|

市场调查报告书

商品编码

1640686

印度医药包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)India Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

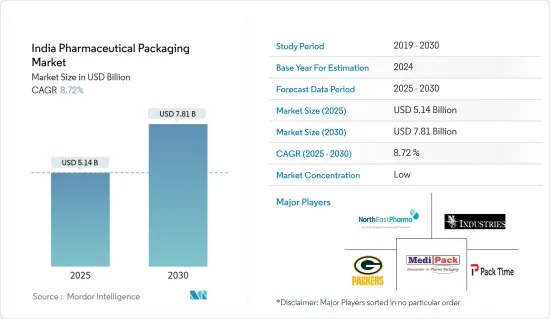

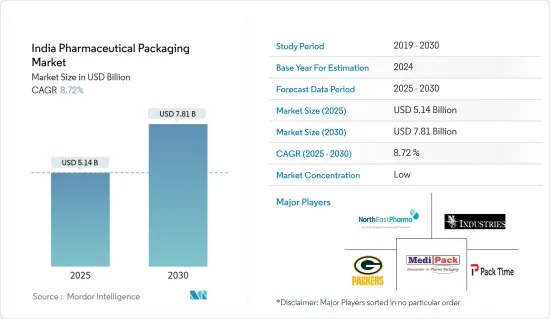

印度的医药包装市场预计在 2025 年价值 51.4 亿美元,预计到 2030 年将达到 78.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.72%。

药品包装采用专门设计用于安全运输和储存药品的材料。这些材料是根据药物特性选择的,旨在保护、识别和维护封闭产品的完整性。包装过程可确保药品免受污染、物理损坏和环境条件等可能影响其功效和安全性的外部因素的影响。药品包装对于提供有关药品的重要资讯(例如剂量说明和法规遵循详细资讯)至关重要。

主要亮点

- 医药产品面临各种危害,包括机械、化学、生物和气候风险。药品包装有多种材料,包括塑胶、纸、玻璃和金属,并适合多种给药方式,包括口服、经皮、注射、局部、介入、鼻腔和眼科。

- 印度政府正在实施广泛而持续的改革,以加强製药业,并宣布了鼓励外国直接投资(FDI)的政策。作为「自强不息印度」倡议的一部分,政府正在推出短期和长期措施来加强医疗保健体系。其中包括实施专门用于促进国内製药和医疗设备製造业的生产连结奖励计划(PLI)。此外,印度正积极将自己定位为精神和健康旅游目的地,发挥阿育吠陀和瑜伽的优势。这些策略倡议将对所研究的市场产生重大影响。

- 由于人们越来越担心其对生态系统和人类健康的影响,印度医药包装市场受到越来越多的审查。推动製药业的永续性不仅是为了减少碳排放,也是为了长期维护生态系统和公众健康,尤其是在印度这样的国家。有效应对这些环境挑战的需求正在迅速增加对环保和永续药品包装解决方案的需求。

- 此外,供应商的议价能力直接影响价格和质量,从而决定价值链,并最终决定向消费者提供的产品和服务。随着供应商实力增强,原物料成本增加,进而导致最终产品价格上涨。

- 印度製药业已经因生产学名药而闻名于全球。国内外对药品的需求不断增长,推动了对多样化和先进包装解决方案的需求。 COVID-19 疫苗的开发和分发需要专门的包装解决方案,包括管瓶、注射器和低温运输包装,以确保安全有效的交付。据印度卫生和家庭福利部称,截至 2023 年 11 月 13 日,印度北方邦已接种了数量最多的新冠病毒疫苗。

印度医药包装市场趋势

塑胶产业推动市场成长

- 受卫生、安全和便利性的关注,印度医疗保健产业对柔性、一次性塑胶包装的需求显着增长。儘管许多行业出于对环境问题的考虑逐渐放弃使用一次性塑料,但医疗保健行业却是个例外,这主要是出于安全和卫生方面的考虑。这意味着该行业依赖一次性塑胶包装,从而推动对塑胶包装的需求。塑胶是用途广泛的材料,例如 HDPE、PET 和 PP,由于其柔韧性、机械强度和稳定性等特性而被用于製药业。

- 印度政府正在实施广泛而持续的改革,以加强製药业。根据印度品牌股权基金会 (IBEF) 的数据,2023 财年印度政府在医疗保健方面的支出占其 GDP 的 2.6%。预计2025年将达到GDP的2.5%。

- 在产品类型中,瓶类产品中,国内 HDPE 和宝特瓶的产量有所增加,而 HDPE(高密度聚苯乙烯)瓶凭藉其强度、弹性和耐化学性,已成为製药行业的行业标准。预计这将对市场成长做出重大贡献。高密度聚乙烯瓶因其强度、弹性和耐化学性已成为製药业的行业标准。这些特性使其成为保护和储存各种药品的理想选择,支持了塑胶瓶在市场上的广泛使用。

