|

市场调查报告书

商品编码

1640632

菲律宾塑胶:市场占有率分析、行业趋势和成长预测(2025-2030 年)Philippines Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

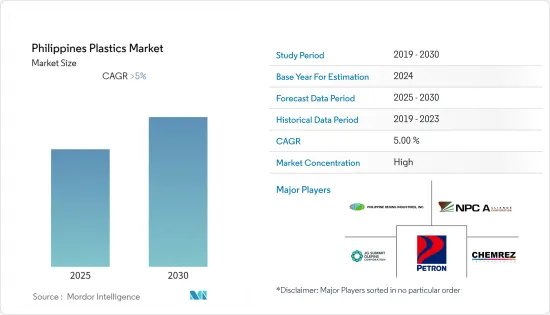

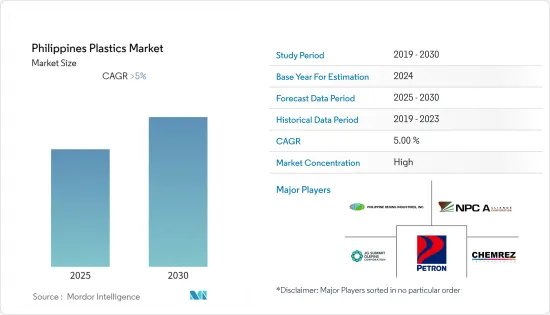

预计预测期内菲律宾塑胶市场的复合年增长率将超过 5%。

受新冠疫情影响,汽车与运输、建筑与施工、消费品和电子产品等各终端用户产业因封锁和贸易问题而暂停营运。然而,由于电子商务和智慧包装市场的蓬勃发展,包装产业也见证了显着的成长率。食品和医疗保健产业也出现成长。这些因素影响了菲律宾终端用户产业的塑胶消费。

主要亮点

- 短期内,包装、电气电子、建筑等终端用户产业的需求不断成长,推动市场成长。

- 然而,过度依赖原料和成品塑胶的进口是预测期内抑制目标产业成长的主要因素。

- 然而,创新的应用/产品很可能很快就会为全球市场创造有利可图的成长机会。

菲律宾塑胶市场趋势

主导市场的射出成型技术

- 射出成型是将熔融的塑胶材料注射入模具中,经冷却固化而获得成型品的成型方法。

- 射出成型通常使用原始树脂或高品质工程树脂。高性能塑胶托盘一般采用射出成型製成。射出成型是一个相对资本密集的过程。但它的优点是能够高速处理。

- 因此射出成型有利于塑胶托盘的批量生产。射出成型工艺用于线轴、包装、瓶盖、汽车仪表板、小梳子等。

- 全球汽车、包装和化学加工行业的快速成长预计将为射出成型提供利润丰厚的市场。

- 根据 OICA 的数据,2021 年汽车总产量达到 83,852 辆,而 2020 年为 67,297 辆,成长了 25%。

- 菲律宾优越的地理位置和易于接触亚太地区快速成长的终端用户的优势预计将导致射出成型塑胶托盘的消费量大幅增加。

- 菲律宾政府旨在减少塑胶垃圾的立法和回收改革将进一步加强射出成型流程的市场前景。

- 由于各终端用户产业的需求不断增加,预计预测期内射出成型市场将会成长。

包装产业的需求不断增长

- 包装是菲律宾塑胶市场最大的应用领域。推动工程塑胶扩展到包装应用的关键因素是其耐化学性、耐磨性、易成型性、可回收性、抗穿刺性和高机械强度。

- 聚对苯二甲酸乙二醇酯 (PET) 是一种主要用于食品和饮料行业包装的塑胶。 PET 用于食品包装的其他原因包括其处理危害低、毒性低、不含双酚 A (BPA) 和重金属。

- 据菲律宾港务集团称,2021 年菲律宾食品和饮料服务业创造的总增加值达到约 2,230.2 亿菲律宾比索(40 亿美元)。

- PET 用于製作贝壳包装、烘焙容器、外带容器、微波食品托盘、汽水瓶和其他包装。其他应用包括洗髮精、洗手液、食用油等的包装。

- 根据美国农业部的调查,2021年菲律宾的棕榈油消费量将达到约120万吨。

- 对便携式包装和加工食品及软性饮料的需求不断增长,推动了硬质塑胶容器的使用。罐头因其便携性和便利性在食品和非酒精饮料行业中很受欢迎,这可能会继续推动对这种包装材料的需求。

- 预测期内,容器、塑胶袋、罐子和餐具等家庭和商务用应用的不断增长预计将推动包装领域对塑胶的消费需求。

- 上述因素将导致预测期内菲律宾的塑胶消费需求增加。

菲律宾塑胶行业概况

菲律宾塑胶市场已经整合。市场的主要企业(不分先后顺序)包括 JG Summit Petrochemicals Group、Chemrez Technologies、NPC Alliance Corporation、Petron Corporation 和 Philippine Resins Industries Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 终端用户产业需求不断成长

- 其他驱动因素

- 限制因素

- 过度依赖原料和塑胶成品的进口

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 按类型

- 传统塑料

- 工程塑料

- 生质塑胶

- 依技术分类

- 吹塑成型

- 挤压

- 射出成型

- 其他技术

- 按应用

- 包装

- 电气和电子

- 建筑和施工

- 汽车和运输

- 家具和床上用品

- 其他用途

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Chemrez Technologies Inc.

