|

市场调查报告书

商品编码

1640643

阻燃化学品-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

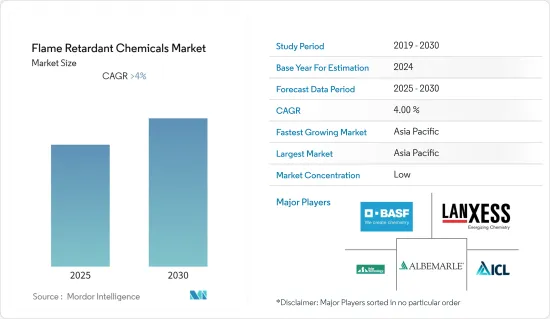

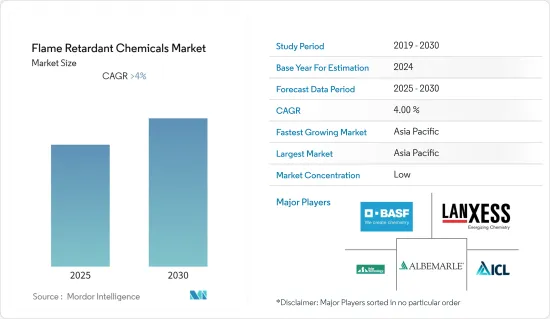

预测期内,阻燃化学品市场预计将以超过 4% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。然而,建筑业正在迅速復苏,预计未来几年将会成长,刺激阻燃化学品市场的需求。

关键亮点

- 短期内,亚太地区基础设施活动的增加、建筑工程安全标准的提高以及消费电气和电子产品製造业的成长预计将推动市场成长。

- 关于卤化阻燃剂的环境和健康问题以及氢氧化物不适合高温应用预计会阻碍市场的成长。

- 人们对环保阻燃剂的认识不断提高以及对非卤化阻燃剂的积极研究和开发预计将为市场带来有利机会。

- 由于建设活动活跃,亚太地区在全球市场占据主导地位。

阻燃剂市场趋势

建筑业占据市场主导地位

- 家庭火灾是造成人员伤亡的主要原因之一。由于严格的消防安全法规,建筑材料和产品中都使用了阻燃剂。在建筑物中,阻燃剂主要用于结构隔热材料。住宅和其他建筑物中使用隔热材料来保持舒适的温度并节省能源。

- 预计预测期内中国整体建筑业实际成长4.6%。根据中国国家统计局发布的报告,2022年上半年建筑投资成长6.7%。

- 印度政府已于2021年推出国家基础设施计画(NIP),计画投资1.4兆美元,其中24%用于可再生能源,19%用于道路和高速公路,13%用于铁路,20%用于基础建设.城市基础设施占16%。

- 美国拥有庞大的建筑业,在商业、工业、机构、住宅、基础设施、能源和公共工程建设中发挥关键作用。 2022年1月建筑支出经季节性已调整的后预估年率为1,6772亿美元。此外,美国2 月建筑支出较 2022 年 1 月经季节性已调整的后的年率 1.677 兆美元增加 1.3%。

- 预计未来几年全球建筑业在中东和非洲等地区的成长速度将会加快。这反映了沙乌地阿拉伯、阿联酋和卡达在基础建设方面投入的巨额投资。为了减少对石油的依赖,沙乌地阿拉伯在其「2030愿景」计画中启动了各种建设和城市发展计划。

- 德国拥有欧洲最大的建筑业。该国建筑业继续以温和的速度成长,主要原因是住宅建设增加。预计预测期内该国的非住宅和商业建筑将显着增长。较低的利率、不断上升的实际可支配收入以及欧盟和德国政府的大量投资将支持这一成长。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率的主导地位。在亚太地区,中国和印度预计将主导市场成长,因为它们在建筑、交通等关键领域进行了大量投资。

- 中国航太业预计将在先前大幅下滑后于2022年恢復获利。中国民航局估计,航空业国内客运量将恢復到疫情前水准的85%左右。

- 亚太航空中心(CAPA)印度分部在其题为《2022年印度航空业展望》的报告中预测,2022年国内航空旅客数量将激增52%,国际航空旅客数量将激增60%。 2022财年国内航空旅客数量将达4,822万人次。此外,2021 年印度旅客在航空运输上的支出预计为 1,360 亿美元。政府正试图透过增加国内机场数量来满足空中交通需求。

