|

市场调查报告书

商品编码

1640596

硅酸钠-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Sodium Silicate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

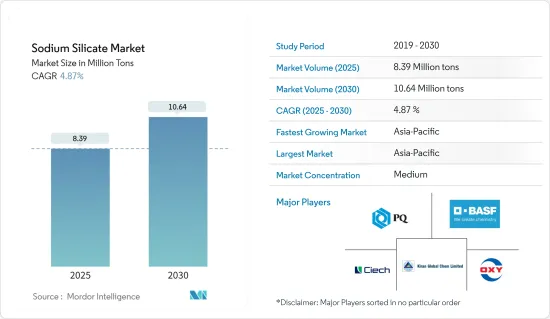

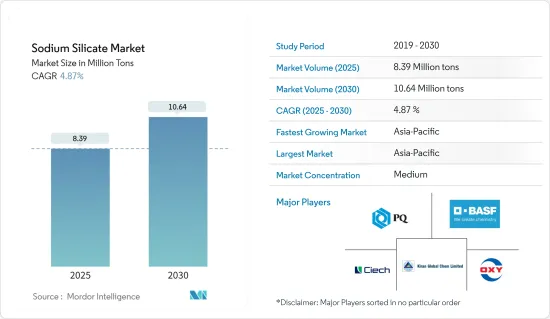

预计 2025 年硅酸钠市场规模为 839 万吨,预估 2030 年将达到 1,064 万吨,预测期内(2025-2030 年)的复合年增长率为 4.87%。

新冠肺炎疫情为市场带来了负面影响。这是因为製造设施和工厂由于封锁和限製而关闭。供应链和运输中断进一步扰乱了市场。但2021年,产业復苏,市场需求回归。

关键亮点

- 从中期来看,再生纸需求的增加以及橡胶和轮胎行业对沉淀二氧化硅的需求的增加是推动市场成长的因素之一。

- 另一方面,严格的政府监管和因硅酸钠的有害影响而增加的健康风险预计将阻碍硅酸钠市场的成长。

- 然而,预计预测期内建筑业的成长将提供许多机会。

- 由于各种应用的需求量很大,亚太地区占据了市场主导地位。

硅酸钠市场趋势

清洁剂市场需求旺盛

- 硅酸钠是一种由二氧化硅和氧化钠组成的无色化合物。用于生产肥皂、清洁剂和硅胶。硅酸钠在清洁剂组合物中的作用是抑製油脂和有机油的腐蚀、碱化和乳化,并降低钙和镁的硬度。

- 许多清洁剂作业都使用硅酸钠进行,包括金属清洗、纺织品加工、洗衣、纸张脱墨,以及清洗餐具、酪农用具、瓶子、地板、机车等。

- 液体清洁剂主要用于清洗衣物,主要有两个最终用户群:住宅和商业。液体清洁剂的需求正在增长,因为它使用起来更方便,而且比粉状清洁剂产生的废物更少。

- 北美目前是全球液体清洁剂需求和消费的主要地区。美国是家用和工业清洁剂的新兴市场之一。例如,根据《Happi》杂誌的报道,截至2022年10月30日的52週内,美国液体清洁剂类别的销售量总合约为6.41亿台。

- 此外,2022 年,汰渍是美国第一大洗衣精品牌,销售额超过 12 亿美元,其次是「Gain」和「All」品牌。所有品牌销售额均突破1亿美元。

- 在德国,由于人们对健康和卫生的关注度日益提高,对洗衣精的需求也日益增加。例如,根据IKW的数据,2022年德国洗衣精和清洁产品的销售额将达到51.4亿欧元(约54.2亿美元),较2021年成长1%。因此,洗衣精消费量的增加预计将促进硅酸钠市场的发展。

- 预计此类应用将增加对硅酸钠的需求。

亚太地区主导硅酸钠市场

- 亚太地区是一个主要的工业地区,拥有多个重工业、工业和小型工业。由于中国和印度等国家对硅酸钠产品的需求很高,预计亚太地区的硅酸钠市场将会成长。

- 中国是世界上最大的水消耗国之一,每年需要6,100亿立方公尺的饮用水添加剂供人类消费量。这是硅酸钠市场的一个潜在驱动力,因为自从硅酸钠被核准作为人类饮用的饮用水添加剂以来,它被广泛用于水处理。例如,2022年6月,专注于水环境治理的环保公司中国光大水务取得山东省淄博市张店东化学工业园区工业污水处理扩建升级计划。该计划将采用建设-运营-转移(BOT)模式运营,每日处理工业污水能力约为5,000立方米。

