|

市场调查报告书

商品编码

1640685

会计软体 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Accounting Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

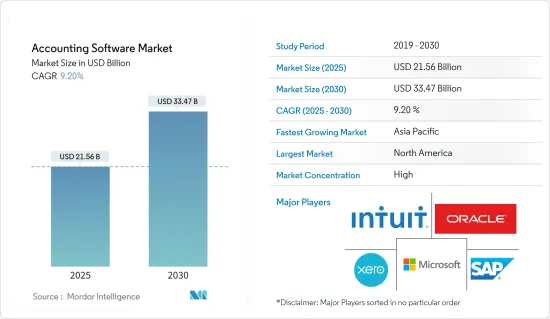

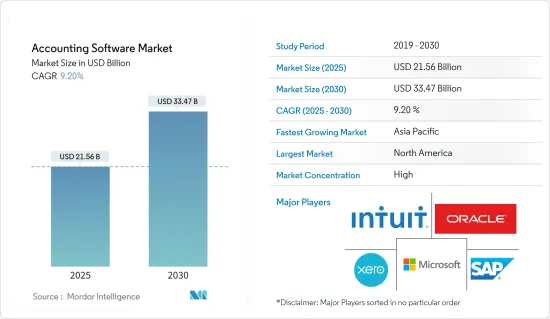

预计 2025 年会计软体市场规模为 215.6 亿美元,预计到 2030 年将达到 334.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.2%。

在过去的二十年里,财务和会计软体解决方案市场经历了无数的变化。最大的变化之一是云端基础的会计软体解决方案交付。

关键亮点

- 会计软体解决方案简化了会计流程,节省了时间并确保了企业和客户之间的交易没有错误。这些系统旨在透过归檔、自动化和与人力资源系统的整合来提高生产力。为小型企业实施会计软体可以帮助减少与客户和公司打交道时的错误,从而改善关係和声誉,并腾出时间专注于您的核心业务理念。

- 中小企业与电子商务参与企业合作以及与自动银行资讯传输和自动发票功能等其他线上应用程式整合的趋势日益明显,这将推动预测期内会计软体的采用,预计...该软体透过追踪所有会计交易并控制企业的资金流入和流出来帮助您提高效率。该软体也为企业会计管理提供了更好的解决方案。轻鬆管理应付帐款、应收帐款、薪资核算、总分类帐和其他业务模组。

- 市场上,以会计为核心业务的供应商正在利用云端运算的成本效益来占领大量市场份额。此外,这些供应商瞄准的受众比以往任何时候都更小众:微型、小型和中型企业。这些会计软体新进业者展示的一项显着策略是将人工智慧等先进功能融入规划、学习、解决问题和语音辨识的应用程式中。

- 例如,MYOB Advisor 是一家来自澳洲的税务、会计和其他商业服务软体供应商的解决方案,它可以自然地解释公司的财务状况。会计师和簿记员可以根据小型企业客户的知识和经验客製化报告。此外,MYOB Advisor 提供的洞察还包括现金流量可见性,让顾问能够帮助客户了解现金流向何处并了解其主要帐户,从而帮助他们更好地管理高价值关係。

- 此外,许多公司正在扩大合作伙伴计划以增加市场占有率。 2022 年 3 月,GTreasury 宣布与 Infor 建立合作关係。 GTreasury 建立在 Azure 平台上,为 Infor 客户提供全面的财务解决方案,包括现金管理、付款、负债和投资管理、风险和曝险管理、避险会计以及包括仪表板在内的报告功能。此次收购将把 Infor资料与 GTreasury 的功能结合起来,帮助 Infor 客户更好地处理现金管理。

- 此外,随着世界各国面临应对冠状病毒疫情和封锁的挑战,越来越多的企业,甚至是小型企业,都在远距办公。这推动了个人对更动态、远端存取财务记录和系统的需求,这些人需要这些资讯来业务,也需要及时、准确的资讯来做出财务管理决策。

会计软体市场趋势

会计软体效率的提高推动了市场成长

- 会计软体用于记录财务交易并管理企业的资金流入和流出,从而提高效率。会计软体已成为管理企业财务的更好的解决方案,因为它允许您轻鬆管理应付帐款、应收帐款、薪资核算、总分类帐和其他业务模组。

- 此外,节省时间、高效营运和提高整体生产力等确保企业财务状况准确的功能预计将推动需求。此外,这些因素使得该软体更容易为中小型企业部署。

- 企业购买基于会计的软体来增加功能并替换过时的系统。原因是会计计算繁琐、复杂。要完成某件事,需要付出劳动。然而,会计软体可以准确、精确地进行分析,无需任何劳动。

