|

市场调查报告书

商品编码

1640660

北美机器视觉系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)NA Machine Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

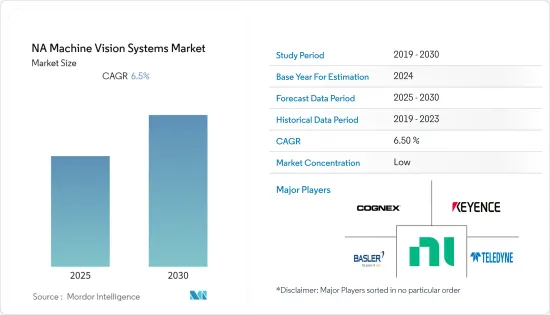

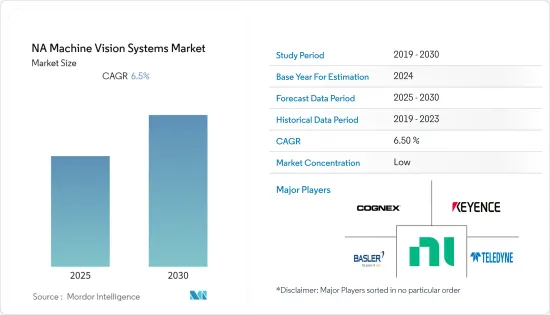

预测期内北美机器视觉系统市场预计复合年增长率为 6.5%

关键亮点

- 北美是提供机器视觉解决方案的公司的巨大市场。由于製造业早期采用自动化,且该地区有大量供应商,预计该区域市场将在预测期内显着成长。据先进自动化协会称,为机器人和其他机器提供视觉智慧的机器视觉组件和系统的销售额在 2020 年上半年有所下降,但下半年北美市场有所復苏。

- 例如,总部位于加拿大的iENSO最近推出了基于Ambarella的嵌入式视觉平台生态系统。非视觉运算和3D成像等新兴机器视觉技术与人工智慧、机器学习和深度学习相结合,将使机器视觉能够解决不断扩展的新应用范围。

- 从品质检测到产品分类再到引导机器人,机器视觉系统正在帮助自动化技术将人类工人从危险而繁琐的任务中解放出来。机器视觉还可以帮助安全系统发现威胁、驾驶自动驾驶汽车以及检查世界上大部分基础设施。

- 随着汽车、工业等多个领域以及常规产业发生越来越多的变化,机器视觉系统市场正在加速发展。

- 例如,2022 年 3 月,Zebra Technologies 收购了 Matrox Imaging,后者提供独立于平台的软体、软体开发套件(SDK)、智慧型相机、3D 感测器、视觉控制器、输入/输出(I/O) 卡和帧采集器。 Matrox Imaging 用于获取、检查、评估和记录工厂自动化、电子和医药包装、半导体检查等领域的工业视觉系统的资料。

- 新冠肺炎疫情严重扰乱了所调查市场中各行业的供应链和生产。然而,疫情扩大了工业自动化和机器视觉的范围,以提高效率并解决安全问题。伙伴关係、新产品发布以及应对新冠疫情的倡议是该地区的主要趋势。

北美机器视觉系统市场趋势

智慧相机基数可望大幅成长

- 由于许多终端用户行业的产品创新率高以及现有应用的扩展,基于相机的创新产品在行业中越来越受欢迎。智慧型相机也使机器视觉系统设计变得更加容易。近年来,该领域不断创新,出现了配备更大影像感测器的型号、可充当智慧相机的新兴嵌入式视觉相机以及能够执行深度学习和人工智慧任务的新型相机。

- 智慧型相机中影像感测器解析度的提高、更快的处理器和带有MIPI 介面的嵌入式视觉相机的集成,以及越来越多的彩色和单色选项(尤其是自COVID-19 疫情爆发以来,这些选项变得越来越流行)都促进了这一领域的进步智慧相机。

- 机器视觉系统可以在整个生产过程中追踪产品、成分和包装,主动追踪其路径,确保高水准的品质和安全。例如,根据美国人口普查局的数据,2022年3月美国食品和饮料机构的月度零售额估计约为763亿美元。该数据比上个月(2022 年 2 月)增加了约 10%。

- 总部位于加拿大的 Matrox Imaging 公司最近宣布推出适用于边缘物联网设备和新一代智慧相机的 Matrox Iris GTX 型号。该公司的Matrox Iris GTX智慧相机拥有Intel Atom x6,000嵌入式处理器,既可以进行传统的机器视觉操作,也可以使用Matrox Design Assistant X设备上的软体以影像分类和分割的形式进行深度学习推理。

预计美国将占很大市场占有率

- 该国处于自动化和产品创新的前沿,从而具有竞争优势。此外,微晶片技术公司也宣布推出智慧嵌入式视觉计画。该生态系统将 Microchip 的低功耗 PolarFire FPGA 与高速影像处理介面、影像处理知识产权以及不断发展的外部合作伙伴生态系统结合。该倡议旨在加速工业、医疗设备、汽车和航太领域机器视觉的发展。预计硬体和软体供应商的此类技术创新将在预测期内推动市场需求。

