|

市场调查报告书

商品编码

1640594

能源采集系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Energy Harvesting Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

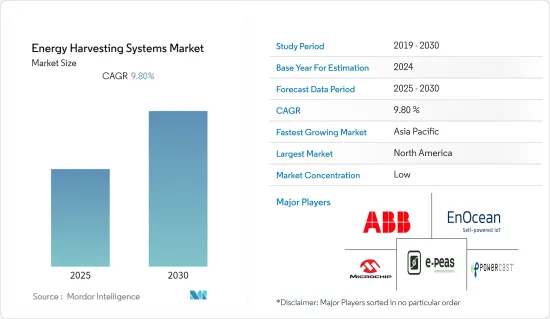

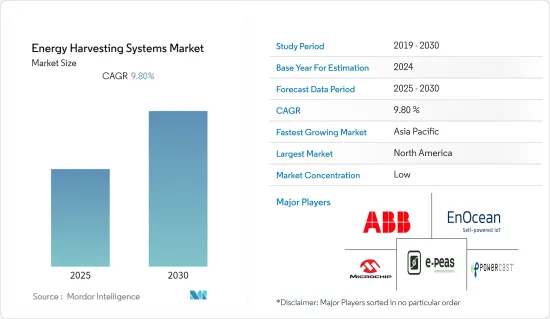

预计预测期内能源采集系统市场复合年增长率将达到 9.8%。

主要亮点

- 物联网设备在自动化领域的普及、都市区的扩张、对可靠、安全和持久系统的需求不断增长、绿色能源日益普及、能源采集技术在楼宇和家庭自动化领域的广泛使用、政府的支持性政策等,都是预计将在预测期内促进市场扩张。

- 能源采集系统主要用于感测器、手錶和家用电器等低功率电力公共事业。这些系统为电池等传统电源提供了有效的替代方案。

- 此外,政府的支持性政策、日益增强的环保意识以及温室气体排放的减少也有助于推动对此类技术的需求。

- 使用能源采集系统具有优势,因为它允许连接的设备长时间运行而不会对环境造成任何负面影响。此外,在包括光能、热能、射频能源、动能、化学/生物能等各种环境能源来源中,最常用的能源采集系统是太阳能、热能和它是一种能量,振动能量。

- 能源采集系统也部署在需要备用电池的应用中,主要是在难以到达电池的偏远地区。能源采集系统中使用的发射器和接收器需要彼此靠近安装,以实现更好的讯号传输。当这些感测器安装在远端位置时,很难在中央接收器上收集资料。

- 新冠肺炎疫情的爆发对中国的太阳能产业和经济产生了重大影响。出口情况仍未完全了解。这种延迟可能会限制能源采集系统的发展。

能源采集系统市场趋势

消费性电子产品占据很大市场占有率

- 能源采集系统越来越多地应用于穿戴式装置、智慧型手机、遥控器、无线装置、身体植入等消费性电子产品。

- 此外,能源采集系统使消费性电子产品能够在没有传统电源的地方运作。这些特性扩展了应用范围并消除了设备必须始终靠近电源的地理限制。这些特点推动了能源采集系统在家用电子电器中的应用。

- 例如,能源采集系统用于远端控制装置,从使用者按下按钮的力量中获取电能。最近,ARM 开发了这样一款设备,利用了 ARM Cortex-M0+ 处理器的低功耗特性。

- 收集的能量可用于大多数无线应用、身体植入、穿戴式装置和其他低功耗应用。即使捕获的能量不足以为整个设备供电,它仍然可以用来延长传统电池的寿命。

- 例如,香港中文大学的研发部门开发出一种装置,可在行走时从人体膝盖获取能量,且无需显着增加佩戴者的体力。演示的设备可产生高达 1.6mW 的功率,而不会显着改变呼吸模式。