- 塑胶包装在印度製药业非常受欢迎,因为这种产品类型可以透过添加剂进一步增强其固有性能,提高最终产品的抗氧、抗湿、抗紫外线性能。

瓶装产品将成为印度市场成长最快的产品类别

- 液体药品包装用瓶的需求正在推动对玻璃、塑胶和其他基于材料的瓶包装的需求。这些瓶子不仅可用于盛装液体药物,还可用于盛装固态锭剂和凝胶锭剂。有多种尺寸适用于特定剂量和产品。它们有玻璃和塑胶两种材质,如果按照说明存放,即使打开后也能保持其品质。

- 对可获得、高品质的医疗保健,特别是对慢性病患者可负担得起的医疗保健的追求,导致印度对永续瓶装药品包装解决方案的需求日益增长。根据联合国亚洲及太平洋经济社会委员会(ESCAP)预测,到2023年,15至64岁人口将占印度人口的68.9%。预计到 2050 年这群人将占到 67.0%。

- 高密度聚乙烯 (HDPE) 瓶的生产和供应可支持市场上瓶子部分的成长。这是因为瓶子可以在药品保质期内保护药品免受污染和劣化,确保药品的安全有效。印度对安全药品包装的需求持续成长。 HDPE 瓶因其能够满足药品储存和保护所需的严格标准而越来越受到认可。

- 宝特瓶因其产品保护、可视性和可客製化等用途和优点,已成为药品包装的首选。 宝特瓶具有环境永续,因为它们可回收利用,从而减少碳排放并节省资源。预计在预测期内,这些因素将推动印度製药业使用宝特瓶进行包装的增加。

印度医药包装产业概况

印度医药包装市场较为分散,主要由 Medipack Innovations Private Limited、Packtime Innovations Private Limited、North East Pharma Pack、NS Industries 和 AS Packers 等主要公司主导。这些公司正在利用策略合作措施来增加市场占有率和盈利。然而,随着技术进步和产品创新,中小企业透过赢得新合约和开拓新市场来扩大其市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 评估微观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 环保意识增强,新监理标准的采用

- 印度慢性疾病患者急剧上升

- 市场限制

- 原料成本因供应商议价能力而波动

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 其他材料类型

- 依产品类型

- 瓶子

- 管瓶/安瓿瓶

- 注射器

- 管子

- 瓶盖和瓶塞

- 袋子和包包

- 标籤

- 其他产品类型

第七章 竞争格局

- 公司简介

- Medipack Innovations Private Limited

- Packtime Innovations Private Limited

- North East Pharma Pack

- NS Industries

- AS Packers

- JK Print Packs

- West Pharmaceutical Packaging India Pvt. Ltd(West Pharmaceutical Services Inc.)

- Huhtamaki India Ltd(Huhtamaki Oyj)

- SGD Pharma India Ltd(SGD Pharma)

- Uflex Limited

- Amcor Flexibles India Pvt. Ltd(Amcor PLC)

- Essel Propack Ltd

- Parekhplast India Limited

- Regent Plast Pvt. Ltd

- Graham Blow Pack Pvt. Limited

- Hoffmann Neopac AG

- 供应商市场占有率分析

第八章投资分析

第九章:市场的未来

The India Pharmaceutical Packaging Market size is estimated at USD 5.14 billion in 2025, and is expected to reach USD 7.81 billion by 2030, at a CAGR of 8.72% during the forecast period (2025-2030).

Pharmaceutical packaging uses materials designed to transfer and store pharmaceutical drugs safely. These materials are selected based on the drugs' characteristics, aiming to safeguard, identify, and maintain the integrity of the enclosed product. The packaging process ensures that the drugs are protected from external factors such as contamination, physical damage, and environmental conditions, which could potentially compromise their efficacy and safety. Pharmaceutical packaging is crucial in providing essential information about the drug, including dosage instructions and regulatory compliance details.

Key Highlights

- Pharmaceutical drugs face various hazards, spanning mechanical, chemical, biological, and climatic risks. They are packaged using multiple materials, including plastics, paper, glass, and metal, and tailored to different delivery methods, such as oral, pulmonary, injectable, transdermal, topical, interventional, nasal, and ocular.

- The Indian government has implemented extensive and ongoing reforms to bolster the pharmaceutical industry, unveiling policies to foster foreign direct investments (FDI). As part of the Aatmanirbhar Bharat Abhiyaan initiative, the government has introduced a range of short- and long-term measures to fortify the health system. These include implementing Production-linked Incentive (PLI) schemes specifically designed to enhance domestic pharmaceutical and medical device manufacturing. Moreover, India is actively positioning itself as a destination for spiritual and wellness tourism, leveraging its strengths in Ayurveda and yoga practices. These strategic moves are poised to impact the market studied significantly.

- The pharmaceutical packaging market in India is under increasing scrutiny for its impact on ecosystems and human health, given the escalating environmental concerns. The push for sustainability in the pharmaceutical industry is not just about reducing its carbon footprint but also about safeguarding ecosystems and public health for the long haul, especially in a country like India. The demand for eco-friendly and sustainable pharmaceutical packaging solutions is growing rapidly, driven by the need to address these environmental challenges effectively.

- Moreover, supplier bargaining power directly impacts pricing and quality, thereby dictating the value chain and, ultimately, the products and services delivered to consumers. As a supplier's power grows, so do the costs of raw materials, subsequently elevating the final product's price tag.

