|

市场调查报告书

商品编码

1640593

拉丁美洲输油管-市场占有率分析、产业趋势与成长预测(2025-2030 年)South and Central America Oil Country Tubular Goods (OCTG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

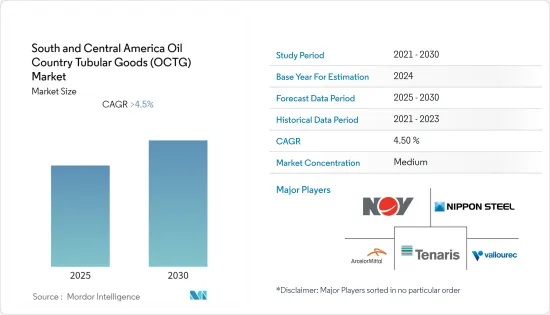

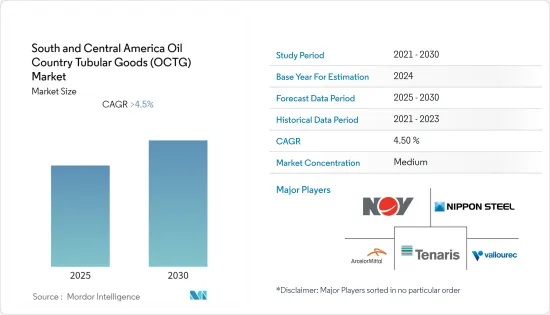

预测期内,拉丁美洲输油管产品市场预计将以超过 4.5% 的复合年增长率成长。

所调查的市场在 2020 年受到了 COVID-19 的负面影响。市场现已復苏,目前已达到疫情前的水准。

推动市场成长的关键因素是供需缺口缩小、技术进步导致原油损益平衡价格降低、石油服务成本降低、定向钻井增加。然而,原油价格波动和油管週期性风险预计会抑製输油管供应市场的成长。拉丁美洲主要国家对石油天然气产业的自由化可望增加外国投资,促进石油天然气产业的成长,并提振该地区的输油管产品市场。

由于石油和天然气探勘活动的增加,预计预测期内巴西将在拉丁美洲看到巨大的需求。

拉丁美洲输油管市场趋势

高檔品市场需求强劲

由于上游石油和天然气行业的需求不断增加,优质输油管产品的市场正在成长。优质应用涵盖气井、水平井、高压井(超过 5,000 PSI)和高温井(超过 250 F)。优质输油管用品适用于更复杂的应用以及连接需要紧密气封的地方。

随着页岩蕴藏量的快速成长,天然气勘探得到极大推动。水平定向钻井正在提高页岩气的蕴藏量,从而推动优质输油管市场的成长。

截至2022年11月,南美洲海上钻机总供应量为39座,其中35座处于市场和合约状态。在恶劣和偏远地区的深海探勘的增加推动了优质钻井平台的使用,从而促进了市场的成长。墨西哥湾是主要的深海油气蕴藏量地之一,预计预测期内产量将会增加。

2022年10月,埃克森美孚宣布在圭亚那近海斯塔夫罗克区块的Sailfin-1和Yarrow-1井发现两项发现,这进一步增加了其丰富的开发机会。不断增加的石油和天然气发现需要优质的输油管产品,例如钻桿、套管和油管。

因此,由于上述因素,预测期内优质豆类预计在拉丁美洲仍将保持成长动能。

预计巴西的需求将大幅增加

巴西为世界最大石油、天然气生产国之一、南美洲最大生产国、世界第七大石油产品消费国。巴西生产的石油和天然气约80-90%是在海上生产的。

利布拉油田位于巴西桑托斯盆地,是个超深水盆地,是巴西最大的油田。预计该开发案将使用多套输油管进行定向钻井、修井和完井。

大型海上盐盐层下矿床的发现帮助巴西进入了十大石油液体生产国。 2022年11月,中国石油天然气集团公司与巴西石油公司完成巴西桑托斯盆地深水油田首次石油探勘试验。古拉1井是桑托斯盆地大型油田,是中国石油天然气集团公司海外深水油气开发的重大成果。

鑑于巴西实施了重大有利于投资者的监管改革,外国石油和天然气公司的前景光明。预计不断增长的石油和天然气探勘活动将推动该地区输油管供应市场的成长。

2022 年 10 月,挪威石油巨头 Equinor 开始在巴西坎波斯盆地近海的佩莱格里诺重油田第二阶段生产。佩莱格里诺 (Pellegrino) 油田正在由名为「Pellegrino C」的新型井口平台和钻井钻机进行生产。新平台将位于水深120公尺处,此类计划预计将推动全国输油管供应市场的成长。

因此,由于上述因素,预计巴西将在预测期内推动拉丁美洲输油管供应市场的成长。

拉丁美洲输油管管产业概况

拉丁美洲输油管供应市场适度整合。主要参与企业(不分先后顺序)包括 National-Oilwell Varco Inc.、Nippon Steel Corporation、Tenaris SA、ArcelorMittal SA 和 Vallourec SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 按製造工艺

- 无缝的

- 电阻焊接

- 按年级

- 优等品

- API 等级

- 按地区

- 巴西

- 阿根廷

- 委内瑞拉

- 其他拉丁美洲国家

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- ArcelorMittal SA

- National-Oilwell Varco Inc.