- 连网型设备的激增以及对更便宜、更可靠能源来源的需求正在推动消费性电子产业能源采集系统的成长。

北美占有最大市场占有率

- 随着该地区技术持续快速进步,北美正在成为投资建筑和家庭自动化、采用可再生能源和推动能源采集系统需求的最重要市场。

- 该地区的大部分收益来自美国。由于政府希望实现国家能源独立以及工业和运输业的蓬勃发展,该行业预计将大幅扩张。

- 与其他市场相比,北美市场对工业IoT的采用程度更高,推动了对能源采集系统的需求。

- 政府减少老旧建筑和公共设施能源排放的计划也促进了这一增长。例如,美国总务管理局已与 IBM 签署合同,在联邦政府能源最密集型的 50 座建筑中安装先进的智慧建筑技术。

- 此外,智慧城市计划的推出也改变了当地的市场环境。除了举办活动促进全国参与智慧城市建设的城市、企业和大学之间的合作和知识共用外,该计划还包括各种津贴资助计划。

能源采集系统产业概况

能源采集系统市场竞争激烈。其中,ABB Limited 和 STMicroelectronics NV 是该市场两大竞争对手。然而,一些新参与企业正透过其产品线的重大进步吸引大量投资进入该行业。

2022 年 9 月,E-Peas SA 和 Energous Corporation 宣布推出一款新型无线储能能源采集智慧建筑/智慧家庭、工业IoT医疗以及零售和仓库中的资产追踪器中的能量收集套件而开发。该套件包括两块来自 E-Peace 的评估板(AEM30940 RF 评估板和 EP112能源采集优化天线评估板),可协助设备製造商将无线电源和能源采集实现到各种连网型设备。 PowerBridge 发射器提供无线解决方案

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 智慧城市的发展

- 製造业技术发展

- 市场挑战

- 初期成本高

第六章 市场细分

- 依技术分类

- 光能能源采集

- 振动能源采集

- 能源采集

- 射频能源采集

- 按应用

- 消费性电子产品

- 楼宇和家居自动化

- 产业

- 运输

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Microchip Technology Inc.

- E-Peas SA

- EnoCean GmbH

- ABB Limited

- Powercast Corporation

- Advanced Linear Devices Inc

- Analog Devices Inc

- STMicroelectronics NV

- Texas Instruments Incorporated

- Cypress Semiconductor Corporation

- Piezo.com

第八章投资分析

第九章:市场的未来

The Energy Harvesting Systems Market is expected to register a CAGR of 9.8% during the forecast period.

Key Highlights

- The widespread use of IoT devices in automation, the expansion of urban areas, the rising demand for reliable, safe, and long-lasting systems, the increasing popularity of green energy, the widespread adoption of energy harvesting technology in building and home automation, and supportive government policies are all anticipated to contribute to the market's expansion during the forecast period.

- Energy harvesting systems are primarily used in low-power electrical utilities, such as sensors, watches, and home appliances. These systems provide an efficient alternative to conventional power sources, like batteries.

- Moreover, supportive government policies and increased awareness about the environment, along with the reduction in the emission of greenhouse gases, have helped raise the demand for such technologies.

- Using energy harvesting systems is advantageous since the connected devices can run for a very long time without causing adverse environmental effects. Additionally, the solar, thermal, and vibrational energy forms of energy are those that energy harvesting systems use the most frequently among the various sources of ambient energy, including light energy, thermal energy, radiofrequency energy, kinetic energy, chemical/biological energy, and others.

- The energy harvesting systems are also deployed in applications that require a backup battery, and primarily battery is located remotely at a difficult place to reach. The transmitters and receivers used in the energy harvesting systems should be installed close to each other for better signal transmission. Collecting data at the central receiver is difficult when these sensors are deployed in remote locations.

- Owing to the outbreak of the COVID-19 pandemic, the Chinese solar industry and its economy are reeling under the impact. The exports are yet to be gauged fully. Such delay would restrict the growth of the energy harvesting systems.

