|

市场调查报告书

商品编码

1640703

雷达感测器 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

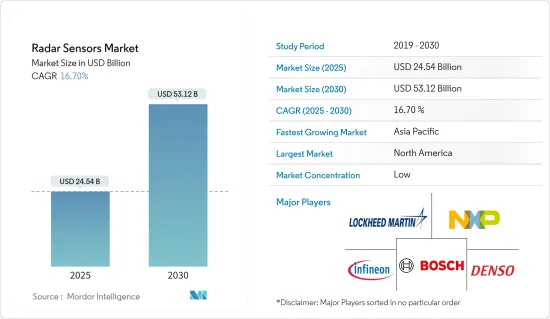

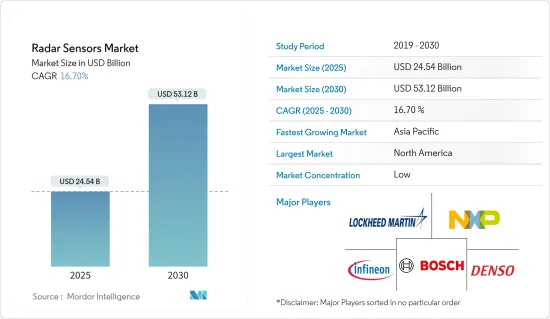

雷达感测器市场规模预计在 2025 年为 245.4 亿美元,预计到 2030 年将达到 531.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.7%。

关键亮点

- 自动化程度的快速提高、自动驾驶的发展和工业 4.0 的进步,推动了对高级安全和控制的存在和运动检测的需求。

- 汽车产业正在经历技术转型,以提高安全性、舒适性和娱乐性,为雷达感测器创造了充足的机会。无人机、自动驾驶汽车和 ADAS(高级驾驶辅助系统)等感测器密集型应用的发展推动了雷达感测器的需求。

- 雷达感测器技术的改进对市场成长产生了重大影响。毫米波(mm-Wave)技术的采用预计将成为雷达感测器市场的重点,该技术的采用将显着提高感测器的功能和效率。

- 雷达感测器已成为智慧家庭市场的重要元素,其中包括提供照明、暖通空调、卫生系统和自动门的非接触式控制,以及警报、门禁和追踪应用等安全系统。

- 在航太领域,雷达感测器透过侦测飞机等远程物体的位置和速度来确保安全标准。这些感测器透过精确的距离测量有助于使民航机和军用飞机更安全、更有效率。它们也用于间谍飞机的空中监视系统,以探测敌军的意外到来并追踪其他可疑活动。

- 雷达感测器用于航空系统,提供有关导弹类型、弹道和目标的详细信息,并有助于提前检测导弹袭击。此外,航太和国防设备以及感知环境和检测障碍物的设备的进步正在推动雷达感测器市场的成长。

- 然而,市场成长面临的主要挑战包括视野有限和加速度存在差异时的侦测能力有限。

雷达感测器市场趋势

汽车产业可望大幅成长

- 汽车雷达在侦测车辆附近物体的速度和范围方面发挥着至关重要的作用。根据丰业银行预测,全球汽车销售将从 2022 年的约 6,730 万辆成长至 2023 年的约 7,530 万辆。

- 雷达感测器在自动驾驶环境中发挥关键作用。 ADAS 车辆配备多个雷达,涵盖多种安全和舒适应用,包括防撞、自动停车、内部监控、协同驾驶和群组情境察觉。

- 自动驾驶汽车生态系统中的人工智慧也将推动市场发展。数位雷达与最新的电脑视觉演算法结合使用,可提高人工智慧能力并使物体检测和分类更容易。

- 这些数位雷达支援先进的自动驾驶,并可部署左转辅助、盲点监控、自动紧急煞车、主动车距控制巡航系统、交通拥堵导航和高速公路导航等先进功能。为了显着提高5G mmWave通讯的效率,正在开发一种基于先进模拟技术并提供5G主动和被动反射阵列的新型汽车雷达系统。

北美占据雷达感测器市场的大部分份额

- 高阶国防应用、智慧型手机、自动驾驶汽车和家用电子电器的日益普及是美国雷达感测器市场的主要成长动力。该地区的国防预算在世界上名列前茅,因此 FMCW 应用(尤其是短程应用)的兴起势头强劲。

- 该地区正在开拓智慧电网、智慧家庭、智慧交通、智慧水网和使用雷达感测器技术的基础设施等新兴技术。雷达感测器技术的发展有望在这些领域开闢新的使用案例,为供应商创造成长机会。