- 此外,会计行业的自动化也是软体进步推动的持续趋势。会计高度自动化,不需要大量物理干预。现代会计软体使组织能够最大限度地减少人力资源。这将带来高效率的资本利用和更好的可用资源管理。

亚太地区将经历最高成长

- 预计亚太地区会计软体将出现加速成长,这主要归因于商业会计行动应用程式的日益普及以及云端运算技术和解决方案的日益普及。此外,中小企业的崛起以及它们在云端运算和 SaaS 市场不断增加的投资可能会推动市场成长。

- 透过实施各种倡议来提高企业对云端的信任,地方政府在发展全部区域的云端整合服务市场方面发挥着至关重要的作用,为所研究的市场创造了更多机会。

- 此外,该地区政府越来越重视促进组织付款和交易,并实现债务、负债和资产的追踪,从而推动了对研究市场的需求。

- 此外,该地区的国家正在推动拥抱自动化的新技术的开发和使用,这反过来又增加了对会计软体的需求,以帮助企业优化业务。中国、日本和印度等国家在工业级数位技术方面取得了进展,对云端基础的会计软体有着强烈的偏好,财务管理和税务规划方法也得到了改善。此外,企业正在向数位化和工业 4.0 迈进以满足其需求,加速了各行业对会计软体的采用。这是因为他们必须应对商业世界中正在发生的激烈竞争。

会计软体行业概况

会计软体市场适度整合。主要企业占有较大的份额。此外,现有的企业已经拥有基本客群,因此不愿意转换新参与企业,而从长远来看,新参与企业也会被排名更高的企业收购,因此他们将无法维持其在市场中的地位。长期..主要参与企业包括 Oracle Corporation、Microsoft Corporation、Intuit Inc.、SAP SE、Sage Software Inc.、Infor Inc.、Epicor Software Corporation、Xero Ltd. 和 Unit4 Business Software Limited。

- 2023 年 3 月 - Focus Softnet 宣布推出其新的会计软体,即 FocusLyte,这是一个云端基础的处理商业发票和付款的系统。该软体主要针对中小型企业设计。

- 2023 年 1 月-Halfpricesoft.com 的 ezAccounting 软体已更新。该公司已更新其软体并免费提供给客户。该软体允许客户在一个软体应用程式中轻鬆且经济地处理薪资核算和业务任务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 技术简介

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 会计自动化趋势日益增强

- 市场限制

- 缺乏意识

第六章 市场细分

- 依实施类型

- 本地

- 云端基础

- 按组织规模

- 中小型企业

- 大型企业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Intuit Inc.

- Sage Software Inc.

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Infor Inc.

- Epicor Software Corporation

- Unit4 Business Software Limited

- Xero Ltd

- Zoho Corp

- Red Wing Software Inc.

- MYOB Group Pty Ltd

- Reckon Ltd.

- Saasu Pty Ltd

8.供应商市场占有率分析

第九章投资分析

第十章:投资分析市场的未来

The Accounting Software Market size is estimated at USD 21.56 billion in 2025, and is expected to reach USD 33.47 billion by 2030, at a CAGR of 9.2% during the forecast period (2025-2030).

Over the past two decades, the financial and accounting software solution market has witnessed numerous changes. One of the most significant changes is the cloud-based offering of accounting software solutions.

Key Highlights

- The accounting software solutions streamline the accounting process, save time, and ensure an error-free transaction between the companies and clients. These systems are designed to increase productivity by archiving, automating, and integrating human resource systems. Implementing accounting software across SMEs helps reduce errors from dealings with clients and companies, thereby improving relationships and reputations while ensuring time to focus on the core business idea.

- The increasing trend of small and medium enterprises collaborating with e-commerce players and integrating with other online applications, such as automated bank feeds and automated billing features, is expected to further drive the adoption of accounting software during the forecast period. It helps increase efficiency, keeping track of all the accounting transactions and managing the money flowing in and out of business. The software has also become a better solution for managing a company's accounts. It can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- The market has seen a significant share of vendors with accounting at the core, leveraging the cloud's cost benefits. Additionally, they have been targeting the ever niche "micro and small and medium" businesses. One of the notable strategies exhibited by these new accounting software entrants is the inclusion of advanced features, such as artificial intelligence, for applications, such as planning, learning, problem-solving, and speech recognition.

