|

市场调查报告书

商品编码

1640697

软体定义安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Software Defined Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

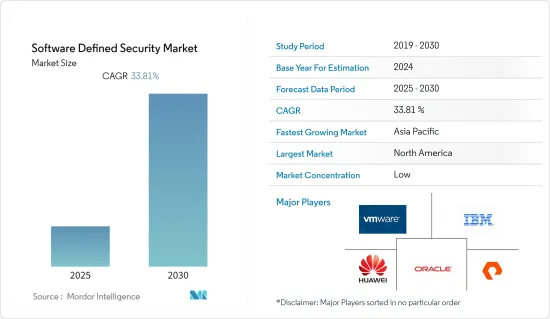

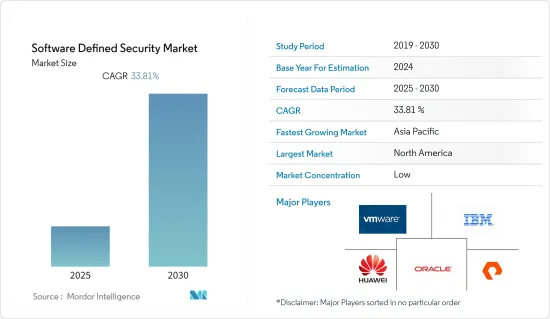

预计预测期内软体定义安全市场复合年增长率为 33.81%。

主要亮点

- 软体定义储存(SDS)是企业储存市场新兴趋势之一。 SDS 是一个更大的生态系统的一部分,其中软体与相应的硬体分离,让您可以根据所需的储存量自由选择已安装的硬体。 SDS 可让您降低成本,同时提高效能和灵活性。就这样,企业逐渐走向软体定义储存。

- 一些协会正在塑造 SDS 在终端用户行业中的应用方式,其中大多数协会与主要供应商有直接联繫,以进行类似的工作。储存网路产业协会(SNIA)为企业储存产业制定标准。现有的储存供应商包括 IBM、Dell EMC 和 NetApp,以及 Atlantis Computing 和 Falcon Star 等新兴供应商。其中一些公司(如 NetApp、IBM 和 Red Hat)提供软体,而其他公司(如 HPE 和 Dell EMC)则提供超融合解决方案。思科等其他公司则提供硬体并与 SDS 软体供应商合作。

- 透过使用网路安全解决方案和软体安装,政府对资料安全的监管和标准日益增多,预计将在未来几年为网路解决方案提供诱人的前景。 2022 年 2 月,Telstra 将向澳洲联邦、州和地方政府扩展新的网路安全解决方案。网路侦测和回应能力将与政府系统和云端基础的服务集成,使用来自 Telstra 託管安全服务平台的巨量资料分析来监控网路威胁,而 Sovereign SecureEdge 在检测和回应分散式威胁方面将特别有用。环境中的云端安全。

- 这些线上安全程序是为了确保您的安全。为了避免危险和攻击,必须规范真正的基础,分离、观察和确保现有框架。由于亚马逊网路服务等云端服务公司广泛使用和可存取地储存高度敏感和独特的资料,与网路安全相关的风险有所增加,从而导致市场成长。

- 在疫情期间,软体定义储存在迅速扩大我们的客户群和加速收入成长方面发挥了重要作用。在 COVID-19 期间,储存成长并没有停止,但一直在不断发展,以便为无法扩展 Kubernetes 基于容器的资料管理的公司提供跨平台的整合功能。

软体定义安全市场趋势

云端驱动软体定义安全

- 这与几年前相比发生了巨大变化,当时大多数资讯安全专家认为云端是有限且安全的。如今,云端被视为一种潜在的转型,而不是安全态势的潜在权衡,云端是采用安全硬体和基础设施的垫脚石,这些硬体和基础设施受益于日益增长的网路威胁和日益增长的网路连接。它正在威胁玩家。云端可能是安全转型背后的驱动力。