- 此外,2022年3月中国纸製品及纸板产量为1,246万吨,较2021年3月的1,197万吨产量增加4%。 2022年9月,加工纸和纸板产量约1,160万吨。

- 在韩国,政府透过《2016-2025 年水环境管理总体规划》采取的倡议可能会进一步促进该国的水处理活动,从而在预测期内推动硅酸钠市场的成长。

- 水和污水处理是印尼的主要问题。印尼的水资源量占全球的6%,亚太地区的21% 。处理系统。例如,根据联合国儿童基金会的数据,印尼只有 75% 的人口能够获得水和卫生设施。政府正在不遗余力地建造足够的水处理基础设施,以确保饮用水水资源部门不会落后。为了全面提供水卫生设施,每人每年需要投资 70,000印尼币(5 美元)。雅加达对清洁水的需求预计将从 2017 年的每秒 28 立方公尺(m3/s)增加到 2030 年的每秒 41.6 立方公尺(m3/s)。

- 根据国家统计局预测,2022年中国纸及纸製品製造企业销售收入将超过2,175亿美元,较2021年成长3.59%。此外,根据联合国商品贸易资料库,2022年中国纸和纸板、纸浆、纸和纸板製品出口额为316.3亿美元。因此,这些纸和纸板的出口预计将使硅酸钠市场受益。

- 预计预测期内各行业的成长将推动亚太地区硅酸钠市场的发展。

硅酸钠产业概况

硅酸钠市场本质上呈现部分盘整态势。该市场的主要企业(不分先后顺序)包括 CIECH Group、Kiran Global Chem Limited.、PQ Corporation、 BASF SE、Occidental Petroleum Corporation 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 再生纸需求不断增加

- 橡胶和轮胎产业对沉淀二氧化硅的需求不断增加

- 其他驱动因素

- 限制因素

- 硅酸钠的有害影响

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 类型

- 固体的

- 液体

- 应用

- 黏合剂和涂料

- 清洁剂

- 食品保鲜

- 沉淀二氧化硅

- 造纸

- 水处理

- 其他用途(建筑、金属铸造)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alumina doo Zvornik

- BASF SE

- CIECH Group

- C THAI GROUP

- Evonik Industries AG

- FUJI SILYSIA CHEMICAL LTD.

- Hindcon

- Kiran Global Chem Limited

- Occidental Petroleum Corporation

- PQ Corporation

- Silmaco

- WR Grace & Co.-Conn.

- Z. Ch. Rudniki SA

第七章 市场机会与未来趋势

- 建筑业成长

- 其他机会

The Sodium Silicate Market size is estimated at 8.39 million tons in 2025, and is expected to reach 10.64 million tons by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, the increasing demand for waste paper recycling and increasing demand for precipitated silica from the rubber and tyre industry are some of the factors driving the growth of the market studied.

- On the flip side, stringent government regulations and increased health risks due to the hazardous effects of sodium silicate are expected to hinder the growth of the sodium silicate market.

- However, growth in construction sector is anticipated to provide numerous opportunities over the forecast period.

- Asia-Pacific dominated the market, owing to the high demand from various applications.

Sodium Silicate Market Trends

Detergents Segment to Witness Healthy Demand

- Sodium silicate is a colorless compound of silica and oxides of sodium. It is used in soaps, detergents, and the making of silica gel. The role of sodium silicate in the composition of detergents is to control the corrosion, alkalization, and emulsion of fats and organic oils, and reduce the hardness of calcium and magnesium.

- Many detergent operations are performed using sodium silicates, such as metal cleaning, textile processing, laundering, and de-inking paper, to wash dishes, dairy equipment, bottles, floors, and locomotives.

- Liquid laundry detergent is primarily used in cleaning laundry and has two main end-user segments, namely, residential and commercial. The demand for liquid laundry detergent is growing due to the comfort and ease of application and lesser wastage than detergent powders.

- North America is currently the region leading the global demand and consumption of liquid laundry detergent. The United States is among the developed markets for household and industrial detergents. For instance, according to Happi Magazine, for the 52 weeks that ended October 30, 2022, the liquid laundry detergent category had sales totaling approximately 641 million units in the United States.

- Moreover, in 2022, Tide was the leading unit dose laundry detergent brand in the United States, registering over USD 1.2 billion in sales, followed by the brands "Gain" and "All". The brand, All, had a sales value of over USD 100 million.

