|

市场调查报告书

商品编码

1640679

环氧树脂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

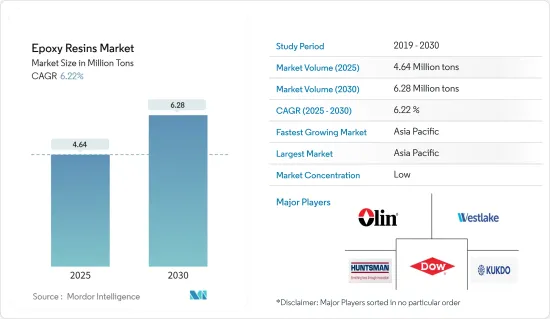

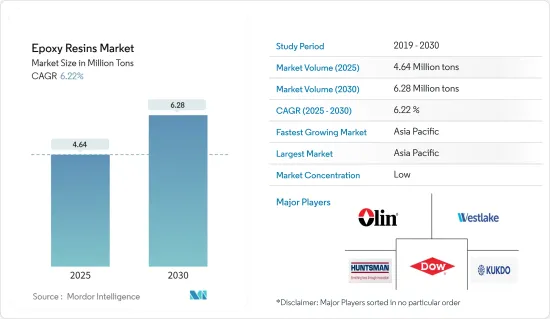

环氧树脂市场规模预计在 2025 年为 464 万吨,预计到 2030 年将达到 628 万吨,预测期内(2025-2030 年)的复合年增长率为 6.22%。

2020年,新冠疫情以及全球范围内的严厉法规对环氧树脂市场带来沉重打击。油漆和涂料、黏合剂、电气和电子等行业面临挑战,遭受供应链中断、停工和劳动力短缺等影响。然而,由于油漆和涂料、黏合剂和密封剂以及电气和电子领域的需求激增,市场在 2021 年有所復苏。

关键亮点

- 短期内,油漆和涂料领域的需求增加以及电气和电子领域的需求增加是推动研究市场需求的关键因素。

- 然而,有关环氧树脂使用的严格规定预计会阻碍市场的成长。

- 生物基环氧树脂的发展和技术进步有望为该市场带来新的机会。

- 预计亚太地区将主导全球市场,其中中国和印度的需求将占据大部分市场。

环氧树脂市场趋势

油漆和涂料领域预计将占据市场主导地位

- 环氧树脂是涂料应用中的黏合剂,可增强地板和金属上使用的涂料的耐久性。

- 这些树脂赋予涂层强度、耐久性和耐化学性等基本特性。其干燥速度快、韧性强、附着力优异、固化有效、耐磨、防水性能优异,是保护金属及各种表面的理想选择。

- 根据世界油漆和涂料工业协会(WPCIA)的数据,预计2023年全球油漆和涂料市场估值将达到1,855亿美元,与前一年同期比较增长3.2%。这一成长的主要驱动力是建筑、汽车和製造业领域的需求不断增长。

- 此外,根据WPCIA的资料,亚太地区将成为全球最大的油漆和被覆剂生产地,到2023年将占全球产量的54.7%,其次是欧洲(19.6%)、北美(15.6%)和拉丁美洲(6.4% )以及中东和非洲(3.6%)。因此,油漆和涂料行业的扩张可能会推动市场的发展。

- 美国是世界上最大、技术最先进的经济体之一。这种主导地位使该国成为油漆和涂料市场的热点之一。美国是世界领先的油漆和被覆剂生产国之一,拥有超过 1,400 家製造商。

- 根据美国油漆协会的数据,2022 年美国油漆和涂料行业的产量约为 13.2 亿加仑。预计到 2024 年将超过 13.4 亿加仑。 PPG、宣威公司、艾仕得涂料系统、RPM Inc. 和 Diamond Paints 是美国领先的油漆和被覆剂製造商和供应商。

- 法国的油漆和涂料行业正在经历最近的发展趋势,预计这将在评估期内推动对环氧树脂的需求。例如,2023年12月,PPG宣布将在法国图卢兹开设一个价值1,700万美元的航太应用支援中心(ASC)。该工厂将提供航太材料的填充包装能力,包括各种飞机的被覆剂和密封剂。

- 预计这些动态将推动油漆和涂料领域对环氧树脂的需求,从而推动未来几年的市场成长。

亚太地区预计将主导市场

- 亚太地区可望引领全球环氧树脂市场。印度、中国、日本和韩国等国家在油漆、涂料和电气电子领域正在经历快速成长,推动了该地区对环氧树脂的需求和消费。

- 根据《欧洲涂料》报道,中国作为世界工业化中心,拥有多达 10,000 家涂料製造商。尤其是日本涂料、阿克苏诺贝尔、PPG工业等大公司都在中国建立了製造地。

- 根据中国涂料工业协会统计,2023年中国涂料产量将达357.72亿吨,与前一年同期比较增4.5%。出口量飙升 19.6% 至 262,000 吨,而国内消费量增长 4.2% 至 35,663 万吨,证实了该行业的强劲增长。

