|

市场调查报告书

商品编码

1640658

绿色资料中心-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

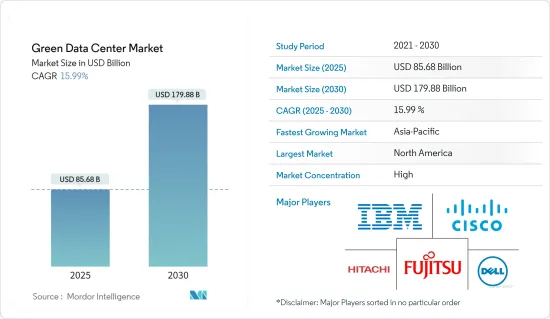

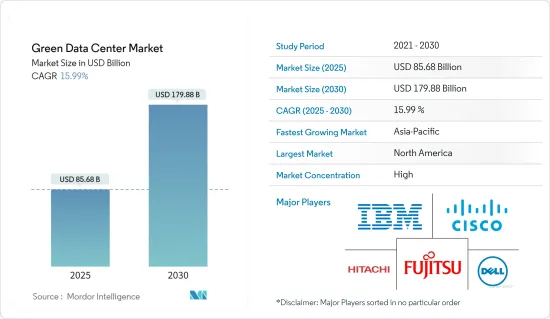

2025年绿色资料中心市场规模预估为856.8亿美元,预估至2030年将达1,798.8亿美元,预测期间(2025-2030年)复合年增长率为15.99%。

关键亮点

- 全球绿色资料中心市场规模预计将在未来五年内从目前的576.3亿美元增加到1,200亿美元。多年来,人们对资料中心所消耗能源份额不断增加的担忧已警告世界各国政府要规范能源消耗,这被认为是推动绿色资料中心市场的主要因素。资料中心和主机代管服务的成长是推动绿色资料中心的另一个因素。

- 随着云端运算变得更加节能并且更依赖可再生能源,製造业、运输业和建筑业等其他行业也将转向绿色资料中心以减少排放。例如,汽车製造商可以将其所有内部计算委託给零排放资料中心。

- 对资料储存和储存空间的不断增长的需求是推动绿色资料中心需求的关键因素。据华为称,预测期内全球资料中心需求估计值将成长三到十倍。绿色资料中心为资料储存和节能资料了实用、环保的解决方案。前景光明,我们预计会看到强劲的需求。

- 此外,随着人工智慧(AI)、机器学习(ML)、巨量资料和物联网(IoT)的兴起,全球资料中心的电力消耗量只会增加,这也支持了对绿色资料中心的需求. 这是一个促进因素。根据国际能源总署(IEA)的数据,资料中心占全球电力消耗的1-1.5%。因此,高度关注能源效率可能会推动市场发展。

- 儘管长期来看可以节省开支并带来投资回报,但可再生能源资料中心的前期投资成本很高。建设节能的绿色资料中心的初期投资比传统资料中心高。要改变现有的基础设施,企业将需要做出更大的投资,这将是一个负担。然而,即使改善拥有成本和长期节省可以收回最初的投资,企业仍然热衷于投资绿色资料中心。

- 由于云端资料资料服务的资料、对资料中心自动化的依赖增加、推动硬体重用作为关键驱动因素以及资料中心硬体再行销的不断增长等因素,COVID-19 导致绿色资料中心市场发生了巨大转变。将推动需求。鑑于新冠疫情提高了人们的环保意识,以及组织间资料流量和巨量资料分析的增加,即使在疫情结束后,这一趋势仍将继续增长。

绿色资料中心市场趋势

电力领域占据主要市场占有率

- 建立绿色资料中心是为了最大限度地提高能源效率并减少对环境的影响。资料中心的电力消耗和冷却问题是全球企业面临的两个最重大挑战,随着对这些领域的大量投资,提高能源效率是一项主要需求。控制这些营运成本对于改善业务营运和维持市场竞争力至关重要。

