|

市场调查报告书

商品编码

1641821

麻纸:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Sack Kraft Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

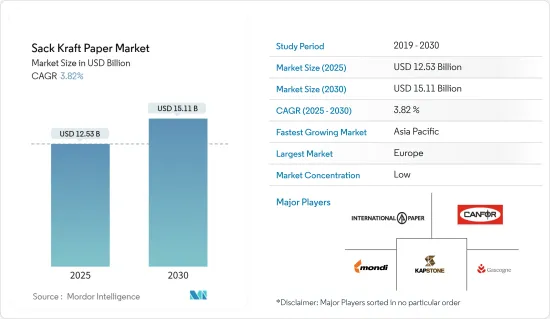

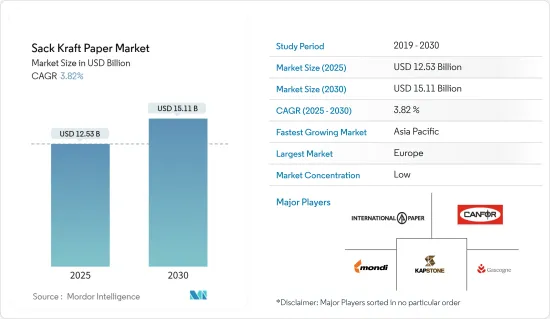

预计 2025 年袋装牛皮纸市场规模为 125.3 亿美元,到 2030 年将达到 151.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.82%。

关键亮点

- 推动市场扩张的主要因素是建筑业的显着成长。袋装牛皮纸市场成长的其他主要驱动力是包装行业许多领域对塑胶使用的严格规定和禁令,以及包装和包裹应用的改进。

- 环保人士和政府越来越意识到使用塑胶的危害,迫使他们专注于更环保的替代品,从而推动了 SacKraft 纸的采用。基础建设计划带动建筑业的需求稳定成长,增加了Sac Kraft纸的使用量。此外,对环保和可生物降解包装材料的需求不断增加将推动成长。此外,根据国际回收局(BIR)的数据,每年约生产4.2亿吨纸和纸板,其中超过一半的原料来自回收料。

- 此外,随着生物分解性包装替代塑胶的采用,市场成长预计还将增加。例如在加拿大,塑胶正在污染河流、湖泊和海洋,危害野生动物并导致水中出现微塑胶。根据博登·拉德纳·热维斯介绍,加拿大每年倾倒300万吨塑胶垃圾,其中只有9%被回收。

- 高端纸张所需的装有石膏、水泥、细糖、黏土等粉状成分的袋子也将成倍地推动市场成长。此外,填充过程中的变形较少,这意味着袋子破损更少,因此它们在建筑(水泥)行业中越来越多地被采用。

- 电子商务的兴起及相关发展正在推动牛皮纸包装的高檔化。这包括对可在短时间内印刷高品质图形的工艺材料的需求。像 Mondi 这样的公司对这些发展做出了反应,创造了针对高端和创新印刷和包装应用(包括购物袋)的新产品。此外,企业还推出了多项创新,以改进和加速纸袋牛皮纸和纸袋的生产,并透过即时运算和纸张等级选择来增强产品保护。

- 然而,塑胶材料和柔性中型散货箱和散装袋等替代品的出现以及袋装牛皮纸价格的上涨可能会阻碍市场的成长。

- 新冠肺炎疫情爆发后,北美、欧洲和亚洲许多地区非必要业务关闭或暂停,导致全球需求急剧下降,企业纷纷寻求融资以减轻财务影响。其中包括大幅削减产量、减少资本支出和严格的成本管理措施。然而,到年中,营运恢復正常化、库存减少以及需求增加,有助于减轻疫情对该市场主要参与企业的影响。整个全球包装生态係都受到俄乌战争的影响。

袋装牛皮纸的市场趋势

食品估计占了很大的市场份额

- 在众多终端垂直产业中,食品业是袋装牛皮纸的最大用户,并且受到食品业额外需求的推动。从包装食品产业转向环保包装的转变可以看出,这导致对袋牛皮纸的需求增加。例如,根据美国劳工统计局的数据,2021 年美国家庭平均家庭食品支出达到 5,259 美元。

- 袋装牛皮纸通常用于运输麵粉、糖、淀粉、食品添加物、加工和干果、鸡蛋、牛奶等食品。所有这些因素都在推动对敞口袋的需求。年轻人对于速食店的偏好也满足了对牛皮纸的需求。根据美国人口普查局的数据,美国快餐店的年销售额将从 2020 年的 3,284 亿美元增加到 2021 年的 3,895 亿美元。预计销售额的成长将支持 Sac Kraft Paper 的扩张。

