|

市场调查报告书

商品编码

1640684

机油 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Engine Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

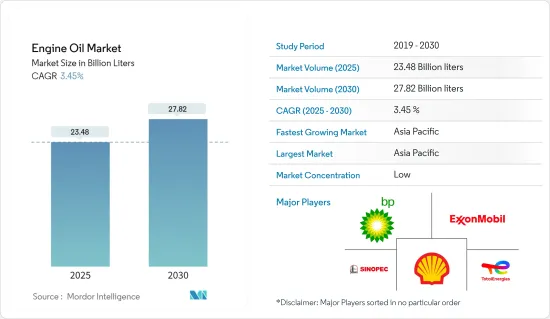

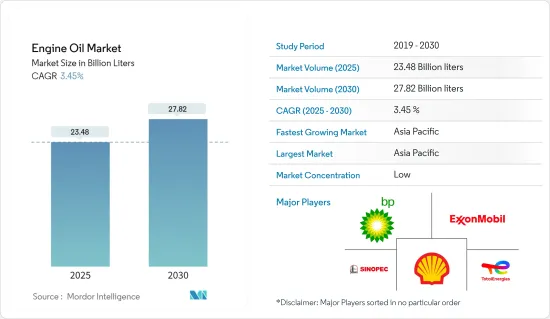

预计 2025 年机油市场规模为 234.8 亿公升,到 2030 年将达到 278.2 亿公升,预测期内(2025-2030 年)的复合年增长率为 3.45%。

新冠疫情危机影响了全球汽车产业,导致大多数地区的汽车生产和销售突然停止。这些停工导致全球数百万辆汽车停产。汽车产业对机油市场有直接影响,因为机油用于提高引擎整体效率并减少排放气体。然而,在2021年下半年限制措施解除后,随着汽车产业活动的活性化,市场成长稳定恢復,进而引发市场復苏。

关键亮点

- 从中期来看,汽车产销量的增加以及高性能润滑油的普及是推动市场成长的关键因素。

- 然而,预计在预测期内,换油间隔的增加和电动车(EV)的适度影响是抑制目标产业成长的关键因素。

- 中东和非洲不断发展的汽车工业以及北美和亚太地区众多即将开展的建设计划很可能很快就会为全球市场提供丰厚的成长机会。

- 预计亚太地区将主导市场,并可能在预测期内实现最高的复合年增长率。

机油市场趋势

汽车产业需求不断成长

- 机油广泛用于润滑内燃机。机油由75-90%的基础油和10-25%的添加剂组成,主要用于全球汽车和其他运输领域。

- 使用机油的主要好处是减少磨损、防止腐蚀并保持引擎平稳运转。机油在运动部件之间形成一层薄膜,可促进热传递并减少部件接触时的张力。

- 小型汽车产销量的增加预计将对机油消耗产生直接影响。因此,预计预测期内机油的需求将会增加。

- 根据国际汽车工业组织(OICA)预测,2022年全球汽车产量将达85,016,728辆,与前一年同期比较成长5.9%。 2021年、2022年汽车产量年增率与前一年同期比较6%。

- 同样,根据 OICA 的数据,2022 年商用车产量将达到 5,749 万辆,较 2021 年的 5,644 万辆有所增长。

- 同时,根据美国商务部经济分析局的数据,2022 年年轻型汽车零售将为 13,754,300 辆,与 2021 年的 14,946,900 辆相比最低。

- 此外,根据德国汽车工业协会(Verband 工业)预测,2022年德国汽车产量预计将达到340万辆,较2021年的310万辆成长9.6%。

- 因此,预计上述因素将对未来机油市场产生重大有利影响。

亚太地区占市场主导地位

- 亚太地区在机油市场占据主导地位,主要原因是汽车生产和发电行业的需求大幅增长。

- 中国是世界领先的汽车製造国之一。该国的汽车工业正在不断改进其产品,重点是生产燃料效率更高、排放气体的汽车。

- 根据中国工业协会(CAAM)的数据,2022 年中国乘用车销量约 2,356 万辆,商用车销量约 330 万辆。

- 同样,根据印度品牌资产基金会的预测,到2022财年,印度的发电能力将增加到400吉瓦左右。这延续了先前发电能力的成长。 1992年至2022年间,印度的发电量增加了5倍。

