|

市场调查报告书

商品编码

1640591

中东和非洲分散式太阳能发电:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Middle-East and Africa Distributed Solar Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

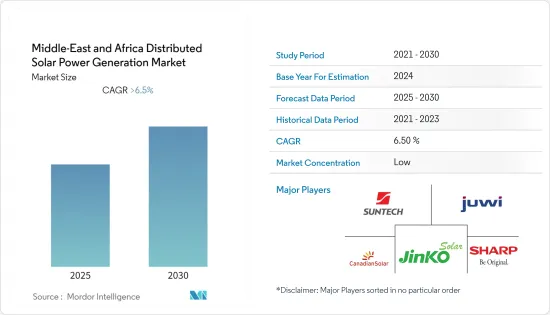

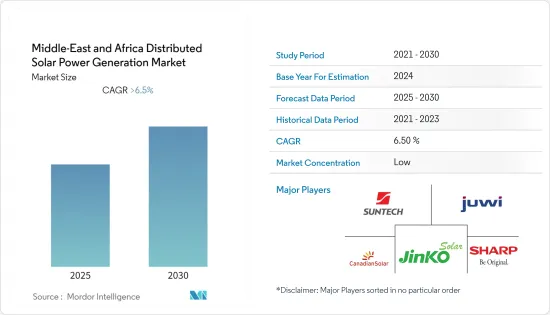

预测期内,中东和非洲分散式太阳能发电市场预计将以超过 6.5% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,我们将看到对绿能的需求增加,面对石化燃料价格上涨,人们将从柴油和天然气等传统发电来源转向分散式太阳能等离网发电来源。太阳能发电的转变,进而促进市场成长。

- 另一方面,由于完全依赖太阳能硬体的进口,分散式太阳能发电的成本很高,预计预测期内成本将保持在较低水准。

- 该地区的新技术创新、即将上马的太阳能发电工程和混合电力解决方案的利用很可能在不久的将来为分散式太阳能发电市场创造巨大的机会。

- 由于沙乌地阿拉伯政府采取各种措施推动可再生能源计划,尤其是太阳能计划的发展,预计预测期内沙乌地阿拉伯的需求将大幅增加。

中东和非洲分散式太阳能发电市场趋势

清洁电力需求不断增长将推动市场

- 清洁能源包括太阳能和风能等可再生能源以及垃圾焚化发电和核能发电等替代燃料,仅占该地区发电量的一小部分。

- 截至2021年,中东和非洲可再生能源装置容量分别为2405万千瓦和5571万千瓦。近年来,两个市场的可再生能源容量一直在稳步增长,其中中东可再生能源容量自 2017 年以来增长了近 40%,非洲可再生能源容量自 2017 年以来增长了近 30%。在这两个地区,太阳能发电占总装置容量的很大一部分。这表明该地区对清洁能源的需求不断增长,预计将在预测期内推动市场发展。

- 屋顶太阳能光电可以为没有电力的家庭提供现代电力服务,减少依赖燃油发电的岛屿和其他偏远地区的电费,并使居民和小企业能够发电。

- 例如,沙乌地阿拉伯电力和热电联产监管局宣布了2020年分散式发电太阳能光电装置的新规定。新框架适用于1kW至2MW之间的太阳能光电系统,并适用于所有能源消费者。

- 此外,沙乌地阿拉伯在 2030 年安装 5,870 万千瓦可再生能源的目标可能为该地区及其他地区的投资者和能源公司带来一些最令人兴奋的机会。阿联酋已设定目标,在 2050 年实现 50% 的能源来自无碳能源来源,并有望继续在清洁能源转型中发挥核心作用。

- 因此,基于上述因素,预计绿能将在预测期内推动中东和非洲分散式太阳能市场的发展。

沙乌地阿拉伯需求庞大

- 沙乌地阿拉伯的能源需求不断增长,过去十年消费量增加了60%。预计2021年的电力需求将达到65GW左右,到2030年将上升至120GW。

- 根据国际可再生能源机构(IRENA)的数据,沙乌地阿拉伯的可再生能源装置容量将从 2012 年的 12 兆瓦成长到 2021年终的443 兆瓦。太阳能发电总设备容量为389兆瓦,占2021年可再生能源总设备容量的86%以上。

- 沙乌地阿拉伯已成为中东和北非 (MENA) 地区利用可再生能源竞赛的领导者之一。 2021年,沙乌地阿拉伯绿色倡议加强了其承诺,到2030年将可再生能源在初级能源结构中的占比提高到50%,其余50%来自天然气。

- 此外,根据“2030愿景”,预计到2030年将开发超过4000万千瓦的光伏(PV)和270万千瓦的聚光型太阳热能发电(CSP)。能源部可再生能源计划开发办公室 (REPDO) 成立于 2017 年,负责根据 2030 愿景实现国家可再生能源计画 (NREP) 的目标。

- 因此,基于上述计划,预计预测期内沙乌地阿拉伯将在中东和非洲看到对分散式太阳能发电的巨大需求。

中东和非洲分散式太阳能发电产业概况

中东和非洲的分散式太阳能市场部分细分,参与企业众多。市场上的主要企业(不分先后顺序)包括无锡尚德电力、阿特斯阳光电力有限公司、Juwi Solar Inc.、晶科能源控股和夏普太阳能解决方案集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2027年装置容量及预测(单位:MW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Wuxi Suntech Power Co. Ltd

- First Solar Inc.

