|

市场调查报告书

商品编码

1640624

欧洲智慧製造:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

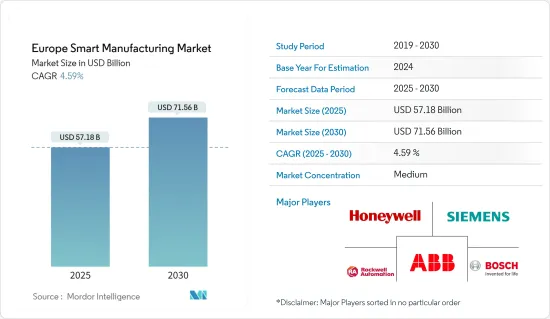

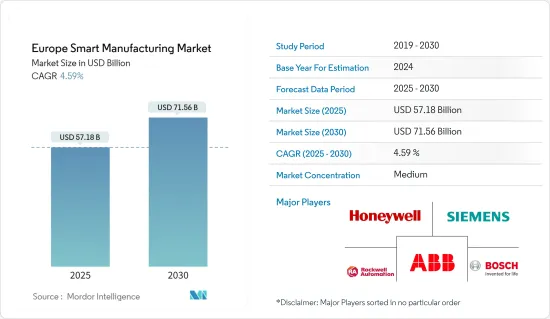

2025年欧洲智慧製造市场规模预估为571.8亿美元,预估至2030年将达715.6亿美元,预测期间(2025-2030年)复合年增长率为4.59%。

根据欧盟委员会的报告,製造业是欧洲经济的强大资产,拥有超过200万家企业和近3,300万个就业机会。该地区的竞争力在很大程度上取决于製造业利用最新的资讯和通讯技术进步提供高品质创新产品的能力。然而,目前缺乏具备智慧製造流程和数位转型技术知识的专业人员,预计将阻碍欧洲智慧製造市场的成长。

主要亮点

- 欧盟的研究与创新 (R&I) 计画大力支持智慧技术和解决方案的开发,使欧洲製造业能够充分利用数位机会。

- 许多计划都是透过未来工厂官民合作关係关係资助的。该伙伴关係旨在透过开发广泛的终端用户产业所需的关键实行技术,帮助欧盟製造商和中小企业应对全球竞争。

- 中小型製造商是德国工业基础的支柱。据悉,德国拥有许多中型製造商,其中90%在B2B市场营运。为促进这一目标,德国政府设立了“中小企业数位化计划”,在相关人员之间建立网络,使中小企业和企业家能够相互学习。这有助于在中小企业中建立对采用工业 4.0 的信任、接受和支持。

- 物联网和机器人等智慧製造技术结合的主要好处之一是机器人可以无错误或故障地工作。因此,预计它将对预测期内的市场成长产生积极影响。此外,这些机器人将透过执行重复性任务来帮助同事,从而促进使用更熟练的劳动力来提高工作品质和生产力。

- 例如,总部位于欧洲的Geesinknorba公司透过製造智慧技术缩短了前置作业时间,提高了45%的生产效率,并增加了40%的产量。除其他措施外,该团队仅用八个月就取得了这一非凡成绩。

- 然而,新冠疫情危机对欧洲汽车产业的影响却十分严重。根据欧洲汽车工业协会(ACEA)2020年4月发布的报告,受危机影响工厂停工导致的产量损失达1,465,415辆。 2021年11月,该地区乘用车註册量跌至1993年以来的最低水平,整个欧洲都出现了两位数的降幅。不过,预计 2021 年下半年销售量将回升。

欧洲智慧製造市场趋势

预测期内,工业机器人技术预计将实现健康成长

- 在工业 4.0 等趋势的推动下,製造机器人正在自动执行重复性任务、减少错误并允许人类工人专注于更有生产力的领域。如今,机器人已被广泛应用于工具机维修、材料移除、码垛和卸垛、物料输送、焊接、气体金属电弧焊接、组装等领域。这催生了汽车和电子製造业。