- 云端基础设施旨在满足新的需求,特别是在垂直和水平规模和安全性方面。云端环境通常采用以技术和服务为中心的安全解决方案,无论位于何处,都可以在全球顺利扩展。

- 云端处理彻底改变了企业使用、分发和储存资料、应用程式和工作负载的方式。但同时,各种新的安全隐忧和问题也随之出现。随着越来越多的资料储存在云端和公共云端服务中,风险也随之增加。在最终用户数位化需求的推动下,一些国家,特别是新兴国家,处于云端运算采用的前沿。由于内容、边缘服务和最后一哩连接的资料传输不断增长的需求,互连频宽容量正在扩大。

- 根据 Equinix 全球互连指数 (GXI) 报告,拉美地区预计将以 50% 的复合年增长率主导已安装互连频宽容量发展,预计到2023 年在该地区运营的企业将达到12 亿美元。地区将贡献安装 1,479 Tbps 的互连频宽。随着云端运算需求潜力的上升,多家供应商的采用率不断提高,从而推动了支出。

- 此外,数位化将增加云端交付的压力,鼓励 IT 部门采用更多的软体和服务,摆脱硬体定义的权衡。这一因素,加上买家的整合和商品化,将使基础设施即服务 (SaaS) 和託管服务提供者比传统硬体供应商拥有更大的权力。因此,软体定义技术预计将在未来几年内成长。

亚太地区将占据软体定义安全市场最大份额

- 在亚太地区,跨企业的非结构化资料量呈指数级增长,不仅储存在本地,还储存在云端环境中。此外,随着物联网在该区域的普及,边缘产生的资料正在迅速增加。这些因素支援高度扩充性、可靠且安全的储存架构。

- 在人口密集的国家,如中国和印度,存储仍然依赖于传统硬件,需要进行数位转型才能跟上技术变化,使该地区成为软体定义存储(SDS) 服务的领先提供商。可图供应商。

- 此外,日益增多的网路攻击迫使中国加强国防能力。然而,中国也是世界其他地区网路攻击的重要源头。

- 2022年3月,网路安全公司Mandiant声称,一个中国政府支持的骇客组织作为情报收集行动的一部分,对美国一个地方政府机构进行了骇客攻击。美国当局称,骇客利用一个严重的软体漏洞于 2021 年 12 月入侵了两个国家机构的网路。据联邦调查局和网路安全和基础设施安全美国(CISA) 称,目标国家机构包括交通、医疗保健、高等教育、农业和法院网路和系统。

- 尤其是超大规模国际数位资料内容供应商和公有云服务供应商,如 Facebook、Google、亚马逊网路服务 (AWS) 和阿里云,正在建立大型平台。尤其是香港的远端储存服务需求持续成长,奠定了基础。

软体定义安全产业概况

由于多种网路威胁迫使政府和产业在电脑网路空间投入更多资金,软体定义安全市场高度分散。投资增加导致市场竞争加剧,许多新参与企业以更低的价格提供解决方案。市场的主要企业包括 Pure Storage Inc.、华为技术有限公司、VMWare Inc.、戴尔公司、甲骨文公司和 IBM 公司。这些公司不断创新和升级其产品以满足日益增长的市场需求。

- 2023 年1 月- 领先的汽车供应商和全球合作伙伴法雷奥(Valeo) 与整合式、自动驾驶和电动汽车自动驾驶汽车网路安全解决方案的领先供应商C2A Security 宣布签署合资协议,为自动驾驶汽车开发和部署保全服务安全解决方案。此次新的合作满足了业界对简化和有效的网路安全的需求。 C2A Security 与法雷奥之间的合作将使汽车产业能够采用自动化网路安全,在将安全放在首位的同时实现创新和麵向未来的业务。

- 2022 年 10 月-全球领先的应用程式安全测试工具供应商 Veracode 宣布其持续软体安全平台已增强,以纳入容器安全。现有客户现在可以参与 Veracode Container Security 早期存取倡议。新的 Veracode 容器安全服务涵盖容器映像的安全性配置、漏洞扫描和秘密管理系统,旨在满足云端原生软体工程团队的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 相关人员分析

- 市场驱动因素

- 对快速回应和提高安全性的需求

- 云端服务的采用率提高

- 市场限制

- 缺乏虚拟环境中的安全意识

- 缺乏业界标准

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 按类型

- 堵塞

- 文件

- 目的

- 超融合基础设施

- 按公司规模

- 中小企业

- 大型企业

- 按最终用户

- BFSI

- 通讯和 IT

- 政府

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- IBM Corporation

- Oracle Corporation

- Netapp Inc.