- Juwi Solar Inc.

- JA Solar Holdings Co. Ltd

- Trina Solar Limited

- JinkoSolar Holding Co. Ltd

- Sharp Solar Energy Solutions Group

- Canadian Solar Inc.

- Sonnedix Power Holdings Limited

第七章 市场机会与未来趋势

The Middle-East and Africa Distributed Solar Power Generation Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing demand for clean electricity and the impetus to shift from conventional power generation sources, such as diesel and gas gen-sets, in the face of rising fossil fuel prices to power off-grid electricity requirements with sources such as distributed solar is expected to help the distributed solar power generation market grow.

- On the other hand, the higher costs of distributed solar energy due to complete dependence on solar PV hardware imports are expected to restrain costs during the forecast period.

- Nevertheless, the innovation of new technologies, the upcoming solar power projects, and the use of hybrid power solutions in this region can create immense opportunities for distributed solar power generation market in the near future.

- Saudi Arabia is expected to witness significant demand due to various government initiatives to promote renewable energy projects, particularly solar energy-based projects, in the country during the forecast period.

MEA Distributed Solar Power Generation Market Trends

Increasing Demand for Clean Electricity to Drive the Market

- Clean energy, which includes renewables, such as solar and wind power, and alternative fuels, including waste-to-energy and nuclear, accounts for only a small proportion of electricity generation in the region.

- As of 2021, the total installed renewable energy capacity in the Middle East and Africa regions stood at 24.05 GW and 55.71 GW, respectively. Installed renewable energy capacity in both markets has been growing steadily over the past few years, with the installed renewable capacity in the Middle East growing by nearly 40% since 2017 and installed renewable capacity in Africa growing by nearly 30% since 2017. In both regions, a significant share of the total installed capacity came from solar energy. This demonstrated the growing demand for clean energy in the region, which is expected to drive the market during the forecast period.

- Rooftop solar offers the benefits of modern electricity services to households with no access to electricity, reducing electricity costs on islands and in other remote locations dependent on oil-fired generation and enabling residents and small businesses to generate electricity.

- Various governments are taking various initiatives to promote the solar market in the region; for instance, In 2020, Saudi Arabia's Electricity & Cogeneration Regulatory Authority published new rules for distributed-generation solar installations, which is anticipated to encourage electricity consumers to install PV systems under the country's net billing regime. The new framework will apply to PV systems ranging in size from 1 kW-2 MW and to all energy consumers.

- Moreover, Saudi Arabia's target to install 58.7 GW of renewable energy by 2030 may offer some of the most exciting opportunities for regional and international investors and energy firms. The United Arab Emirates is expected to remain a focal point of the clean energy transition, having set a target of 50% of its energy to be produced by carbon-free sources by 2050.

- Therefore, based on the above factors, clean electricity is expected to drive the Distributed Solar Power Generation Market in the Middle East and Africa region over the forecast period.

Saudi Arabia to Witness Significant Demand

- Saudi Arabia's energy demand has been rising, with consumption increasing by 60% in the last ten years. The demand for electricity in 2021 is about 65 GW, which is expected to increase to 120 GW in 2030.

- According to the International Renewable Energy Agency (IRENA), Saudi Arabia's total renewable installed capacity stood at 12 MW in 2012, which rose to 443 MW at the end of 2021. Solar PV has been the most significant share in total solar energy capacity, with 389 MW in the country, accounting for more than 86% of the total renewable energy as of 2021.

- Saudi Arabia has become one of the Middle East and North Africa (MENA) region's leaders in the race to use renewable energy. In 2021, the Saudi Green Initiative reinforced the country's commitment to increase the share of renewable energy to 50% of its primary energy mix while producing the other 50% from natural gas by 2030.

- Moreover, under Vision 2030, more than 40 GW of solar photovoltaic (PV) capacity and 2.7 GW of concentrated solar power (CSP) capacity are expected to be developed in the country by 2030. The Renewable Energy Project Development Office (REPDO) within the Ministry of Energy, established in 2017, is responsible for delivering on the goals of the National Renewable Energy Program (NREP) in line with Vision 2030.

- Therefore, based on the projects mentioned above, Saudi Arabia is expected to witness significant demand for distributed solar power generation in the Middle-East and Africa region over the forecast period.

MEA Distributed Solar Power Generation Industry Overview

The market for distributed solar power generation in Middle-East and Africa is partially fragmented, with the presence of numerous players. Some of the major players in the market (not in particular order) include Wuxi Suntech Power Co. Ltd., Canadian Solar Inc., Juwi Solar Inc., JinkoSolar Holding Co. Ltd, and Sharp Solar Energy Solutions Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 Saudi Arabia

- 5.1.2 United Arab Emirates

- 5.1.3 South Africa

- 5.1.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wuxi Suntech Power Co. Ltd

- 6.3.2 First Solar Inc.

- 6.3.3 Juwi Solar Inc.

- 6.3.4 JA Solar Holdings Co. Ltd

- 6.3.5 Trina Solar Limited

- 6.3.6 JinkoSolar Holding Co. Ltd

- 6.3.7 Sharp Solar Energy Solutions Group

- 6.3.8 Canadian Solar Inc.

- 6.3.9 Sonnedix Power Holdings Limited