- In Germany, due to increasing demand for laundry detergent drugs owing to growing concerns regarding the health and hygienic living among the people. For instance, according to IKW, in 2022, revenue from laundry detergents and cleaning products in Germany amounted to EUR 5.14 billion (~USD 5.42 billion), which showed an increase of 1% compared to 2021. Therefore, increasing the consumption of laundry detergents is expected to create an upside for the sodium silicate market.

- Such aforementioned applications are, in turn, expected to boost the demand for sodium silicate.

Asia-Pacific to Dominate the Market for Sodium Silicate

- Asia-Pacific is a major industrialized region that houses multiple heavy, medium, and small-scale industries. The Asia-Pacific sodium silicate market is expected to experience growth on account of high product demand in China, India, etc.

- China is one of the biggest water consumers worldwide, with a consumption volume of 610 billion cubic meters of drinking water additives for human consumption. This is a potential driver for the sodium silicate market, as sodium silicate has been extensively used in water treatment since its approval as a drinking water additive for human consumption. For instance, in June 2022, an environmental protection company that focuses on water environment management, named China Everbright Water secured the expansion and upgrading project of the ZhangdianEast Chemical Industry Park Industrial Wastewater Treatment in Zibo City, Shandong Province. This project will be operated on a BOT (Build-Operate-Transfer) model, with a designed daily industrial wastewater treatment capacity of around 5 thousand m3.

- Moreover, China produced 12.46 million metric tons of processed paper and cardboard in March 2022, compared to 11.97 million metric tons in March 2021, registering a growth of 4%. In September 2022, the production volume of processed paper and cardboard in the country was around 11.6 million metric tons.

- In South Korea, the government initiative, under the Water Environment Management Master Plan of 2016-2025 plan, is likely to further boost the water treatment activities in the country, which, in turn, will proliferate the sodium silicate market growth during the forecast period.

- Water and wastewater treatment is an important issue in Indonesia. Indonesia's water resources account for 6% of the world's and 21% of Asia-Pacific's water resources, and yet 68% of rivers in Indonesia are heavily polluted due to the discharge of wastewater without treatment, thus, requiring huge investment in water treatments system that will augment the demand sodium silicate market in the country. For instance, according to UNICEF, only 75% of Indonesians have complete water accessibility and sanitation. The government is trying to put significant efforts to build sufficient infrastructure for water treatment so that the drinking water sector is not left behind. An investment of IDR 70 thousand (USD 5.00) per capita per year is needed in the country to ensure fully developed water sanitation. Clean water needs in Jakarta are expected to rise from 28 cubic meters per second (m3/s) in 2017 to 41.6 m3/s by 2030.

- According to the National Bureau of Statistics, paper and paper product manufacturers in China generated a revenue of more than USD 217.5 billion in 2022, which showed an increase of 3.59% compared to 2021. Moreover, according to United Nations COMTRADE database on international trade, China's exports of paper and paperboard, articles of pulp, paper, and board amounted to USD 31.63 billion in 2022. Therefore, these paper and paperboard exports are expected to create an upside for the sodium silicate market.

- Such growth in various industries is expected to drive the market for sodium silicate in the Asia-Pacific region during the forecast period.

Sodium Silicate Industry Overview

The Sodium Silicate Market is partially consolidated in nature. The major players in this market (not in a particular order) include CIECH Group, Kiran Global Chem Limited., PQ Corporation, BASF SE, and Occidental Petroleum Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Waste Paper Recycling

- 4.1.2 Rising Demand for Precipitated Silica from the Rubber and Tyre Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Hazardous Effects of Sodium Silicate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Solid

- 5.1.2 Liquid

- 5.2 Application

- 5.2.1 Adhesives and Paints

- 5.2.2 Detergents

- 5.2.3 Food Preservation

- 5.2.4 Precipitated Silica

- 5.2.5 Paper Production

- 5.2.6 Water Treatment

- 5.2.7 Other Applications (Construction, Metal Casting)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alumina doo Zvornik

- 6.4.2 BASF SE

- 6.4.3 CIECH Group

- 6.4.4 C THAI GROUP

- 6.4.5 Evonik Industries AG

- 6.4.6 FUJI SILYSIA CHEMICAL LTD.

- 6.4.7 Hindcon

- 6.4.8 Kiran Global Chem Limited

- 6.4.9 Occidental Petroleum Corporation

- 6.4.10 PQ Corporation

- 6.4.11 Silmaco

- 6.4.12 W. R. Grace & Co.-Conn.

- 6.4.13 Z. Ch. Rudniki S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Construction Sector

- 7.2 Other Opportunities