- 製造商正在建设新工厂并扩大现有工厂的产能。这些策略倡议正在推动对油漆和涂料的需求,从而支持整体市场的成长。

- 例如,2024 年 1 月,Berger Paints India 宣布计划在奥里萨邦的一个新的待开发区综合体投资超过 100 亿印度卢比(约 1.206 亿美元)。这项大胆的投资预计将在不久的将来提振对油漆和被覆剂的需求,从而使研究市场受益。

- 中国的电子产品市场蓬勃发展,智慧型手机和电视等产品正在显着成长。不仅满足了国内电子设备的需求,而且出口也蓬勃发展,刺激了市场的进一步扩张。

- 中国是全球最大的智慧型手机製造地。根据中国国家统计局的资料,2023年11月,中国行动电话产量约14亿支。凭藉在手机製造领域的雄厚实力,中国国内市场已成为全球最大的手机市场之一。

- 根据通讯资料显示,受产量上升以及国内外需求復苏的推动,中国电子製造业在 2024 年前四个月表现强劲。根据工业信部报告显示,2024年1-4月中国电子业主要企业利润总合1,442亿元人民币(约203亿美元),年增75.8%。

- 根据日本电子情报技术产业协会资料显示,2024年1月至6月日本电子产业总产值为5,452.56亿日圆(约33.86亿美元),较去年同期成长104.7%。

- 在这些趋势中,预测期内亚太地区对环氧树脂的需求可能会激增。

环氧树脂产业概况

环氧树脂市场比较分散。主要企业(不分先后顺序)包括 Olin Corporation、Huntsman International LLC、Dow、Kukdo Chemical 和 Westlake Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 油漆和涂料领域的需求增加

- 电气和电子领域的需求增加

- 其他驱动因素

- 限制因素

- 环氧树脂使用的严格规定

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 按原料

- DGBEA(双酚 A 和 ECH)

- DGBEF(双酚 F 和 ECH)

- 酚醛树脂(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 缩水甘油胺(芳香胺和 ECH)

- 其他成分

- 按应用

- 油漆和被覆剂

- 黏合剂和密封剂

- 复合材料

- 电气和电子

- 海洋

- 风力发电机

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Aditya Birla Chemicals

- Atul Ltd

- BASF SE

- Chang Chun Group

- DIC Corporation

- Dow

- Huntsman International LLC

- Jiangsu Sanmu Group

- Kukdo Chemical Co. Ltd

- NAMA Chemicals

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab

- Sika AG

- Sinochem Internation Corporation

- SPOLCHEMIE

- Westlake Corporation

第七章 市场机会与未来趋势

- 生物基环氧树脂的开发

- 技术进步创造成长机会

- 其他机会

The Epoxy Resins Market size is estimated at 4.64 million tons in 2025, and is expected to reach 6.28 million tons by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

In 2020, the COVID-19 pandemic and stringent regulations across the globe took a toll on the epoxy resin market. Industries like paints and coatings, adhesives, and electrical and electronics faced challenges, grappling with supply chain disruptions, work stoppages, and labor shortages. However, in 2021, the market rebounded, driven by a surge in demand from the paints and coatings, adhesives and sealants, and electrical and electronics sectors.

Key Highlights

- Over the short term, the increasing demand from the paints and coatings sector and rising demand from electrical and electronics are the major factors driving the demand for the market studied.

- However, stringent regulations regarding the use of epoxy resin are expected to hinder the market's growth.

- Nevertheless, the development of bio-based epoxy resins and technological advancements are anticipated to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the market across the world, with the majority of demand coming from China and India.

Epoxy Resins Market Trends

Paints and Coatings Segment is Expected to Dominate the Market

- Epoxy resins are binders in coating applications, bolstering the durability of coatings used on floors and metals.

- These resins impart fundamental properties to coatings, including strength, durability, and chemical resistance. Their quick-drying nature, toughness, excellent adhesion, effective curing, abrasion resistance, and superior water resistivity make them ideal for safeguarding metals and various surfaces.

- According to the Worlds Paint and Coatings Industry Association (WPCIA), the global paint and coatings market achieved a valuation of USD 185.5 billion in 2023, marking a 3.2% increase from the prior year. This uptick was primarily fueled by heightened demand across the construction, automotive, and manufacturing sectors.

- Furthermore, the Asia-Pacific region is the largest producer of paint and coatings globally, accounting for 54.7% of global production in 2023, followed by Europe (19.6%), North America (15.6%), Latin America (6.4%), and the Middle East & Africa region (3.6%) as per the data from WPCIA. Thus, expansion in the paints and coatings industry is likely to drive the market.