- 随着越来越多的製造商为行动电话添加新功能,智慧型手机的高普及率也有望推动雷达感测器的需求。 GSMA预测,到2025年终,北美近三分之二的行动电话连线将为5G,达到约2.7亿。

- 考虑到雷达感测器所提供的优势,许多政府机构和私人组织正在加强研发力度,以进一步提高这些感测器的效率,预计这将对市场产生积极影响。

雷达感测器产业概况

雷达感测器市场细分化,有许多重要的参与企业。着名参与企业包括罗伯特·博世有限公司、洛克希德·马丁公司、恩智浦半导体公司、英飞凌科技公司、意法半导体公司和大陆汽车集团。

- 2024 年 1 月,恩智浦半导体公司 (NXP Semiconductors NV) 推出了其汽车雷达单晶片系列的扩充。新款 SAF86xx 无缝整合了高性能雷达收发器、多核心雷达处理器和 MACsec 硬体引擎,从而实现透过汽车乙太网路进行的最先进的安全资料通讯。此综合系统解决方案与恩智浦的S32高效能处理器、车载网路连接和电源管理功能相结合,为先进的软体定义雷达技术奠定了基础。

- 2023 年 11 月,洛克希德马丁公司宣布,在该公司位于纽约州遍远地区的工厂经过数月的内部测试和调整后,美国将开始对其先进的 TPY-4 雷达进行进一步评估。这款软体定义的感测器可以侦测和追踪从小型无人机到喷射机再到弹道飞弹的一切物体,是3D远征远距雷达(3DELRR) 的一部分,将取代已有数十年历史的TPS-75雷达。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的实力

- 竞争对手之间的竞争

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 国家安全需求日益增加

- 自动驾驶汽车增多,对安全性的重视程度不断提高

- 市场问题

- 研发维护成本高

第六章 市场细分

- 按类型

- 成像雷达

- 非成像雷达

- 按范围

- 短程雷达感测器

- 中程雷达感测器

- 远距雷达感测器

- 按最终用户

- 车

- 安全监控

- 工业的

- 环境及气象监测

- 流量监控

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Robert Bosch GmbH

- Lockheed Martin Corporation

- NXP Semiconductors NV

- Denso Corporation

- Infineon Technologies AG

- Continental AG

- Hella KGaA Hueck & Co.

- Delphi Automotive LLP

- Baumer Group

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Veoneer Inc.

- STMicroelectronics NV

- Hitachi Automotive Systems(Hitachi Ltd)

- Banner Engineering Corporation

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 57286

The Radar Sensors Market size is estimated at USD 24.54 billion in 2025, and is expected to reach USD 53.12 billion by 2030, at a CAGR of 16.7% during the forecast period (2025-2030).

Key Highlights

- Due to rapidly advancing automation, developments in autonomous driving, and the progression of Industry 4.0, the need for presence and motion detection for advanced safety and control is increasing.

- The automotive sector is undergoing a technological transition to improve safety, comfort, and entertainment and has ample opportunities for radar sensors. The need for radar sensors is being accelerated by the development of sensor-rich applications such as drones, autonomous cars, and advanced driver assistance systems.

- Technological improvements in radar sensors are a significant factor impacting market growth. The introduction of millimeter-wave (mm-Wave) technology, which is expected to become a primary focus in the radar sensors market, significantly improves sensor capabilities and efficiency.

- Radar sensors have become an integral part of the smart home market, particularly offering contactless control for lighting, air conditioning, sanitary systems, and automatic doors, as well as security systems such as alarms, access control, and tracking applications.

- In the aerospace sector, radar sensors are employed to ensure safety and security standards by detecting the position and velocity of an object found at a distance, such as an aircraft. These sensors help enhance the safety and efficiency of commercial and military aircraft through exact distance measurements. It is also used in airborne surveillance systems of spy planes to detect the surprising arrival of enemy forces and track other dubious activities.

- Radar sensors are used in aviation systems to deliver detailed information regarding the missile type, trajectory, and target, and they also help in the prior detection of missile attacks. Additionally, advancements in aerospace and defense equipment and instruments to sense the environment and detect obstacles are boosting the growth of the radar sensors market.

- However, some of the main challenges to market growth are factors like a limited field of vision and limitations in detection when there is an acceleration difference.