- For instance, an Australia-based tax, accounting, and other business services software provider's solution, MYOB Advisor, gives natural descriptions of a business's financial position. Accountants and bookkeepers can customize the report based on their SME client's knowledge and experience. Moreover, the insights provided by MYOB Advisor include visualization of cash flow that enables the advisor to help their client see where their cash is going or give a view of top customers and help clients better manage their high-value relationships.

- Also, many companies are extending their partnership programs to increase their market share. Hence, in March 2022, GTreasury has announced a partnership with Infor. Built on the Azure platform, GTreasury will provide Infor customers with a comprehensive Treasury solution that includes cash management, payments, debt and investment management, risk and exposure management, hedge accounting, and reporting functionality that includes dashboards. The acquisition will combine the data from Infor with GTreasury features, enabling Infor customers to handle cash management better.

- Moreover, as multiple countries worldwide have faced the challenge of dealing with the coronavirus outbreak and lockdown, more businesses, tiny businesses, have been working remotely. This has increased the demand for more dynamic and remote access to the business financial records and systems by the individuals who need to work on them and those who must access this timely information accurately to make decisions to manage the financial affairs.

Accounting Software Market Trends

Increased Efficiency Offered by Accounting Software to Drive the Market Growth

- Accounting software increases efficiency as it is used to keep track of accounting transactions or to manage the money flowing in and out of business. It has emerged as a better solution for managing a company's accounts, as it can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- Additionally, features that ensure the company's accurate financials, such as time-saving, cost-effective operation, and higher overall productivity, are expected to drive the demand. Besides, these factors make this software more deployable for small businesses.

- Businesses purchase accounting-based software to increase their functionality and replace the dated system. The reason being, in accounting calculation, is tedious and complex. It will require the workforce to complete things. But accounting software can do the analysis precisely and accurately without a workforce.

- Moreover, automation in the accounting industry is also an ongoing trend driven by software advancement. Accounting has been made highly automated without the need for significant physical intervention. The latest accounting software has enabled organizations to minimize their human resources. This has led to efficient capital utilization and better available resources management.

Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific is expected to grow faster for accounting software, primarily due to the increasing penetration of business accounting mobile applications and higher adoption of cloud computing technologies and solutions across the region. Moreover, the emergence of small businesses and rising investments by SMEs in the cloud and the SaaS market will likely boost the market's growth.

- By implementing various initiatives to build more business confidence in the cloud, the local governments play a significant role in developing the cloud integration services market across the region, creating more opportunities for the studied market.

- Also, the government's growing focus in the region to ease organizational payments and transactions and generate a track of debt, liabilities, and assets increases the demand for the market studied.

- Moreover, countries in the region are adopting automation is promoting the development and use of new technologies, which has increased the demand for accounting software to help businesses optimize their operations. Countries like China, Japan, India are witnessing advancement in industrial-grade digital technology, A high preference for cloud-based accounting software, as well as an increase in demand for improved financial management and tax planning methods, all contribute to the market's expansion. Additionally, businesses are accelerating the adoption of accounting software in various industries as they move towards digitalization and Industry 4.0 in order to meet their needs. This is due to the need to deal with the ongoing, fierce competition in the business world.

Accounting Software Industry Overview

The accounting software market is moderately consolidated. The top players occupy a significant share of the market. Moreover, existing players already have their client base, which doesn't want to switch to new players, and new players cannot sustain the market for a more extended period as they get acquired by the top players in the long run. Some key players include Oracle Corporation, Microsoft Corporation, Intuit Inc., SAP SE, Sage Software Inc., Infor Inc., Epicor Software Corporation, Xero Ltd., and Unit4 Business Software Limited.

- March 2023 - Focus Softnet announced the launch of its new accounting software i.e FocusLyte which is a cloud-based system that assists in handling company's invoices and payments. The software is mainly designed for medium and small enterprises.

- January 2023 - ezAccounting software from Halfpricesoft.com has been updated. The company has updated its software and made it available for the customers at no additional cost. The software will allow customers to process payroll and business tasks all in one easy and affordable software application.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Technology Snapshot

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Trend of Accounting Automation

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intuit Inc.

- 7.1.2 Sage Software Inc.

- 7.1.3 SAP SE

- 7.1.4 Oracle Corporation

- 7.1.5 Microsoft Corporation

- 7.1.6 Infor Inc.

- 7.1.7 Epicor Software Corporation

- 7.1.8 Unit4 Business Software Limited

- 7.1.9 Xero Ltd

- 7.1.10 Zoho Corp

- 7.1.11 Red Wing Software Inc.

- 7.1.12 MYOB Group Pty Ltd

- 7.1.13 Reckon Ltd.

- 7.1.14 Saasu Pty Ltd