|

市场调查报告书

商品编码

1640598

黏胶短纤维:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Viscose Staple Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

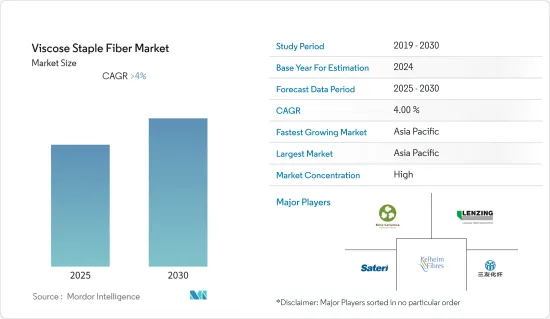

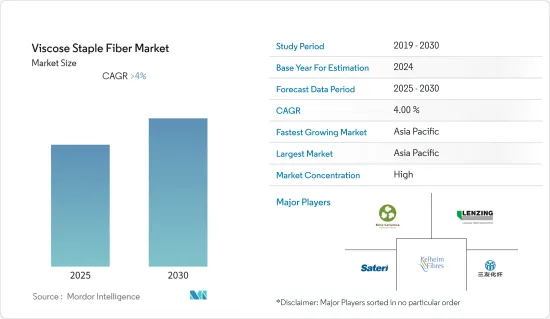

预测期内,粘胶短纤维市场预计将以超过 4% 的复合年增长率成长。

新冠肺炎疫情对各个维度的价值链产生了重大影响。政府的限制措施已导致原材料供应停止。由于多个国家实施封锁,粘胶纤维的价格下跌,迫使兰精集团等许多公司开始在其工厂生产安全口罩,因为製造口罩需要不织布纤维。疫情对市场产生了负面影响,尤其是汽车和服饰应用。然而,2021 年,随着一些公司开始在自己的工厂生产纺织品,该行业略有成长。根据预测,市场预计将实现正成长。

关键亮点

- 短期内,市场将受到时尚服饰领域对黏胶纤维的需求所推动。

- 合成纤维可能会阻碍黏胶纤维的市场扩张。

- 未来的市场机会可能来自于医疗领域高密度纤维的日益广泛的应用。

- 亚太地区占据市场主导地位,预计在估计和预测期内将以最快的复合年增长率成长。

粘胶短纤维市场趋势

纺织纤维需求不断成长

- 天然和生物分解性的粘胶短纤维 (VSF) 或人造棉纤维由木浆和棉状浆製成,两者都具有与棉纤维相似的特性。这些纤维具有延展性和柔韧性,可用于各种应用,包括服饰、家纺、家居装饰、服装材料、机织织物和针织品。

- 预计纺织品和服装需求的增加将推动这些应用对 VSF 的需求。亚太地区是最大的纺织品市场,由于印度和中国等国家的需求不断增长,该市场正在经历健康成长。

- 在印度,随着外国纺织品牌的增多,消费者的偏好不断提升,服装需求也随之增加。数位化、社交网站和应用程式促进了服饰销售的成长。根据美国商务部国际贸易管理局的数据,2021年印度对美国的服装出口成长38.5%,总额达2.0963亿美元。

- 黏胶纤维是最重要的人造纤维素纤维,约占全部人造纤维素纤维79%的市场占有率。

- 孟加拉等小地区人口不断增长、生活水准不断提高,推动了对针织布料的需求。

- 预计预测期内所有上述因素都将增加对黏胶短纤维的需求。

亚太地区可望主导市场

- 由于纱线产量的快速成长,预计预测期内亚太地区将主导 VSF 市场。中国是世界上最大的粘胶短纤维生产国和消费国。

- 中国是世界第一大服饰生产国,棉纺织、合成纤维纺织、丝织等产品生产能力位居世界第一。我国粘胶短纤维产业面临的一个重大问题是存在产能过剩。

- 兰精集团和博拉集团是全球主要製造商,在中国设有生产基地。

- 根据印度投资局预测,到2021年,国内服饰和纺织业将贡献印度国内生产毛额的5%、工业以金额为准的7%和出口收入的12%。印度是世界第六大纺织品和服饰出口国。

- 随着印度取消粘胶纤维反倾销税,未来几年该产业将蓬勃发展。

- 由于印度工资上涨,纺织品生产预计将转移到工资较低的东南亚国协,最终影响中国粘胶短纤维的销售。

- 此外,修订后的技术升级基金计画(ATUFS)和综合纺织工业计画(SITP)等政府支持性法规以及马哈拉斯特拉邦拉邦和哈里亚纳邦为纺织产品提供的资本和运费补贴,均有助于促进纺织业的发展。因此,印度粘胶短纤维市场正在经历强劲成长。

- 预计预测期内所有这些因素都将推动该地区粘胶短纤维市场的成长。

粘胶短纤维产业概况

黏胶短纤维市场较为集中,前五大公司约占60%的市占率。市场的主要企业包括兰精集团、Birla Cellulose、SATERI、新疆中泰化工、唐山三友集团兴达化纤等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 对服装和服饰的需求不断增加

- 棉花价格波动导致黏胶纤维布料的采用增加

- 限制因素

- 与合成纤维的竞争

- 受新冠疫情影响,情势不利(尤其是汽车等终端用户产业)

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 生产流程

- 产品技术进步

第五章 市场区隔(市场规模(基于数量))

- 应用

- 纺织品(纺织品和服装)