- 在法国,Groupe Roux-Jourfier 等公司正在使用「协作机器人」来执行完全自动化的流程,并与人类操作员一起执行更复杂的任务。这对于航太业来说尤其重要,因为该行业中的OEM)一直面临着按时完成任务的压力,而这种压力还会转嫁给供应商。

- 在欧洲工业生态系中,国家层级对工业机器人的采用显示了需求和供应的走向。根据IFR关于製造业机器人密度的最新报告,预计预测期内德国的自动化程度将大幅提升。该国每10,000名员工安装了338台机器人。瑞典、丹麦和义大利每10,000名员工拥有的机器人数量也超过200台。

- 随着区域和全球市场对机器人解决方案的需求不断增长,各领先的全球供应商都在寻求扩大产品系列,以满足由于 COVID-19 后市场影响而预期的需求增长。例如,2021 年 2 月,ABB 推出了下一代机器人,将为新领域和首次用户开启自动化时代。预计在预测期内此类发展将会增加。

英国可望占主要份额

- 降低製造成本的需求不断增长以及物联网和机器对机器 (M2M) 技术的应用正在推动该国市场的成长。

- 一项由政府委託的调查显示,随着英国迎接第四次工业革命并迈向脱欧后的未来,英国製造业未来十年可以收回 4550 亿英镑的收入并创造数百万个就业机会。

- 与其他已开发国家相比,英国製造业在机器人和其他自动化方面的投资不足。製造业创新投资约占GDP的1.7%,远低于经合组织2.4%的平均值。

- 此外,采用5G来提高工厂产量预计将成为未来工业4.0的关键进步。例如,2019年2月,位于英国伍斯特的博世工厂安装了感测器和基于5G的技术来监控营运。该工厂将物联网智慧感测器与 5G 结合,实现预测性维护。

欧洲智慧製造概况

欧洲智慧製造市场中等分散,中小型製造商占大部分市场。这些参与者占据了相当大的市场份额,并致力于扩大其在欧洲国家的基本客群。这些参与者正在利用产品开发、策略伙伴关係和其他成长策略来在预测期内扩大市场占有率。

- 2021年2月-IBM宣布与沃达丰葡萄牙公司签署了新的数位转型协议。先前,另一个区域联盟最近宣布将与西班牙电信公司合作,利用混合云转型其企业服务,并与布依格电信合作推动 5G 创新。此次合作不仅体现了通讯业者对 IBM 的深度信任,全部区域的通讯业者来说也正值重要时刻。

- 2021 年 2 月-西门子和 IBM 将合作范围扩大到製造业物联网。两家公司正在扩大现有合作,在 Red Hat OpenShift 平台执行个体上部署西门子託管的物联网 (IoT) 服务 MindSphere。目标是简化建立边缘运算应用程式的过程,以便在建立资料时进行处理和分析。当今製造商使用 MindSphere 收集和分析来自产品、工厂、系统和机器的即时感测器资料。西门子现在希望将这些资料输入到本地而不是云端运行的分析应用程式中。这消除了资料透过广域网路 (WAN)传输时出现的延迟。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 为实现效率和质量,对自动化的需求不断增加

- 数位化规性和政府支持

- 物联网的兴起

- 市场限制

- 资料安全问题

- 高昂的初始实施成本和技术纯熟劳工的短缺阻碍了企业全面采用该技术。

第六章 市场细分

- 依技术分类

- 可程式逻辑控制器(PLC)

- 监控和资料采集 (SCADA)

- 企业资源规划 (ERP)

- 分散式控制系统(DCS)

- 人机介面 (HMI)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 按组件

- 通讯部分

- 控制设备

- 机器视觉系统

- 机器人

- 感应器

- 按最终用户产业

- 车

- 石油和天然气

- 化工和石化

- 药品

- 饮食

- 金属与矿业

- 按国家

- 英国

- 法国

- 德国

- 俄罗斯

- 西班牙

- 义大利

第七章 竞争格局

- 公司简介

- ABB Ltd

- Emerson Electric Co.

