|

市场调查报告书

商品编码

1640674

欧洲燃料电池:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

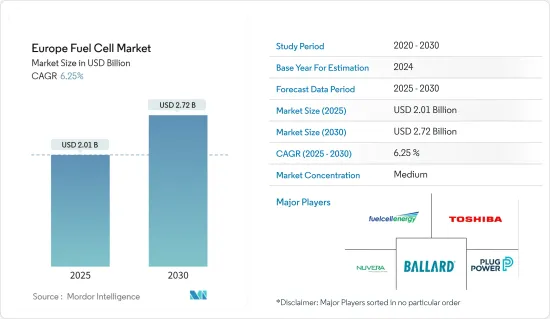

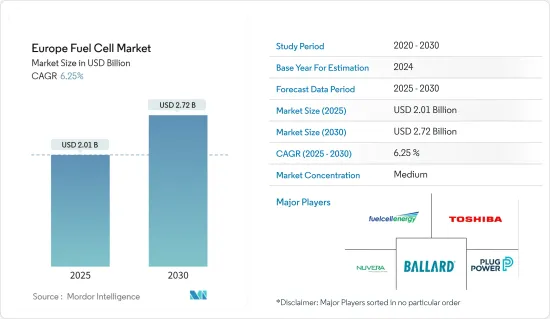

预计2025年欧洲燃料电池市场规模为20.1亿美元,预计到2030年将达到27.2亿美元,预测期内(2025-2030年)的复合年增长率为6.25%。

关键亮点

- 从中期来看,预计预测期内再生能源来源的不断普及和政府的支持性政策将推动市场发展。

- 然而,预计高昂的前期成本将阻碍预测期内的市场成长。

- 对氢气生产和基础设施发展的更多关注预计将为欧洲燃料电池市场创造重大机会。

- 预计德国将在欧洲燃料电池市场发挥重要作用。德国是燃料电池技术的领先国家,并实施了各种政策和倡议来支持其应用。

欧洲燃料电池市场趋势

运输业预计将主导市场

- 燃料电池特别适合大型运输应用,例如巴士、卡车和火车。这些车辆通常对能源的需求较高且行驶距离较长,这使得纯电池电动解决方案具有挑战性。燃料电池可以提供必要的动力和行驶里程,同时实现零排放运行。

- 交通运输业是温室气体排放的主要贡献者,全球脱碳的力道正不断增加。燃料电池为内燃机提供了零排放的替代品,使其成为减少交通运输碳排放的一个有吸引力的解决方案。

- 作为向零排放运输更广泛转型的一部分,欧洲燃料电池电动车 (FCEV) 的兴起正逐渐获得发展动力。根据国际能源总署(IEA)的数据,到2023年,道路上的燃料电池电动车总数将达到820辆,2013年为42辆。过去十年销售量大幅成长,显示运输业的市场成长机会。

- 燃料电池的另一个好处是它们可以利用现有的基础设施。加氢站可以整合到现有的加油站中,因此与电动车充电基础设施的普及相比,加氢基础设施的推出相对较快。

- 此外,2023年2月,欧洲正式决定自2035年起禁止销售新的汽油和柴油汽车。在欧洲议会通过一项法律要求汽车製造商生产的所有新车完全排放二氧化碳之后,世界第二大汽车市场做出了这个决定。预计这将在预测期内促进燃料电池电动车的销售。

- 因此,考虑到这些新兴市场的发展,预计运输业将在预测期内占据市场主导地位。

德国可望主导市场

- 预计德国将在欧洲燃料电池市场发挥重要作用。德国在推广燃料电池技术方面处于领先地位,并实施了各种政策和倡议来支持其应用。德国政府为广泛应用氢能和燃料电池设定了雄心勃勃的目标,并为燃料电池技术的研究、开发和商业化投入了大量资金。