- 不织布/特种

- 医疗

- 车

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 其他的

- 巴西

- 阿根廷

- 其他的

- 亚太地区

第六章 竞争格局

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Asia Pacific Rayon Limited

- Birla Cellulose

- Glanzstoff

- Jilin Chemical Fiber Group Co. Ltd

- Kelheim Fibres GmbH

- LENZING AG

- Nanjing Chemical Fibre Co. Ltd

- Sateri

- SNIACE Group

- Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- Yibin Hiest Fibre Limited Corporation(Milan)

- Xinjiang Zhongtoi Chemical Co. Ltd

第七章 市场机会与未来趋势

- 纤维素纤维在医疗应用的使用日益增多

The Viscose Staple Fiber Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic has significantly impacted the value chain in every aspect. Because of the government's limitations, the supply of raw materials came to a standstill. As a result of the lockdowns in several countries, viscose fiber prices have dropped, forcing many companies, such as Lenzing AG, to start making safety masks at their factories, as non-woven fibers are needed for mask manufacturing. The pandemic had a detrimental influence on the market, particularly in automobile and garment applications. However, the industry saw marginal growth in 2021, as several firms have begun to produce woven textiles in their facilities. In the scheduled time, the market is expected to grow positively.

Key Highlights

- In the short term, the market will be driven by the demand for viscose fiber from the fashion apparel sector.

- Synthetic fibers may hamper the market expansion of viscose fibers.

- Future market opportunities will arise from the growing usage of dense fibers in the medical sector.

- The Asia-Pacific region dominated the market and is also estimated to record the fastest CAGR during the forecast period.

Viscose Staple Fibre Market Trends

Increasing Demand for Woven Fibers

- Natural and biodegradable viscose staple fibers (VSF) or artificial cotton fibers are made from wood pulp and cotton pulp, both of which have properties similar to cotton fibers. These fibers are adaptable and pliable and may be used in various applications, including garments, home textiles, home furnishings, dress materials, and woven and knitted.

- Increasing demand for textiles and apparel is expected to drive the demand for VSF in these applications. Asia-Pacific, the largest market for woven fabrics, is witnessing healthy growth due to the increasing demand in countries like India, China, etc.

- In India, the demand for apparel has increased with growing consumer preference in response to growing foreign textile brands. The demand has been augmented by digitalization and social networking sites and apps, which help increase garments sales. Indian apparel exports to the United States climbed by 38.5% in 2021 to a total of USD 209.63 million, according to The International Trade Administration of the U.S. Department of Commerce.

- Viscose is the most critical artificial cellulose fiber, with a market share of around 79% of all man-made cellulose fibers.

- Small regions, such as Bangladesh, have witnessed an increase in population and living standards, driving the demand for knitted fabrics.

- All the factors above are expected to increase the demand for viscose staple fiber during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the VSF market during the forecast period owing to the rapidly increasing yarn production.. China is the largest producer and consumer of viscose staple fiber globally.

- China is the largest clothing producer in the world and has the largest production capacity for textile products consisting of cotton, man-made fibers, and silk. The major problem faced by the Chinese viscose staple fiber industry is the presence of surplus production capacities.

- Lenzing and Birla are some of the major global manufacturers with their production facilities in China.

- According to Invest India, in 2021, India's domestic clothing and textile sector provides 5% of the GDP, 7% of industrial production in value terms, and 12% of export revenues. India is the world's sixth-largest exporter of textiles and clothing.

- With the removal of Anti Dumping Duty on viscose fiber in India, the industry is set to see a growth surge in the coming years.

- There has been an increase in wages in the country due to which the textile production is expected to shift to low-wage ASEAN countries, ultimately affecting the sales of viscose staple fiber in China.

- Additionally, supportive government regulations, such as the Amended Technological Upgradation Fund Scheme (ATUFS) and the Scheme for Integrated Textile Parks (SITP), and capital and freight subsidy on textiles by the states of Maharashtra and Haryana have provided a boost to the industry. This, in turn, has significantly driven the market for viscose staple fiber in India.

- Due to all these factors, the market for viscose staple fiber is expected to grow in the region during the forecast period.

Viscose Staple Fibre Industry Overview

The viscose staple fiber market is consolidated, and the top five manufacturers occupy around 60% of the market. The major players in the market include Lenzing AG, Birla Cellulose, SATERI, Xinjiang Zhongtai Chemical Co. Ltd, and Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Apparels and Clothing

- 4.1.2 Increased Adoption of Viscose Fabrics, due to Ambiguity in Cotton Prices

- 4.2 Restraints

- 4.2.1 Competition from Synthetic Fibers

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19, Especially in End-user Industries like Automotive and Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Process

- 4.6 Technological Product Advancement

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Woven (Textile and Apparel)

- 5.1.2 Non-woven and Specialty

- 5.1.2.1 Healthcare

- 5.1.2.2 Automotive

- 5.1.2.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Other Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share(%)**/Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Asia Pacific Rayon Limited

- 6.3.2 Birla Cellulose

- 6.3.3 Glanzstoff

- 6.3.4 Jilin Chemical Fiber Group Co. Ltd

- 6.3.5 Kelheim Fibres GmbH

- 6.3.6 LENZING AG

- 6.3.7 Nanjing Chemical Fibre Co. Ltd

- 6.3.8 Sateri

- 6.3.9 SNIACE Group

- 6.3.10 Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- 6.3.11 Yibin Hiest Fibre Limited Corporation (Milan)

- 6.3.12 Xinjiang Zhongtoi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Cellulose Fibers in Healthcare Applications