to lead the metalworking fluids market in the coming years.

Metal Working Fluids Industry Overview

The metal working fluids market is partially consolidated in nature. The major players (not in any particular order) include Exxon Mobil Corporation, FUCHS, TotalEnergies, BP PLC, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand from the Automotive Sector

- 4.1.2 Increasing Demand from the Heavy Machinery Industry

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Adoption of Dry Machining Technologies

- 4.2.2 Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product Type

- 5.1.1 Removal Fluids

- 5.1.2 Forming Fluids

- 5.1.3 Protection Fluids

- 5.1.4 Treating Fluids

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 NORDIC Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP PLC

- 6.4.2 Carl Bechem Lubricants India Private Limited

- 6.4.3 Chevron Corporation

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 FUCHS

- 6.4.6 Hindustan Petroleum Corporation Limited

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Kemipex

- 6.4.9 SKF

- 6.4.10 Motul

- 6.4.11 PETRONAS Lubricants International

- 6.4.12 TotalEnergies

- 6.4.13 Saudi Arabian Oil Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of Multi-phase Metal Working Fluids

- 7.2 Advancements in Technology

- 7.3 Other Opportunities

02-2729-4219

+886-2-2729-4219