- The Indian pharmaceutical industry was already a major global player known for its generic drug manufacturing. The increasing demand for pharmaceutical products both domestically and internationally drove the need for diverse and advanced packaging solutions. The development and distribution of COVID-19 vaccines required specialized packaging solutions, including vials, syringes, and cold chain packaging, to ensure safe and effective delivery. According to the Ministry of Health and Family Welfare (India), the Indian state of Utter Pradesh reported the highest number of administered doses of the vaccine against the coronavirus as of November 13, 2023.

India Pharmaceutical Packaging Market Trends

Plastic Segment to Witness Major Market Growth

- The healthcare industry in India is witnessing a notable surge in the demand for flexible single-use plastic packaging, driven by a heightened emphasis on hygiene, safety, and convenience. While many industries are moving away from single-use plastics due to environmental concerns, healthcare is an exception, primarily due to safety and hygiene. This signifies the industry's reliance on single-use plastic packaging and drives the demand for plastic packaging. Plastic is a highly versatile material, including HDPE, PET, and PP, and is used in the pharmaceutical industry due to its flexibility, mechanical strength, and stability characteristics.

- The Indian government has implemented extensive and ongoing reforms to bolster the pharmaceutical industry. According to the India Brand Equity Foundation (IBEF), the Indian government spent 2.6% of the country's GDP on healthcare in the financial year 2023. Government healthcare spending is anticipated to be 2.5% of the GDP in the financial year 2025.

- Among product types, the bottle segment is anticipated to contribute significantly to the market's growth in line with the growth of HDPE and PET bottle production in the country and the emergence of HDPE (high-density polyethylene) bottles as the industry standard in the pharmaceutical industry due to their strength, resilience, and chemical resistance. These qualities make them perfect for safeguarding and storing a variety of medical supplies, supporting the growth of plastic bottle usage in the market.

- The material's intrinsic properties can be further improved through additives, improving performance and properties to act against oxygen, moisture, and UV radiation to the finished product, making plastic packaging a highly preferable type of packaging in the Indian pharmaceutical industry.

Bottles to be the Fastest-growing Product Segment in the Indian Market

- The demand for bottles for liquid pharmaceutical product packaging fuels the demand for glass, plastic, and other material-based bottle packaging. These bottles can be used for more than liquid medicines, solid pills, and gel tablets. They come in various sizes tailored to the specific dosage or product. Available in both glass and plastic, they maintain quality even after opening, provided they are stored as directed.

- The push for accessible, high-quality healthcare, especially for chronic diseases, at affordable rates is fueling the need for sustainable bottle pharmaceutical packaging solutions in India. According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), individuals aged between 15 and 64 constituted 68.9% of India's population in 2023. This demographic is projected to account for a share of 67.0% by 2050.

- The production and availability of HDPE-based bottles can support the growth of the bottles segment in the market because bottles ensure that medications remain safe and effective throughout their shelf life, shielding them from contamination and degradation. The demand for safe pharmaceutical packaging continues to grow in India. HDPE bottles are increasingly recognized for their ability to meet the rigorous standards required for storing and protecting medicinal products.

- PET plastic bottles have become the favored choice for pharmaceutical packaging owing to their applications and advantages in offering product protection, visibility, and customization. PET bottles can be environmentally sustainable due to their recyclability, reduced carbon footprint, and resource conservation. These factors are expected to support their increasing usage for packaging in the Indian pharmaceutical industry during the forecast period.

India Pharmaceutical Packaging Industry Overview

The Indian pharmaceutical packaging market is fragmented and dominated by significant players like Medipack Innovations Private Limited, Packtime Innovations Private Limited, North East Pharma Pack, NS Industries, and AS Packers. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Awareness of Environmental Issues and Adoption of New Regulatory Standards

- 5.1.2 Surging Number of Chronic Disease Cases in India

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Costs Due to Suppliers' Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Other Material Types

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Vials and Ampoules

- 6.2.3 Syringes

- 6.2.4 Tubes

- 6.2.5 Caps and Closures

- 6.2.6 Pouches and Bags

- 6.2.7 Labels

- 6.2.8 Other Product Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Medipack Innovations Private Limited

- 7.1.2 Packtime Innovations Private Limited

- 7.1.3 North East Pharma Pack

- 7.1.4 N S Industries

- 7.1.5 A S Packers

- 7.1.6 JK Print Packs

- 7.1.7 West Pharmaceutical Packaging India Pvt. Ltd (West Pharmaceutical Services Inc.)

- 7.1.8 Huhtamaki India Ltd (Huhtamaki Oyj)

- 7.1.9 SGD Pharma India Ltd (SGD Pharma)

- 7.1.10 Uflex Limited

- 7.1.11 Amcor Flexibles India Pvt. Ltd (Amcor PLC)

- 7.1.12 Essel Propack Ltd

- 7.1.13 Parekhplast India Limited

- 7.1.14 Regent Plast Pvt. Ltd

- 7.1.15 Graham Blow Pack Pvt. Limited

- 7.1.16 Hoffmann Neopac AG

- 7.2 Vendor Market Share Analysis