- 德国拥有发达的工业基础和强大的製造能力,可以支援燃料电池系统的生产和部署。德国拥有多家知名燃料电池製造商、研究机构和行业协会,为技术进步和市场成长做出了贡献。

- 此外,德国的可再生能源和脱碳努力与燃料电池作为清洁和永续能源解决方案的潜力一致。向可再生能源(尤其是风能和太阳能)的过渡可以透过燃料电池的整合来补充,以实现高效的能源转换和储存。

- 此外,德国也雄心勃勃地计划发展综合氢能基础设施,包括氢气生产设施和加氢站。该基础设施对于燃料电池汽车和其他基于氢的应用的广泛应用至关重要。德国致力于发展氢能基础设施,这使其成为燃料电池应用的领导者。

- 据H2 Station组织称,近年来德国加氢站的数量大幅增加。至2023年,全国加氢站总数将达91座,而2018年为52座。

- 2023年1月,由H2 MOBILITY Germany营运的位于柏林Tempelhofer Weg 102的加氢站将正式开放。该站预计将满足氢动力汽车的加油需求,包括燃料电池卡车、废弃物收集车、汽车和轻型商用车。值得注意的是,Tempelhofer Weg加氢站的储氢能力超过850公斤,是欧洲最高效的加氢站之一。该加氢站的成功对于首都氢能交通的发展和扩大至关重要。

- 因此,考虑到这些因素,预计德国将在预测期内占据市场主导地位。

欧洲燃料电池产业概况

欧洲燃料电池市场适度细分。该市场的主要企业(不分先后顺序)包括 Ballard Power Systems Inc.、东芝公司、Fuelcell Energy Inc.、Plug Power Inc. 和 Nuvera Fuel Cell LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府支持和奖励

- 可再生能源整合

- 限制因素

- 初期成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 可携式的

- 固定式

- 运输

- 燃料电池技术

- 固体电解质燃料电池 (PEMFC)

- 固体氧化物燃料电池(SOFC)

- 其他燃料电池技术

- 地区

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯

- 北欧的

- 西班牙

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Ballard Power System Inc.

- Toshiba Corp.

- Fuelcell Energy Inc.

- Nuvera Fuel Cells LLC

- Plug Power Inc.

- AFC Energy

- Topsoe

- Ceres Power

- SFC Energy

- Cummins Inc.

- 市场排名分析

第七章 市场机会与未来趋势

- 氢气生产和基础设施开发

简介目录

Product Code: 56719

The Europe Fuel Cell Market size is estimated at USD 2.01 billion in 2025, and is expected to reach USD 2.72 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adaption of renewable energy sources and supportive government policies are expected to drive the market during the forecasted period.

- On the other hand, the high upfront cost is expected to hinder the market's growth during the forecast period.

- Nevertheless, the increasing focus on hydrogen production and infrastructure development is expected to create huge opportunities for the European fuel cell market.

- Germany is expected to play a major role in the fuel cell market in Europe. Germany has been a leading country in promoting fuel cell technology and has implemented various policies and initiatives to support its adoption.

Europe Fuel Cell Market Trends

Transportation Industry Expected to Dominate the Market

- Fuel cells are particularly suitable for heavy-duty transportation applications such as buses, trucks, and trains. These vehicles typically have higher energy demands and longer operating ranges, making them challenging for purely battery-electric solutions. Fuel cells can provide the required power and range while offering zero-emission operation.

- The transportation industry is a significant contributor to greenhouse gas emissions, and there is a growing global commitment to decarbonizing it. Fuel cells offer a zero-emission alternative to internal combustion engines, making them an attractive solution for reducing carbon emissions from transportation.

- The growth in the number of fuel cell electric vehicles (FCEVs) in Europe has gradually gained momentum as part of the broader transition to zero-emission transportation. According to the International Energy Agency, in 2023, the total number of fuel cell electric vehicles accounted for 820 units compared to 42 units in 2013. Over a decade, the sales number has increased significantly, signifying the growth opportunity for the market in the transportation industry.