- 据内阁府透露,2022年国内製造商的重型电机订单约为2.25兆日圆(约152.2亿美元),较上年的约2.15兆日圆(约145.5亿美元)有所减少。

- 因此,预计上述因素将在未来几年对该地区的机油市场产生重大影响。

机油业概况

机油市场比较分散。主要参与企业包括(不分先后顺序):道达尔能源、埃克森美孚、英国石油公司、壳牌公司和中国石油化学集团公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 汽车产销售成长

- 高性能润滑剂的采用日益增多

- 限制因素

- 延长换油週期

- 电动车(EV)对未来影响不大

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监理政策分析

第五章 市场区隔(市场规模(基于数量))

- 最终用户产业

- 发电

- 汽车及其他运输设备

- 重型机械

- 冶金与金属加工

- 化学製造

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 菲律宾

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMSOIL INC

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Corporation

- China Petrochemical Corporation

- Eni SPA

- Exxon Mobil Corporation

- FUCHS

- Gazpromneft-Lubricants, Ltd

- Gulf Oil International

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co.,Ltd

- Illinois Tool Works Inc.

- Indian Oil Corporation Ltd

- JX Nippon Oil & Gas Exploration Corporation

- LUKOIL

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- SK Enmove CO., Ltd

- Tide Water Oil Co. (India) Ltd

- TotalEnergies

- Valvoline Cummins Pvt. Ltd.

第七章 市场机会与未来趋势

- 中东和非洲汽车工业的成长

- 北美和亚太地区的众多建设计划

The Engine Oil Market size is estimated at 23.48 billion liters in 2025, and is expected to reach 27.82 billion liters by 2030, at a CAGR of 3.45% during the forecast period (2025-2030).

The COVID-19 crisis impacted the global automotive industry, as both the production and sales of motor vehicles came to a sudden halt in most regions. These work stoppages led to a loss in the production of millions of vehicles across the world. The automobile industry has a direct effect on the engine oil market as it is used to improve the overall efficiency of an engine and reduce emissions. However, the market growth picked up steadily, owing to increased automotive activities after the lifting of restrictions in the second half of 2021, leading to market recovery.

Key Highlights

- Over the medium term, the increasing automotive production and sales and the increasing adoption of high-performance lubricants are significant factors driving the growth of the market studied.

- However, extended drain intervals and the modest impact of electric vehicles (EVs) are key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the growing automotive industry in the Middle East and Africa and numerous upcoming construction projects in North America and APAC are likely to create lucrative growth opportunities for the global market soon.

- Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Engine Oil Market Trends

Increasing Demand from Automotive Industry

- Engine oils are widely used to lubricate internal combustion engines. They are composed of 75-90% base oils and 10-25% additives and are mostly used in automotive and other transport segments across the world.

- The major advantages of using engine oils are wear and tear reduction, corrosion protection, and the engine's smooth operation. They function by creating a thin film between the moving parts for enhancing heat transfer and reducing tension during the contact of parts.

- The increasing production and sales of light-duty vehicles are estimated with a direct impact on engine oil consumption. It, in turn, is anticipated to drive the demand for engine oil during the forecast period.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production reached 85,016,728 units in 2022, and the production increased by 5.9% when compared to the previous year's data. Motor vehicle production growth year-on-year between the 2021 and 2022 markets was at 6%.

- Similarly, as per OICA, commercial vehicle production reached 57.49 million units in 2022 and registered growth when compared to 56.44 in 2021.