- 电力在绿色资料中心投资中发挥关键作用。低功耗和有效的解决方案均能帮助企业实现目标。使用变速风扇是减少资料中心能耗的一种方法。最近的研究表明,降低中央处理器 (CPU) 风扇速度可以减少 20% 的功耗。因此,企业应该采用变速风扇来冷却资料中心设备并减少能源使用。

- 资料中心的能源成本超过了机房和支援设备的全部投资。然而,最近的研究表明,由于美国和欧洲等成熟市场采取了有效的绿色效率措施,这一趋势正在放缓。

- 伺服器虚拟,透过将伺服器切换为经济模式,将实体伺服器用作资源池,使用公用电源运作伺服器,提高伺服器利用率,整合空间和设备,并减少资料中心所需的实体伺服器数量。消费量。使用更少的伺服器可以减少电力和冷却需求,从而显着降低消费量。

- 随着电力使用量增加、帐单上涨以及资料中心二氧化碳排放增加,对绿色资料中心的需求不断增加,并推动市场的发展。根据 Uptime Institute 的一项调查,资料中心营运商的目标是在过去五年内将其平均电源使用效率 (PUE) 比率从 1.98 降低到 1.55,这是超大规模部署的结果,尤其註重能源效率。由于规模资料中心和主机託管提供者的现代资料中心的发展。

北美占有最大市场占有率

- 北美地区占据绿色资料中心市场的最大份额,因为该市场受到众多服务供应商和软体供应商的推动。在北美,由于主机託管提供商和超大规模资料中心营运商的大量投资,预计美国将占据市场主导地位,其次是加拿大。北美绿色资料中心建设数量的不断增加推动了对经济高效的电力解决方案的需求。根据美国能源部的数据,资料中心约占美国全部电力使用量的 2%。

- 行动宽频的扩展、5G的出现、巨量资料分析和云端运算的成长是推动该地区对新资料中心基础设施需求的关键因素。网路供应商正在加快部署 5G,以实现更好的创新。绿色资料中心供应商强调透过减少能源使用和提高效率来减少公司的碳排放。

- 北美拥有大量资料中心,且大量公司从硬体转向软体服务,预计将对市场产生重大影响,并成为资料中心转型的利润丰厚的市场。微软、亚马逊和 Facebook 都致力于将现有的资料中心改造成绿色资料中心。

- 北美地区也对 IT、银行、金融和保险 (BFSI)、零售和医疗保健行业的全球资料中心需求做出了重大贡献。此外,由于该地区的资料中心数量及其扩张,这是一个利润丰厚的市场,因此该地区的资料中心服务供应商有动力控制其营运成本。

- 该地区各国政府正在采取积极措施维护环境永续性,进一步加速资料中心的部署。全部区域智慧型手机和网路普及率的提高也有助于开拓该地区的绿色资料中心市场。

绿色资料中心产业概况

绿色资料中心市场竞争激烈,国内外都有许多参与企业。市场集中度适中。主要企业采取的关键策略是产品创新和併购。该市场的一些主要参与企业包括思科科技公司、IBM 公司、戴尔 EMC 公司和富士通。部分进展如下:

2022 年 11 月,大众汽车集团表示,目标是到 2027 年实现其资料中心营运的净碳中和。为了实现这一目标,该公司与Green Mountain合作,扩大挪威二氧化碳中性资料中心营运商的运算能力。透过与 Green Mountain 合作,大众汽车将利用 100% 水力发电产生的可再生电力运作Green Mountain 的所有伺服器,从而实现这一目标。同时,邻近的峡湾也为其提供了自然冷却。

2022 年 11 月,SB Energy Global 与Google合作,供应 942MW 绿色能源,以配合德克萨斯州德州资料中心的消费量。根据该伙伴关係关係,谷歌在德克萨斯州的投资和清洁能源承诺将由 SB Energy 目前正在建设的四个总合容量为 1.2 千兆瓦的太阳能发电工程所产生的 75% 的可再生能源来支持。计划预计将于 2024 年中期投入运作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场概况

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 资料储存需求不断增长

- 电力领域占据主要市场占有率

- 市场限制

- 增加初始投资

第六章 市场细分

- 按服务

- 系统整合

- 监控服务

- 专业服务

- 其他服务

- 按解决方案

- 力量

- 伺服器

- 管理软体

- 网路科技

- 冷却

- 其他解决方案

- 按用户

- 主机託管提供者

- 云端服务供应商

- 企业

- 按行业

- 医疗

- 金融服务

- 政府

- 电讯和 IT

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Fujitsu Ltd

- Cisco Technology Inc.