- Dupont

- JG Summit Petrochemicals Group

- LyondellBasell Industries Holdings BV

- Nan Ya Plastics Corporation(Formosa Plastics Corporation)

- NPC Alliance Corporation

- Philippine Polypropylene Inc.(Petron)

- Philippine Resins Industries Inc.(Tosoh Corporation)

- SGS Philippines Inc.

- Sumitomo Chemical Co. Ltd

第七章 市场机会与未来趋势

- 创新应用/产品

- 其他机会

The Philippines Plastics Market is expected to register a CAGR of greater than 5% during the forecast period.

Due to the COVID-19 impact, various end-user industries, such as automotive and transportation, building and construction, consumer goods, and electronics, went into a temporary shut-down phase due to lockdowns and trade issues. However, the packaging industry showed a significant growth rate due to the booming e-commerce business and smart packaging market. It saw increased growth in the food and healthcare industry. Such factors have affected the consumption of plastics in these end-user industries in the Philippines.

Key Highlights

- Over the short term, growing demand from end-user industries, such as packaging, electrical and electronics, and construction major factor is driving the growth of the market studied.

- However, over-reliance on imports of raw materials and finished plastics is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the innovative applications/products is likely to create lucrative growth opportunities for the global market soon.

Philippines Plastic Market Trends

Injection Molding Technology to Dominate the Market

- Injection molding is a method to obtain molded products by injecting plastic materials molten by heat into a mold and then cooling and solidifying them.

- Injection molding is mostly done using virgin or high-quality processing resins. High-performance plastic pallets are usually injection molded. Injection molding is a relatively capital-consuming process. However, it offers the advantage of high-speed processes.

- Therefore, injection molding is beneficial in the bulk production of plastic pallets. Injection molding processes are used in wire spools, packaging, bottle caps, automotive dashboards, pocket combs, etc.

- The rapid growth of local automotive, packaging, and chemical processing industries worldwide is expected to provide a favorable market for injection molding.

- According to OICA, the total production of motor vehicles reached 83,852 units in 2021 and registered a growth of 25% when compared to 67,297 units in 2020.

- Due to the advantageous geographical location of the Philippines and easy access to the rapidly growing Asia-Pacific end users, the consumption of injection-molded plastic pallets is expected to increase drastically.

- The Philippine government's legislation and recycling reforms to reduce plastic litter further strengthen the market scenario for injection molding manufacturing processes.

- Due to the increasing demand from various end-user industries, the market for injection molding is projected to grow during the forecast period.

Growing Demand from Packaging Industry

- Packaging is the largest application segment in the Philippine plastics market. The primary factors for the growing application of engineering plastics in the packaging segment are better chemical and wear resistance, ease of molding, recyclability, puncture resistance, and high mechanical strength.

- Polyethylene terephthalate (PET) is a plastic that is mostly used for packaging purposes in the food and beverage industry. In addition, low handling hazards, low toxicity, and the absence of bisphenol A (BPA) and heavy metals are some of the other factors that allow PET to be used for food packaging.

- According to the PSA Philippines , the gross value added generated from the food and beverage service activities industry in the Philippines amounted to around PHP 223.02 billion (USD 4.00 billion) in 2021.

- PETs are used for making clamshells, bakery and take-out containers, microwaveable food trays, carbonated soft drink bottles, and other packages. Other applications include packaging materials for shampoo, handwash, cooking oil and more products.

- According to the survey by the US Department of Agriculture, the consumption of palm oil in the Philippines amounted to approximately 1.2 million metric tons in 2021.

- Rising demand for packaged and processed foods and soft drinks in portable and convenient formats is driving the use of rigid plastic containers. The high popularity of cans in food and non-alcoholic beverages industries for their portability and convenience may continue to drive the demand for this packaging material.

- Increasing household and commercial applications for containers, plastic bags, canisters, and tableware, are expected to drive the consumption demand for plastics in the packaging sector during the forecast period.

- The aforementioned factors are contributing to the increasing demand for philippines plastics consumption in the region during the forecast period.

Philippines Plastic Industry Overview

The Philippine plastics market is consolidated in nature. The major players in the market (not in any particular order) include JG Summit Petrochemicals Group, Chemrez Technologies, NPC Alliance Corporation, Petron Corporation, and Philippine Resins Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from End-user Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Over-reliance on Imports of Raw Materials and Finished Plastics

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Furniture and Bedding

- 5.3.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemrez Technologies Inc.

- 6.4.2 Dupont

- 6.4.3 JG Summit Petrochemicals Group

- 6.4.4 LyondellBasell Industries Holdings BV

- 6.4.5 Nan Ya Plastics Corporation (Formosa Plastics Corporation)

- 6.4.6 NPC Alliance Corporation

- 6.4.7 Philippine Polypropylene Inc. (Petron)

- 6.4.8 Philippine Resins Industries Inc. (Tosoh Corporation)

- 6.4.9 SGS Philippines Inc.

- 6.4.10 Sumitomo Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovative Applications/Products

- 7.2 Other Opportunities