- The United States represents one of the largest and most technologically advanced economies globally. This dominant position enabled the country to become one of the hotspots for the paints and coatings market. It is one of the top global paints and coatings producers, with more than 1,400 manufacturing companies.

- According to the American Coatings Association, the paint and coatings industry's production volume in the United States was approximately 1.32 billion gallons in 2022. Moreover, the industry's production is forecast to surpass 1.34 billion gallons in 2024. PPG, The Sherwin-Williams Company, Axalta Coating Systems, RPM Inc., and Diamond Paints are the major paints and coatings manufacturers and suppliers in the United States.

- The French paints and coating industry has witnessed development in recent years, which is expected to stir up the demand for epoxy resin over the assessment period. For instance, in December 2023, PPG announced the opening of a USD 17 million aerospace application support center (ASC) in Toulouse, France. The facility is set to offer filling and packaging capabilities for aerospace materials, including coatings and sealants for various aircraft.

- Given these dynamics, the paints and coatings sector is expected to see a rising demand for epoxy resins, driving the market's growth in the coming years.

Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is poised to lead the global epoxy resin market. Countries such as India, China, Japan, and South Korea are witnessing a surge in their paints, coatings, and electrical & electronics sectors, driving up the demand and consumption of epoxy resin in the region.

- China, a global hub for industrialization, boasts a staggering 10,000 coatings manufacturers, as reported by European Coatings. Notably, major players like Nippon Paint, AkzoNobel, and PPG Industries have established manufacturing bases in the country.

- Figures from the China Coatings Industry Association reveal that in 2023, China's coatings production hit 35,772 million tons, marking a 4.5% increase from the previous year. Exports surged by 19.6% to 262,000 tons, while domestic consumption rose by 4.2% to 35,663 million tons, underlining the sector's robust growth.

- Manufacturers are either setting up new plants or ramping up the capacities of their existing facilities. These strategic moves bolster the demand for paints and coatings and underpin the overall market growth.

- For instance, in January 2024, Berger Paints India announced plans to inject over INR 1,000 crore (~ USD 120.6 million) into a new greenfield composite plant in Odisha, focusing on decorative and industrial paints. This bold investment is poised to catalyze the demand for paints and coatings in the near future, thus benefiting the market studied.

- China's electronics landscape is vibrant, with products like smartphones and TVs witnessing significant growth. Not only does the nation cater to its domestic electronics appetite, but it also exports extensively, fueling further market expansion.

- China is the largest smartphone manufacturing base in the world. As per the National Bureau of Statistics of China data, in November 2023, the country produced nearly 1.4 billion cell phones. With its established prowess in mobile manufacturing, China's domestic market has emerged as one of the largest globally.

- As per the data from Xinhua News Agency, China's electronics manufacturing industry showcased robust performance in the initial four months of 2024, buoyed by rising production and a rebound in domestic and global demand. As reported by the Ministry of Industry and Information Technology, major companies in China's electronics sector saw their combined profits surge by 75.8% year-on-year, reaching CNY 144.2 billion (~USD 20.3 billion) from January to April 2024.

- The overall electronics production by the Japanese electronics industry was JPY 5,452,56 million (~USD 3,386 million) from January to June 2024, registering a growth rate of 104.7% compared to the previous year at the same period, as per the data from Japan's Electronics and Information Technology Industries Association.

- Given these dynamics, the Asia-Pacific region is poised for a surge in epoxy resin demand during the forecast period.

Epoxy Resins Industry Overview

The epoxy resin market is fragmented in nature. The major players (not in any particular order) include Olin Corporation, Huntsman International LLC, Dow, Kukdo Chemical Co. Ltd., and Westlake Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Paints and Coatings Sector

- 4.1.2 Rising Demand from Electrical and Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Regarding the Use of Epoxy Resin

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and Sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Marine

- 5.2.6 Wind Turbines

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Atul Ltd

- 6.4.4 BASF SE

- 6.4.5 Chang Chun Group

- 6.4.6 DIC Corporation

- 6.4.7 Dow

- 6.4.8 Huntsman International LLC

- 6.4.9 Jiangsu Sanmu Group

- 6.4.10 Kukdo Chemical Co. Ltd

- 6.4.11 NAMA Chemicals

- 6.4.12 Nan Ya Plastics Corporation

- 6.4.13 Olin Corporation

- 6.4.14 Robnor ResinLab

- 6.4.15 Sika AG

- 6.4.16 Sinochem Internation Corporation

- 6.4.17 SPOLCHEMIE

- 6.4.18 Westlake Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Epoxy Resins

- 7.2 Technological Advancement to Create Growth Opportunities

- 7.3 Other Opportunities