- 此外,百货商场、超级市场也常使用牛皮纸袋。根据美国人口普查局的数据,超级市场、其他百货公司和杂货店的总销售额从 2020 年的 7,415.7 亿美元增加到 2021 年的 7,659.8 亿美元。超级市场连锁店在美国食品零售业中占据主导地位。沃尔玛与克罗格公司在美国各地拥有并经营多家小型超级市场,是美国最大的两家杂货公司。

- 此外,消费者的偏好以及各地区FDA的绿色法规正在推动食品产业的包装技术进步。欧洲纸袋和牛皮纸产业为许多发展做出了贡献,使纸袋成为食品包装的首选。据纸质运输袋製造商协会(PSSMA)称,食品业使用的纸质运输袋和消费袋已发展成为一个价值 10 亿美元的产业,每年运输超过 30 亿个袋子。

欧洲占很大市场份额

- 该地区对袋装牛皮纸的需求不断增长,因为它是运输各种散装产品的主要包装形式,可以降低总包装成本。袋装牛皮纸主要用于宠物食品的散装包装,满足日益增长的宠物食品需求。

- 此外,英国地区拥有多家大型跨国公司,提供麻绳纸及其生产设施。总部位于英国的泛欧公司(例如 Mondi Group)提供用于阀口工业袋的棕色、白色和 PE 涂层等级的袋牛皮纸。该地区的市场参与企业也正致力于扩大在其他领域的影响力。例如,2022 年 4 月,Mondi Paper Bags 从埃及领先的水泥製造商拉法基埃及水泥的子公司 National Bag 和 Egyptian Sack 收购了一条纸袋加工生产线。收购的生产线将使Mondi的年生产能力增加约1.5亿至1.8亿袋,从而巩固Mondi在埃及纸袋市场的地位。

- 而根据英国造纸工业联合会(CPI)的数据,英国地区共有 47 家造纸厂,分布在英格兰、苏格兰、威尔斯和北爱尔兰,年产纸张 400 万吨,出口 100 万吨。此外,该国的消费量接近1000万吨,因此出口量很大。

- 此外,预计欧洲纸袋业务将在预测时限展现对食品业客户需求的关注。该地区的贸易商因酪农和可可行业的问题而来到该平台。全球领先的公司正在大力投资 SacKraft 纸张研发业务并建立新的仓库,以满足日益增长的客製化包装解决方案需求。

- 此外,当地企业正在努力扩大生产能力,以策略性地改善商业机会。马林斯基纸浆造纸厂是俄罗斯领先的纸袋纸和其他纸製品供应商,目前正在投资现有的精製製程(两级、低浓度)进行现代化升级。 Segezha 集团也在投资现代化建设,目标是到 2021 年将其袋装牛皮纸产量提高到每年 45 万吨。

袋装牛皮纸产业概况

袋子牛皮纸市场相对分散,拥有大量参与企业,例如 Mondi、Nordic Paper、Segezha 等,可以削弱市场上的联合包装商。此外,参与企业的分销管道和原材料也会影响区域市场的竞争。垂直整合,即转换器/包装公司收购原材料供应商,是过去几年的趋势。

2022 年 8 月:法国纸张和麻袋製造商 Gascogne 与多家银行企业联合贷款,为其 2022 年至 2026 年的资本资金筹措资金。 EIB) 签订了合约价值 5,000 万欧元(4,980 万美元)。

这项投资计画主要涉及在法国南部的米米藏工厂安装一台新的造纸机。加斯科尼宣布已与造纸机製造商进行独家谈判,目标是在今年底前完成买卖协议。该公司计划在 2022 年至 2026 年期间投资总计 3 亿欧元(2.991 亿美元)。为了资助其投资计划,该公司计划资金筹措,包括上述投资贷款和未来至少 1,000 万欧元(990 万美元)的股本增加。

根据加斯科尼介绍,造纸机的安装,包括建筑物和科技环境,将耗资 2.2 亿欧元(2.194 亿美元)。此外,该公司还将投资 8,000 万欧元(7,970 万美元)加强其现有的工业资产。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 对环保和可生物降解包装材料的需求不断增加

- 建筑业快速成长

- 市场问题

- 塑胶材质、软质中型散装容器和散装袋等替代品的出现

第六章 市场细分

- 按包装类型

- 阀袋

- 开袋

- 其他的

- 按年级

- 製作

- 半弹性

- 弹性

- 其他的

- 按行业

- 建筑材料/水泥

- 食物

- 化学

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- BillerudKorsnas AB

- Mondi PLC

- Segezha Group

- Natron-Hayat doo

- Nordic Paper AS

- Gascogne Group

- KapStone Paper and Packaging Corporation(Westrock)

- Horizon Pulp & Paper Ltd.