- Huawei Technologies Co. Ltd

- Fujitsu Limited

- Genetec Inc.

- VMWare Inc.(Dell Inc.)

- Hitachi Vantara Corp.

- Pure Storage Inc.

- Promise Technology Inc.

- FalconStor Software Inc.

第七章投资分析

第八章 市场展望

The Software Defined Security Market is expected to register a CAGR of 33.81% during the forecast period.

Key Highlights

- Software-defined storage (SDS) is one of the new technologies trending in the enterprise storage market. SDS is part of a larger ecosystem where the software is separated from its respective hardware, revealing the freedom to choose installed hardware depending on the amount of storage needed. SDS enables cost savings while improving performance and flexibility. Thus, enterprises are slowly shifting toward software-defined storage.

- Multiple associations shape how SDS is employed across end-user industries with direct connections to major vendors, most of which are involved in similar endeavors. The Storage Network Industry Association (SNIA) sets standards for the enterprise storage industry. The established storage vendors include IBM, Dell EMC, NetApp, and emerging players, like Atlantis Computing and Falcon Star. Some offer software, like NetApp, IBM, and RedHat, while others offer hyper-converged solutions, like HPE and Dell EMC. Others, like Cisco, offer hardware and partner with SDS software vendors.

- An increase in government regulations and standards for data security, as achieved through the use of cybersecurity solutions and the installation of software, is expected to provide attractive prospects for cyber solutions in the next years. Telstra will expand its new cyber security solutions for federal, state, and municipal governments in Australia in February 2022. The Cyber Detection and Response capacity integrates with government systems and cloud-based services to monitor cyber threats using big data analytics from Telstra's managed security service platform, while Sovereign SecureEdge assists in delivering cloud security, especially in the context of a distributed workforce.

- These online security procedures are meant to ensure safety. To avoid any danger or attack, regulating genuine foundations, present frameworks should be isolated, observed, and guaranteed. Dangers associated with network security are growing, aided by the widespread use and accessibility of cloud companies such as Amazon Web Services for storing sensitive and unique data, which is expected to hinder market growth.

- Over the pandemic, software-defined storage has proven invaluable in rapidly expanding its customer base and accelerating top-line growth. For businesses during COVID-19 that continued to see unabated growth in storage but were unable to scale their Kubernetes container-based data management, there has been constant development primed toward enabling integrational capabilities across the platform case point, the previously mentioned NetApp addition of Kubernetes capability.

Software Defined Security Market Trends

Cloud is Driving Software Defined Security

- There has been a strong shift from a few years ago when most information security professionals saw the cloud as limited and secure. The cloud is now seen as transformational rather than a possible security posture tradeoff, threatening security hardware and infrastructure players, who have profited from growing cyber threats and expanding increasingly connected networks. The cloud may prove to be the driver of security transformation.

- Cloud infrastructure is designed to meet new, emerging needs, particularly in terms of vertical and horizontal scale and security. Cloud settings will typically employ technology and service-centric security solutions that can scale worldwide and smoothly without regard to location.

- Cloud computing has revolutionized how businesses utilize, distribute, and store data, apps, and workloads. It has, however, generated various new security concerns and problems. The risk grows with so much data and public cloud services being stored in the cloud. Several nations, primarily emerging economies, are at the forefront of cloud adoption, aided by end-user demand for digitization. Interconnection bandwidth capacity has been expanding due to increased demand from content, edge services, and last-mile connections to transport-led growing data volumes.

- According to Equinix's Global Interconnection Index (GXI) report, the LATAM region is predicted to dominate interconnection bandwidth capacity installation development by a 50% CAGR, with firms operating in the region contributing 1,479 Tbps by 2023. As the potential of cloud demand grows, several providers are experiencing an increase in adoption, which is driving expenditures.