- 日本汽车经销商协会称,660cc以上新车销量下降2.9%至2,795,818辆。根据轻型汽车协会统计,同年轻型汽车销量下降3.8%至1,652,522辆。

- 根据国际贸易组织统计,2021年韩国国内医疗设备产量为112.57亿美元。医疗设备出口额为86.29亿美元,自美国进口额为53.53亿美元。

- 随着2030年国家航太工业蓝图的实施,马来西亚航太工业的成长势头强劲。过去十年,该行业已经历了平均5%的成长率。空中巴士预计马来西亚将继续成为其供应链的核心,并预计到2023 年,其在马来西亚的供应、采购和MRO 业务将增长至每年12 亿美元,这得益于该地区强劲的飞机需求。将这一数字提高到5.5亿美元。预计航太业的这种压倒性情况将有助于低摩擦被覆剂市场在预测期内实现非常健康的成长率。

阻燃化学品产业概况

阻燃化学品市场是一个分散的市场,五大主要企业占了相当大的份额。主要企业(不分先后顺序)包括 ICL 集团、朗盛、BASF、雅保集团和江苏雅克科技。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区基础建设不断加强

- 提高建筑施工安全标准

- 消费性电子电气製造业成长

- 限制因素

- 关于溴化和卤化阻燃剂的环境和健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监理政策分析

- 原料分析

- 技术简介

第五章 市场区隔

- 产品类型

- 无卤阻燃剂

- 无机

- 氢氧化铝

- 氢氧化镁

- 硼化合物

- 磷光

- 氮

- 其他的

- 卤素阻燃化学品

- 溴化合物

- 氯化化合物

- 无卤阻燃剂

- 最终用户产业

- 电气和电子

- 建筑和施工

- 运输

- 纺织品和家具

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Albemarle Corporation

- Apexical Inc.

- BASF SE

- Clariant

- DAIHACHI CHEMICAL INDUSTRY CO. LTD

- DIC CORPORATION

- Dow

- Eti Maden

- ICL Group

- Italmatch Chemicals SpA

- JM Huber Corporation

- Jiangsu Jacques Technology Co. Ltd

- Kemipex

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- Nyacol Nano Technologies Inc.

- RIN KAGAKU KOGYO Co. Ltd

- RTP Company

- Sanwa Chemical Co. Ltd

- Shandong Brother Sci. & Tech. Co. Ltd

- Thor

- Tor Minerals International Inc.

- Tosoh Corporation

- UFP Industries Inc.

第七章 市场机会与未来趋势

- 人们对环保阻燃剂的认识不断提高

- 积极研发无卤阻燃剂

The Flame Retardant Chemicals Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. However, the construction industry is recovering fast and is estimated to rise in the coming years, which will stimulate the demand for the flame retardant chemical market.

Key Highlights

- Over the short term, increasing infrastructure activities in Asia-Pacific, a rise in safety standards in building construction, and rising consumer electrical and electronic goods manufacturing are expected to drive the market's growth.

- Environmental and health concerns regarding halogenated flame retardants and the non-suitability of hydroxides for high-temperature applications are expected to hinder the market's growth.

- Rising awareness regarding environment-friendly flame retardants and active R&D into non halogenated flame retardants are expected to act as market oppurtunities.

- Asia-Pacific dominates the market across the world due to the high construction activities in the region.

Flame Retardant Chemicals Market Trends

Building and Construction Segment to Dominate the Market

- Household fires are one of the biggest causes of the loss of human life. Due to strict fire safety regulations, flame retardants are used in building materials and products. In buildings, flame retardants are majorly used in structural insulation. Insulations are used in homes and other buildings to maintain a comfortable temperature and to conserve energy.

- The overall Chinese construction industry is expected to increase by 4.6% in real terms in the forecast period. According to the report published by the National Bureau of Statistics of China, construction investment increased by 6.7% in the first half of 2022.

- The Indian government launched National Infrastructure Pipeline (NIP) in 2021, under which investment of 1.4 trillion USD is planned in which the further bifurcation is 24% on renewable energy, 19% on roads and highways, 13% on railways, and 16% on urban infrastructure.

- The United States boasts a colossal construction sector that plays a prominent role in commercial, industrial, institutional, residential, infrastructure, energy, and utility construction. The construction spending during January 2022 was estimated at a seasonally adjusted annual rate of USD 1,677.2 billion. Further, construction spending in the United States rose 1.3% in February, as compared to a seasonally adjusted annual rate of USD 1.677 trillion in January of 2022.