- International Paper Company

- Canfor Corporation

第八章投资分析

第九章:市场的未来

The Sack Kraft Paper Market size is estimated at USD 12.53 billion in 2025, and is expected to reach USD 15.11 billion by 2030, at a CAGR of 3.82% during the forecast period (2025-2030).

Key Highlights

- The main factor driving the market's expansion is the building and construction industry's significant growth. Other major drivers of the sack kraft paper market growth are strict regulations and bans on plastic use in numerous regions of the packaging industry and improvements in packaging and wrapping applications.

- The growing awareness among environmentalists and governments about the hazards of using plastic is forcing them to focus on greener alternatives, favoring the adoption of sack kraft paper. Due to infrastructure projects, a steady rise in demand in the construction industry has increased the use of sack kraft paper. Also, increasing demand for eco-friendly and bio-degradable packaging material will promote growth. Additionally, according to the Bureau of International Recycling (BIR), around 420 million tonnes of paper and cardboard are produced yearly, with well over half of the raw material coming from recovered sources.

- Further, accepting the demand for biodegradable packaging as an alternative to plastic will increase market growth. For instance, in Canada, Plastic is polluting rivers, lakes, and oceans, harming wildlife, and generating microplastics in the water. Every year, Canadians throw away 3 million tons of plastic waste, only 9% of which is recycled, meaning the vast majority of plastic ends up in landfills, and about 29,000 tons find their way into the natural environment, according to Borden Ladner Gervais.

- Sacks filled with powdered materials, such as gypsum, cement, fine-grained sugar, clays, etc., which are necessary for high-quality papers, also exponentially aid market growth. The sack is also exposed to less strain during filling, leading to a lower sack breakage and increasing its adoption in the construction (cement) industry.

- The increasing popularity of e-commerce and related developments have led to the premiumization of kraft packaging. It includes the demand for kraft material that can take high-quality graphics on short print runs. Companies like Mondi have kept up with such developments and developed new products targeting premium creative print and packaging applications, including shopping bags. Moreover, players initiated many innovations that have improved and accelerated the production of sack kraft paper and paper sacks and enhanced product protection along with real-time calculations and selection of paper grade.

- However, the emergence of alternatives, such as plastic materials and flexible intermediate bulk containers and bulk bags, and the rise in the prices of sack kraft paper may hinder the market's growth.

- After the onset of COVID-19, global demand declined sharply in the wake of closures of non-essential businesses and lockdowns in many parts of North America, Europe, and Asia which pushed the companies to take a series of measures to mitigate the financial impacts. It includes extensive production curtailment, reduced capital spending, and disciplined cost management initiatives. However, by mid-year, a return to more normalized operation, lean inventories, and increased demand helped the major player operating in the market mitigate the impact of the pandemic. The overall packaging ecosystem across the globe has been impacted owing to the Russia-Ukraine war.

Sack Kraft Paper Market Trends

Food is Estimated to Have Significant Share in the Market

- The food sector is a large user of sack kraft paper among the many end-user verticals and is motivated by the additional need of the food industry. It is seen from the packaged food industry's transition to environmentally friendly packaging, which subsequently increased demand for sack kraft paper. For instance, according to the Bureau of Labor Statistics, a US household's average food at-home expenditure amounted to USD 5,259 in 2021.

- Transporting food items like flour, sugar, starch, food additives, processed or dried fruit, eggs, or milk typically involves using sack kraft paper. All of these factors are increasing the demand for open-mouth bags. Youth's preference for quick-service eateries is also meeting sack kraft paper demand. The US Census Bureau reports that from USD 328.4 billion in 2020, the country's yearly quick-service restaurant sales increased to USD 389.5 billion in 2021. Sales growth will support the expansion of sack kraft paper.

- Furthermore, department stores and supermarket stores frequently use kraft paper bags. According to the US Census Bureau, supermarkets and other departmental and grocery stores achieved total sales of USD 765.98 billion in 2021, up from USD 741.57 billion in 2020. Chain supermarkets dominate the US food retail sector. Walmart and Kroger Company, which own and run several smaller supermarkets around the country, are two top American grocery companies.

- Moreover, the consumer's preference, along with the green regulations from the FDA across the regions, also promotes sack kraft packaging in the food industry. The European paper sack and sack kraft paper industry have contributed many developments that make paper sacks the perfect packaging for food. According to Paper Shipping Sack Manufacturers' Association (PSSMA), paper shipping sacks and consumer bags used in the food industry have emerged into a billion-dollar industry with shipments of over three billion sacks annually.