- HP Inc.

- Dell EMC Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Vertiv Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Green Data Center Market size is estimated at USD 85.68 billion in 2025, and is expected to reach USD 179.88 billion by 2030, at a CAGR of 15.99% during the forecast period (2025-2030).

Key Highlights

- The global green data center market is expected from USD 57.63 billion in the current year and is projected to reach USD 120 billion over the next five years. Over the years, the concern regarding the growing percentage of energy consumption by data centers has alerted governments globally to regulate energy consumption, which is the primary factor for driving the green data center market. Also, the growth of data centers and colocation services are other factors driving green data centers.

- As cloud computing becomes more energy-efficient and increasingly relies on renewable sources, other industry verticals such as manufacturing, transportation, and buildings are expected to turn to green data centers to reduce emissions. For instance, a car manufacturer can outsource all of its in-house computing to zero-emission data centers.

- The rise in demand for data storage and storage space is a key factor driving the need for green data centers. According to Huawei, the global estimate of data center demand is expected to increase by 3 to 10 times over the forecast period. Green data center, which provides practical and eco-friendly solutions in terms of data storage and reduction in energy consumption, is expected to witness great demand, owing to the positive outlook of the data center storage needs and new constructions, which have been brought about due to the regulations and the anticipated rise in need to reduce the operational expenditure.

- Moreover, due to the rise of artificial intelligence (AI), machine learning (ML), big data, and the Internet of Things (IoT), the data centers' global electricity consumption will continue to increase, which is another driving factor for green data centers. According to International Energy Agency (IEA), data centers account for 1 to 1.5 percent of global electricity consumption. Hence, a strong focus on energy efficiency could drive the market.

- Despite the long-term savings and ROI, renewable energy data centers have a high initial investment cost. The initial investment in building an energy-efficient green data center is higher than the traditional one. To modify the existing infrastructure, companies need higher investments which is a restrain. However, companies are willing to invest in green data centers even though the cost of ownership is better and savings in the long term will pay back initial investments.

- COVID-19 is expected to drive the demand for green data centers owing to factors such as acceleration of cloud data center services, growing reliance on data center automation, driving up of hardware reuse as a primary challenge, greater remarketing of data center hardware. An increase in environmental awareness due to COVID-19 and this trend continues to grow post-pandemic considering the increase in organizations data traffic and big data analytics.

Green Data Center Market Trends

Power Segment to Hold a Significant Market Share

- Green data centers are built to maximize energy efficiency and lower environmental impact. The key demand is for greater energy efficiency because these data centers' power consumption and cooling problems are two of the most significant problems that enterprises confront globally and invest heavily in these. It is vital to control these operating costs to improve business operations and maintain market competitiveness.

- Power plays a significant role in investments in green data centers. Both low-power and effective solutions assist organizations in achieving their goals. Moving to variable-speed fans is one technique to reduce energy consumption in the data center. According to recent research, lowering the central processing unit (CPU) fan speed can reduce power consumption by 20%. As a result, businesses should employ variable-speed fans to cool data center equipment and reduce energy use.

- Datacenter energy costs have exceeded the overall investments in equipment rooms and auxiliary devices. However, results from recent research have shown that this trend is slowing down due to the effective green efficiency measures taken up in mature markets of the United States and Europe.

- By switching to economy mode, where servers run on utility power, server virtualization, where physical servers are used as pools, increases server utilization, consolidates space and equipment and reduces energy consumption because it decreases the number of physical servers needed within the data center. Due to the reduced number of servers being utilized, energy consumption decreases significantly due to a reduced need for electricity and cooling.