- Fanuc Corporation

- IBM Corporation

- Schneider Electric SE

- Siemens AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- General Electric Company

- Robert Bosch GmbH

第八章投资分析

第九章 市场机会与未来趋势

The Europe Smart Manufacturing Market size is estimated at USD 57.18 billion in 2025, and is expected to reach USD 71.56 billion by 2030, at a CAGR of 4.59% during the forecast period (2025-2030).

According to the European Commission's report, the manufacturing sector is a strong asset of the European economy, accounting for over 2 million enterprises and nearly 33 million jobs. The region's competitiveness is highly dependent on the ability of the manufacturing sector to provide high-quality, innovative products through the latest advancements in ICT. However, currently, there is a skill gap within professionals with knowledge of smart manufacturing processes and digital transformation technologies, which is expected to impede the growth of the European smart manufacturing market.

Key Highlights

- The European Union's research and innovation (R&I) programs have firmly supported the development of smart technologies and solutions that enable the European manufacturing industry to take full advantage of digital opportunities.

- Many projects are financed by the 'Factories of the Future Public-Private Partnership,' which aims to help EU manufacturing companies and SMEs face worldwide competition by developing the required key enabling technologies across a broad range of end-user industries.

- The backbone of Germany's industrial base is the mid-sized manufacturers. Reportedly, the country hosts many mid-size manufacturers, 90% of which operate in the business-to-business markets. To encourage this, the Government of Germany has created the Mittelstand-Digital Initiative, in part in recognition, which creates networks between stakeholders, through which SMEs and entrepreneurs can learn from each other. This has helped develop trust, acceptance, and buy-ins among SMEs regarding Industry 4.0 adoption.

- One of the major benefits of integrating smart manufacturing technologies such as IoT and robotics is that robots can work without having any errors or glitches. As a result, it is expected to positively impact market growth over the forecast period. Moreover, these robots help the co-worker by doing repetitive tasks and thus drive for the use of a more skilled workforce to improve the quality of work and productivity.

- For instance, Europe-based Geesinknorba, through smart technologies in manufacturing, achieved decreased lead-time, increased production efficiency by 45%, and increased the production output by 40%. With a set of other measures, it took the team only eight months to achieve these remarkable results.

- However, the impact of the COVID-19 crisis on the European automobile sector is severe. Factory shutdowns because of the crisis have resulted in lost production amounting to 1465,415 motor vehicles, as stated by the European Automobile Manufacturers' Association (ACEA) in April 2020. In November 2021, the region saw the lowest passenger car registration since 1993, and double-digit losses were recorded across Europe. However, sales recovery was expected by late 2021.

Europe Smart Manufacturing Market Trends

Industrial Robotics Technology is Expected to Experience a Healthy Growth over the Forecast Period

- With a trend like Industry 4.0, Manufacturing robots automate repetitive tasks, reduce margins of error, and enable human workers to focus on productive areas of operation. Currently, robots are being deployed for machine tool tending, material removal, palletization and de-palletizing, material handling, welding, gas metal arc welding, and assembly, to name a few. This has created automotive and electronics in manufacturing activities.

- In France, firms like Groupe Roux-Jourfier are enabling companies to incorporate "collaborative robotics" into their plants to perform entirely automatic processes and to work collaboratively alongside human operators to perform more complex tasks. This is particularly essential for the aerospace industry, where OEMs are always under pressure to deliver products in time, and hence, transfer this pressure to suppliers.

- In the European industry ecosystem, country-level adoption of industrial robots is indicative of demand and supply destinations. According to IFR's latest report on robot density in the manufacturing industry, Germany is expected to witness an automation surge over the forecast period. The country has 338 robots installed per 10,000 employees. Sweden, Denmark, and Italy also have more than 200 robots per 10,000 employees.

- With the growing demand for robotic solutions in the region and global markets, various major global vendors are looking to expand their product portfolio to cater to the expected growth in demand from the post-COVID-19 effects in the market. For instance, in February 2021, ABB launched its next generation of robots to unlock automation for new sectors and first-time users. Such developments are expected to increase over the forecast period.