- 政府的先进製造业伙伴关係等倡议将工业界、各大学和联邦政府聚集在一起,共同投资新的自动化技术,预计将增加机器视觉系统的产量。

- 此外,许多供应商正在采用伙伴关係和收购策略来获得竞争优势。为了保持市场主导地位,大多数硬体供应商透过伙伴关係和收购来获得强大的软体开发商。

- 为了保持生产运作并确保更高的质量,食品和饮料製造商正在转向人工智慧 (AI) 为其机器视觉检测系统动力来源。由于人工智慧具有学习和分类模式的能力,机器视觉技术可以发现可能导致生产停止或浪费的瓶子破损或包装撕裂等问题。

- 近日,美国斑马技术公司收购了图形机器视觉软体开发商Adaptive Vision,并推出了一系列全新机器视觉智慧相机和固定式工业扫描器。对 Adaptive Vision 及其 Adaptive Vision Studio 和 Library、Deep Learning Add-on 和 WEAVER 推理引擎的收购扩大了 Zebra Technologies 在机器视觉硬体和软体市场的影响力。该公司还在其 PartnerConnect 计划中为工业自动化业务合作伙伴、分销商和系统整合商推出了新的专业轨道。

北美机器视觉系统产业概况

北美机器视觉系统市场竞争适中。产品研究、研发支出、伙伴关係和收购是该地区公司为维持激烈竞争而采取的主要成长策略。市场的主要企业包括康耐视公司、基恩士公司、巴斯勒公司、国家仪器公司、Teledyne DALSA、Flir Systems Inc.、Datalogic SpA 和 Perceptron Inc.

2022 年 9 月, 资料宣布最近与尖端神经形态视觉系统发明家 Prophesee SA 合作开发下一代工业产品。根据该公司介绍,神经形态视觉是一项令人着迷的技术,其灵感来自人类生物系统——确切地说是神经网路——的运作。 Prophesse 开发了一种突破性的基于事件的电脑视觉方法。这个新的视觉类别能够显着降低功耗、延迟和资料处理要求,从而揭示传统基于框架的感测器以前看不到的东西。

2022 年 3 月,RG Group 扩大了与机器视觉供应商康耐视的合作关係。康耐视公司设计、开发、製造和销售各种基于图像的产品,所有产品均采用人工智慧 (AI) 技术。康耐视产品包括机器视觉系统和机器视觉感测器。据 RG 集团称,先进的视觉系统技术是其客户解决方案的基石,康耐视继续引领这一快速发展的领域。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对北美机器视觉系统市场的影响

第五章 市场动态

- 市场驱动因素

- 对品质检验和自动化的需求日益增加

- 精确缺陷检测的需求日益增加

- 市场问题

- 实施MV系统的复杂性

第六章 市场细分

- 按组件

- 硬体

- 视觉系统

- 相机

- 光学和照明系统

- 影像撷取器

- 其他的

- 软体

- 硬体

- 按产品

- 基于PC

- 智慧型相机底座

- 按最终用户产业

- 饮食

- 医疗药品

- 物流与零售

- 车

- 电子和半导体

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Cognex Corporation

- Keyence Corporation

- Basler AG

- National Instruments Corporation

- Teledyne DALSA

- Flir Systems Inc

- Datalogic SpA

- Perceptron Inc

- Baumer Ltd.

- Optel Group

- Uss Vision Inc

第八章投资分析

第九章:市场的未来

The NA Machine Vision Systems Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- North America is a sizable market for companies providing machine vision solutions. The regional market is expected to grow substantially over the forecast period, owing to the early introduction of automation in manufacturing and the presence of a significant number of market vendors of regional origin. According to the Association for Advancing Automation, sales of machine vision components and systems that offer vision intelligence to robots and other machines dropped in the first half of 2020; however, the market recovered in North America in the second half.

- Various innovations are also being seen in the market.For instance, recently, Canada-based iENSO launched an Ambarella-based platform ecosystem for embedded vision applications. AI vision processors for the Edge are provided by Ambarella Inc.Emerging machine vision technologies such as non-visible computational and 3D imaging combined with AI, machine learning, and deep learning enable machine vision to address an ever-expanding range of new applications.

- Machine vision systems have helped automation technologies save human workers from dangerous and dull jobs, from quality inspection to sorting products to guiding robots. Machine vision has even helped security systems find threats, driven self-driving cars, and inspected a lot of the world's infrastructure.

- The machine vision systems market is picking up speed as more changes are made in a number of areas and as more changes are made in its usual industries, such as automotive and industrial.

- For instance, in March 2022, Zebra Technologies announced its intent to acquire Matrox Imaging, a provider of platform-independent software, software development kits (SDKs), smart cameras, 3D sensors, vision controllers, input/output (I/O) cards, and frame grabbers that are used to capture, inspect, assess, and record data from industrial vision systems in factory automation, electronics and pharmaceutical packaging, semiconductor inspection, and more.

- The outbreak of COVID-19 significantly disrupted the supply chain and production in various industries of the studied market. However, the pandemic also expanded the scope of industrial automation and machine vision to enhance efficiency and address safety concerns. Partnerships, new product launches, and developments addressing COVID-19 were significant regional trends.

