|

市场调查报告书

商品编码

1640694

潮汐能 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Tidal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

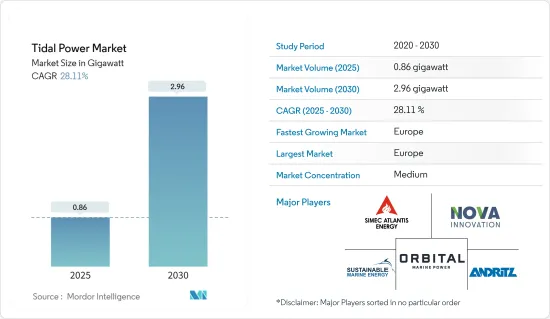

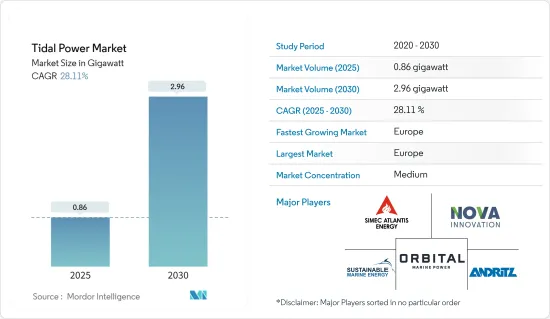

预计 2025 年潮汐能市场规模为 0.86 吉瓦,到 2030 年将达到 2.96 吉瓦,预测期内(2025-2030 年)的复合年增长率为 28.11%。

关键亮点

- 从中期来看,全球能源向可再生能源转型以及许多新兴国家部署新技术等因素预计将成为预测期内潮汐能市场最重要的驱动力。

- 同时,高昂的成本和环境影响也对市场造成了重大障碍。这对预测期内的潮汐能市场构成了威胁。

- 行业巨头的研究和创新努力为市场成长带来了巨大的机会。突破性的潮汐能加速器(TiPA)计划就是对此的完美证明。作为最近倡议的一部分,TiPA 为潮汐涡轮机开发了可靠、高效且经济实惠的水上发射系统。预计这些因素将在未来几年为市场创造许多机会。

- 由于全部区域规划了大量潮汐发电工程,预计在预测期内欧洲将占据市场主导地位。

潮汐能市场趋势

浮体式潮汐能平台预计将大幅成长

- 潮汐能是一种高效能、高功率的再生能源来源,因为潮汐全年都有恆定的流动和方向。

- 近年来,潮汐能市场对浮体式发电系统的采用有所增加。在该系统中,涡轮机以特定方式排列并安装在标准游动樑上。它们比固定结构产生更多的能量。

- 根据国际可再生能源机构的数据,2022年的预计海洋能容量为524MW,其中包括来自海洋波浪动能、潮汐能、盐度和海洋温差的能量。其中大部分是由于浮体式潮汐发电厂和波浪能发电能力的增加。随着许多国家实现净零排放目标,预计未来几年该产业将进一步成长。因此,多个利用潮汐能技术的发电工程正在规划中。

- 美国能源局实施水力发电计划,致力于开发海洋能源和技术。 2022年10月,美国能源局同意提供3,500万美元的资金,用于推进潮汐和河流能源系统。

- 由于浮体式/河流潮汐能平台的安装增加,这些新兴市场的发展可能会显着促进市场的发展。

预计欧洲将主导市场

- 近年来欧洲已有多座潮汐电站计划运作併网发电。英国和丹麦等国家是该地区最突出的国家。

- 英国爱丁堡大学专家在2021年的研究发现,光是潮汐能一项就能满足英国目前每年电力需求的11%,是上年度太阳能光电和生质总合贡献的2.2倍。

- 英国水力发电协会补充说,目前发展缓慢的潮汐发电工程如果获得许可和足够的资金,到 2030 年将能够提供额外的 10GW 容量。这些计划遍布英国各地,包括斯旺西湾、默西塞德郡、北萨默塞特海岸和北威尔斯海岸。

- 2023年3月,利物浦市政府希望将默西河改造成大型潮汐发电厂的所在地。一旦建成,它的发电量将至少达到 10 亿吨,并可利用默西河的潮汐能。

- 此外,2022 年 5 月,Minesto 完成了位于丹麦法罗群岛韦斯特曼纳的 Dragon 4 潮汐电站的第一周试运行。 Minest 的 Deep Green Kite 技术即使在低潮和低流区域也具有成本效益。

- 这些新兴市场的发展有望提升该地区在潮汐能市场成长中的地位。

潮汐能产业概况

潮能市场是半静态的。市场的主要企业(不分先后顺序)包括 Andritz AG、Nova Innovation Ltd、Orbital Marine Power Ltd、SIMEC Atlantis Energy Ltd 和 Sustainable Marine Energy Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 潮汐能装置容量及2028年预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 全球能源向可再生能源转型

- 许多新兴国家推出新技术

- 限制因素

- 技术的成本过高,对环境的影响

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 发电方式

- 防波堤

- 浮体式潮汐能平台

- 潮汐发电

- 动态潮汐发电

- 潮汐能转换

- 水平轴涡轮机

- 垂直轴涡轮机

- 其他的

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 丹麦

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Andritz AG

- Nova Innovation Ltd

- Orbital Marine Power Ltd

- MAKO Turbines Pty Ltd

- SIMEC Atlantis Energy Ltd

- Hydroquest SAS

- Sustainable Marine Energy Ltd

- Lockheed Martin Corporation

第七章 市场机会与未来趋势

- 致力于研究和创新的产业领袖

简介目录

Product Code: 57135

The Tidal Power Market size is estimated at 0.86 gigawatt in 2025, and is expected to reach 2.96 gigawatt by 2030, at a CAGR of 28.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the global energy transition toward renewables and the rollout of new technologies in many developed countries are expected to be one of the most significant drivers for the tidal power market during the forecast period.