Europe has Significant Share in the Market

- The demand for sack kraft paper drives the region as a primary packaging format for transporting various products in bulk to lower the total packaging expenditure. Sack kraft paper is used mainly for large quantities of pet food packaging in the region and supports the growing demand for pet food.

- Additionally, the UK region is marked by various major global key players offering sack kraft paper with production units. Companies like Mondi Group, operating throughout Europe with a significant presence and headquartered in the UK, offer brown, white, and PE-coated paper grades for sack kraft papers used in valve and open-mouth industrial bags. The market players in the region are also focusing on expanding their footprint in other areas. For instance, in April 2022, Mondi Paper Bags acquired the paper bag converting lines from National Bag and Egypt Sack, two subsidiaries of Lafarge Cement Egypt, a major cement producer in the country. The acquired production lines will increase Mondi's capacity by around 150-180 million bags annually and strengthen Mondi's position in the Egyptian paper bag market.

- Also, according to the Confederation of Paper Industries (CPI), the UK region has 47 mills operating throughout England, Scotland, Wales, and Northern Ireland, which produce 4 million tons of paper, with exports of 1 million tons. Furthermore, the country has a consumption nearing 10 million tons, which results in heavy exports of the material.

- Additionally, the European paper sack business will demonstrate its dedication to client demands in the food sector in the forecast timeframe. The regional merchants are driven to this platform by problems in the dairy and cocoa industries. Major global corporations are extensively investing in sack paper kraft R&D operations and setting up new warehouses to meet the rising demand for customized packaging solutions.

- Moreover, regional companies are involved in capacity expansion to improve their business opportunity strategically. Mariinsky Pulp and Paper Mill, a prominent Russian supplier of sack paper, including other paper products, is investing in modernizing the existing refining process (two-stage, low-consistency). Segezha Group similarly invests in modernization and has increased sack kraft paper production to 450,000 tons annually by 2021.

Sack Kraft Paper Industry Overview

The sack kraft paper market is relatively fragmented, with a large volume of players, including Mondi, Nordic Paper, and Segezha, among others, which can cut out co-packers in the market. Further, the players' distribution channels and raw materials impact the regional market competition. Vertical integration, which means raw material suppliers acquired by converters/packaging companies, has been a trend for the past couple of years.

August 2022: French paper and sacks manufacturer Gascogne signed a syndicated loan contract worth EUR 126.8 million (USD 126.4 million) with a banking pool and an agreement worth EUR 50 million (USD 49.8 million) with the European Investment Bank (EIB) to finance its Capital Expenditure program for the 2022-2026 period.

The investment program mainly includes the installation of a new paper machine at the company's Mimizan mill in Southern France. Gascogne said that it entered into exclusive negotiations with a paper machine manufacturer to finalize the purchase agreement before the end of the year. The company intends to invest a total of EUR 300 million (USD 299.1 million) in 2022-2026. To finance the investment program, it has set up a financing plan which includes the investment loans mentioned above and a future increase in capital of at least EUR 10 million (USD 9.9 million), amongst others.

According to Gascogne, the installation of the paper machine, including the building and the technical environment, will cost EUR 220 million (USD 219.4 million). In addition, the reinforcement of the existing industrial assets will be pursued for EUR 80 million (USD 79.7 million).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-Friendly and Bio-degradable Packaging Material

- 5.1.2 Rapid Growth of Construction Industry

- 5.2 Market Challenges

- 5.2.1 Emergence of Alternatives such as Plastic Materials and Flexible Intermediate Bulk Containers and Bulk Bags

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Valve Sacks

- 6.1.2 Open Mouth Sacks

- 6.1.3 Other Packaging Types

- 6.2 By Grade

- 6.2.1 Kraft

- 6.2.2 Semi-extensible

- 6.2.3 Extensible

- 6.2.4 Other Grades

- 6.3 By End-user Vertical

- 6.3.1 Building Material and Cement

- 6.3.2 Food

- 6.3.3 Chemical

- 6.3.4 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BillerudKorsnas AB

- 7.1.2 Mondi PLC

- 7.1.3 Segezha Group

- 7.1.4 Natron-Hayat d.o.o

- 7.1.5 Nordic Paper AS

- 7.1.6 Gascogne Group

- 7.1.7 KapStone Paper and Packaging Corporation (Westrock)

- 7.1.8 Horizon Pulp & Paper Ltd.

- 7.1.9 International Paper Company

- 7.1.10 Canfor Corporation