North America Machine Vision Systems Market Trends

Smart Camera-based Expected to Witness Significant Growth

- Innovative camera-based products are gaining popularity in industries due to the high rate of product innovation and expansion of existing applications in many end-user industries. Also, smart cameras have long eased the task of designing machine vision systems. The segment has witnessed continuous innovation in recent years, including models with larger image sensors, emerging embedded vision cameras that function as smart cameras, and new cameras capable of performing deep learning and AI tasks.

- Increased image sensor resolution in smart cameras, the integration of much faster processors or embedded vision cameras with MIPI interfaces, and the increasing availability of color and monochrome options in the market, which are also gaining popularity, especially after the COVID-19 outbreak, were all innovations in the market.

- Machine vision systems can track products, raw ingredients, and packaging throughout the production process and actively trace the paths to ensure high levels of quality and safety. For instance, according to the U.S. Census Bureau, the monthly retail sales from U.S. food and beverage stores were estimated at approximately USD 76.3 billion in March 2022. These statistics indicated an increase of about 10 percent from the previous month, February 2022.

- Matrox Imaging, based in Canada, recently introduced the Matrox Iris GTX model for edge IoT devices and the next generation of intelligent cameras. The company's Matrox Iris GTX smart cameras boast an Intel Atom x6000 embedded processor that can be used for both conventional machine vision operations and deep learning inference in the form of image classification and segmentation using Matrox Design Assistant X on-device software.

United States Expected to Witness Significant Market Share

- The country is at the forefront of automation and product innovation, providing a competitive advantage. Also, Microchip Technology Corporation introduced its Smart Embedded Vision Initiative. The ecosystem combines Microchip's low-power PolarFire FPGAs with high-speed imaging interfaces, intellectual property for image processing, and an expanded ecosystem of outside partnerships. This initiative aims to accelerate machine vision advancements for industrial, medical device, automotive, and aerospace applications. Such innovations by hardware and software vendors are expected to amplify market demand over the forecast period.

- Government initiatives, such as the Advanced Manufacturing Partnership, which is undertaken to make the industry, various universities, and the federal government invest in emerging automation technologies, are expected to increase the production of machine vision systems.

- Product innovation is still a key differentiator among market vendors.Also, many vendors are adopting partnership and acquisition strategies to gain a competitive advantage. Most hardware vendors have acquired strong software developers through partnerships or acquisitions to stay strong in the market.

- To keep production running and ensure higher quality, food and beverage manufacturers are turning to artificial intelligence (AI) to power machine vision inspection systems. AI's ability to learn and classify patterns lets machine vision technology find broken bottles, torn packaging, and other problems that can stop production and cause waste.

- Recently, a US-based company, Zebra Technologies Corporation, acquired graphical machine vision software developer Adaptive Vision and launched a new suite of machine vision smart cameras and fixed industrial scanners. With the acquisition of Adaptive Vision and its Adaptive Vision Studio and Library, Deep Learning Add-on, and WEAVER inference engine, Zebra Technologies expands its presence in the machine vision hardware and software marketplaces. The company is also introducing a new specialized track for industrial automation business partners, distributors, and systems integrators in its PartnerConnect program.

North America Machine Vision Systems Industry Overview

The North America Machine Vision Systems Market is moderately competitive in nature. Product launches, high expenses on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Key players in the market are Cognex Corporation, Keyence Corporation, Basler AG, National Instruments Corporation, Teledyne DALSA, Flir Systems Inc., Datalogic SpA, and Perceptron Inc.

In September 2022, Datalogic partnered with Prophesee SA, inventor of the most advanced neuromorphic vision systems, to announce the recent collaboration regarding the next generation of industrial products. According to the company, neuromorphic vision is a fascinating technology inspired by the behavior of the human biological system, precisely like neural networks. Prophesse has developed a breakthrough event-based vision approach to computer vision. This new vision category enables significant reductions in power, latency, and data processing requirements to reveal what was previously invisible to traditional frame-based sensors.

In March 2022, RG Group expands its partnership with machine vision supplier Cognex. Cognex Corporation designs, develops, manufactures, and markets a wide range of image-based products, all of which use artificial intelligence (AI) techniques that give them the human-like ability to make decisions based on what they see. Cognex products include machine vision systems and machine vision sensors. According to RG Group, the advanced vision system technology is a cornerstone of the company's solutions for clients, and Cognex continues to lead this quickly evolving field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the North America Machine Vision Systems Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Quality Inspection and Automation

- 5.1.2 Rising Demand for Accurate Defect Detection

- 5.2 Market Challenges

- 5.2.1 Complications in the Implementation of Mv Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabber

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 By End-User Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistic and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-User Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Basler AG

- 7.1.4 National Instruments Corporation

- 7.1.5 Teledyne DALSA

- 7.1.6 Flir Systems Inc

- 7.1.7 Datalogic SpA

- 7.1.8 Perceptron Inc

- 7.1.9 Baumer Ltd.

- 7.1.10 Optel Group

- 7.1.11 Uss Vision Inc