- On the other hand, the market is highly obstructed due to the exorbitant costs and environmental impacts of the technology. This poses a threat to the tidal power market during the forecast period.

- Nevertheless, the research and innovation endeavors by the industry leaders present an enormous opportunity for the market's growth. The ground-breaking Tidal Turbine Power Take-off Accelerator (TiPA) project is a perfect demonstration of the statement. It recently developed a highly reliable, efficient, and cost-effective power-take-off system for a tidal turbine. This factor is expected to create several opportunities for the market in the future.

- The European region is expected to dominate the market during the forecast period due to many planned tidal energy projects across the region.

Tidal Power Market Trends

Floating Tidal Power Platform Expected to Witness Significant Growth

- Tidal energy uses tidal currents consistent in volume and direction throughout the year, making it an incredibly efficient renewable energy source with a high power output.

- The tidal power market recently witnessed increased floating power production system deployments. In the system, the turbines are aligned in a particular way and attached to a standard moving beam. They produce more energy as compared to fixed structures.

- According to the International Renewable Energy Agency, the estimated global marine energy capacity accounted for 524 MW in 2022, which includes the ocean energy derived from the kinetic energy of ocean waves, tides, salinity, and differences in ocean temperatures. Most of this was due to the added capacity from floating tidal power stations and wave energy. The industry is expected to grow even more in the coming years, parallel with the net-zero emission goals in many countries. Thus, several upcoming projects are lined up to harness the technology for power production.

- The US Department of Energy has a Water Power Program to develop marine energy and technologies. In October 2022, the US Department of Energy agreed to fund USD 35 million to advance tidal and river current energy systems as part of measures to boost a sector whose current impact is negligible.

- Such developments will likely significantly boost the market due to the expansion of floating/instream tidal energy platform installations.

Europe Expected to Dominate the Market

- Europe planned a series of tidal power plants coming into operation or getting grid-connected recently. Countries like the United Kingdom and Denmark are the most highlighted parts of the region.

- According to a 2021 study conducted by experts at Edinburgh University, tidal stream alone has the potential to produce 11% of the United Kingdom's current annual electricity demand, which is the same as the combined contribution of solar and biomass over the previous year.

- The British Hydropower Association adds that tidal range projects under development, which are now delayed, would provide 10 GW of extra capacity by 2030 if permission and enough funding were granted. These projects throughout the United Kingdom include Swansea Bay, Merseyside, the North Somerset Coast, and the North Wales Coast.

- In March 2023, authorities in Liverpool wanted the River Mersey to be the site of a massive tidal power plant that could power up to 1 million homes while creating thousands of employment in the region. If constructed, the plant would have a capacity of at least one gigatonne and use Mersey's tidal range.

- Moreover, in May 2022, Minesto completed the first week of commissioning the Dragon 4 tidal power plant in Vestmanna, Faroe Islands, Denmark, including energy production and verification of all critical operations. Minesto's Deep Green Kite technology is cost-effective in places with low-flow tidal streams and ocean currents.

- Such developments will likely boost the region's position in the tidal power market's growth.

Tidal Power Industry Overview

The tidal power market is semi consolidated. Some of the key players in the market (in no particular order) include Andritz AG, Nova Innovation Ltd, Orbital Marine Power Ltd, SIMEC Atlantis Energy Ltd, and Sustainable Marine Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Tidal Power Installed Capacity and Forecast, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Global Energy Transition Toward Renewables

- 4.5.1.2 The Rollout of New Technologies in Many Developed Countries

- 4.5.2 Restraints

- 4.5.2.1 The Technology's Exorbitant Costs and Environmental Impacts

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Generation Method

- 5.1.1 Tidal Barrage

- 5.1.2 Floating Tidal Power Platform

- 5.1.3 Tidal Stream Generation

- 5.1.4 Dynamic Tidal Power

- 5.2 Tidal Energy Converters

- 5.2.1 Horizontal Axis Turbine

- 5.2.2 Vertical Axis Turbine

- 5.2.3 Other Tidal Energy Converters

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Denmark

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Andritz AG

- 6.3.2 Nova Innovation Ltd

- 6.3.3 Orbital Marine Power Ltd

- 6.3.4 MAKO Turbines Pty Ltd

- 6.3.5 SIMEC Atlantis Energy Ltd

- 6.3.6 Hydroquest SAS

- 6.3.7 Sustainable Marine Energy Ltd

- 6.3.8 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Innovation Endeavors by Industry Leaders

02-2729-4219

+886-2-2729-4219