- Moreover, digitalization will add to cloud delivery pressures and force IT into more software and services and away from hardware-defined tradeoffs. This factor, coupled with buyer consolidation and commoditization, will make infrastructure-as-a-service (IaaS) and managed service providers powered by software-defined abilities much more powerful than conventional hardware vendors. Therefore, due to such determinants, software-defined technologies are predicted to grow in the coming years.

Asia-Pacific Accounts for the Fastest Growing Share in the Software-defined Security Market

- Asia-Pacific is experiencing a rapid increase in the volume of unstructured data across various enterprises in the region, which is stored not only on-premise but also in cloud environments. In addition, with the proliferation of IoT across the region, the data generated at the edge is rapidly increasing. These factors have supported a scalable, reliable, secure storage architecture.

- With high-density countries like China and India still relying on traditional hardware for their storage and the need for digital transformation to keep up with the technological changes, the region presents lucrative business for software-defined storage (SDS) vendors.

- Furthermore, the increasing cyberattacks have compelled China to bolster its defense capabilities. However, the country is also a significant source of origin for cyberattacks in other regions of the world.

- In March 2022, cybersecurity firm Mandiant alleged that a Chinese government-backed hacking organization hacked local government entities in the United States as part of an intelligence-gathering operation. According to the US authorities, the hackers utilized a significant software defect to access the networks of two states' agencies in December 2021. According to the FBI and the US Cybersecurity and Infrastructure Security Agency (CISA), the state agencies targeted included transportation, health, higher education, agricultural, court networks, and systems.

- In particular, hyper-scale and international digital media content providers and public cloud service providers, like Facebook, Google Amazon Web Services (AWS), and Alibaba Cloud, have been fundamental in pushing demand for remote storage services, significantly enhancing their uptake of data center capacity in the Asian region and particularly in Hong Kong over the past few years by building massive-scale platforms.

Software Defined Security Industry Overview

The software-defined security market is highly fragmented, as several cyber threats are forcing governments and respective industries to invest more in cyberspace. Increasing investments drive many new players to offer solutions at lower prices, making the market more competitive. Some key players in the market are Pure Storage Inc., Huawei Technologies Co. Ltd, VMWare Inc. (Dell Inc.), Oracle Corporation, and IBM Corporation. These players constantly innovate and upgrade their product offerings to cater to the increasing market demand.

- January 2023 - Valeo, a top automobile supplier, and global partner, and C2A Security, a leading supplier of automatic vehicle cybersecurity solutions for integrated, autonomous, and EVs, announced a strategic collaboration to augment Valeo's cybersecurity services on their product lines in development and ongoing operations. The new collaboration responds to the industry's requirement for simplified and effective cybersecurity. The collaboration of C2A Security and Valeo will enable the automotive sector to deploy automated cybersecurity, putting security first while allowing innovation and future business.

- October 2022 - Veracode, a leading global supplier of applications security testing tools, announced that its Continuous Software Security Platform had been enhanced to incorporate container safety. Existing customers can now participate in an early access initiative for Veracode Container Security. The new Veracode Container Security service covers the secure configuration, vulnerability scanning, and secrets management systems for container images and is intended to satisfy the demands of cloud-native software engineering teams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Market Drivers

- 4.3.1 Requirement for Quicker Response and Increased Security

- 4.3.2 Rise in Cloud Services Adoption

- 4.4 Market Restraints

- 4.4.1 Lack of Security Awareness in Virtualization Environment

- 4.4.2 Industry Standard Deficiency

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Block

- 5.1.2 File

- 5.1.3 Object

- 5.1.4 Hyper-converged Infrastructure

- 5.2 By Size of Enterprise

- 5.2.1 Small and Medium Enterprise

- 5.2.2 Large Enterprise

- 5.3 By End User

- 5.3.1 BFSI

- 5.3.2 Telecom and IT

- 5.3.3 Government

- 5.3.4 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Netapp Inc.

- 6.1.4 Huawei Technologies Co. Ltd

- 6.1.5 Fujitsu Limited

- 6.1.6 Genetec Inc.

- 6.1.7 VMWare Inc. (Dell Inc.)

- 6.1.8 Hitachi Vantara Corp.

- 6.1.9 Pure Storage Inc.

- 6.1.10 Promise Technology Inc.

- 6.1.11 FalconStor Software Inc.