- The pace of growth in the global construction industry is expected to increase during the coming years in regions such as the Middle East and Africa. This reflects the huge investment in building and infrastructure that is taking place in Saudi Arabia, the United Arab Emirates, and Qatar. In order to reduce dependence on the oil economy, Saudi Arabia launched various construction and city development projects as part of Vision 2030.

- Germany has the largest construction industry in Europe. The construction industry in the country has been growing at a slow pace, majorly driven by increasing new residential construction activities. The non-residential and commercial buildings in the country are expected to witness significant growth prospects during the forecast period. The growth is likely to be supported by lower interest rates, an increase in real disposable incomes, and numerous investments by the European Union and the German government.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share. In the Asia Pacific region, China and India are expected to dominate the market's growth because of large investments in key sectors such as construction, transportation, etc.

- China's aerospace industry is projected to return to profitability in 2022 after facing a significant decline in the previous years. The Civil Aviation Administration of China (CAAC) has estimated the aviation sector to recover domestic traffic to around 85% of pre-pandemic levels.

- The Centre for Asia Pacific Aviation (CAPA) India, in a report titled India Airline Outlook 2022, indicated that 2022 was expected to see a surge of 52% in domestic and 60% in international air traffic. The air passenger traffic in FY 2022 stood at 48.22 million in the country. Furthermore, the estimated expenditure of Indian travelers through air transport stood at USD 136 billion in 2021. The government is trying to cater to air traffic by increasing the number of airports in the country.

- According to the Japan Automobile Dealers Association, sales of new vehicles larger than 660 CC slipped by 2.9% to 2,795,818 units. The Japan Light Motor Vehicle and Motorcycle Association reported that sales of mini-vehicles fell by 3.8% to 1,652,522 units in the same year.

- As per the International Trade Administration, in 2021, the local production of medical devices in South Korea was valued at USD 11,257 million. The exports of medical devices stood at USD 8,629 million, while the imports from the United States stood at USD 5,353 million.

- The growth in the Malaysian aerospace industry is gaining momentum with the implementation of the National Aerospace Industry Blueprint 2030. The industry is already growing at an average of 5% over the past decade. Airbus, which expects Malaysia to remain its focal point in its supply chain, is looking to increase the value of its supply, source, and MRO operations here to USD 550 million a year by 2023, driven by robust demand for aircraft in the region. This overwhelming scenario in the aerospace industry is projected to aid the low-friction coatings market to exercise very healthy growth rates over the forecast period.

Flame Retardant Chemicals Industry Overview

The flame retardant chemicals market is a fragmented market, with the top five players accounting for a significant share in the market studied. The major companies (in no particular order) include ICL Group, LANXESS, BASF SE, Albemarle Corporation, and Jiangsu Yoke Technology Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Infrastructure Activities in Asia-Pacific

- 4.1.2 Rise in Safety Standards in Building Construction

- 4.1.3 Rising Consumer Electrical and Electronic Goods Manufacturing

- 4.2 Restraints

- 4.2.1 Environmental and Health Concerns Regarding Brominated and Halogenated Flame Retardants

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

- 4.6 Raw Material Analysis

- 4.7 Technical Snapshot

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Non-halogenated Flame Retardant Chemicals

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus

- 5.1.1.3 Nitrogen

- 5.1.1.4 Other Product Types

- 5.1.2 Halogenated Flame Retardants Chemicals

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-halogenated Flame Retardant Chemicals

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Apexical Inc.

- 6.4.3 BASF SE

- 6.4.4 Clariant

- 6.4.5 DAIHACHI CHEMICAL INDUSTRY CO. LTD

- 6.4.6 DIC CORPORATION

- 6.4.7 Dow

- 6.4.8 Eti Maden

- 6.4.9 ICL Group

- 6.4.10 Italmatch Chemicals SpA

- 6.4.11 J.M. Huber Corporation

- 6.4.12 Jiangsu Jacques Technology Co. Ltd

- 6.4.13 Kemipex

- 6.4.14 LANXESS

- 6.4.15 MPI Chemie BV

- 6.4.16 Nabaltec AG

- 6.4.17 Nyacol Nano Technologies Inc.

- 6.4.18 RIN KAGAKU KOGYO Co. Ltd

- 6.4.19 RTP Company

- 6.4.20 Sanwa Chemical Co. Ltd

- 6.4.21 Shandong Brother Sci. & Tech. Co. Ltd

- 6.4.22 Thor

- 6.4.23 Tor Minerals International Inc.

- 6.4.24 Tosoh Corporation

- 6.4.25 UFP Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness Regarding Environment-friendly Flame Retardants

- 7.2 Active R&D into Non-halogenated Flame Retardants