- Nippon Steel Corporation

- Tenaris SA

- Vallourec SA

- TPCO Enterprise Inc.

第七章 市场机会与未来趋势

The South and Central America Oil Country Tubular Goods Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The market studied was negatively impacted by COVID-19 in 2020. Since then, the market has been recovering and has now reached pre-pandemic levels.

Major factors driving the growth of the market studied are reducing the supply-demand gap, low oil breakeven prices due to technological advancement, reduced oil services cost, and increased directional drilling. However, volatile crude oil prices and the risk associated with the cyclic nature of the tube are expected to restrain the OCTG market's growth. Liberalization of the oil and gas industry by major countries in South and Central America is expected to increase foreign investment, thereby helping the oil and gas industry to grow, and is anticipated to boost the OCTG market's growth in the region.

Due to the increase in oil and gas exploration activities, Brazil is expected to witness significant demand in South and Central America during the forecast period.

South and Central America Oil Country Tubular Goods Market Trends

Premium Grade Segment is Expected to Witness Significant Demand

The premium-grade OCTG market is growing due to the increasing demand from upstream oil and gas activities. The premium-grade applications are widespread in gas wells, horizontal wells, high-pressure (above 5,000 PSI), and high-temperature (above 250 F) wells. The premium-grade OCTG is applied to connections with more complex applications and where gas-tight sealing is required.

The exploration of natural gas is receiving huge impetus with the surge in the development of shale reserves. Horizontal directional drilling has promulgated natural gas production from shale reserves, which boosts the premium-grade OCTG market's growth.

As of November 2022, the total supply of offshore rigs in South America was 39 units, of which the amount of marketed and contracted rigs was 35. The increase in deepwater exploration in remote areas with harsh environments has resulted in the rise in the use of premium quality drilling equipment, which has resulted in the growth of the market. The Gulf of Mexico, one of the major offshore deepwater reserves, is expected to witness an upsurge in production during the forecast period.

In October 2022, ExxonMobil announced two discoveries at the Sailfin-1 and Yarrow-1 wells in the Stabroek block offshore Guyana, adding to its extensive portfolio of development opportunities. The growing oil and gas discoveries will require premium-grade OCTG products such as drill pipes, casings, and tubings.

Therefore, based on the above-mentioned factors, the premium grade segment is expected to maintain its growth momentum in South and Central America during the forecast period.

Brazil is Expected to Witness Significant Demand

Brazil is one of the largest producers of oil and gas across the world, the largest producer in South America, and the seventh largest oil product consumer in the world. Almost 80-90% of oil and gas produced in Brazil are from offshore.

Libra oil field in Santos Basin in Brazil is an ultra-deep-water basin, is the largest oil field in Brazil, is under the development phase, and is expected to complete by the end of 2022. The development is expected to use several units of OCTG for directional drilling, well intervention, and well completion.

The discoveries of large, offshore, pre-salt oil deposits have transformed Brazil into a top-10 petroleum liquid fuels producer. In November 2022, China National Petroleum Corp and Petrobras completed their first oil exploration test of a deepwater field in Brazil's Santos basin. Well Gura-1, a large oil field in the Santos basin, represents a significant accomplishment in CNPC's foreign deepwater oil and gas exploration.

The outlook for foreign oil and gas companies in Brazil is bright, considering the significant investor-friendly regulatory reforms. The increase in oil and gas exploration activities is expected to drive the OCTG market's growth in the region.

In October 2022, Norway's oil major Equinor started production from Phase 2 of the Peregrino heavy oil field offshore the Campos basin in Brazil. The Peregrino field is being produced through a new wellhead platform and drilling rig called Peregrino C. The new platform is installed at a water depth of 120 m. Such projects are expected to boost the growth of the OCTG market across the country.

Therefore, based on the above-mentioned factors, Brazil is expected to boost the OCTG market's growth in South and Central America during the forecast period.

South and Central America Oil Country Tubular Goods Industry Overview

The South and Central America oil country tubular goods (OCTG) market is moderately consolidated. Some major players (in no particular order) include National-Oilwell Varco Inc., Nippon Steel Corporation, Tenaris SA, ArcelorMittal SA, and Vallourec SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Manufacturing Process

- 5.1.1 Seamless

- 5.1.2 Electric Resistance Welded

- 5.2 By Grade

- 5.2.1 Premium Grade

- 5.2.2 API Grade

- 5.3 By Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Venezuela

- 5.3.4 Rest of South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ArcelorMittal SA

- 6.3.2 National-Oilwell Varco Inc.

- 6.3.3 Nippon Steel Corporation

- 6.3.4 Tenaris SA

- 6.3.5 Vallourec SA

- 6.3.6 TPCO Enterprise Inc.