Energy Harvesting Systems Market Trends

Consumer Electronics to Hold Significant Market Share

- Energy harvesting systems are increasingly used in consumer electronics, such as wearables, smartphones, remote control units, wireless appliances, body implants, etc.

- Moreover, Energy harvesting systems allow consumer electronic products to operate where conventional power sources are unavailable. Such features extend the use and eliminate the geographical constraint for devices to always be near a power source. Such features are driving the use of energy harvesting systems in consumer electro.

- For instance, energy harvesting systems are used in remote control units, where power is harvested from the force applied by the user in pressing the button. Recently, ARM has built such a device with the low power of the ARM Cortex-M0+ processor.

- The energy captured may be used in most wireless applications, body implants, wearables, and other low-power consumption applications. Even if the harvested energy is not enough to power the entire device, it may still be used to extend the life of conventional batteries.

- For example, researchers from the Chinese University of Hong Kong have developed a device that may harvest energy from the human knee during walking without a substantial increase in effort for wearers. The demonstrated device generates up to 1.6 mW of power without significantly changing breathing patterns.

- The proliferation of connected devices and the need for less expensive and reliable energy sources drive the growth of energy harvesting systems in the consumer electronics industry.

North America to Hold the Largest Market Share

- Due to the region's ongoing and rapid technical advancements, North America has emerged as the most critical market for investments in building and home automation, which employ renewable energy and propel the demand for energy harvesting systems.

- The majority of the region's revenue came from the United States. Due to the administration's intention to make the nation an energy-independent state and the thriving industrial and transportation sectors, the industry is anticipated to experience significant expansion.

- Comparatively to other markets, the North American market is seeing a high level of industrial IoT adoption, boosting the need for energy harvesting systems.

- Government programs to reduce energy emissions from outdated and public buildings have also contributed to this growth. For instance, 50 of the federal government's most energy-intensive buildings will have installed sophisticated and smart building technology due to a deal the U.S. General Services Administration signed with IBM.

- Additionally, the smart cities project launch has altered the local market environment. In addition to holding events to promote collaboration and knowledge sharing amongst cities, businesses, and colleges involved in creating smart cities around the nation, this effort also includes various grants and funding packages.

Energy Harvesting Systems Industry Overview

Energy Harvesting Systems Market is very competitive. Among others, ABB Limited and STMicroelectronics NV are the market's two biggest competitors. However, a few new entrants are drawing considerable investments into the industry due to significant advances in product lines.

In September 2022, E-Peas SA and Energous Corporation announced the launch of a new Wireless Energy Harvesting Evaluation Kit, developed for energy harvesting applications for smart buildings/smart homes, industrial IoT medical, and asset trackers for retail and warehouses. The kit includes the company's 1W WattUp PowerBridge transmitter, delivering an over-the-air solution that enables device manufacturers to implement wireless power and energy harvesting across a range of connected devices along with two evaluation boards from e-peas: the AEM30940 RF Evaluation Board and the EP112 Energy Harvesting Optimized Antenna Evaluation Board.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Smart Cities

- 5.1.2 Technology Developments in Manufacturing Industries

- 5.2 Market Challenges

- 5.2.1 High Initial Costs

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Light Energy Harvesting

- 6.1.2 Vibration Energy Harvesting

- 6.1.3 Thermal Energy Harvesting

- 6.1.4 RF Energy Harvesting

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Building and Home Automation

- 6.2.3 Industrial

- 6.2.4 Transportation

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microchip Technology Inc.

- 7.1.2 E-Peas SA

- 7.1.3 EnoCean GmbH

- 7.1.4 ABB Limited

- 7.1.5 Powercast Corporation

- 7.1.6 Advanced Linear Devices Inc

- 7.1.7 Analog Devices Inc

- 7.1.8 STMicroelectronics NV

- 7.1.9 Texas Instruments Incorporated

- 7.1.10 Cypress Semiconductor Corporation

- 7.1.11 Piezo.com