- With the increasing electricity usage, billings, and increasing emissions of CO2 from these data centers, the need for green data centers is set to increase, thereby driving the market forward. According to the survey conducted by the Uptime Institute, Data center operators aim to get their average power usage effectiveness (PUE) ratio reduced from 1.98 to 1.55 over the last five years owing to the development of the newest data centers from hyper-scale and colocation providers with a particular focus of energy efficiency.

North America Occupies the Largest Market Share

- The North American region holds the largest share in the green data center market, owing to the presence of many services and software providers driving the market forward. The United States is expected to dominate the market in North America, followed by Canada, with high investments by colocation providers and hyper-scale data center operators. The demand for cost-effective and efficient power solutions has increased, with more facilities being developed as green data centers in North America. According to the Department of Energy, data centers account for about 2% of all electricity use in the US.

- The expansion of mobile broadband, the emergence of 5G, growth in big data analytics, and cloud computing are the primary factors driving the demand for new data center infrastructures in this region. Network providers are working to ensure the implementation of 5G at a rapid pace for better innovation. Green data center providers have highlighted the reduction in the carbon footprint of corporations by reducing energy usage and increasing efficiency.

- North America, comprising a considerable amount of data centers and a large number of enterprises switching from hardware to software-based services, is expected to impact the market significantly and be a lucrative market for data center transformation. Microsoft, Amazon, and Facebook pledged to convert their existing data centers into green ones.

- The North American region also contributes substantially to the global data center requirements from the IT, banking, financial servcies, and insurance (BFSI), retail, and healthcare industries. In addition, data center service providers in the region are prompted to manage their operating costs, as the region is a lucrative market, considering the number of data centers and their expansions.

- The government across the region is taking active measures to maintain environmental sustainability, further accelerating data centers' deployment. The rising smartphone and internet penetration across this region lead to the development of the green data center market in the region.

Green Data Center Industry Overview

The green data center market is highly competitive, owing to many players in the market running their business domestically and internationally. The market is moderately concentrated. The key strategies adopted by the major players are product innovation and mergers and acquisitions. Some major players in the market are Cisco Technology Inc., IBM Corporation, Dell EMC Inc., and Fujitsu Ltd, among others. Some of the developments are:-

In November 2022, Volkswagen AG aims to make its data center operations net carbon neutral by 2027. To reach this goal, the company has expanded its computing capacities at the Norwegian operator of CO-neutral data centers by partnering with Green Mountain. The partnership with Green Mountain will allow Volkswagen to hit this target, with all servers at Green Mountain running on 100% renewable electricity generated by hydropower. At the same time, they are naturally cooled by the adjacent fjord.

In November 2022, SB Energy Global partnered with Google to supply 942 MW of Green Energy to match Google's texas Data center consumption. Under the partnership, Google's investment in Texas and commitment to clean energy will be supported by 75% of the renewable energy generated by four solar projects of SB Energy that have a combined capacity of 1.2 gigawatts and are currently under construction. These projects aim to be operational by the middle of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Data Storage

- 5.1.2 Power Segment to Hold a Significant Market Share

- 5.2 Market Restraints

- 5.2.1 Higher Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 System Integration

- 6.1.2 Monitoring Service

- 6.1.3 Professional Service

- 6.1.4 Other Services

- 6.2 By Solution

- 6.2.1 Power

- 6.2.2 Servers

- 6.2.3 Management Software

- 6.2.4 Networking Technologies

- 6.2.5 Cooling

- 6.2.6 Other Solutions

- 6.3 By User

- 6.3.1 Colocation Providers

- 6.3.2 Cloud Service Providers

- 6.3.3 Enterprises

- 6.4 By Industry Vertical

- 6.4.1 Healthcare

- 6.4.2 Financial Services

- 6.4.3 Government

- 6.4.4 Telecom and IT

- 6.4.5 Other Industry Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Technology Inc.

- 7.1.3 HP Inc.

- 7.1.4 Dell EMC Inc.

- 7.1.5 Hitachi Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 IBM Corporation

- 7.1.8 Eaton Corporation

- 7.1.9 Vertiv Corporation