- Meanwhile, as per the Bureau of Economic Analysis of the United States Department of Commerce, light vehicle retail sales reached 13,754.3 thousand units, registering the lowest production when compared to 14,946.9 thousand units in 2021.

- Further, according to the German Association of the Automotive Industry (Verband der Automobilindustrie), automobile production in Germany reached 3.4 million in 2022 and registered a growth of 9.6% when compared to 3.1 million in 2021.

- As a result, the factors above are anticipated with a substantial beneficial influence on the engine oil market in the future years.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the engine oil market primarily due to the huge growing demand for automotive production and power generation industries.

- China holds the title of the world's leading automobile manufacturer. The nation's automotive industry is poised for product advancement, emphasizing the production of vehicles aimed at enhancing fuel efficiency and reducing emissions, addressing escalating environmental concerns attributed to increasing pollution levels in the country

- According to the China Association of Automobile Manufacturers(CAAM), in 2022, approximately 23.56 million passenger cars and 3.3 million commercial vehicles were sold in China.

- Similarly, according to the India Brand Equity Foundation, in the financial year 2022, India's power generation capacity rose to nearly 400 GW. Thereby, the growth in generation capacity from the previous years continues. Between 1992 and 2022, the country's electricity capacity experienced a five-fold increase.

- As per Cabinet Office Japan, in 2022, the order value for heavy electrical machinery from manufacturers in Japan amounted to approximately JPY 2.25 trillion (~USD 15.22 billion), increasing from around JPY 2.15 trillion (~USD 14.55 billion) in the previous year.

- As a result, the factors above are projected to have a substantial influence on the engine oil market in the region in the coming years.

Engine Oil Industry Overview

The engine oil market is fragmented in nature. The major players include (not in particular order) Total Energies, Exxon Mobile Corporation, BP p.l.c., Shell PLC, and China Petrochemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Automotive Production and Sales

- 4.1.2 Increasing Adoption of High-performance Lubricants

- 4.2 Restraints

- 4.2.1 Extended Drain Intervals

- 4.2.2 Modest Impact of Electric Vehicles (EVs) in the Future

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Power Generation

- 5.1.2 Automotive and Other Transportation

- 5.1.3 Heavy Equipment

- 5.1.4 Metallurgy and Metalworking

- 5.1.5 Chemical Manufacturing

- 5.1.6 Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Philippines

- 5.2.1.6 Indonesia

- 5.2.1.7 Malaysia

- 5.2.1.8 Thailand

- 5.2.1.9 Vietnam

- 5.2.1.10 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.2.4 Rest of North America

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Russia

- 5.2.3.6 Spain

- 5.2.3.7 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Qatar

- 5.2.5.4 United Arab Emirates

- 5.2.5.5 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP p.l.c

- 6.4.4 Chevron Corporation

- 6.4.5 China Petrochemical Corporation

- 6.4.6 Eni SPA

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 FUCHS

- 6.4.9 Gazpromneft - Lubricants, Ltd

- 6.4.10 Gulf Oil International

- 6.4.11 Hindustan Petroleum Corporation Limited

- 6.4.12 Idemitsu Kosan Co.,Ltd

- 6.4.13 Illinois Tool Works Inc.

- 6.4.14 Indian Oil Corporation Ltd

- 6.4.15 JX Nippon Oil & Gas Exploration Corporation

- 6.4.16 LUKOIL

- 6.4.17 Motul

- 6.4.18 Petrobras

- 6.4.19 PETRONAS Lubricants International

- 6.4.20 Phillips 66 Company

- 6.4.21 PT Pertamina Lubricants

- 6.4.22 Repsol

- 6.4.23 Shell PLC

- 6.4.24 SK Enmove CO., Ltd

- 6.4.25 Tide Water Oil Co. (India) Ltd

- 6.4.26 TotalEnergies

- 6.4.27 Valvoline Cummins Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Automotive Industry in Middle East and Africa

- 7.2 Numerous Upcoming Construction Projects In North America and APAC