Radar Sensors Market Trends

The Automotive Sector is Expected to Witness Significant Growth

- Automotive radar plays a vital role in detecting the speed and range of objects in the car's proximity. According to Scotiabank, car sales worldwide grew to around 75.3 million units in 2023, up from around 67.3 million units in 2022.

- Radar sensors play a crucial role in the autonomous driving environment. An ADAS vehicle has multiple radars covering multiple safety and comfort applications, like crash avoidance, self-parking, in-cabin monitoring, cooperative driving, and collective situational awareness.

- AI in the autonomous vehicle ecosystem also drives the market. Digital radar is used with a modern computer vision algorithm to improve AI functionality, making object detection and classification easier.

- These digital radars can deliver a high degree of automatic driving and deploy sophisticated features, such as left turn assist, blindspot monitoring, automatic emergency braking, adaptive cruise control, traffic jam pilot, or highway pilot. In order to significantly increase the efficiency of 5G millimeter-wave communications, a new type of automotive radar system is being developed based on advanced analog technology and providing 5G active and passive reflection arrays.

North America Holds a Significant Share of the Radar Sensors Market

- High-end defense applications, smartphone penetration, autonomous vehicles, and consumer electronics devices are significant growth drivers for the US radar sensors market. As the region has the highest defense budget in the world, the increase in FMCW applications, particularly short-range applications, is gaining momentum.

- New and emerging technologies, like smart grids, smart homes, intelligent transport, smart water networks, and infrastructure with radar sensor technology, are being pioneered in the region. The development of radar sensor technology is expected to open up new use cases in these areas, creating growth opportunities for suppliers.

- The demand for radar sensors is also expected to be driven by the high penetration of smartphones as more manufacturers incorporate new features into their mobile phones. GSMA estimates that almost two-thirds of North America's cellular connections will be 5G by the end of 2025, with approximately 270 million contacts.

- Given the benefits that radar sensors provide, a number of government and commercial organisations are increasing their research and development efforts to further increase the efficiency of these sensors, which is expected to positively impact the market.

Radar Sensors Industry Overview

The radar sensors market is fragmented due to the presence of many significant players. Some prominent players include Robert Bosch Gmbh, Lockheed Martin Corporation, NXP Semiconductors, Infineon Technologies, STMicroelectronics NV, and Continental AG.

- January 2024: NXP Semiconductors NV launched an extension to its automotive radar one-chip family. The new SAF86xx seamlessly integrates a high-performance radar transceiver, a multi-core radar processor, and a MACsec hardware engine to facilitate cutting-edge secure data communication via Automotive Ethernet. This comprehensive system solution lays the groundwork for advanced, software-defined radar technology when coupled with NXP's S32 high-performance processors, vehicle network connectivity, and power management capabilities.

- November 2023: Lockheed Martin Corporation announced that the US Air Force would launch its advanced TPY-4 radar for further evaluation following months of internal testing and tweaks at company facilities in rural New York. The software-defined sensor, capable of detecting and tracking everything from small drones to jets to ballistic missiles, is slated to replace the decades-old TPS-75 radar as part of the Three-Dimensional Expeditionary Long Range Radar effort, or 3DELRR.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Substitute Product

- 4.3.5 Threat of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for National Security

- 5.1.2 Increasing Number of Autonomous Cars and Focus on Security and Safety Needs

- 5.2 Market Challenges

- 5.2.1 High R&D and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Imaging Radar

- 6.1.2 Non-Imaging Radar

- 6.2 By Range

- 6.2.1 Short-range Radar Sensor

- 6.2.2 Medium-range Radar Sensor

- 6.2.3 Long-range Radar Sensor

- 6.3 By End User

- 6.3.1 Automotive

- 6.3.2 Security and Surveillance

- 6.3.3 Industrial

- 6.3.4 Environment and Weather Monitoring

- 6.3.5 Traffic Monitoring

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GmbH

- 7.1.2 Lockheed Martin Corporation

- 7.1.3 NXP Semiconductors NV

- 7.1.4 Denso Corporation

- 7.1.5 Infineon Technologies AG

- 7.1.6 Continental AG

- 7.1.7 Hella KGaA Hueck & Co.

- 7.1.8 Delphi Automotive LLP

- 7.1.9 Baumer Group

- 7.1.10 Smart Microwave Sensors GmbH

- 7.1.11 InnoSenT GmbH

- 7.1.12 Veoneer Inc.

- 7.1.13 STMicroelectronics NV

- 7.1.14 Hitachi Automotive Systems (Hitachi Ltd)

- 7.1.15 Banner Engineering Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219