- Moreover, fuel cells have the advantage of utilizing existing infrastructure. Hydrogen fueling stations can be integrated into existing gas stations, allowing for a relatively faster rollout of refueling infrastructure compared to widespread electric charging infrastructure.

- Additionally, in February 2023, Europe officially confirmed the prohibition on selling new petrol and diesel cars starting in 2035. As the world's second-largest car market, this decision follows the passing of a law by the European Parliament mandating car manufacturers to achieve complete elimination of CO2 emissions from all newly produced vehicles. This is expected to increase the sales of fuel-cell electric vehicles during the forecasted period.

- Therefore, considering such developments, the transportation industry is expected to dominate the market during the forecast period.

Germany Expected to Dominate the Market

- Germany is expected to play a major role in the European fuel cell market. Germany has been a leading country in promoting fuel cell technology and has implemented various policies and initiatives to support its adoption. The German government has set ambitious targets for hydrogen and fuel cell deployment and has allocated significant funding for research, development, and commercialization of fuel cell technologies.

- Germany has a well-developed industrial base and strong manufacturing capabilities, which can support the production and deployment of fuel cell systems. The country is home to several prominent fuel cell manufacturers, research institutions, and industry associations that contribute to technological advancements and market growth.

- Furthermore, Germany's commitment to renewable energy and decarbonization efforts aligns with the potential of fuel cells as a clean and sustainable energy solution. The country's transition to renewable energy sources, particularly wind and solar, can be complemented by integrating fuel cells for efficient energy conversion and storage.

- Additionally, Germany has ambitious plans to develop a comprehensive hydrogen infrastructure, including hydrogen production facilities and refueling stations. This infrastructure is vital for the widespread adoption of fuel-cell vehicles and other hydrogen-based applications. Germany's commitment to hydrogen infrastructure development positions it as a leader in fuel cell deployment.

- According to the H2 stations organization, the number of hydrogen refueling stations has increased significantly in Germany in recent years. In 2023, the country's total number of hydrogen refueling stations was 91 compared to 52 in 2018.

- In January 2023, the hydrogen refueling station at Tempelhofer Weg 102 in Berlin, operated by H2 MOBILITY Germany, officially opened. This station is expected to cater to the refueling needs of hydrogen-powered vehicles, including fuel cell trucks, waste collectors, cars, and light commercial vehicles. Notably, the Tempelhofer Weg station boasts over 850 kg of hydrogen storage capacity, making it one of Europe's most efficient hydrogen stations. This station's successful operation is crucial for advancing and expanding hydrogen-powered mobility in the capital city.

- Therefore, owing to such points, Germany is expected to dominate the market during the forecast period.

Europe Fuel Cell Industry Overview

The European fuel cell market is moderately fragmented. Some key players in this market (not in particular order) include Ballard Power System Inc., Toshiba Corp., Fuelcell Energy Inc., Plug Power Inc., and Nuvera Fuel Cell LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Supportive Policies and Incentives

- 4.5.1.2 Renewable Energy Integration

- 4.5.2 Restraints

- 4.5.2.1 High Initial Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Portable

- 5.1.2 Stationary

- 5.1.3 Transportation

- 5.2 Fuel Cell Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Other Fuel Cell Technologies

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 Italy

- 5.3.4 United Kingdom

- 5.3.5 Russia

- 5.3.6 NORDIC

- 5.3.7 Spain

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ballard Power System Inc.

- 6.3.2 Toshiba Corp.

- 6.3.3 Fuelcell Energy Inc.

- 6.3.4 Nuvera Fuel Cells LLC

- 6.3.5 Plug Power Inc.

- 6.3.6 AFC Energy

- 6.3.7 Topsoe

- 6.3.8 Ceres Power

- 6.3.9 SFC Energy

- 6.3.10 Cummins Inc.

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Hydrogen Production and Infrastructure Development

02-2729-4219

+886-2-2729-4219