The United Kingdom is Expected to Hold a Significant Share

- The rising requirement to reduce manufacturing costs and applications of the Internet of Things and machine-to-machine (M2M) technologies are fueling the growth of the market in the country.

- According to a government-commissioned review, the manufacturing sector in the country can unlock GBP 455 billion over the next decade and create a significant number of job opportunities if it cracks the fourth industrial revolution and carves out a successful post-Brexit future.

- Compared with other developed countries, the UK manufacturing sector has underinvested in robotics and other forms of automation. It invests around 1.7% of its GDP into manufacturing innovation, well behind the OECD average of 2.4%.

- Furthermore, the adoption of 5G to boost factory output is expected to be a significant advancement in the future of Industry 4.0. For instance, in February 2019, Bosch's factory in Worcester, United Kingdom, was fitted with sensors and 5G-based technology for monitoring its operations. The factory has combined IoT smart sensors and 5G for preventative maintenance.

Europe Smart Manufacturing Industry Overview

The European smart manufacturing market is moderately fragmented, with a large number of small- and medium-sized manufacturers that account for a major part of the share. These players hold a significant share in the market and focus on expanding their customer base across European countries. These players are leveraging product development, strategic partnerships, and other growth strategies to increase their market shares during the forecast period.

- February 2021 - IBM announced that it signed a new digital transformation agreement with Vodafone Portugal. This builds on another regional momentum it recently announced with Telefonica to transform its enterprise offerings to take advantage of hybrid cloud and work with Bouygues Telecom to drive 5G innovation. Not only do these collaborations underscore the deep trust leading that telcos are continuing to place in IBM, but these also come at a crucial point in time for telcos across the EMEA region.

- February 2021 - Siemens and IBM extend alliance to IoT for manufacturing. The companies expanded an existing alliance to include deployments of MindSphere, a managed internet of things (IoT) service provided by Siemens, on an instance of the Red Hat OpenShift platform. The goal is to make it simpler to build edge computing applications that process and analyze data as it is being created. Manufacturers currently use MindSphere to collect and analyze real-time sensor data from products, plants, systems, and machines. Siemens now wants to feed that data into analytics applications that run locally versus in the cloud. This will eliminate latency that would otherwise be created when data is transferred over a wide area network (WAN).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation to Achieve Efficiency and Quality

- 5.1.2 Need for Compliance and Government Support for Digitization

- 5.1.3 Proliferation of Internet of Things

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Data Security

- 5.2.2 High Initial Installation Costs and Lack of Skilled Workforce Restricting Enterprises from Full-scale Adoption

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Programmable Logic Controller (PLC)

- 6.1.2 Supervisory Controller and Data Acquisition (SCADA)

- 6.1.3 Enterprise Resource and Planning (ERP)

- 6.1.4 Distributed Control System (DCS)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Product Lifecycle Management (PLM)

- 6.1.7 Manufacturing Execution System (MES)

- 6.2 Component

- 6.2.1 Communication Segments

- 6.2.2 Control Devices

- 6.2.3 Machine Vision Systems

- 6.2.4 Robotics

- 6.2.5 Sensors

- 6.3 End-user Industry

- 6.3.1 Automotive

- 6.3.2 Oil and Gas

- 6.3.3 Chemical and Petrochemical

- 6.3.4 Pharmaceutical

- 6.3.5 Food and Beverage

- 6.3.6 Metals and Mining

- 6.4 Country

- 6.4.1 United Kingdom

- 6.4.2 France

- 6.4.3 Germany

- 6.4.4 Russia

- 6.4.5 Spain

- 6.4.6 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Electric Co.

- 7.1.3 Fanuc Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Schneider Electric SE

- 7.1.6 Siemens AG

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 Honeywell International Inc.

- 7.1.9 General Electric Company

- 7.1.10 Robert Bosch GmbH